Aircraft MRO Market Outlook:

Aircraft MRO Market size was over USD 92.21 billion in 2025 and is anticipated to cross USD 151.64 billion by 2035, growing at more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aircraft MRO is assessed at USD 96.44 billion.

The aircraft maintenance, repair, and overhaul (MRO) sector has been transformed by the advent of AI ushering in predictive maintenance features. The aircraft MRO market is characterized by the integration of automation systems in MRO services and improvement in the quality of services. Moreover, the regulatory push for frequent aircraft maintenance creates profitable opportunities in the market while the expansion of fleets to cater to the rapidly rising air travel demands has expanded the scope of aircraft MRO services. The table below highlights key trends in global aviation which impact the demand for aircraft MRO services.

Air Transport Outlook

|

Particulars |

Details |

|

Revenue Passenger Kilometers (RPKs) |

11.6% growth in total RPKs and an increase of 10.4% in the number of global passengers estimated for 2024 |

|

Estimated Regional Growth |

APAC is poised to contribute to more than half of the net gain in passengers’ numbers by 2043 |

|

Global Air Cargo Traffic Growth |

Estimated 5% growth in 2024 |

|

Revenue Growth |

10% revenue growth estimated and predicted to almost reach USD 1 trillion |

Source: International Air Transport Association (IATA)

The trends in the aviation sector will directly impact the aircraft MRO market. The increase in revenue bodes well for a boost in the manufacturing of aircraft while the rising investments to modernize legacy fleets have created sustained opportunities to provide MRO solutions. Moreover, a key facet that has bolstered the scope of service is the emergence of digital twins technology. The fusion of digital tools has fostered a proactive maintenance culture.

The rising percentage of commercial flying hours has strengthened the aircraft MRO market. In general, the majority of commercial airlines require to be serviced every 3,500 to 8,000 flight hours. Aircraft require daily checks and comprehensive maintenance every few months and even more intensive maintenance in 2-3 years. Hence, the growth of fleets, be it for the commercial or the defense sectors, remains a lucrative opportunity for aircraft MRO solutions providers. Emerging macroeconomic trends, such as the demand for a workforce fluent in mechanical expertise and blockchain documentation systems, bolstering traceability across global supply chains are assisting market growth. Furthermore, the favorable trends bode well for the continued expansion of the aircraft MRO market.

Key Aircraft MRO Market Insights Summary:

Regional Highlights:

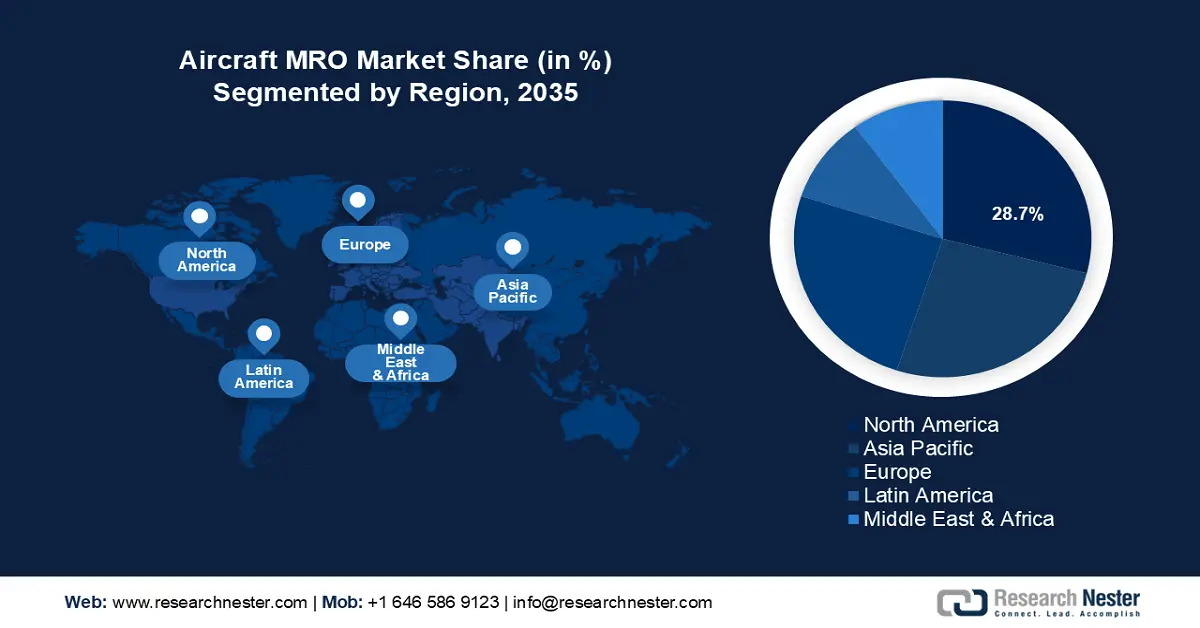

- North America leads the Aircraft MRO Market with a 28.7% share, driven by the stringent imposition of regulatory oversight, positioning it as a global leader in aviation maintenance through 2026–2035.

