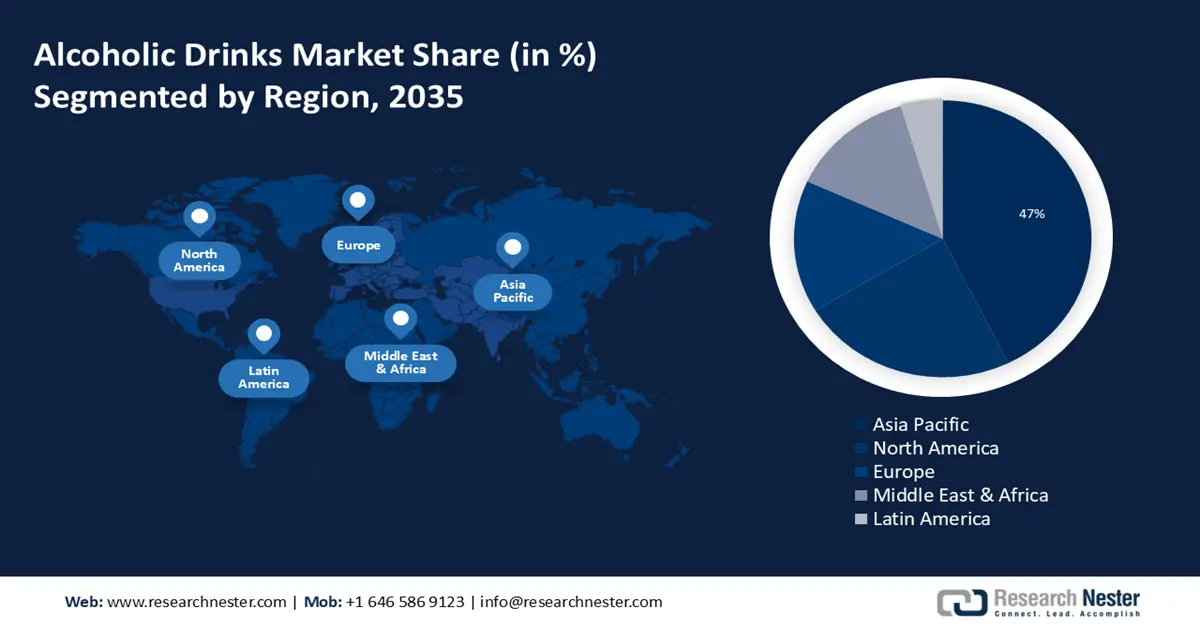

Alcoholic Drinks Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is likely to hold largest revenue share of 47% by 2035. The market growth in the region is also expected on account of the growing demand for premium alcohol among the population. The market is progressing due in part to the rapid urbanization and simple availability of alcoholic beverages in metropolitan areas. According to the Asian Development Bank, Asia will have a population that is over 55% urban by 2030.

China's economic growth has raised people's disposable income, which permits them to spend more on upscale products like fine wine. According to data from the National Bureau of Statistics, China's per capita disposable income was USD 1,624.57 in the first quarter of 2024, growing nominally 6.2% year over year. Globalization and the impact of Western culture have also shaped consumer tastes, with a rise in interest in imported alcoholic beverages.

In South Korea, consumers are looking for more distinctive and high–quality alcoholic beverages, like small–batch spirits and artisanal brews. The rising demand for traditional Korean alcoholic beverages is one of the major trends in the country's alcoholic drink sector. Traditional Korean alcoholic beverages like soju and makgeolli are becoming more and more well–liked among younger customers. For instance, Over the previous two years, soju consumption has climbed by 1.4%, accounting for 47.9% of the total consumption rate among those polled in May 2024.

North America Market Insights

North America alcoholic drinks market is predicted to capture revenue share of around 26% by the end of 2035. This is owing to the growing concerns regarding health which has increased the demand for honey–based drinks in the region. Also, the growing consumption of alcohol is accelerating the market demand. For instance, 62% of American adults claim to have ever consumed alcohol, while 38% never do.

The rising demand for alcoholic beverages, especially whiskey, in the United States is influencing the market's expansion. For instance, it is anticipated that 34.9 million 9–liter cases of straight whiskey will be consumed by 2025, a more than 100% increase over the volume consumed in the late 1990s and early 2000s. Several causes, such as the emergence of craft distilleries, growing interest in mixology and cocktails, and the reputation of whiskey as a classy and premium beverage, have contributed to the surge in whiskey consumption in recent years.

It is projected that the money given by private companies in Canada to purchase high–end alcoholic beverages will accelerate industry expansion. For instance, the Molson Coors Beverage Company unveiled new capital deployment plans, a long–term financial outlook, and a new plan to accelerate growth today. The Acceleration Plan was unveiled at the company's 2023 Strategy Day in New York City. Its goal is to further the company's growth in the years to come.