Air to Water Heat Pump Market Outlook:

Air to Water Heat Pump Market size was over USD 38.28 billion in 2025 and is projected to reach USD 190.39 billion by 2035, witnessing around 17.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of air to water heat pump is evaluated at USD 44.27 billion.

The net-zero emission goal by 2050 is a significant future for energy-efficient heating solutions including air to water heat pump. These systems make use of outside air for water-heating purposes and are gaining traction in both residential and commercial settings. The report by the International Energy Agency (IEA) reveals that the annual growth of global air to water heat pump in 2021 was poised at 24%. Europe captured the most dominating growth of 49% in 2021. Germany and Poland observed the highest adoption of air to water heat pump owing to the technology of choice trend. The hybrid setup trend, a combination of air to water heat pump with gas boilers augmented the Italy market growth and held over 40.0% share.

In August 2024, the International Institute of Refrigeration (IIR) revealed that the demand for air to water heat pump is estimated to reach 4.96 million units in 2023, a o.2% rise from 2022. The majority of the share of around 30% was captured by China, followed by Europe at 11.5%. France, Germany, and Italy represent over half of the Europe air to water heat pump market. Furthermore, the European Heat Pump Association revealed that the air to water heat pump system sales increased by 127,329 units in 2021.

The rising strict regulations on carbon emissions and policies in the form of schemes and tax benefits on sustainable energy solution adoption are augmenting the sales of air to water heat pump across the world. The increasing fossil fuel prices are also surpassing the sales of air to water heat pump technologies over gas furnaces and boilers.

Key Air to Water Heat Pump Market Insights Summary:

Regional Highlights:

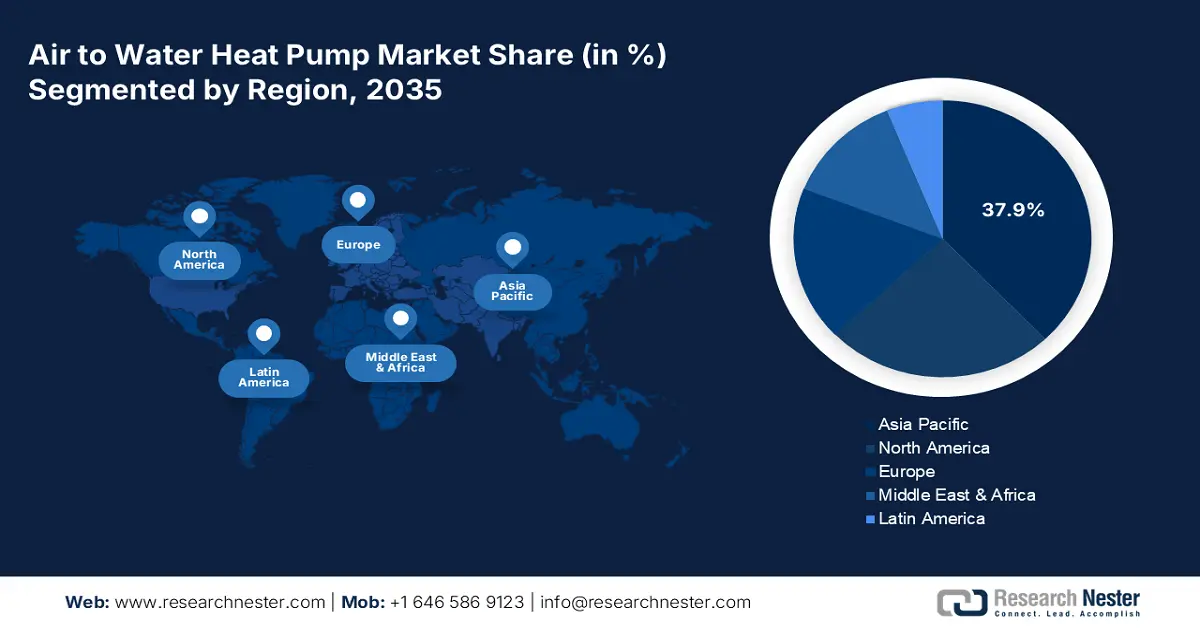

- The Asia Pacific air to water heat pump market is projected to secure over 37.9% share by 2035, reinforced by intensifying electrification efforts owing to strict environmental regulations on carbon emissions.

- North America is anticipated to grow at the fastest pace through 2026-2035, supported by ongoing technological advancements attributed to favorable policy frameworks on energy-efficient technology adoption.

Segment Insights:

- The residential segment is projected to command over 71.5% share by 2035 in the air to water heat pump market, supported by its strong alignment with modern smart-home ecosystems impelled by increasing adoption of smart homes.

Key Growth Trends:

- Technological boom

- Sustainability trend

Major Challenges:

- High initial costs

- Complexity issues

Key Players: SunEarth, Inc., LG Electronics, Inc., Bosch Thermotechnology Corp., Carrier Corporation, Johnson Controls, and Glen Dimplex Group.