- The APAC region is anticipated to see the fastest growth in the Aircraft MRO Market from 2026 to 2035, driven by the surge in air traffic in the region.

Segment Insights:

- Engine Overhaul segment is expected to capture around a 43.3% share by 2035, driven by demand for next-gen aircraft engines and maintenance.

Key Growth Trends:

- Accelerated adoption of next-generation aircraft

- Expansion of OEM-led performance-based contracts

Major Challenges:

- Complexities in supply chain resilience

- Material science complexity in the next-generation aircraft

- Key Players: Lufthansa Technik, Rolls Royce PLC, ST Engineering, HAECO, AAR Corporation, SIA Engineering Company, Air Works, GA Telesis, Boeing, Avia Solutions, MRO Holdings, GE Aerospace, Safran SA.

Global Aircraft MRO Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 92.21 billion

- 2026 Market Size: USD 96.44 billion

- Projected Market Size: USD 151.64 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (28.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, France, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Aircraft MRO Market Growth Drivers and Challenges:

Growth Drivers

- Accelerated adoption of next-generation aircraft: With the defense sector of countries and commercial airlines continuing to upgrade fleets with next-generation aircraft, MRO providers are answering the calls for innovative maintenance solutions. The integration of next-generation avionics requires MRO operations to adopt cutting-edge diagnostic tools, predictive analytics, and digital twin simulations to optimize the maintenance cycles. Moreover, new-generation aircraft such as Airbus A350, Boeing 787, etc., require specialized MRO expertise. Additionally, the market analysis predicts the demand for MRO services to coincide with the surge in demand for next-generation aircraft engines.

The table below highlights three recent aircraft MRO market movements indicating a surge in investments to bolster aircraft MRO technician jobs and the creation of training institutions, and the trends confluence with the growth expected of the aircraft MRO sector.

Aircraft MRO Trends

|

Date |

Particulars |

|

November 2024 |

The Air India Group announced the setting up of a Basic Maintenance Training Organization (BMTO) offering an integrated 2+2 years of Aircraft Maintenance Engineering (AME) program. |

|

September 2024 |

American Airlines announced an investment in nearly 500 new aviation maintenance jobs and additional lines of heavy maintenance work at the carrier’s maintenance bases in the U.S. |

|

April 2024 |

Embraer announced plans to invest USD 390 million for job creation in Brazil and around 90% of hires will occur throughout the year for the operations sector, with positions for mechanics, electricians, millers, molders, and aircraft maintenance technicians. |

- Expansion of OEM-led performance-based contracts: Original equipment manufacturers (OEMs) are increasingly offering power-by-the-hour agreements, which bundle maintenance with real-time performance analytics. The advent of bundled models incentivizes predictive maintenance, driving long-term MRO engagement and fleet optimization. Furthermore, the development of integrated digital platforms that enable seamless data sharing between airlines, OEMs, and maintenance teams aligns with manufacturer benchmarks. Another key feature of the aircraft MRO market’s growth is the tie-ups with aftermarket component suppliers boosting MRO services. For instance, in January 2025, GA Telesis, LLC announced a long-term agreement (till 2030) with a leading OEM to improve the component supply chain to airlines and operators globally.

- Rising geopolitical emphasis on aviation sovereignty: The growth in geopolitical tensions with the rising regional fracas among nations have ensured a steady stream of investments to bolster domestic aerospace capabilities. With the expansion of military aircraft fleets in multiple nations, the demand for aircraft MRO services is poised to expand. Additionally, an emerging driver is the growth of investments in fleet modernization, which ties up with the demand for MRO solutions as aircraft are being retrofitted with modern equipment. For MRO providers, aligning with strategic national priorities opens new funding opportunities whilst providing long-term lucrative defense contracts to be leveraged. The table below highlights three major investments in modernization initiatives of military fleets.

