Aircraft Attitude Indicator Market Outlook:

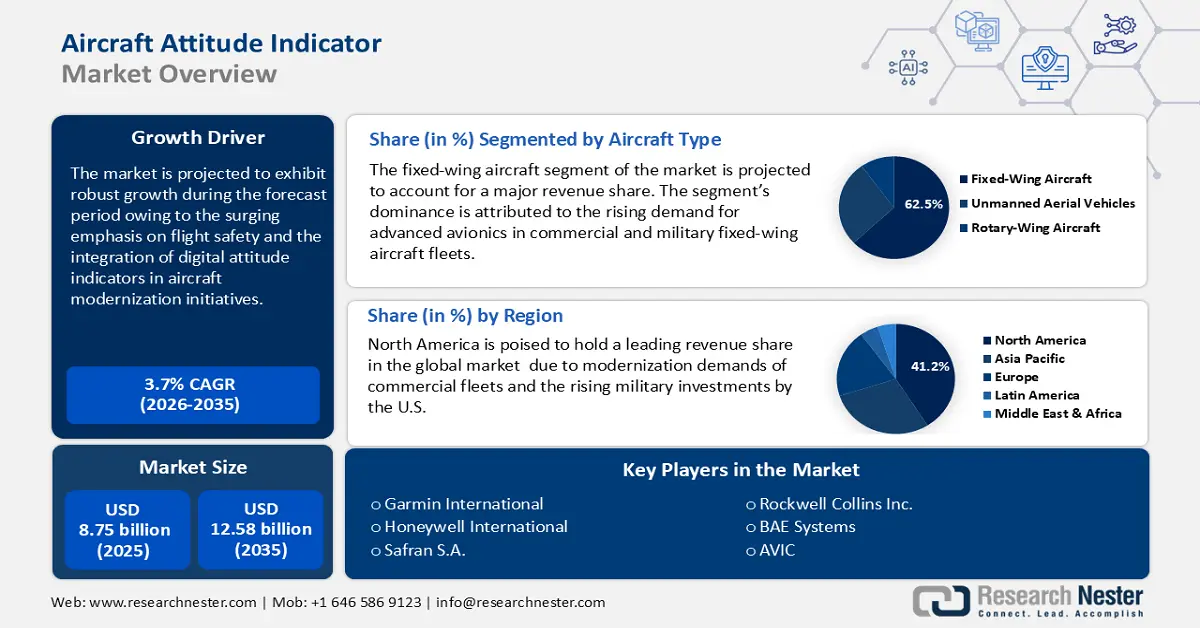

Aircraft Attitude Indicator Market size was valued at USD 8.75 billion in 2025 and is set to exceed USD 12.58 billion by 2035, registering over 3.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aircraft attitude indicator is estimated at USD 9.04 billion.

The rising emphasis on flight safety propels the aircraft attitude indicator market’s growth. Integrating digital attitude indicators, which offer precision and reliability over traditional analog systems, is becoming a standard in modern cockpits. Aircraft attitude indicators provide pilots with real-time accurate representations of an aircraft’s orientation relative to the horizon, thereby improving situational awareness and mitigating the risks of spatial disorientation. Attitude indicators remain a critical component in nighttime flights boosting the market’s growth. Moreover, the increase in flight traffic globally is positioned to bolster the demand for aircraft attitude indicators. The table below highlights air traffic by numbers published by the Federal Aviation Administration (FAA) in 2024.

Air Traffic by Numbers in 2024 (U.S.)

|

Air Traffic |

Flight Data |

|

Total Flights handled by the FAA Yearly |

16,405,000 |

|

Average Daily Flights handled by the FAA |

45,000 |

|

Scheduled Passenger Flights Yearly |

10,000,000+ |

|

Aircraft in the Sky in Peak Operational Times |

5,400 |

Source: FAA

The data highlights a large number of flights handled by the FAA yearly with a growing number of operational flights in peak operational times. The increasing number of fleets bodes well for greater opportunities to supply attitude indicators, benefiting the manufacturers. Furthermore, the technological shifts in the aircraft attitude indicator sector are major market drivers, with the rising adoption of Micro-Electro-Mechanical Systems (MEMS) contributing to compact and efficient attitude indicators. Additionally, the rising demand for air travel boosts the production of commercial and private aircraft, integrated with state-of-the-art attitude indicators. In July 2024, the Boeing Company, a major aerospace company, forecasted demand for around 44 thousand new airplanes through 2043 as air travel surges.

