Alginates Market Outlook:

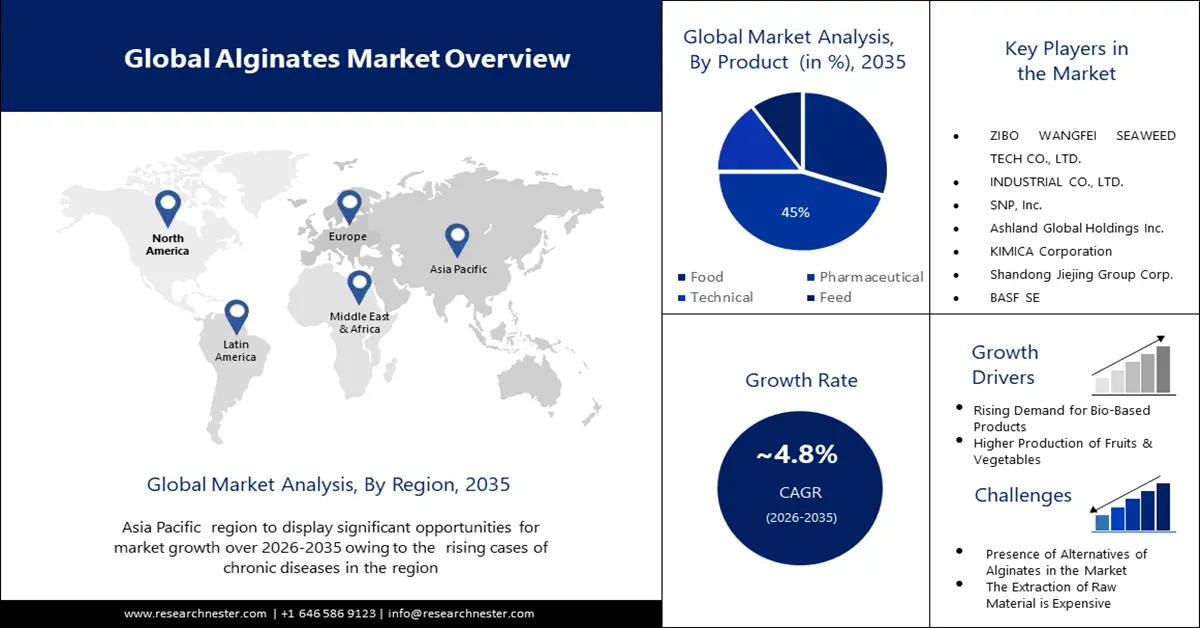

Alginates Market size was valued at USD 778.8 million in 2025 and is likely to cross USD 1.24 billion by 2035, expanding at more than 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of alginates is assessed at USD 812.44 million.

The market is driven by the expanding use of alginate in biomedical applications, such as tissue engineering, wound dressing, and drug delivery systems. Growing demand for clean-label and organic food products also pushes manufacturers to adopt alginate as a natural stabilizer and thickener. Moreover, as per OEC 2022, alginic acid export expanded up to USD 14.4% between 2021 and 2022. The global trade of alginic acid, the primary raw material for producing various alginate products, fosters innovation and encourages development of specialized alginate formulations. OEC further states that, in 2022, alginic acid world trade was valued at USD 476 million, with China being the top exporter registering USD 189 million worth exports, and U.S. ranked the first with USD 8 million worth imports.

Recent studies in the market have focused on its potential for advanced medical purposes, highlighting its versatility, and biocompatibility. For instance, in May 2024, IFF Pharma Solutions, unveiled groundbreaking study results for NovaMatrix portfolio of ultrapure alginate biopolymers intended to revolutionize regenerative medicine and 3D cell culture applications. Key trends shaping the market include rising preference for biodegradable and eco-friendly materials, particularly in packaging and industrial applications. Innovation in alginate-based bioplastics and advanced drug delivery systems presents lucrative opportunities to the market. Application in textile and paper industries for printing and coating enhancements to improve fabric quality and surface properties is also driving the global market growth significantly.

