Algae Treatment Chemical Market Outlook:

Algae Treatment Chemical Market size was over USD 3.4 billion in 2025 and is projected to reach USD 5.86 billion by 2035, growing at around 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of algae treatment chemical is evaluated at USD 3.57 billion.

Concerns about the ecological impacts of harmful algae blooms (HABs), which can lead to dead zones in water bodies, damage aquatic life, and pose health risks to humans, have resulted in increasing demand for effective algae treatment solutions that are both environmentally responsible and efficient. As a result, various companies are focusing on developing eco-friendly and biodegradable products that diminish adverse effects on the environment. For instance, in January 2023, ARQUIMEA launched BIO100, a biodegradable algaecide derived from natural elements that can eliminate and prevent algae from growing in irrigation reservoirs while highlighting its commitment to environmentally friendly practices. As it is a 100% natural product, it is appropriate for both traditional and organic agriculture. The increasing frequency of algal blooms is a substantial catalyst for the market as it promotes innovation and strategic responses from companies as well as regulatory authorities.

Key Algae Treatment Chemical Market Insights Summary:

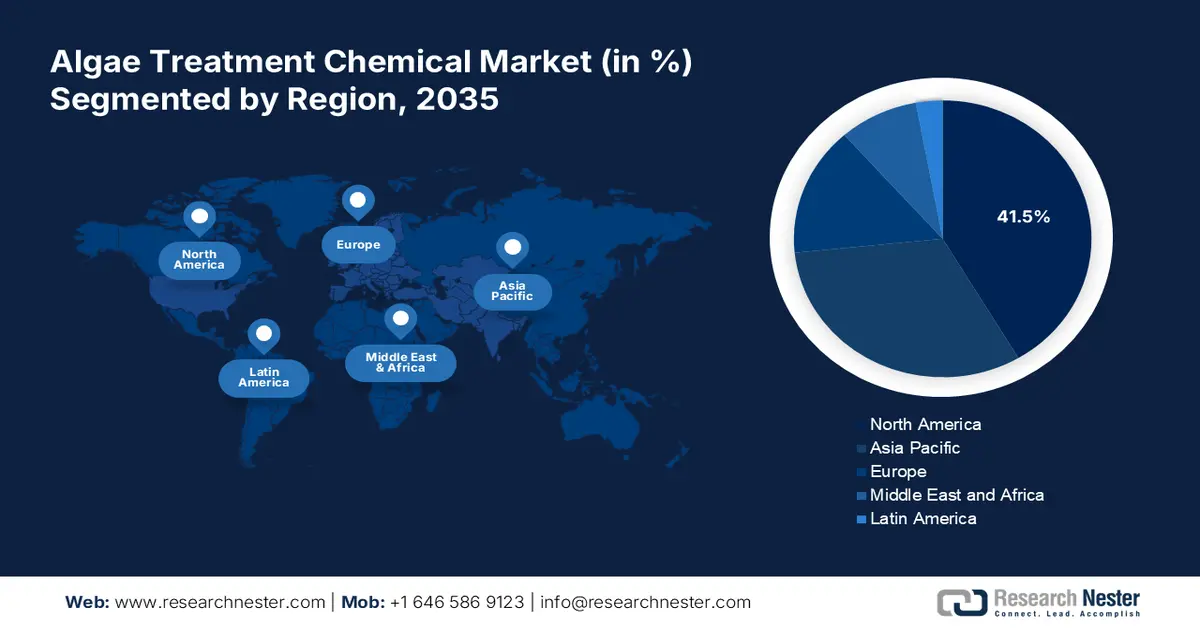

Regional Insights:

- North America algae treatment chemical market is projected to secure over 41.5% revenue share by 2035, underpinned by escalating investments in advanced and eco-safe algae treatment solutions and intensifying sustainability priorities.

- Asia Pacific is expected to witness steady growth through 2026–2035, supported by expanding urbanization and industrial activity that heightens regional water-pollution control needs.

Segment Insights:

- The green algae segment is set to capture more than 54.6% share of the algae treatment chemical market by 2035, bolstered by its widespread presence across aquatic environments which amplifies the need for targeted mitigation solutions.

- The algaecides segment is anticipated to command over 45.2% revenue share by 2035, propelled by its essential application in diverse settings requiring reliable and sustainable algae-control performance.

Key Growth Trends:

- Strict regulations governing water quality and environmental protection

- Integration of advanced technologies

Major Challenges:

- Complication of algal blooms

- Environmental concerns and public perception

Key Players: Applied Biochemists, SePRO Corporation, Biosafe Systems LLC, BASF SE, Solenis LLC, Kemira Oyj, and Algaecytes Ltd.

Global Algae Treatment Chemical Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.4 billion

- 2026 Market Size: USD 3.57 billion

- Projected Market Size: USD 5.86 billion by 2035

- Growth Forecasts: 5.6%

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 2 December, 2025

Algae Treatment Chemical Market - Growth Drivers and Challenges

Growth Drivers

- Strict regulations governing water quality and environmental protection: Several government mandates about the usage of particular chemicals to mitigate harmful algal blooms and protect aquatic ecosystems is expected to drive market growth. These guidelines increasingly enforced by regional and national agencies are rooted in rising concerns about the adverse effects of pollutants and excess nutrients on water quality. For instance, in the United States, the Environmental Protection Agency (EPA) imposes the Clean Water Act, which requires water treatment facilities and industrial plants to meet strict quality standards, by controlling algal growth that may disrupt the ecosystem and water supplies. This is expected to increase the sales of different types of algae treatment chemicals going ahead.

- Integration of advanced technologies: The algae treatment chemical market is driven by the integration of advanced technologies such as nanotechnology, biotechnology, and artificial intelligence (AI) to improve the efficiency and efficacy of algae treatment solutions, enabling more specific and environmentally friendly solutions.

