Airport Biometric Service Market Outlook:

Airport Biometric Service Market size was over USD 34.93 billion in 2025 and is projected to reach USD 146.3 billion by 2035, growing at around 15.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of airport biometric service is evaluated at USD 39.77 billion.

Airports across the globe are implementing biometric solutions in their smart airport initiatives to improve operational efficiency and optimize passenger journey control. Facial and fingerprint recognition technologies operate within airports through self-service kiosks, e-gates, and automated boarding procedures to enhance security and cut down passenger waiting time. Major airports are investing in technologies such as facial recognition, together with fingerprint scanning technologies in North America, Europe, and Asia Pacific to provide automated travel solutions.

The advancements are resulting in reduced human contact and operational expenses, leading to better identity verification accuracy. As a part of their system evolution, in May 2023, Changi Airport implemented biometric automation for immigration clearance, enabling document-free travel. The initiative reflects airport industry standards to use automation for handling increased passenger volumes efficiently. The progress of biometric technology is driving more airports to choose these solutions to accelerate the smart airport transformation process.

Key Airport Biometric Service Market Insights Summary:

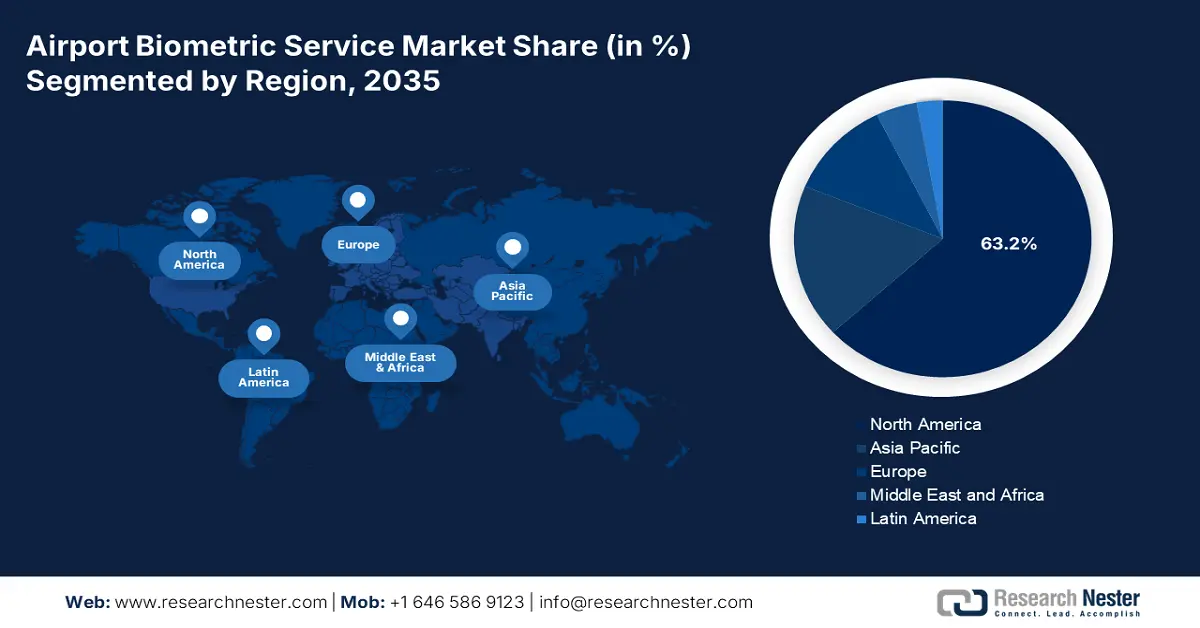

Regional Highlights:

- North America dominates the airport biometric service market with a 63.2% share, driven by increasing adoption of contactless travel solutions and rising demand from travelers supported by regulatory initiatives, fostering strong growth through 2035.

- The Asia Pacific region is expected to witness significant growth in the Airport Biometric Service Market from 2026 to 2035, driven by expanded passenger traffic and implementation of facial recognition and iris scanning systems that minimize wait times.

Segment Insights:

- The Facial Recognition segment is forecasted to achieve over 46.1% market share by 2035, propelled by the integration of advanced identity verification systems to enhance airport security and passenger flow.

- Contactless segment is anticipated to experience significant expansion from 2026-2035, driven by the growing adoption of touchless biometric verification to meet traveler expectations and hygiene standards.

Key Growth Trends:

- Focus on airport security and contactless travel

- Expansion of smart airports and automation

Major Challenges:

- Data privacy and security concerns

- Resistance to biometric authentication

- Key Players: ADB Safegate, Amadeus IT Group SA, IndraSistemas S.A., and Inner Range.