Key Alginates Market Insights Summary:

Regional Highlights:

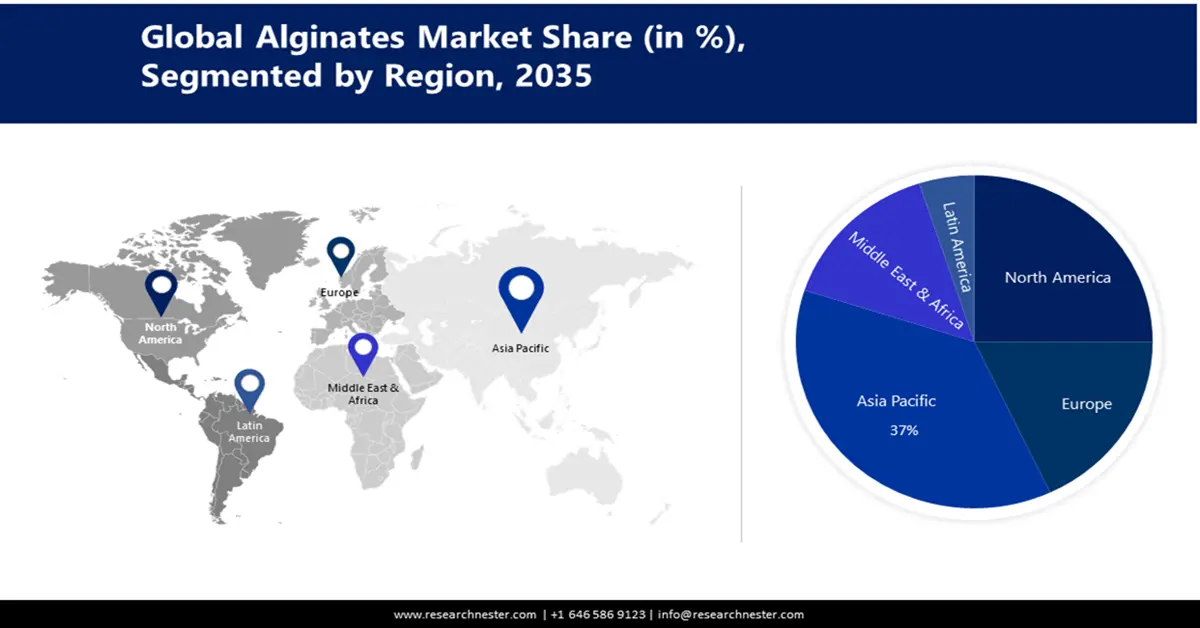

- Asia Pacific alginates market is predicted to capture 36% share by 2035, driven by developing healthcare infrastructure and rising chronic diseases boosting alginate demand.

- North America market will capture significant revenue share by 2035, attributed to rising demand in food, pharmaceutical, and personal care industries for alginates.

Segment Insights:

- The food additives segment in the alginates market is poised for substantial growth during 2026-2035, driven by the widespread and regulated use of alginates in the industry.

- The pharmaceutical feed grade segment in the alginates market is anticipated to capture a 45% share by 2035, fueled by growing use of alginates in drug formulations and wound care applications.

Key Growth Trends:

- Innovation in 3D printing

- Cosmetic industry growth

Major Challenges:

- Competition from alternative ingredients

- Limited application scope restricting market expansion

Key Players: One.Five GmbH, IRO Alginate Industry Co., Ltd., ZIBO WANGFEI SEAWEED TECH CO., LTD., FMC Corporation, QINGDAO GFURI SEAWEED INDUSTRIAL CO., LTD., SNP, Inc., Ashland Global Holdings Inc., KIMICA Corporation, Shandong Jiejing Group Corp., BASF SE.

Global Alginates Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 778.8 million

- 2026 Market Size: USD 812.44 million

- Projected Market Size: USD 1.24 billion by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Malaysia

Last updated on : 9 September, 2025

Alginates Market Growth Drivers and Challenges:

Growth Drivers

-

Innovation in 3D printing: Alginate has gained significant attention in medical and research fields, particularly for bio-printing. Its biocompatibility and ability to form hydrogels make it ideal for creating scaffolds that mimic human tissue structures. These properties are crucial for enabling the development of customised implants and drug testing models. Ongoing advancements in alginate formulations for 3D printing are expected to enhance precision and broaden its applications in biomedical innovation.

-

Cosmetic industry growth: Alginate is used in face masks, creams, and lotions to improve the texture of the cosmetic products for its moisture-retention properties that provides hydrating effect on the skin. Moreover, the rising demand for natural ingredients has further propelled the use of alginate as eco-friendly alternative in beauty products. Innovations in cosmetic formulations incorporating alginate continue to meet consumer preferences for clean-label, high-performance skincare solutions.

Challenges

-

Competition from alternative ingredients: The availability of substitutes such as gelatin, carrageenan, and pectin poses a significant challenge to the alginate market. These alternatives often offer similar functionalities at competitive prices and are more familiar to manufacturers, making it harder for alginate to gain a dominant foothold. Additionally, some substitutes provide better thermal stability or gel strength, making them preferable in certain applications.

- Limited application scope restricting market expansion: The low product usage volume further hampers the growth of the alginate market. Alginate is used in niche applications such as pharmaceuticals, food, and biotechnology, with limited widespread adoption compared to other thickeners or gelling agents. This constrained market size leads to lower production economies of scale, making it difficult to reduce costs and compete effectively with more established ingredients.