Defense Aircraft Modernization Trends

|

Date |

Particulars |

|

January 2025 |

Lockheed Martin announced receiving of USD 270 million contract from the U.S. Air Force to integrate a system of next-generation infrared defensive sensors on the F-22 Raptor. |

|

September 2024 |

Amentum was awarded a contract worth USD 490 million to modernize the U.S. Navy’s multi-engine training aircraft fleet. |

|

July 2024 |

The U.S. Department of Defense (DoD) announced modernization plans to upgrade tactical aircraft based in Japan. |

The growth in military fleet expansion and modernization provides opportunities for MRO solutions providers to tie up with companies awarded lucrative defense contracts, and benefit from the sector’s growth.

Challenges

- Complexities in supply chain resilience: Post-pandemic recovery has highlighted the vulnerabilities in the global aerospace supply chain. The vulnerabilities are pronounced in sourcing specialized components such as turbine blades and avionics. Geopolitical tensions have also impacted supply chains by disrupting lead times. This has forced MRO providers to adopt costlier inventory buffers to mitigate operational delays. Moreover, OEMs prioritizing new production over aftermarket support can create bottlenecks for repairs.

- Material science complexity in the next-generation aircraft: The proliferation of advanced aerospace composites in next-generation fleets has led to the demand for new repair methodologies. Regulatory bodies such as the FAA and EASA lag in certifying novel techniques for critical repairs, which creates operation bottlenecks. Moreover, regulatory delays in approval can cause revenue loss for MRO providers.

Aircraft MRO Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 92.21 billion |

|

Forecast Year Market Size (2035) |

USD 151.64 billion |

|

Regional Scope |

|

Aircraft MRO Market Segmentation:

Service (Engine Overhaul, Airframe Maintenance, Line Maintenance, Modification, Components)

Engine overhaul segment is set to capture aircraft MRO market share of around 43.3% by the end of 2035, attributed to the rising demand for next-generation aircraft engines. MRO providers investing in state-of-the-art facilities and skilled technicians to meet the complex requirements of engine maintenance are set to leverage a competitive edge in the aircraft MRO market. The calls to modernize aging aircraft fleets and the regulatory mandates for periodic maintenance create lucrative opportunities for MRO providers. Moreover, the IATA highlights an increase in shop turnaround times (TAT) for new-generation engines, creating a pain point for aircraft operators. MRO providers that can streamline booking slots and reduce TAT are expected to dominate the aircraft MRO market by the end of 2035. The table below highlights recent developments in aviation technology which are poised to characterize the next wave of engine overhaul demands from MRO providers.

Aviation Advancements

|

Date |

Particulars |

|

January 2025 |

The U.S. Airforce announced the raising of GE, and Pratt contracts to USD 3.5 billion each to accelerate the next generation of engine work. |

|

January 2025 |

JobsOhio forwarded a USD 9 million research & development grant to GE Aerospace. Technologies such as Open Fan and compact engine core are being developed. |

|

December 2024 |

Bombardier and Honeywell signed a strategic agreement to provide advanced technology for the current and future bombardier aircraft in propulsion, avionics, and satellite communication technologies. |

Organization Type (Independent MRO, Airline/Operator MRO, OEM MRO)

The independent MRO segment is projected to account for a larger revenue share in the aircraft MRO market by organization type. Independent MRO providers are expected to have a greater profitability share throughout the forecast period owing to the prevailing outsourcing trends among airlines to specialized third-party providers to negate the cost required to maintain an in-house MRO team. Furthermore, the rapid expansion of commercial fleets in emerging markets, particularly in APAC and Africa, has ensured a steady stream of business for independent MRO providers.

Our in-depth analysis of the global aircraft MRO market includes the following segments:

|

Service |

|

|

Organization Type |

|

|

Aircraft Type |

|

|

Aircraft Generation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aircraft MRO Market Regional Analysis:

North America Market Forecast

North America aircraft MRO market is projected to hold revenue share of over 28.7% by the end of 2035. A key feature driving the growth of the North America market is the stringent imposition of regulatory oversight to ensure regular maintenance of aircraft to prevent flight risks. Collaborative partnerships between regulatory bodies, such as the FAA and industry organizations, have propelled continuous improvements in maintenance practices across both commercial and military sectors. Moreover, collaborations between OEMs and MROs within the region bolster the scope of services and expansion opportunities. For instance, in November 2024, GE Aerospace signed a maintenance, repair, and overhaul (MRO) offload agreement with United Aerospace Maintenance Company to focus on quick turn workscopes for CFM LEAP engines.

