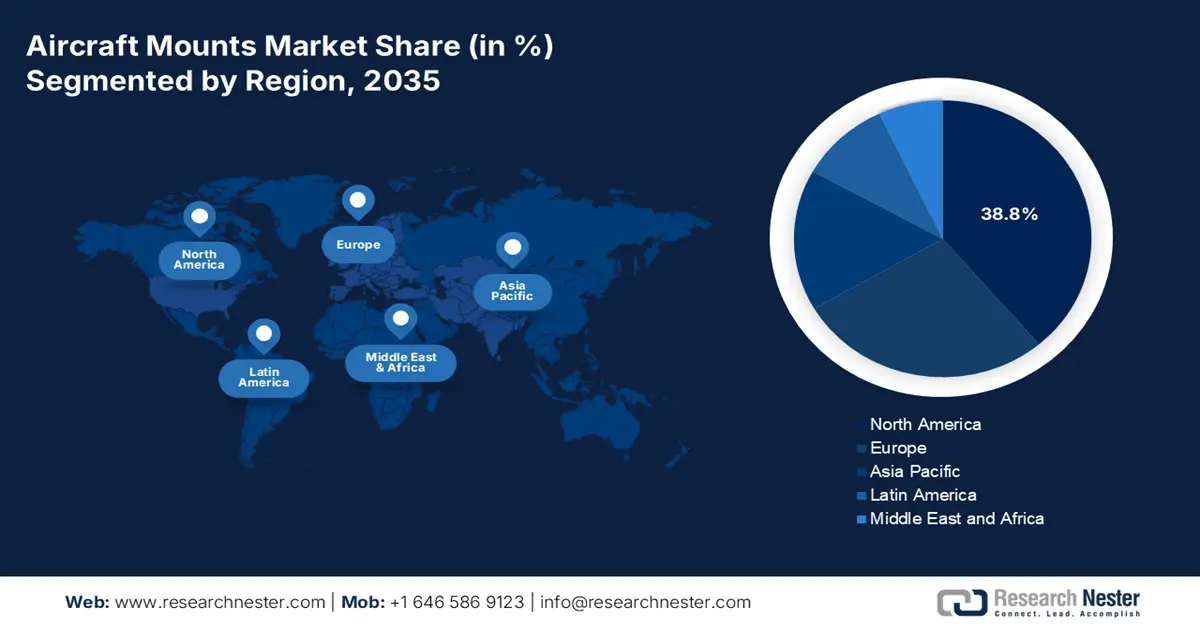

Aircraft Mounts Market - Regional Analysis

North America Market Insights

North America is the dominant player in the aircraft mounts market and is poised to hold the revenue share of 38.8% by 2035. The market is driven by the high defense spending, a mature MRO sector, and a strong OEM presence. The U.S. Department of Defense’s sustained investment in next-generation aircraft such as the B-21 Raider and F-35 programs creates a consistent demand for the advanced mounting systems. Further, the FAA’s forecast of a growing commercial fleet necessitates new mounts and sustains a robust aftermarket. The key trends include the integration of the smart mounts with the health monitoring capabilities and the shift towards the lightweight composite materials to improve the fuel efficiency and performance across both commercial and military platforms.

The U.S. aircraft mounts market is driven by military modernization and commercial surges, capturing the demand. The primary trends include the heightened focus on vibration isolation for engine mounts, aimed FAA FAA-mandated inspection for the Gulfstream G500/G600 models due to the quality escapes in the engine attachments, ensuring safety in high-performance jets. According to the CSIS October 2022 report, the army’s improved turbine engine program, peaking at USD 260 million in 2022 with sustained growth, emphasizes advanced mounts for thermal efficiency, reducing the weight in airframes. This focus on lightweight, durable materials is vital for next-gen aircraft performance. Further, manufacturers are investing in R&D for composite and smart material solutions. These innovations are vital to meet the dual demands of escalating defense budgets and expanding commercial aviation capacity.

Investments Related to Aircraft Mounting

|

Investment Category |

Description |

Investment Amount |

Notes |

|

NextGen Avionics & Equipage |

Joint FAA and airline investment in aircraft avionics upgrades including mounting hardware |

FAA spent over USD 15 billion by end 2024; industry ~USD 15 billion expected |

Investments include avionics equipage necessary for new capabilities like ADS-B In, DataComm systems |

|

FAA NextGen Program Funding |

FAA’s capital program investments in air traffic control modernization and avionics systems |

Included within overall USD 36 billion NextGen program funding estimate |

Covers technology and hardware installations, including mounts supporting avionics and system integration |

|

Aircraft System Component R&D |

Research funding directed towards aerospace safety, avionics, and aircraft system innovations |

Not specifically quantified; part of FAA R&D budget |

Supports technology development relevant to aircraft mounting and integration in NextGen modernization |

Source: FAA July 2025

Canada’s aircraft mounts market is influenced by a steady fleet renewal, increased regional airline activity, and investments in aviation infrastructure. The key trends revolve around fighter procurement modernization, with USD 27.7 billion allocated for 88 fighter aircraft related to the equipment, training, and information services, sustainment set-up and services, and construction of Fighter Squadron Facilities. This data directly drives the demand for the aircraft mounts as the fighter aircraft require engine and powerplant mounts, vibration isolation mounts, and structural mounts for sensors, weapons, and electronics. As each aircraft integrates hundreds of mounting components across the critical system, large-scale procurement programs materially expand the demand base for OEM-installed and lifecycle-replacement mounts.