Alginates Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 778.8 million |

|

Forecast Year Market Size (2035) |

USD 1.24 billion |

|

Regional Scope |

|

Alginates Market Segmentation:

Product Segment Analysis

The pharmaceutical feed grade segment in the alginates market is poised to gain the largest revenue share of about 45% in the year 2035. The various application of pharmaceutical grade in the pharma industry is expected to augment the segment growth. Pharmaceutical-grade alginates are highly used in wound dressing, as they form a gel-like matrix that helps maintain the moisture around the wound and expedites the healing process. Besides this, the alginates are fused with the formulation of drugs to enable the sustained release of the drug over an extended period.

Application Segment Analysis

The food additives segment is expected to garner around 46% market share by 2035. Alginates are widely used in the food industry, as they themselves are the group of food additives that are derived from brown seaweeds. Additionally, the use of alginates in the food sector complies with the regulatory guidelines of the food industry, since they are considered safe by regulatory authorities when used at controlled levels.

Our in-depth analysis of the global alginates market includes the following segments:

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Alginates Market Regional Analysis:

APAC Market Insights

Asia Pacific is predicted to have the largest alginates market share registering over 36% by 2035. In September 2023, WHO stated that despite being highly preventable, cardiovascular disease (CVD) remains the leading cause of mortality in Asia-Pacific, accounting for 3.9 million deaths in the WHO South-East Asia Region every year. With developing healthcare infrastructure and rising cases of chronic diseases, there has been a greater emphasis on advanced wound management and drug delivery systems in countries such as India and China. These factors have boosted the region's need for alginates significantly.

Japan market is driven by the rising demand for processed meat and seafood products. Alginate casings, derived from seaweed, offer advantages such as better moisture retention, improved texture, and enhanced shelf life for food products. Additionally, the increasing emphasis on food safety and sustainability has led to a preference for plant-based, biodegradable casings. In November 2020, KIMICA Corporation completed the expansion of its powder blending and packaging facilities for alginate production at its factory in Chiba, Japan, increasing its annual production capacity to over 2000MT to meet the rising demand.

North American Market Insights

North America industry is estimated to register a significant share by 2035. Rising demand in the food, pharmaceutical, and personal care industries due to its thickening, stabilizing, and gelling properties, is significantly driving the market growth. The region also benefits from well-established production facilities and advanced R&D efforts focused on innovative applications. Increased consumer preference for natural and clean-label ingredients has also fueled market growth.

The France alginates market is primarily influenced by the food and beverage industry, where it is widely used in dairy products, dressings, and bakery items. Rising demand for plant-based and functional foods has further boosted alginate usage. Advancements in controlled drug delivery systems also contribute to the market’s expansion in the country. In February 2023, Algaia announced the expansion of the Algaia R&D center in Saint Lô with the help of funding from Saint Lô Agglo. The expansion comprises new laboratories with state-of-the-art equipment and additional offices to support R&D activities for the growth of Algaia.

Alginates Market Players:

- One.Five GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- IRO Alginate Industry Co., Ltd.

- ZIBO WANGFEI SEAWEED TECH CO., LTD.

- FMC Corporation

- QINGDAO GFURI SEAWEED INDUSTRIAL CO., LTD.

- SNP, Inc.

- Ashland Global Holdings Inc.

- KIMICA Corporation

- Shandong Jiejing Group Corp.

- BASF SE

- Handtmann

Companies are typically focusing on product launches, and acquisitions to expand their global footprint and enhance their technological capabilities. For instance, in May 2023, JRS Group announced the acquisition of Algaia SA, both aiming to sustainably harvest and process seaweed along the Atlantic coast of Brittany, which is one of the largest fields Europe. These companies are also investing in sustainable sourcing of the product to ensure a stable supply chain and adhere to regulatory standards.

Recent Developments

- In June 2024, Handtmann launched an advanced innovation in packaging technology, the ConProSachet system, that co-extrudes edible alginate packets at industrial speeds. It represents a noteworthy move from traditional plastic film packaging by using seaweed-based resources, which are either completely ingestible or biodegrade within a few weeks.

- In October 2022, KIMICA Corporation inaugurated the KIMICA HONKAN which is a new top-notch R&D facility with exceptional environmental performance, built with advanced technologies in Futtsu-city, Chiba-Prefecture.

- In June 2022, BASF SE announced the launch of Verdessenece TM RiceTouch, a plant-based sensory powder, made from non-GMO rice that has a high grade and good oil absorption, ideal for a variety of natural and organic cosmetic applications.

- Report ID: 4051

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Alginates Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.