The U.S. aircraft MRO market is estimated to account for a major share in North America, characterized by the surging demand for aircraft maintenance technicians. For instance, the U.S. Bureau of Labor Statistics reported that between 2023 and 2033, the employment demands for aircraft and avionics equipment mechanics and technicians will grow at 5%, which is as fast as the average for all occupations. An average of 13,400 openings for avionics equipment and aircraft mechanics are projected over the decade, indicating the rising demand for aircraft MRO services. Furthermore, the U.S. market is experiencing soaring competition to book slots for the repair and maintenance of commercial aircraft engines. This trend creates opportunities for new entrants in the market to offer faster MRO solutions.

The Canada aircraft MRO market is projected to exhibit robust growth by the end of 2035. The market in Canada is experiencing growth in the backdrop of fleet expansion investments, creating opportunities for MRO providers. For instance, in February 2025, Nolinor Aviation of Canada announced the purchase of multiple aircraft production slots from Natilus for the regional freight KONA. Moreover, in December 2024, Air Canada announced plans to double the size of its fleet in a push to reach USD 30 billion in revenue by 2028. The proactive market movements by airline operators in Canada highlight burgeoning opportunities for MRO service providers.

APAC Market Forecast:

The APAC aircraft MRO market is poised to register the second-fastest revenue growth in the global market. The surge in air traffic in the region is poised to be a major contributor to ensuring sustained growth. IATA has forecasted that APAC will exhibit the largest increase in passenger numbers by 2043, which has to be supported by robust fleet expansion initiatives by airline companies. Both of the trends are poised to assist growth in demand for MRO services. Additionally, in October 2024, IATA’s economic report highlighted APAC exhibiting a 19% YoY growth in the aviation sector, which is intrinsically tied to the expansion of MRO services.

The China aircraft MRO market is set to expand throughout the stipulated timeframe. The Civil Aviation Administration of China (CAAC) has bolstered domestic MRO capabilities under its fourteenth Five-Year Plan for Civil Aviation Deployment. Additionally, the lucrativeness of the China aircraft MRO market is characterized by growing investments in military aircraft, evidenced by the debut of the sixth-generation aircraft in 2024. Furthermore, the Boeing Company, a major player in the aviation market, released an estimate forecasting a 4.1% growth of commercial fleet in China by 2043 and air travel in China to become the world’s largest traffic flow. The forecasts highlight the lucrativeness of MRO services for aircraft in China.

The India aircraft MRO market is poised to increase its revenue share throughout the forecast period. The improvement in ease of doing business in the country has bolstered investments in aerospace clusters. A characteristic of air travel in the country is the proliferation of low-cost airlines to support the massive demand from the world’s largest population. Major airlines in the country are actively investing to expand their fleets as the frequency of air travel within the country and internationally has increased exponentially in this decade. IBEF estimated aircraft movement in the country to have grown to 2.67 million in FY 2024 while the domestic air traffic reached almost 97% of the pre-Covid-19 levels in 2022-2023. The trends support a robust increase in the demand for aircraft MRO services in the country.

Key Aircraft MRO Market Players:

- Lufthansa Technik

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rolls Royce PLC

- ST Engineering

- HAECO

- AAR Corporation

- SIA Engineering Company

- Air Works

- GA Telesis

- Boeing

- Avia Solutions

- MRO Holdings

- GE Aerospace

- Safran SA

The aircraft MRO market is poised to expand during the forecast period. Key players in the sector are investing in reducing the TAT for engines while easing the traffic in booking MRO slots. Furthermore, the proliferation of AI and ML has ensured the advent of predictive analysis to reduce downtime in maintenance works. Furthermore, OEMs are offering MRO services and collaborating with airline providers to improve the scope of services. Recent aircraft MRO market movement is the acquisition of Kellstrom Aerospace Group, Inc. by VSE Corporation announced in October 2024, marking an expansion of the portfolio for commercial aerospace engine aftermarket.

Here are some key players in the aircraft MRO market:

Recent Developments

- In December 2024, AAR Corporation announced a definitive agreement o divest its Landing Gear Overhaul business to GA Telesis. The transaction is valued at $51 million and is expected to close in the first quarter of 2025.

- In October 2024, Safran SA announced an investment of more than USD 1 billion to develop a global MRO network for its LEAP engine. The investment is poised to bolster Safran’s MRO capabilities worldwide.

- Report ID: 7169

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aircraft MRO Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.