APAC Market Insights

Asia Pacific is the fastest growing in the aircraft mounts market and is set to grow at a CAGR of 6.2% during the forecast period. The escalating commercial air travel, military modernization, and strategic government initiatives drive the aircraft mounts market. The region’s dominance is fueled by India and China’s rapidly expanding domestic fleets alongside established aerospace hubs in South Korea and Japan. Key drivers include massive commercial orders from carriers such as IndiGo and Air India that necessitate a corresponding surge in MRO services and component demand. The military’s regional tensions are supporting significant investments in indigenous aircraft programs, such as India’s TEJAS and South Korea’s KF-21 Boramae fighter, both of which require specialized high-performance mounting systems. A key trend is the strategic push for supply chain localization with the governments promoting Make in India and Made in China 2025 to minimize the import dependency and cultivate domestic aerospace manufacturing capabilities, directly impacting the mounts supply chain.

India’s aircraft mounts market is witnessing an explosive growth and is driven by one of the world’s fastest growing commercial aviation sector and a decisive government push for defense indigenization. The primary driver is the historic fleet expansion with Indian airlines placing orders for new aircraft, directly fueling the demand for new OEM mounts and a parallel surge in the MRO services. This commercial boom is matched by the defense modernization under the Make in India initiative. As per the PIB February 2023 report the capital allocation for the Defense Services in the Union Budget 2023 to 2024 was increased to ₹1.62 lakh crore a significant portion of which funds domestic aerospace programs such as the TEJAS fighter and Dhruv helicopter creating a dedicated high value market for locally sourced mounting systems. This strategic focus ensures the domestic aircraft mounts market is poised for sustained double-digit growth throughout the decade.

China is the largest in the aircraft mounts market in the APAC region and is dominated by its state-led ambition to achieve aerospace self-sufficiency. The market is propelled by the rapid production scaling of the COMAC C919 narrow-body jet that directly competes with the Boeing and Airbus models and necessitates a complete domestic supply chain for components like engine and airframe mounts. This commercial push is complemented by the continuous modernization of the People’s Liberation Army Air Force, which fields advanced indigenous aircraft like the J-20 stealth fighter. According to the U.S. Department of Defense 2023 report on China's military power, China has more than 1,300 fourth-generation and fifth-generation combat aircraft indicating the massive scale of its fleet and the sustained high-volume demand for advanced mounting technologies required for these platforms.

Europe Market Insights

The Europe aircraft mounts market is a mature and stable sector defined by a strong aerospace OEM presence, robust EASA regulations, and significant defense modernization programs. The region’s share is anchored by countries with leading aerospace industries, namely France, Germany, and the UK. The key drivers include the high production rates of the Airbus commercial aircraft, mainly the A320neo family, which directly fuel the demand for the OEM-mounted systems. Further, the European defense spending is on an upward trajectory with initiatives such as the Future Combat Air System and Tempest program requiring next-gen mounting solutions for advanced material and stealth capabilities. A vital trend is the shift towards sustainable aviation, forcing the manufacturers to develop lighter composite mounts that contribute to minimizing the fuel consumption and emissions, aligning with the EU’s ambitious Green Deal objectives.

France is projected to hold the highest revenue share by 2035, mainly driven by its key role in the Airbus consortium and the Future Combat Air System program. As the home for the final assembly lines, France is the epicenter of the European commercial aviation production, creating a consistent high volume demand for aircraft mounts. The Ministere Des Armees report in 2025 states that in July 2024, Boeing announced the acquisition of its subcontractor Spirit AeroSystems for USD 4.7 billion. Further the Spirit AeroSystems made revenue of USD 6 billion in 2023 and produced faulty parts for Boeing’s civil aircraft, mainly the 737 MAX. Boeing is known for its re-internalization of part of the production of its aircraft in order to better detect any defects. This acquisition directly affects structural component production, quality assurance, and supply chain stability for aircraft mounts used in Boeing platforms.

The UK aircraft mounts market is forecast to be the second largest market and is driven by its sovereign combat air programs and world-leading aerospace R&D ecosystem. The UK Ministry of Defense’s commitment to the Tempest program via Team Tempest, alongside the modernization of its F-35 and Typhoon fleets, creates a concentrated demand for advanced proprietary mounting solutions. According to the UK Government’s National Shipbuilding Strategy Refresh 2023, principles of technological sovereignty and supply chain resilience are being applied across the defense sector, including aerospace, emphasizing domestic capability. This trend, coupled with research fueled by agencies such as Innovate UK into lightweight composite materials and digital design, ensures the UK market remains at the forefront of mount technology independent of European supply chains post Brexit and secures its strong market position.