Key Aircraft Attitude Indicator Market Insights Summary:

Regional Highlights:

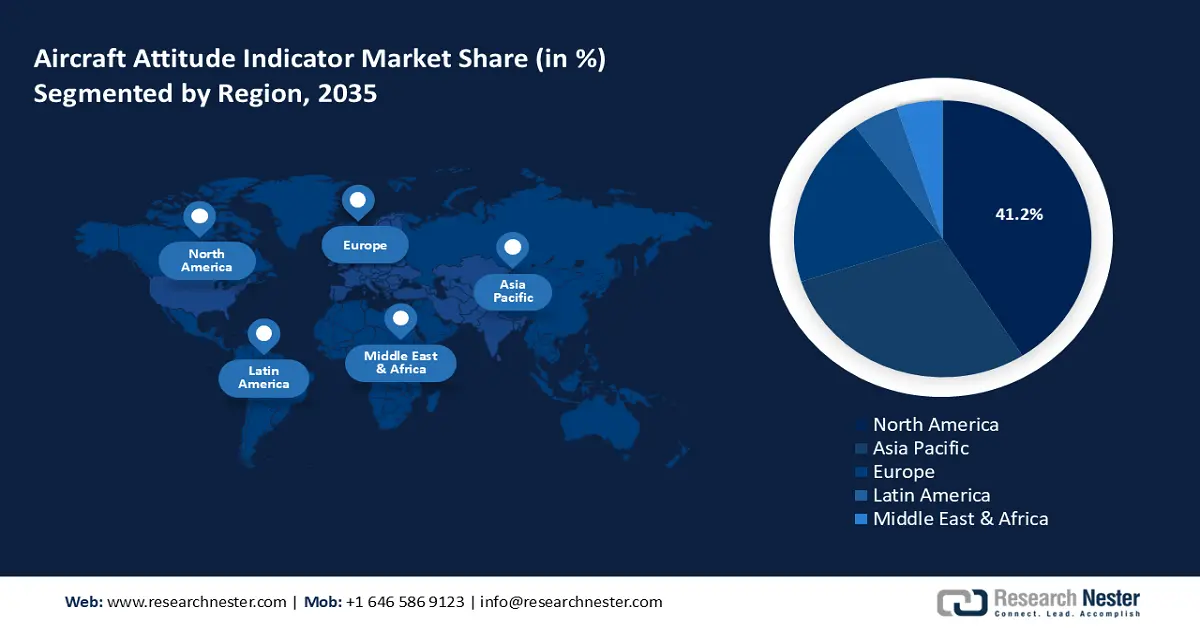

- North America commands a 41.2% share of the Aircraft Attitude Indicator Market, driven by the well-established aviation sector and rising demand for advanced avionics in general and commercial aviation, ensuring strong growth through 2026–2035.

- The Asia Pacific Aircraft Attitude Indicator Market is poised for rapid growth by 2035, driven by the significant surge in air travel demand leading to increased aircraft production and fleet expansion.

Segment Insights:

- The Unmanned Aerial Vehicles segment is expected to experience significant growth from 2026 to 2035, driven by military and commercial UAV applications.

- The Inertial Sensor segment is expected to experience significant growth in the Aircraft Attitude Indicator Market from 2026-2035, driven by advancements in MEMS and GNSS-based sensors.

Key Growth Trends:

- Investments to modernize military aircraft fleets

- Advancements in avionics technology

Major Challenges:

- Complexity in certification and compliance requirements

- Limited utility in non-pressurized and VFR aircraft

- Key Players: Garmin International, Honeywell International Inc., Safran S.A., Rockwell Collins Inc., Woodward Inc., AVIC, Thales, Lockheed Martin, Airbus, Panasonic Avionics, BAE Systems, Boeing.

