Alcohol Ingredients Market Outlook:

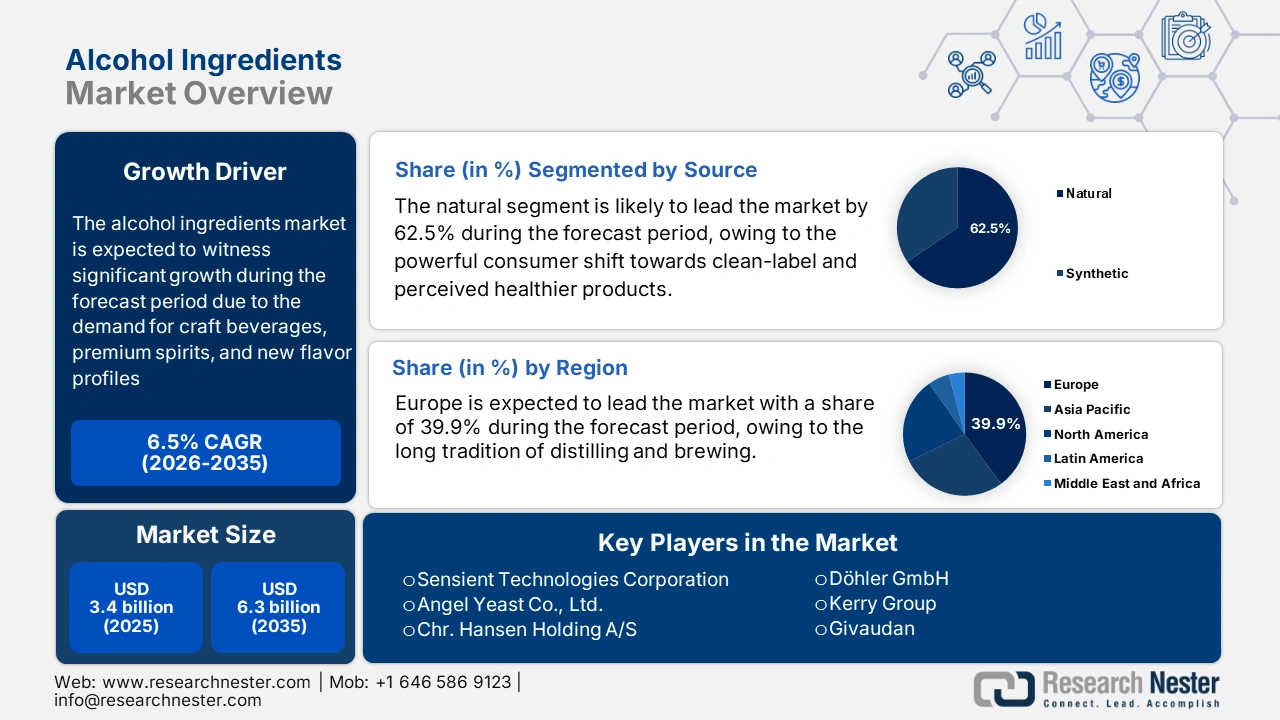

Alcohol Ingredients Market size was valued at USD 3.4 billion in 2025 and is projected to reach USD 6.3 billion by the end of 2035, rising at a CAGR of 6.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of alcohol ingredients is estimated at USD 3.6 billion.

The alcohol ingredients market is growing consistently, driven by increasing global demand for craft beverages, premium spirits, and new flavor profiles. Major ingredients such as yeast, enzymes, colorants, and flavoring agents are crucial to fermentation, flavor fortification, and product differentiation. According to the Environmental Protection Agency report in March 2025, Ethanol is the most important ingredient added to alcoholic drinks and food items. In addition, the U.S. is the largest importer of Ethyl alcohol and other denatured alcohol, with USD 81,686.48K in 2023. The main suppliers are Brazil and the European Union, supplying ethanol from sugarcane and grain, respectively.

On a trade perspective, the alcohol ingredients market is highly globalized and is driven by the comparative advantage of feedstock production and regional regulatory frameworks. Countries with abundant sugarcane, grains, or fruit exports, such as Brazil and members of the European Union, supply ethanol and other base alcohols to major importing markets, including the U.S., India, and Japan. As per the USDA report in 2024, U.S. sugar exports (which are made from sugarcane and beet) in 2024 reached approximately 2.45 million metric tons, with a total export value of USD 2.01 billion. Additionally, manufacturers are prioritizing clean-label and natural ingredients due to health regulations related to the alcohol trade and manufacturing.