Global Airport Biometric Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.93 billion

- 2026 Market Size: USD 39.77 billion

- Projected Market Size: USD 146.3 billion by 2035

- Growth Forecasts: 15.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (63.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

Airport Biometric Service Market Growth Drivers and Challenges:

Growth Drivers

- Focus on airport security and contactless travel: Airports are implementing advanced technologies for enhanced airport security as well as efficient traveler procedures. Regulatory bodies and governments are mandating the use of biological authentication procedures to enhance border security through facial recognition, fingerprint scanning, and iris recognition technologies. Governments are accelerating biometric system investments to meet the increasing demand for touchless travel management solutions. For instance, In July 2024, Abu Dhabi Airports and the Federal Authority for Identity Citizenship Customs and Port Security started their extensive biometric project at Zayed International Airport. The integrated project combines ticket and travel documentation verification, thus shortening passenger handling duration from twenty-five to seven seconds.

- Expansion of smart airports and automation: The deployment of self-service biometric kiosks, e-gates, and automated boarding systems is resulting in security upgrades and shorter waiting times at transport facilities. The technological enhancements reduce the need for human involvement, resulting in reduced operation costs as well as better identity verification results. The deployment of multi-modal biometric authentication systems in airports also uses facial recognition along with fingerprint scanning and iris recognition to accelerate better security and accuracy levels. Thus, the identification of fraud detection is becoming easy through this, leading to accurate passenger verification results. The combination of several biometric authentication types is helping diverse airport conditions by offering various identification techniques when one solution faces difficulties, such as poor lighting or fingerprint system errors. Airports are moving toward modernization and are experiencing an increasing need for biometric integration systems that enable easy traveling experiences for passengers.

Challenges

- Data privacy and security concerns: Secure data privacy regulations along with security concerns create significant obstacles to the adoption of biometric services at airports. International privacy laws, including the General Data Protection Regulation, implement rigorous requirements for collecting biometric data, handling, and storage for these data. The failure to comply with regulations is leading airports to face considerable penalties coupled with legal repercussions that stop the spread of widespread implementation. Concerns, including fears of government surveillance, biometric data security threats, and security breaches, also act as a barrier, restricting the widespread usage of airport biometric systems.

- Resistance to biometric authentication: Several passengers are hesitant to adopt biometric systems as they fear the safety of their data. In addition, ethical and cultural concerns about facial identification and fingerprint scanning services in certain areas are highlighting increased reluctance. AI-driven biometric systems are facing accuracy issues due to false positive reports and algorithmic bias challenges, damaging their impartial execution.

Airport Biometric Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

15.4% |

|

Base Year Market Size (2025) |

USD 34.93 billion |

|

Forecast Year Market Size (2035) |

USD 146.3 billion |

|

Regional Scope |

|

Airport Biometric Service Market Segmentation:

Scanner Type (Fingerprint Recognition, Facial Recognition, Iris Recognition, Palm Recognition, Signature Recognition, Voice Recognition)

Facial recognition segment is set to capture over 46.1% airport biometric service market share by 2037, owing to persisting technological developments and purposeful industrial alliances. Airports throughout the world are implementing facial recognition systems to boost security standards and elevate operational speeds alongside guaranteeing an uninterrupted passage system. The system enables quick identity checks, reducing queuing times and upholding strong security criteria. In October 2023, SITA partnered with Fraport to launch a modern biometric system at Frankfurt Airport to enable passengers to transition from their check-in to boarding using their faces as identification. The new technology streamlines document inspection operations, thus delivering faster check-in times throughout the passenger journey.

Contact Type (Contact, Contact-Less)

The contactless segment in airport biometric service market is expected to witness significant expansion, owing to the increasing adoption of touchless verification systems to provide better passenger convenience and reduced security checkpoint wait times. AI-powered facial recognition and iris scanning are efficient identification tools that reduce passenger contact at security checkpoints. Modern airports are building biometric e-gates to allow travelers to pass through immigration and boarding security by showing their faces to the scanners. This operational change is enhancing efficiency and is matching up with modern traveler expectations for safe, quick, and hygienic airport processing methods.

The segment growth is also fueling attributed to advancements in contactless biometric devices by major companies. For instance, in March 2023, IDEMIA introduced two contactless biometric devices, namely OneLook Gen2 and MorphoWave TP for rapid traveler identity authentication. OneLook Gen2 enables from-a-distance face and iris capture to verify identities, and MorphoWave TP performs quick ten-fingerprint scanning through hand waves alone. Targeted developments of security solutions and passenger-streamlining technology are fueling processing efficiency through time-reduction measures. Airport automation is driving institutions to implement contactless biometric solutions, as seamless airport experiences have become a higher priority.

Our in-depth analysis of the global airport biometric service market includes the following segments:

|

Scanner Type |

|

|

Contact Type |

|

|

Software |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Airport Biometric Service Market Regional Analysis:

North America Market

North America airport biometric service market is expected to dominate revenue share of over 63.2% by 2037, attributed to the increasing adoption of contactless travel solutions. Airport facilities are implementing various scanning methods to reduce contact points between passengers and equipment for enhanced security. The growing demand from travelers, as well as regulatory support, is driving the development of efficient paperless airport systems.

Security checkpoints benefit from accelerated biometric system deployments, and organizations in the airline industry and airport authorities are implementing them to boost operational speed and reduce security wait times. Biometric technologies are also gaining traction in the region, owing to the implementation of automated border control systems. Airports are developing biometric e-gates and self-service kiosks to control immigration procedures better while improving airport security.