Global Aircraft Attitude Indicator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.75 billion

- 2026 Market Size: USD 9.04 billion

- Projected Market Size: USD 12.58 billion by 2035

- Growth Forecasts: 3.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, United Kingdom, Japan

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 13 August, 2025

Aircraft Attitude Indicator Market Growth Drivers and Challenges:

Growth Drivers

-

Investments to modernize military aircraft fleets: Rising investments in modernizing aircraft fleets globally significantly benefit the growth of the aircraft attitude indicator market. Fleet modernization is vital to remaining competitive amidst geopolitical tensions. Integrated with Inertial Navigation Systems (INS) and Global Positioning Systems (GPS), modern attitude indicators provide real-time orientation data ensuring precise navigation. The table below indicates fleet modernization efforts by major economies that are expected to provide rife opportunities for manufacturers of aircraft attitude indicators.

Fleet Modernization Programs

|

Date of Announcement |

Name of the Country |

Program Details |

|

April 2023 |

UK |

The Ministry of Defense (MoD) awarded a contract extension worth USD 688.9 million to BAE systems to improve technologies for the country’s future combat aircraft. |

|

December 2022 |

The U.S. |

The Department of Defense (DoD) announced the upgrade of its fleet with the decision to spend over USD 100 billion on major investments to modernize existing aircraft and buy new ones. The investment plan is USD 14.2 billion over the next 5 years through 2027. |

- Advancements in avionics technology: The aircraft attitude indicator market is set to benefit from a surge in the adoption of advanced avionics systems. The heightened demand for modern instruments to maintain flight safety and accuracy creates lucrative opportunities to supply attitude indicators for commercial and non-commercial flights. Moreover, trends within the aerospace industry indicate a growing shift towards digital cockpit systems supported by federal regulations. For instance, in July 2024, the FAA approved the replacement of a 2-inch standby altimeter and separate standby attitude indicator in the Learjet Model airplanes with Mid-Continent Instruments and Avionics MD23 2-inch Digital Counter Drum Encoding Altimeter and Attitude Indicator.

- Rising demand for advanced pilot training simulators: The flight modernization trends and the advent of advanced instrumentation have bolstered the demand for upgraded pilot training simulators, which rely heavily on high-precision attitude indicators. The systems are vital in creating realistic training environments to assist pilots in gaining proficiency for challenging flight scenarios. Additionally, the incorporation of attitude indicators in simulators ensures accurate orientation data to meet the rising demand for operator training simulations.

Recent key investments that are expected to boost the demand for attitude indicators in flight simulators are the plans to invest USD 100 million in the emerging economy of India to increase pilot simulator training and cut down costs by 30%. The plans were announced in June 2024 by Simaero. Furthermore, the rapid increase in air travel is positioned to drive the demand for commercial fleet expansion and pilots, which in turn creates opportunities to supply simulation training modules equipped with attitude indicators.

Challenges

-

Complexity in certification and compliance requirements: The regulatory challenges associated with the replacement and installation of modern attitude indicators can pose a challenge to the sector’s growth. Manufacturers can face constraints while complying with aviation safety measures set by the authorities such as the DO-160 (environmental testing) and DO-178C (software compliance). The certifications require rigorous testing for electromagnetic compatibility and reliability and can delay product launches.

-

Limited utility in non-pressurized and VFR aircraft: While the aircraft attitude indicator market is forecasted to grow, the necessity of attitude indicators can be limited for smaller, non-pressurized aircraft that operate under the Visual Flight Rules (VFR). In such aircraft, pilots rely on visual cues for navigation during daytime flights and installation of attitude indicators can be seen as an unnecessary cost, especially for flight operators that are focused on low-altitude, short-distance flights. However, the rising focus on flight safety is poised to drive demand for high-end instrumentation in low-altitude flights.

Aircraft Attitude Indicator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 8.75 billion |

|

Forecast Year Market Size (2035) |

USD 12.58 billion |

|

Regional Scope |

|

Aircraft Attitude Indicator Market Segmentation:

Aircraft Type (Fixed-Wing Aircraft, Unmanned Aerial Vehicles, Rotary-Wing Aircraft)

Fixed-wing aircraft segment is estimated to account for aircraft attitude indicator market share of more than 62.5% by the end of 2035. The segment’s growth is attributed to the surging demand for advanced avionics systems in military, commercial, and general aviation. Fixed-wing aircraft require precise attitude indicators to maintain operational safety during IFR operations. Moreover, the rapid transition from the traditional analog indicators to digital, glass cockpit systems is a significant driver of the segment. With the trends of retrofitting aging fixed-wing fleets with modern avionics, opportunities are rife in the fixed-wing aircraft segment of the aircraft attitude indicator market. The table below highlights recent funding rounds of emerging and key players in the aerospace sector, and major investments which are projected to create opportunities for the installation of attitude indicators.