Key Alcohol Ingredients Market Insights Summary:

Regional Highlights:

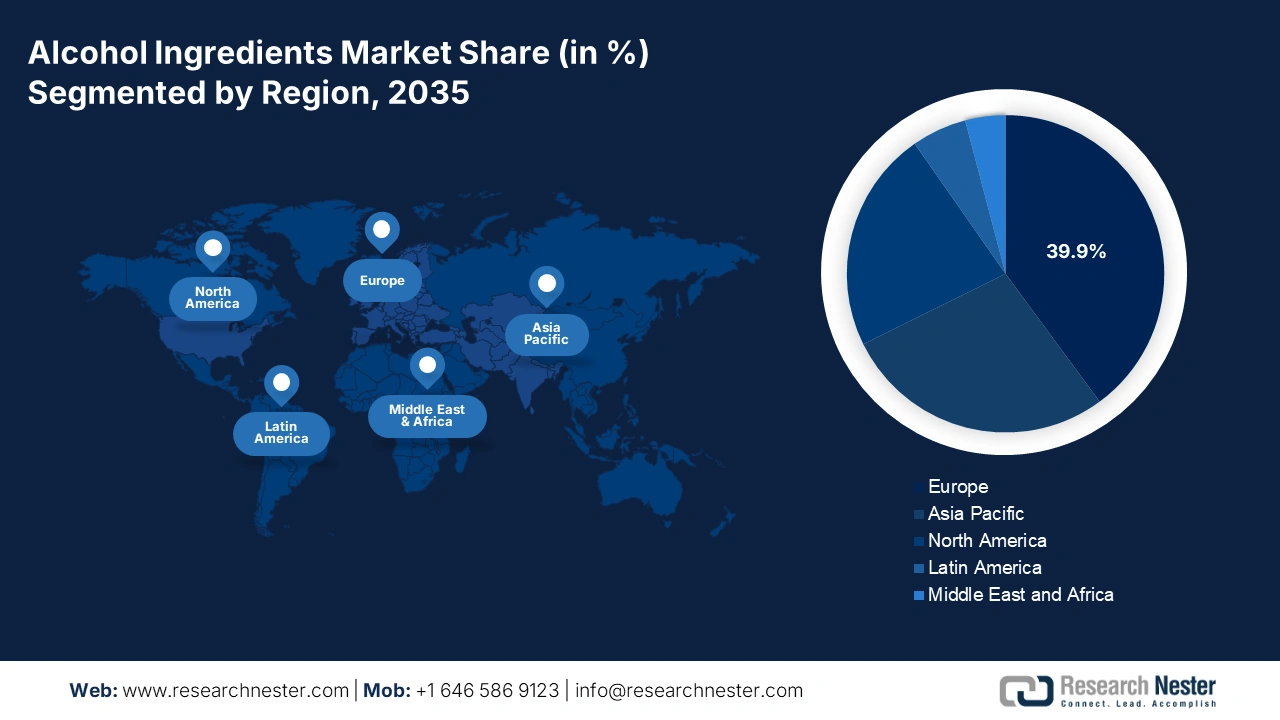

- Europe is projected to hold a 39.9% share of the alcohol ingredients market by 2035, driven by a long-standing brewing and distilling tradition coupled with strict public health regulations.

- The Asia-Pacific region is expected to witness the fastest growth with a 7.3% CAGR by 2035, propelled by rapid urbanization, a growing middle class, and rising demand for specialty malts and unique flavor profiles.

Segment Insights:

- The natural segment of the alcohol ingredients market is projected to hold a 62.5% share by 2035, driven by a strong consumer shift towards clean-label and perceived healthier products.

- The flavoring enhancers segment is anticipated to capture the largest revenue share by 2035, propelled by premiumization and product differentiation in the industry.

Key Growth Trends:

- Increasing demand for low and non-alcoholic drinks

- Health and regulatory compliance

Major Challenges:

- Public health policies and taxation

- Supply chain uncertainty for agricultural inputs

Key Players: Döhler GmbH, International Flavors & Fragrances Inc. (IFF), Givaudan, Sensient Technologies Corporation, Angel Yeast Co., Ltd., Chr. Hansen Holding A/S, Ashland Inc., Kerry Group, Treatt plc, Boortmalt, ADM, Cargill, Incorporated, Roquette Frères, Muntons plc, DSM, McCormick & Company, Takasago International Corporation, D.D. Williamson (DDW), Synergy Flavors, Briess Malt & Ingredients Co..