Challenges

- Complication of algal blooms: Complication of algal blooms presents a substantial challenge for the global market owing to the various causes, types, and unpredictable behavior of these blooms. Various species of algae also add complexity as each type responds differently to chemical treatments. For example, blue-green algae are accountable for toxic blooms and need particular treatments that differ suggestively from those used for green algae.

- Environmental concerns and public perception: Algae treatment chemicals often contain compounds such as algaecides and copper sulfate which can have harmful effects on the aquatic ecosystem if applied or misused in high concentrations. According to the U.S. EPA, additional usage of copper-based algaecides can lead to bioaccumulation in aquatic species, disrupting the food chain and affecting fish as well as other marine life.

Public perception also complicates this issue. Various communities and environmental groups view chemical-based algae treatment as a quick fix with restricted long-term benefits and potentially harm the environment.

Algae Treatment Chemical Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 3.4 billion |

|

Forecast Year Market Size (2035) |

USD 5.86 billion |

|

Regional Scope |

|

Algae Treatment Chemical Market Segmentation:

Algae Type Segment Analysis

Green algae segment is set to hold algae treatment chemical market share of over 54.6% by the end of 2035. The global widespread occurrence of green algae in aquatic ecosystems provides significant potential within the market. It flourishes in various settings including ponds, lakes, and aquariums, which results in challenges such as ecological disturbance and water discoloration. This boosts market growth for specific chemicals such as algistats and algaecides, which are meant for addressing green algae infestations. Companies have further opportunities to develop innovative solutions to effectively tackle these problems and deliver long-lasting results. For example, in April 2023, Green Water Labs launched an algae control, designed to eliminate and prevent algae growth. It is an innovative bio-based solution that is safe to use around pets, people, and the environment.

Product Type Segment Analysis

In algae treatment chemical market, algaecides segment is anticipated to account for revenue share of more than 45.2% by the end of 2035, due to its vital role in controlling algal growth across several environments. Rising concerns about environmental sustainability and water quality are fueling the demand for efficient algaecides. The introduction of eco-friendly substitutes and technological advancements have widened the scope and fostered opportunities for development in algae treatment solutions and market expansion. For instance, in March 2020, BioWorks introduced PERpose Plus, a broad-spectrum algaecide, and fungicide for the suppression, prevention, and control of fungus as well as algae on equipment and hard surfaces, in all phases of crop production, also for post-harvest and storage applications in the U.S.

Our in-depth analysis of the global market includes the following segments:

|

Algae Type |

|

|

Product Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Algae Treatment Chemical Market - Regional Analysis

North America Market Insights

North America algae treatment chemical market is set to hold revenue share of more than 41.5% by 2035, owing to the growing demand for efficient algae treatment chemicals and mounting concerns about environmental sustainability and water quality. Several companies in this region are heavily investing in R&D activities to develop and launch innovative, safe, and advanced algae treatment chemicals.

The U.S. market is rapidly expanding owing to the growing occurrence of algal blooms in water bodies and rising need for efficient treatment methods. Also, the adoption of algae treatment chemicals is inclined by strict regulations governing environmental protection and water quality. Concerns regarding safety, public health, and the conservation of aquatic ecosystems further drive market growth in the country.

Canada market benefits from technological advancements in water treatment processes, including algae monitoring systems, chemical formulations, and remote sensing technologies for initial algal bloom detection. The government and private sector are investing in upgrading water infrastructure to enhance water quality, decrease environmental challenges such as algal blooms, and generate job opportunities in Canada. For example, the government of Canada has come up with an initiative called the Great Lakes Freshwater Ecosystem Initiative (FEI) to prevent toxic and nuisance algae and support this initiative funding.

Asia Pacific Market Insights

Asia Pacific is anticipated to experience a stable CAGR during the forecast period due to rapid urbanization and industrialization which leads to a rise in water pollution. Also, the rising industrial base and environmental concerns in China pose substantial water pollution challenges owing to urbanization and innovative technologies.

China's commitment to environmental sustainability and regulatory compliance inspires using sludge treatment chemicals in several industries, including urban water treatment, aquaculture, agricultural, and industrial activities. The research & development investments by companies and governments in China also strengthen the competitiveness and innovativeness of its algae chemical industry in global markets and its positioning as a key partner.

The development of early detection tools for destructive algal blooms such as CyanoKhoj, to monitor cyanobacterial blooms in inland water bodies is boosting market growth in India. Moreover, in July 2021, the Indian National Centre for Ocean Information Services (INCOIS) launched the Agal Bloom Information Service (ABIS) to offer real-time information on the spatial and temporal circulation of phytoplankton blooms over the north Indian Ocean.

Algae Treatment Chemical Market Players:

- Applied Biochemists

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SePRO Corporation

- Biosafe Systems LLC

- BASF SE

- Solenis LLC

- Kemira Oyj

- Algaecytes Ltd.

The algae treatment chemical market comprises of some leading players such as Applied Biochemists, SePRO Corporation, Biosafe Systems LLC, BASF SE, and more. By concentrating on eco-friendly and innovative solutions, these players are not only addressing the rising concerns over water quality and environmental protection but also increasing the market reach and fostering industry growth. Here are some leading players in the algae treatment chemical market:

Recent Developments

- In October 2023, Solenis, a Wilmington-based company, acquired Cedarchem, to enhance water and wastewater treatment capabilities in the southeastern United States.

- In December 2021, Arxada AG, a leader in specialty chemicals based in Basel, acquired Enviro Tech Chemical Services, Inc., a manufacturer of proprietary and high-efficiency antimicrobial and biocidal products.

- Report ID: 6643

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Algae Treatment Chemical Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.