Funding and Investment in the Aerospace Sector

|

Date |

Funding and Investment Details |

|

January 2025 |

XTI Aerospace Inc. announced the raising of USD 45 million in gross proceeds through the sale of common stock and made progress on the TriFan 600 aircraft, a fixed-wing aircraft with VTOL capabilities. |

|

January 2025 |

Vertical Aerospace announced the closing of an upsized USD 90 million public offering. The USD 90 million raised includes over USD 60 million from new investors and USD 25 million from Mudrick Capital. |

|

February 2024 |

The U.S. Army announced aviation investment rebalance. The army will increase investments in unmanned aerial reconnaissance capabilities and the procurement of commercial small unmanned systems. |

The unmanned aerial vehicles (UAV) segment of the aircraft attitude indicator market is estimated to expand during the stipulated timeframe. The UAV segment is projected to grow due to the growing usage of UAVs in military reconnaissance. Furthermore, the commercial sector’s adoption of UAVs for applications such as agriculture, aerial surveying, and delivery services has heightened the demand for lightweight attitude indicators that integrate seamlessly with flight control systems. Additionally, the segment benefits from the advancements in AI and sensor fusion technology, ensuring greater application of UAVs.

Recent investments to increase the manufacturing capabilities of UAVs in emerging markets are expected to create a sustained demand for the installation of attitude indicators. For instance, in January 2025, the government of the state of Telangana in India announced a Memorandum of Understanding (MoU) with JSW UAV Ltd., to establish a state-of-the-art UAV manufacturing facility with investments worth USD 97.5 million.

Sensor Type (Inertial Sensor, Magnetic Sensor, Pressure Sensor, GPS Sensor)

By sensor type, the inertial sensor segment in aircraft attitude indicator market is predicted to expand its revenue share throughout the stipulated timeline. A major factor in the segment’s growth is the advancements in MEMS technology. MEMS-based gyroscopes are increasingly being used due to their compact size and cost-efficiency which makes them ideal for both manned and unmanned aircraft. Additionally, the development of high-performance inertial sensors integrated with GNSS (Global Navigation Satellite Systems) is expected to drive adoption. An indication of the opportunities within the segment is the recent advancements in inertial measurement units. For instance, in September 2023, Civitanavi Systems and Honeywell announced the launch of a new inertial measurement unit for pointing, stabilization, and short-duration navigation on commercial and military aircraft.

Our in-depth analysis of the global aircraft attitude indicator market includes the following segments:

|

Aircraft Type |

|

|

Sensor Type |

|

|

Display Type |

|

|

Accuracy |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aircraft Attitude Indicator Market Regional Analysis:

North America Market Forecast

North America aircraft attitude indicator market is anticipated to capture revenue share of over 41.2% by 2035. The market’s expansion is driven by the region’s well-established aviation sector and the rising demand for advanced avionics in general and commercial aviation. The U.S. leads the North America market due to investments in modernizing aging fleets, particularly in regional airlines and private aircraft where retrofitting digital attitude indicators is a priority. Canada, with its vast remote areas and reliance on air travel is poised to experience heightened adoption of reliable, all-weather attitude systems for safety. Moreover, partnerships with flight training schools and private aviation hubs can drive adoption among smaller operators seeking cost-effective solutions.

The U.S. aircraft attitude indicator market is projected to account for a major share in North America. A major driver of the market is the FAA’s NextGen program seeking to modernize the National Airspace System (NAS) by 2025. Moreover, the advent of cutting-edge avionics in military, commercial, and general aviation is expected to create a lucrative market for manufacturers of aircraft instrumentations. FAA reports that over 60% of general aviation aircraft in the U.S. still rely on analog systems, creating opportunities for digital retrofits. For instance, in June 2023, Garmin announced the Supplemental Type Certification (STC) by the FAA for the G1 275 electronic flight instrument which is a cost-effective avionics upgrade including the primary attitude indicator, course deviation indicator (CDI), horizontal situation indicator (HSI), or the multi-function display (MFD).