Global Alcohol Ingredients Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.4 billion

- 2026 Market Size: USD 3.6 billion

- Projected Market Size: USD 6.3 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (39.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Germany, United States, France, China, United Kingdom

- Emerging Countries: India, Brazil, Japan, South Korea, Mexico

Last updated on : 9 October, 2025

Alcohol Ingredients Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand for low and non-alcoholic drinks: In the U.S., there is a demand for non-alcoholic drinks, which is driven by healthy consumers and regulatory guidance on alcohol consumption. As per the NLM study in September 2025, sales of low-or-no-alcohol substitutes, which have 1.2% of alcohol by volume, have been boosted in the last five years, an indication of moderation. In addition, manufacturers are responding with innovation in non-alcoholic spirits, low-proof cocktails, and functional drinks, with a focus on clean-label ingredients and meeting FDA labeling and safety regulations.

- Health and regulatory compliance: This is the major driver fueling the alcohol ingredients market as the manufacturers are actively focusing more on clean-label, natural, and GRAS-approved ingredients. On the other hand, beverage producers and food processors completely rely on ingredients that meets the FDA and EPA standards to ensure safety, quality, and consistency. Compliance with these regulations not only supports product integrity but also facilitates smooth trade, storage, and supply chain operations. Further, the health awareness and ingredient transparency in alcohol usage among consumers increase, demand for higher-quality, regulated alcohol ingredients continue to boost the industry.

- Innovation in flavors and formulations: Producers increasingly utilize specialty flavor extracts, botanical infusions, and fermentation additives to create distinctive taste profiles and premium offerings. According to PennState Extension's report in February 2023, nearly 33% of consumers are spending more on premium drinks that emphasize novel flavor profiles and ingredients and links closely with premiumization. This trend encourages manufacturers to invest in high-quality, FDA-compliant ingredients that enhance mixability and product differentiation.

Use of Grains in Distilled Spirit Production in 2023

|

Year |

Grain use in the Production of Whiskey, Brandy, Rum, Gin and Vodka. (Billions of Pounds) |

|

2020 |

2.22 |

|

2021 |

2.44 |

|

2022 |

2.73 |

|

2023 |

2.83 |

Source: Distilled Spirit Council February 2025

Percentage of Total Exports of Spirits to the U.S. in 2024

|

Country |

Percentage |

|

EU |

50 |

|

Canada |

10 |

|

UK |

6 |

|

Japan |

4 |

Source: American Distilled Spirits Exports October 2025

Challenges

- Public health policies and taxation: Governments increasingly use fiscal policies to reduce alcohol consumption, directly impacting ingredient demand. The World Health Organization points out that raising excise taxes on alcohol is the most cost-effective way to decrease harmful use. For example, an increase in price can cause a decrease in consumption in high-income countries. This policy trend suppresses the market size, driving ingredient suppliers to operate in a contracting or flat market, to seek efficiency instead of expansion.

- Supply chain uncertainty for agricultural inputs: The alcoholic beverage industry is dependent on farm commodities such as grains, grapes, and hops, which are vulnerable to climate and geopolitical shocks. The U.S. Department of Agriculture depicts that drought conditions can severely impact on the barley yields, which is a key input for beer. Such uncertainty generates price volatility for maltsters and brewers, making it difficult to forecast costs and develop procurement strategies. Further, suppliers with no long-term, fixed-price agreements with farmers are most susceptible to these spot market variations, which reduces the profit margins.

Alcohol Ingredients Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 3.4 billion |

|

Forecast Year Market Size (2035) |

USD 6.3 billion |

|

Regional Scope |

|

Alcohol Ingredients Market Segmentation:

Source Segment Analysis

The natural sub-segment dominates the source segment and is expected to hold the highest share of 62.5% by 2035. The segment is driven due to a powerful consumer shift towards clean-label and perceived healthier products. This trend is supported by public health advocacy. For instance, the WHO has stated that there are various benefits of reducing synthetic additives in food and beverages. Further, synthetic addictive cause health-related issues and the NLM study in January 2025 has stated that in the U.S. the health-related problems due to the addictive have cost USD 249 billion annually. This influences manufacturers to reformulate products using ingredients derived from fruits, herbs, spices, and grains, thereby securing the market position and premium pricing of natural ingredients over their synthetic counterparts.

