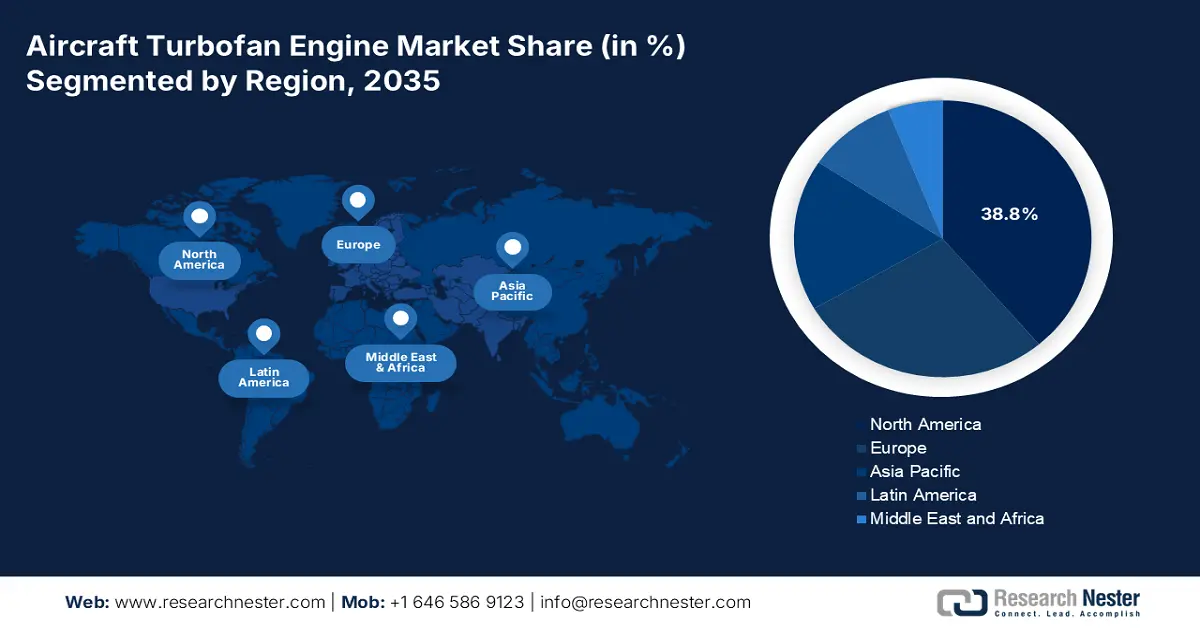

Aircraft Turbofan Engine Market - Regional Analysis

North America Market Insights

North America is dominating the aircraft turbofan engine market and is expected to hold the market share of 38.8% by 2035. The major OEMs and a vast, mature installed fleet drive the market. The primary commercial driver is the ongoing replacement cycle of the aging narrow-body aircraft with the next-gen fuel-efficient models to comply with the emissions standards and reduce the operating costs. This is reinforced by the steady domestic air traffic recovery, with the FAA forecasting U.S. airline passenger growth. This is reinforced by the steady domestic air traffic recovery, with the FAA forecasting U.S. airline passenger growth. The dominant trend is the deep integration of defense spending that provides stable R&D funding and production baseload via programs such as the F-35. Currently, robust environmental regulations are stimulating the investment in sustainable aviation fuel-compatible and advanced hybrid electric propulsion technologies.

The U.S. aircraft turbofan engine market is defined by the synergistic push of Department of Defense investment and regulatory-driven commercial innovation. The defense spending provides foundational R&D and production scale with the programs such as the next-generation air dominance fighter demanding breakthroughs in adaptive cycle and thermal management engine technology, as outlined in the U.S. the report from the CSIS in October 2022 has reported that army spending to improve the turbine engine program allocated USD 270 million in 2022. Additionally, Pratt & Whitney in September 2025 announced that it has completed the critical testing on its small turbofan engine family for use on Collaborative Combat Aircraft, or CCAs. This testing has confirmed that the business can raise the thrust on these existing engines for use on CCA platforms. This announcement supports growth in military turbofan demand, engine retrofit and upgrade programs, and long-term sustainment contracts.

U.S. DoD Aircraft Turbofan Investments (2022-2025)

|

Year |

Program |

Funding Amount (USD million) |

Details |

|

2022 |

Army ITEP (Turboshaft) |

260 |

Peak funding for Black Hawk/Apache engines |

|

2022-2027 |

Army Improved Turbine |

921 (total) |

Next-gen turboshaft development |

|

2023+ |

F-35 AETP (Turbofan) |

Under debate |

Adaptive engine vs. Enhanced Package |

|

2025 |

DARPA AFRE (Turbofan) |

65.1 |

Turbine-based combined-cycle engine |

Source: CSIS October 2022

The aircraft turbofan engine market in Canada is shaped by the strong specialization in the business aviation and regional connectivity, aided by the domestic industrial expertise. This sector received a significant boost in May 2023 when Pratt & Whitney Canada announced its new PW545D engine had been selected to power the Cessna Citation Ascent business jet. This engine is designed mainly for its application, promising improved fuel efficiency, greater thrust, and an extended 6,000-hour Time Between Overhauls. This development leverages the proven PW500 platform that has over 4,600 units and 22 million flight hours of operational history, demonstrating Canada’s strategic role in providing reliable, economically attractive propulsion for the global light to mid-size business jet segment. This aligns with the national aerospace strengths and support fleet modernization goals.

