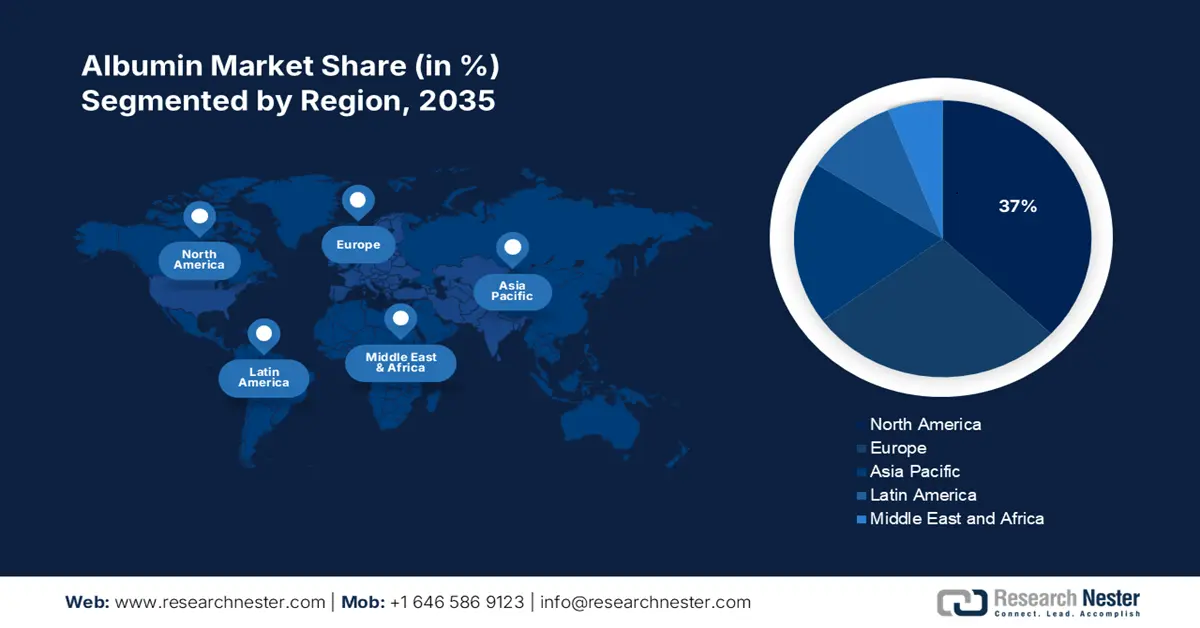

Albumin Market - Regional Analysis

North America Market Insight

North America is expected to hold the highest albumin market share of 37% within the forecast period, driven by advanced healthcare infrastructure, strong regulatory oversight, and high per-capita healthcare spending, which leads to the broader and faster adoption of albumin therapies and other plasma protein products. Further, plasma collection networks exist well in the U.S. and Canada to supply raw material. Public health awareness is quite high, as well as diagnostic screening for kidney dysfunction, liver cirrhosis, etc., thus increasing the possibility of using albumin treatments. According to a report by NIDDK in September 2024, more than 35.5 million U.S. adults had chronic kidney disease in 2023, 1 in 7, who will require therapy with albumin or related proteins.

The albumin market for the U.S. is growing due to an increase in chronic kidney disease (CKD), liver disease, and hypoalbuminemia-inducing disorders, which have clinical applications for albumin-carrying products. According to a report by NIDDK in September 2024, around 2 in 1,000 citizens of the U.S. suffer from end-stage kidney disease (ESKD), or kidney failure. In the ICU (trauma, burns, surgeries), albumin is used as a plasma expander and to correct fluid imbalance, so the demand for it goes up. Here, the growing disease burden due to a rising geriatric population in the U.S. is also ensured.

Albumins, albuminates imports by the U.S in 2023 To Different Countries

|

Product Description |

Partner |

Trade Value 1000USD |

Quantity (KG) |

|

Albumins (excl. egg albumin), albuminates and o |

World |

133,320.16 |

10,226,500 |

|

Albumins (excl. egg albumin), albuminates and o |

New Zealand |

37,025.59 |

3,982,770 |

|

Albumins (excl. egg albumin), albuminates and o |

Denmark |

31,987.82 |

2,258,240 |

|

Albumins (excl. egg albumin), albuminates and o |

UK |

26,471.63 |

1,204,630 |

|

Albumins (excl. egg albumin), albuminates and o |

Ireland |

12,014.83 |

1,441,000 |

|

Albumins (excl. egg albumin), albuminates and o |

Slovak Republic |

7,885.40 |

65,500 |

Source: WITS

The market for Canada is growing due to a rising number of cases of ESKD (end-stage kidney disease), and chronic organ dysfunction engenders albumin demand when given as part of treatment (dialysis, transplant support, fluid management). As per a report by NLM in February 2023, the incidence of chronic kidney disease in Canada stood recently at 71.9 per 1000 persons, thereby increasing the allied protein therapies. The clinical research, biopharmaceutical investments, and collaborations in Canada with plasma collectors or importers drive the supply. The increasing prevalence of comorbidities such as diabetes and hypertension only aggravates the risks of developing CKD and hypoalbuminemia.