Function Segment Analysis

Under the function segment, flavoring enhancers are dominating the segment and is set to capture the largest share in terms of revenue. This dominance is fueled by premiumization and product differentiation in the industry. Manufacturers always use natural and artificial flavors, botanical extracts, and sugars to develop distinctive sensory profiles and respond to changing consumer taste, thus making flavor development a key area of investment and the primary driver of value within this segment.

Ingredient Type Segment Analysis

In the ingredient type segment, the flavors & salts sub-segment is leading the segment and is driven by the constant demand for product innovation and premiumization in the alcoholic beverage industry. Manufacturers use natural and artificial flavors, botanical extracts, and mixing salts to create the unique and complex sensory experiences that consumers demand. The PennState Extension data in February 2023 depicts that nearly 17% of people aged between 21 and 34 prefer flavored malt beverages. Hence, manufacturers are surging to invest in high-quality, flavored ingredients and address the consumer expectations.

Our in-depth analysis of the alcohol ingredients market includes the following segments:

|

Segment |

Subsegments |

|

Ingredient Type |

|

|

Source |

|

|

Beverage Type |

|

|

Form |

|

|

Function |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Alcohol Ingredients Market - Regional Analysis

Europe Market Insights

Europe is the dominating region in the alcohol ingredient market and is expected to hold the market share of 39.9% in 2035. The market is fueled by the long tradition of distilling and brewing, along with strict public health laws. Further, the region is said to be the global leader in the production of raw materials, mainly barley malt and hops. According to the Eurostat report in July 2021, almost 84% of people aged 15 are consuming alcohol daily. A primary driver is the persistent consumer trend towards premiumization and craft products, which fuels demand for high-quality, specialty ingredients like aroma hops and unique yeast strains.

Germany is expected to hold the highest share in Europe by 2035. The immense size of the brewing industry and export power are the main factors driving the market in Germany. According to the Destatis report in 2022, 8.8 billion litres of beer were sold. While domestic consumption is stable, the international demand for German beer, and by extension its ingredients like noble hops and specific malt varieties, sustains a large production base. Furthermore, the growth of non-alcoholic beer, a segment where Germany is a global innovator, creates new demand for specialized ingredients that can maintain flavor profiles without alcohol, ensuring the ingredient market's resilience and technological advancement.

The UK will maintain a leading position, driven by its dynamic and innovative craft spirits and gin sector. The UK is the largest exporter of food, feed and drink products. The government of UK in July 2025 has depicted that whisky has the highest export value accounting to £5.5 billion in the UK. This global success creates sustained, high-value demand for botanicals, neutral grain spirits, and flavorings. The market is further driven by consumer trends towards premiumization within the spirits category.

Trade Flow of Whisky and Wine in Real Terms at 2024 Prices (£ million)

|

Commodity |

Trade Flow |

2022 |

2023 |

2024 |

|

Whisky |

Export |

7378 |

6086 |

5537 |

|

Import |

202 |

217 |

191 |

|

|

Wine |

Export |

642 |

532 |

385 |

|

Import |

4474 |

4145 |

3938 |

Source: Government of UK July 2025

Asia Pacific Market Insights

The Asia-Pacific is the fastest-growing region in the alcoholic ingredients market and is growing at a 7.3% CAGR by 2035, and is characterized by rapid urbanization, a growing middle class, and evolving consumption patterns. The market is driven by premiumization and a rising need for specialty malts, hops, and unique flavor profiles. The emerging countries such as China and India are experiencing massive volume-driven demand from their large domestic spirits (e.g., Baijiu, Whisky) and beer markets. A key regional trend is the rising health consciousness, which is fostering the low-alcohol and ready-to-drink (RTD) segments, requiring innovative ingredients for flavor masking and texture.

Japan's alcohol ingredients market is driven by its sophisticated sake, shochu, and whisky industries, with a growing craft beer segment. As per the OEC data in 2023, Japan has imported USD 419 million of Alcohol > 80% ABV, which means ethyl alcohol that contains more than 80% pure ethanol content. The Ministry of Health, Labour and Welfare addresses alcohol-related harms, which are a significant public health concern, with policies and education campaigns aimed at reducing consumption, indirectly influencing the market environment for ingredients.

China's alcohol ingredients market is expanding rapidly and is driven by the rising demand for premium spirits, flavored beverages, and innovative formulations. Further, the manufacture of ethanol from grains and fruits in China is essential for the supply of food-grade and beverage-grade alcohol. According to the U.S. Department of Agriculture in August 2025, China is set to be the source of 190 million liters of ethanol each year, largely for beverage and industrial applications. This increasing reliance on imports, coupled with strong domestic demand, is pushing ingredient manufacturers to scale production and focus on quality compliance.