The airport biometric service market in the U.S. is anticipated to increase at a fast pace due to the elevated spending on security infrastructure. To handle rising air travel demand, authorities are using biometric authentication systems that combine facial recognition technology with fingerprint scanning for better passenger verification capabilities. The Transportation Security Administration is continually installing biometric screening technologies throughout main airport facilities to enhance airport security and operational efficiency.

Leading airlines operating in the U.S. are implementing biometric services through their advanced boarding and check-in system development. In February 2023, Delta Air Lines expanded its facial recognition-based self-boarding system to additional U.S. airport terminals, which led to a reduction in wait times. These initiatives are helping increase biometric technology adoption across the country to achieve better operational efficiency and fulfill traveler needs regarding fast, convenient airport experience.

The airport biometric service market in Canada is witnessing steady growth, owing to the active promotion of biometric technologies by the local government to streamline passenger processing efficiently and enhance airport security. The airport biometric service market is witnessing growth due to the integration of biometric verification in operations by authorities to improve identity security checks and boost operational speed. The demand for contact-free biometric systems in the country is also increasing as airports are establishing efficient operations and strict hygiene requirements. Airports are implementing contactless identification systems based on facial and iris scan verification for kiosks and e-gates. Airports such as Montréal-Trudea are actively implementing these technologies to accomplish contact-free operations while reducing passenger congestion and fostering market growth in the country.

Asia Pacific Market Analysis

The airport biometric service market in Asia Pacific is expected to witness a significant expansion during the forecast period, attributed to expanded passenger traffic in the airports. Increasing passenger numbers is resulting in the development of better operational methods and minimizing wait times at airports. Passengers are experiencing benefits from biometric technologies when facial recognition and iris scanning systems lower the time required for check-ins, security checks, and boarding procedures.

The China airport biometric service market is experiencing rapid growth, owing to the support of the government for a digital modernization strategy. Through governmental policies that mandate facial recognition and fingerprint-scanning AI technologies, major airports in the country are implementing this technology on a wide scale. These airport initiatives were developed to build better security systems alongside congestion reduction and excellent passenger experiences. There is an implementation of biometric verification through contactless solutions in China due to strong regulations allowing airport operations to move passengers seamlessly.

In its efforts to build advanced airport technology, China is investing in biometric systems to improve airport efficiency alongside security measures. Airports are increasing efficiency by implementing automated systems for facial recognition-based screening, contactless security checks, and boarding procedures at their main terminals. Next-generation airport technologies are receiving considerable support from the country as the government is focused on building fully automated travel hubs while eliminating manual identity verification requirements. The technological improvements are benefiting travelers by delivering higher convenience and enabling airports to operate more efficiently when managing increasing volumes.

The airport biometric service market in India is highlighting a significant expansion, owing to the country’s robust digital initiatives supported by the government. The airport initiative DigiYatra enables people to pass through airports smoothly with the help of facial recognition systems installed specifically at major airports. The government is promoting digital transformation in aviation through AI-driven biometric solution investments that are driving significant adoption. The private airport companies in India are actively advancing developments in biometric technology to build superior operational efficiency and passenger convenience. In June 2023, GMR Group collaborated with IDEMIA to introduce DigiYatra facial recognition services at airports located in Delhi, Hyderabad, and Goa. Passenger operations are turning more efficient through this program while supporting the country’s plans to build smart airports.

Key Airport Biometric Service Market Players:

- ADB Safegate

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amadeus IT Group SA

- IndraSistemas S.A.

- Inner Range

- Vanderbilt Industries

- Inform Software

- Thales Group

The airport biometric service market is highly competitive, driven by increasing demand for secure and seamless passenger identification. Leading players such as Thales Group, IDEMIA, SITA, NEC Corporation, and Vision-Box are innovating in facial recognition, fingerprint scanning, and iris recognition technologies. Airports worldwide are adopting contactless biometric solutions for check-in, security screening, and boarding to enhance efficiency and security. Strategic partnerships between airports, airlines, and technology providers are accelerating deployments. The rise of AI-powered biometric analytics and government-backed digital identity programs is further intensifying competition, with companies focusing on speed, accuracy, and data privacy compliance to gain a competitive edge. Here are some key players operating in the global airport biometric service market:

Recent Developments

- In June 2024, Bengaluru’s Kempegowda International Airport became the first airport in India to introduce a biometric-enabled self-bag drop facility, DigiYatra. With the integration of DigiYatra, domestic travelers can complete the self-bag drop using facial recognition, eliminating the need for a physical boarding pass or ID. This advancement enhances convenience and streamlines passenger movement throughout the airport.

- In November 2023, Honolulu’s Daniel K. Inouye International Airport implemented SITA Smart Path, integrating 54 biometric face pods across Terminals 1 and 2 to support U.S. Customs and Border Protection (CBP) in biometric exit screening. The touchless technology enhances security and streamlines international departures, with an opt-out option for passengers preferring traditional inspection.

- Report ID: 7378

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Airport Biometric Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.