The Canada aircraft attitude indicator market is estimated to expand during the forecast period. The reliance on air transport for remote areas in the country is poised to be an emerging driver of the sector’s growth in Canada. For instance, Transport Canada’s report in 2020 highlights that over 70% of the country’s airports serve regions inaccessible by road. Moreover, the demand for advanced avionics creates a continuous demand to retrofit attitude indicators. In June 2024, NAV CANADA selected Kongsberg Geospatial to equip the Digital Aerodrome Air Traffic Services (DAATS) program which includes deploying advanced navigation systems for remotely piloted aircraft in extremely harsh environments, leading to opportunities to retrofit attitude indicators.

APAC Market Forecast

The APAC aircraft attitude indicator market is expected to register the fastest growth during the stipulated timeline of the market’s analysis after North America. The significant surge in air travel demand has led to an increase in aircraft production and fleet expansion, benefiting the manufacturers of aircraft instrumentations. Economies in APAC, led by China, India, and Japan are investing heavily to modernize their aviation infrastructure propelling the sector’s growth in the region. The table below highlights the Revenue Passenger Kilometers (RPKs) as of February 2024 indicating the need for fleet expansion in APAC.

Airline Industry RPKS (2024)

|

Particulars |

Details |

|

Growth in total RPKs in 2024 |

11.6% |

|

Increase in global passengers |

10.4% |

|

Growth in APAC |

Expected to lead among the other regions and contribute more than half of the global net gain in passenger numbers by 2043. |

Source: International Air Traffic Association (IATA)

The China aircraft attitude indicator market is projected to register a leading revenue share in APAC. China has established itself as one of the leaders in aviation, exemplified by the development of the sixth-generation combat aircraft. Moreover, China’s Commercial Aircraft Corporation (COMAC) is rapidly advancing in avionics development, and with the country’s push to reduce reliance on imports, domestic avionics manufacturers in China are poised to find opportunities to supply advanced attitude indicators to commercial aircraft in the country. Moreover, in August 2024, the Boeing Company predicted that air travel in the country to grow by 5.2% annually and a 40% rate of replacement for older jets. These trends bode well for the aircraft attitude indicator market growth in China, with the sector expected to maintain its dominance throughout the forecast period.

The India aircraft attitude indicator market is set to expand during the stipulated timeframe. The growth of air travel owing to the increase in disposable income has heightened fleet expansion initiatives creating lucrative opportunities for manufacturers to supply aircraft instrumentation. Moreover, the government’s UDAN scheme supports improvement in regional connectivity driving retrofits in turboprop fleets such as ATR 72s with modern avionics. In January 2025, the government approved the Aircraft Leasing Bill to simplify the repossession of aircraft for lessors. The initiative is expected to boost fleet modernization initiatives including glass cockpit systems, which require state-of-the-art attitude indicators for improved flight performance.

Key Aircraft Attitude Indicator Market Players:

- Garmin International

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Safran S.A.

- Rockwell Collins Inc.

- Woodward Inc.

- AVIC

- Thales

- Lockheed Martin

- Airbus

- Panasonic Avionics

- BAE Systems

- Boeing

The aircraft attitude indicator market is poised to expand during the stipulated timeframe of the sector’s analysis. Key players in the market are investing to improve precision and integration with modern avionics systems. Moreover, manufacturers are expanding portfolios to create compact, lightweight, and energy-efficient indicators suitable for manned and unmanned aircraft. In 2024, Garmin International, a major player in the sector, released its annual revenue report indicating consolidated revenue worth USD 1.59 billion which is a 24% increase compared to the prior quarter.

Here are some key players in the aircraft attitude indicator market:

Recent Developments

- In January 2025, Garmin and Qualcomm Technologies, Inc. announced the expansion of their automotive technology collaboration with the new Garmin Unified Cabin 2025, a next-generation digital cockpit solution. The new digital cockpit solution will be powered by Qualcomm Technologies’ Snapdragon Cockpit Elite platform.

- In December 2024, Avianca announced the selection of Honeywell Cockpit Technologies for use in the new Airbus A320neo fleet. The adoption of Honeywell’s portfolio of avionics technologies and mechanical systems is expected to improve situational awareness for Avianca’s pilots.

- Report ID: 7080

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aircraft Attitude Indicator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.