APAC Market Insights

Asia Pacific is the fastest-growing aircraft turbofan engine market and is expected to grow at a CAGR of 5.8% during the forecast period 2026 to 2035. The market is driven by the three interconnected factors: explosive commercial air traffic growth, aggressive fleet expansion by the regional airlines, and strategic national policies aimed at achieving aerospace industrial sovereignty. China is at the forefront with its state-backed initiative to develop the COMAC C919 narrow-body aircraft, directly creating a demand for its indigenous CJ-1000A turbofan and challenging the Airbus-Boeing duopoly. This projected growth solidifies the region’s position as the primary revenue driver for the global industry within the next decade. Further, all the major engine OEMs are intensifying local partnerships and supply chain investment across the region to secure the aircraft turbofan engine market position and access to this long term demand.

China’s aircraft turbofan engine market is driven by the state-led strategy for aerospace sovereignty centered on reducing dependency on the western technology. The cornerstone is developing indigenous powerplants for the COMAC C199 narrow-body jet with the Aero Engine Corporation of China leading the CJ-1000A high-bypass turbofan program, based on ORCASIA June 2024. Further, the push is backed by the immense domestic demand and investment. The Civil Aviation Authority in December 2023 reported that nearly 2,320 aircraft will retire in 2042, expecting continued fleet modernization, creating a captive aircraft turbofan engine market for engines in China. China's aviation authority actively supports this modernization, having approved a comprehensive roadmap for the development of green, smart, and safe aviation technologies by 2035, which includes significant funding for next-generation engine R&D.

India’s aircraft turbofan engine market is expanding rapidly via foreign technology partnerships and ambitious domestic manufacturing goals. This is positioning the country as a global aerospace and MRO hub. A transformative development was the June 2023 agreement between GE Aerospace and Hindustan Aeronautics Limited. Sanctioned by the U.S. government, this deal facilitates the co-production of the GE F414 engines in India. These engines will power the Tejas MkII fighter and future advanced aircraft. This initiative is a direct outcome of India’s defense offset policy and aligns with the broader Make in India campaign, which aims to develop a comprehensive indigenous defense industrial ecosystem and significantly increase the sector’s contribution to the national economy.

Europe Market Insights

Europe’s aircraft turbofan engine market is a global powerhouse anchored by the engineering prowess of its top player such as Rolls-Royce in the UK, Safran in France, and MTU Aero Engines in Germany. The region’s strategy is defined by the deep collaborative partnerships, most notably the Franco-American CFM International Joint venture between GE and Safran, which dominates the narrow-body segment. The core aircraft turbofan engine market drivers include the robust EU emissions regulations pushing the development of revolutionary technologies, such as the open rotor CFM RISE program and the continent's ambitious military programs, the Franco-German Spanish Future Combat Air System, and the UK-led Tempest, which are funneling billions in government R&D funding into the next-gen adaptive cycle and high-thrust military engine.

The aircraft turbofan engine market in Germany is defined by its role as a world-leading specialist in high-integrity engine modules and advanced manufacturing, serving as a critical tier one supplier to the global OEMs rather than a full engine prime contractor. Its industrial backbone, MTU Aero Engines, is a pivotal partner in major programs such as the Pratt & Whitney GTF and the Rolls-Royce UltraFan, specializing in high-pressure compressors and low-pressure turbines. A key government backed initiative driving technological advancement is the National Aerospace Research Program, which funds advanced R&D. For instance, the RWI May 2024 report depicts that LUFO VI-1 project for the year 2020 to 2024 allocated 164 million for the east region mainly for the research into next generation climate neutral propulsion technologies including advanced components for future engines securing Germany’s position in the high value segment of the global supply chain.

Source: RWI May 2024

France’s aircraft turbofan engine market is dominated by Safran Aircraft Engines, a global prime contractor and the co-leader of the CFM International joint venture that holds a commanding share of the global narrow-body engine market with its LEAP engine. The strategy is heavily oriented toward state-supported innovation for next-gen sustainability. A flagship initiative is the France 2030 investment plan, which earmarks substantial funds for decarbonizing aviation. Safran is the lead industrial partner in the CFM RISE Technology Demonstration Program launched in June 2021, which aims to develop an advanced open fan engine architecture targeting 20% reduction in fuel consumption compared to today’s most efficient models, securing France’s leadership in defining the future of commercial propulsion.