Cellulosic Ethanol Pilot Plants in China

|

Producers |

Production Capacity |

Feedstock |

|

Henan Tianguan |

38 million liters |

Wheat and corn stalks |

|

Songyuan Guanghe |

25 million liters |

Corn cobs and stalks |

|

Shandong Longlive |

65 million liters |

Corn cobs |

|

Jinan Shengquan |

25 million liters |

Corn stalks, corn cobs |

|

Anhui Guozhen |

64 million liters |

Corn and wheat stalks |

|

COFCO Zhaodong |

0.6 million liters |

Corn stalks |

|

Anhui Fengyuan |

6 million liters |

Corn stalks, corn cobs |

Source: U.S. Department of Agriculture in August 2025

North America Market Insights

North America is expanding rapidly in the alcohol ingredients market and is set to capture a share a considerable share by 2035. The U.S. is leading the region and is marked by maturity and a high level of premiumization and innovation. The share of the region is led largely by a strong craft beverage industry, where demand for varied and high-quality ingredients such as specialty malts, hops, and distinctive flavoring agents persists. Some of the key trends are the rising consumer demand for low- and no-alcohol drinks, which necessitates advanced ingredients to replicate mouthfeel and flavor, and the need for clean-label and natural ingredients.

The alcohol ingredients market in the U.S is expanding rapidly and is driven by strong demand for flavored beverages and clean-label products. The U.S. Distilled Spirits Council in February 2025 states that distilled spirits production rose by 121% over the past decade also in 2023 the production was 2.83 billion pounds, reflecting higher use of yeasts, flavors, and specialty additives. Regulatory emphasis on safe, GRAS-approved ingredients by the FDA continues to shape the industry. Between 2022 and 2025, innovation in formulations and premium beverages remains a key growth driver.

The alcohol ingredients market in Canada is increasing gradually and is supported by increased demand for craft beer, flavoured spirits, and environmentally friendly brewing inputs. As per Statistics Canada, March 2024, the overall sales of spirits in 2024 are 184.9 million litres, which indicates the immense contribution of malt, yeasts, and flavouring agents. Regulations by the Government under the Canadian Food Inspection Agency (CFIA) provide safety and labelling standards for ingredients. From 2022 to 2025, innovation in natural flavors and fermentation enhancers is expected to drive product diversification and premiumization.

Percentage of Spirit in Alcohol Industry in the U.S.

|

Year |

Percentage |

|

2014 |

35.2 |

|

2019 |

37.8 |

|

2024 |

42.2 |

Source: Distilled Spirits Council, February 2025

Key Alcohol Ingredients Market Players:

- Döhler GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- International Flavors & Fragrances Inc. (IFF)

- Givaudan

- Sensient Technologies Corporation

- Angel Yeast Co., Ltd.

- Chr. Hansen Holding A/S

- Ashland Inc.

- Kerry Group

- Treatt plc

- Boortmalt

- ADM

- Cargill, Incorporated

- Roquette Frères

- Muntons plc

- DSM

- McCormick & Company

- Takasago International Corporation

- D.D. Williamson (DDW)

- Synergy Flavors

- Briess Malt & Ingredients Co.

The global alcohol ingredients market is driven by high fragmentation, and many multinational companies with diversified ingredients. A dominant trend among top players is the high research and development focus on natural and clean-label options, necessitated by consumer pressure. Moreover, mergers and acquisitions are used extensively to consolidate market share and procure special technology or product portfolios. Supply vertical integration, especially of malt and yeast, is also a key strategy to provide cost control, quality, and assured supply for major beverage companies.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In June 2025, ABD Maestro Pvt. Ltd. (ABDM) introduced Russian Standard vodka, Russia’s leading premium vodka brand in the Indian market. This launch marks the arrival of the globally renowned Russian Standard in India, offering vodka lovers its unique taste, purity, and smoothness.

- In November 2024, India Glycols expanded into the premium alcohol market via a partnership with Amrut Distilleries. This partnership is made mainly to produce, distribute, and sell select Amrut premium brands across North India, marking a strategic move into higher-end industry segments.

- In September 2024, Diageo India, under its McDowell’s & Co. brand, launched the X Series vodka, gin, citron rum, and dark rum for premium social experiences. The range is crafted to encourage experimentation, mixability, and elevated drinking occasions for modern consumers.

- Report ID: 8181

- Published Date: Oct 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Alcohol Ingredients Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.