Asia Pacific Market Insight

Asia-Pacific market is projected to be the fastest-growing market in the forecast period, with a rise in chronic disorders such as liver disorders, kidney failure, and sepsis, which increase the medical need for therapies involving albumin. Rapid urbanization and an aging population further limit access to health facilities in countries such as China, India, and Indonesia. Investments in biopharmaceuticals and plasma collection centers are also enhancing supply chains. Notably, NLM in February 2023 cited results from a national study published in 2023 by the National Clinical Research Center of Kidney Diseases, indicating that 8.2% of adults in China had chronic kidney disease, with 6.7% having albuminuria.

The albumin market for China is growing due to the number of liver disease cases, including cirrhosis and NAFLD (non-alcoholic fatty liver disease), which is high and increasing. An urban lifestyle, poor eating habits, increased obesity rates, and diabetes cases are all contributing factors to this trend. Additionally, the Government of China is investing in healthcare manufacturing infrastructure, which includes plasma-derived therapies such as albumin. This usually implies that domestic producers are gearing up to ramp up production, thus lessening dependence on imports. A clinical study reported by NLM in February 2023 stated that among CKD adults, 73.3%, 25.0%, and 1.8% were at stage 1 to 2, 3 and 4 to 5, respectively, and awareness of CKD was 10.0%, which is significantly higher than global averages.

The albumin market is growing in India with the rapidly increasing burden of CKD cases, with demand shooting up sharply for albumin products used in renal care due to diabetes and hypertension. Further, India is developing its dialysis and critical care infrastructures, where albumin finds common administration. The biotechnology sector of India is also investing in plasma fractionation and biologics manufacturing to enhance local supply. Increased income levels and better coverage by insurance make treatments accessible to the average patient with middle and lower-class incomes. According to a 2024 meta-analysis by NLM January 2025, the pooled prevalence rate of CKD among adult Indians stands at 13.2%, and higher rates of 15.3% have been seen in rural areas.

Europe Market Insight

Europe albumin market is expected to grow steadily due to rising cases of liver cirrhosis, nephrotic syndrome, and burns, all of which ought to be treated with albumin. NHS laboratories consider albumin under pharmacotherapy for critically ill patients and also in surgical situations. The UK, through its participation in international plasma collection schemes, secures the steady supply of raw material for albumin production. As per a report by WITS in September 2025, UK imports of Egg albumin stood at USD 59,035.99 and quantity 9,037,670. Additionally, public health campaigns further help amplify awareness regarding the benefits of albumin across the different therapeutic horizons. Further, an aging population across Europe demands increased interventions for health, including albumin-based therapies.

The market for the UK is growing due to increasing rates of conditions such as liver cirrhosis, nephrotic syndrome, and burns, which require albumin therapy. The National Health Service, Netherlands, has been introducing albumin into treatment protocols for critical care and surgical patients. As per a report by WITS in September 2025, the UK imported Egg albumin from the Netherlands (USD 33,607.65, 6,085,990 kg), from Italy (USD 8,514.34, 550,186 kg), and from France (USD 5,816.74, 676,654 kg). Also, the UK's participation in international plasma collection schemes assures a continuous flow of raw materials needed for albumin manufacture. Additionally, public health campaigns have been raising awareness about the application of albumin to various therapeutic areas.

The albumin market in Germany witnesses increasing growth from the country's superiority in the medical R&D for plasma-derived therapies. With a rise in chronic diseases such as chronic kidney disease (CKD) and liver disorders, albumin becomes necessary for treatment regimes. As Germany brings advancement in healthcare with regulations, it creates a favorable environment for market growth. Collaborations between public health organizations and the private sector further foster the availability of albumin treatments. As per a report by WITS in September 2025, Germany imported Egg albumin worth USD 31,137.35 kg in 6,850,560 kg quantities, mainly from the Netherlands, confirming a huge demand for albumin in the German healthcare system.

Egg Albumin Export and Import Countries of Europe (2023)

|

Export Destination |

Export Value (USD) |

Import Destination |

Import Value (USD) |

|

Norway |

288 |

Italy |

3.56 million |

|

France |

71 |

France |

1.2 million |

|

Malta |

59 |

Netherlands |

103,000k |

Source: OEC