Global Air to Water Heat Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 38.28 billion

- 2026 Market Size: USD 44.27 billion

- Projected Market Size: USD 190.39 billion by 2035

- Growth Forecasts: 17.4%

Key Regional Dynamics:

- Largest Region: Asia Pacific (37.9% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Australia, Brazil, France

Last updated on : 2 December, 2025

Air to Water Heat Pump Market - Growth Drivers and Challenges

Growth Drivers

-

Technological boom: Technological advancements in the air to water heat pump such as inverter-driven compressors, smart control systems, and advanced refrigerants are contributing to the overall air to water heat pump market growth. These innovations are improving the performance, reliability, and operating costs of air to water heat pump. Continuous innovations coupled with cost-effective approaches are expected to attract a broader customer base, boosting the profit share of key market players.

For instance, Wonderwall is one of the leading manufacturers of AI-powered air-sourced heat pumps. Its technologies effectively cut energy costs and carbon emissions and attract a wider eco-conscious consumer base. The AI-powered clean technology fits in all structures commercial as well as residential.

The U.S. Department of Energy Office of Scientific and Technical Information (OSTI) estimates that effective and advanced standards, certifying bodies, and technical organizations aid in accelerating the air to water heat pump market acceptance of innovative heating technologies such as air to water heat pump. The residential and commercial building integration programs also aid in bridging the gap from technology commercialization to broader adoption. -

Sustainability trend: The escalating costs of natural gas and oil are driving the sales of sustainable heating solutions such as air to water heat pump. Owing to their high efficiency, air to water heat pump aid in long-term benefits such as operational savings. These pumps when combined with other renewable technologies such as solar panels maximize energy savings and enhance the overall sustainability of heating systems. For instance, in January 2022, SunEarth, Inc. announced its partnership with Nyle Water Heating Systems, Inc. to launch a scalable solar water series heat pump. These solar-integrated air to water heat pump perfectly align with the sustainability trend and are suitable for the multi-family/commercial sector.

Challenges

-

High initial costs: Even if the air to water heating pumps offer long-term savings, the high initial costs are lowering their sales growth. This is most observed in price-sensitive markets or among budget-conscious demographics. Continuous innovations are the prime factors that contribute to the high prices of final products.

-

Complexity issues: The integration of advanced air to water heat pump with existing infrastructure is a complex process. This requires specialized technicians or experts to effectively install these advanced heating technologies without any potential delays, driving up the installation costs. The majority of commercial structures find it costly as they have already installed outdated or conventional heating technologies.

-

Competition from counter heating technologies: The competition from alternative heating technologies such as ground-source heat pumps, solar thermal systems, gas-based furnaces, and oil-based boilers is majorly challenging the revenue growth of air to water heat pump manufacturers. The similar performance and cost-effectiveness of these alternative technologies deter customers from buying air to water heat pump. Thus, the slow adoption rates hamper the overall air to water heat pump market growth to some extent.

Air to Water Heat Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.4% |

|

Base Year Market Size (2025) |

USD 38.28 billion |

|

Forecast Year Market Size (2035) |

USD 190.39 billion |

|

Regional Scope |

|

Air to Water Heat Pump Market Segmentation:

Application Segment Analysis

Residential segment is predicted to hold air to water heat pump market share of more than 71.5% by 2035. The increasing adoption of smart homes is driving the adoption of air to water heat pump. These advanced heating systems seamlessly and effectively integrate with the smart home ecosystem and aid in energy saving. Tech-savvy individuals are prime consumers of residential air to water heat pump. Also, air to water heat pump’s ability to deliver low-temperature heating makes them more compatible with modern and energy-efficient home designs and new construction projects. Manufacturers' continuous focus on technological innovation is anticipated to boost the sales of advanced residential air to water heat pump in the coming years.

For instance, in August 2024 LG Electronics, Inc. announced the launch of its innovative Therma V R290 Monobloc 7- and 9-kilowatt (kW) air-to-water heat pumps. These models are equipped with advanced compressors that drive efficiency and seamlessly integrate with the smart home ecosystem. Such innovations are estimated to significantly boost the adoption of advanced air to water heat pump in residential settings.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air to Water Heat Pump Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific air to water heat pump market is projected to account for revenue share of more than 37.9% by the end of 2035. The electrification trend, strict environmental regulations on carbon emissions, and supportive policies on the adoption of energy-efficient technologies are significantly contributing to the overall market growth. China, Japan, India, South Korea, and Australia are some of the most lucrative marketplaces for air to water heat pump manufacturers.

China is estimated to witness high adoption of air to water heating technologies in the coming years. The International Energy Agency (IEA) report reveals that in 2022 the use of air to water heat pump grew by 20%. The same source also estimates that over 1 million of air to water heat pump were sold in the country. China produces more than 40% of the global heat pumps, which makes it a major producer and exporter of heating technologies including air to water heat pump.

In India, the increasing investments in clean energy technologies are promoting the sales of air to water heat pump. The country’s net zero carbon emission by 2070 goal to cut 50% of fossil fuel energy consumption is generating lucrative opportunities for air to water heat pump manufacturers. Furthermore, infrastructure development projects such as smart cities are expected to augment demand for advanced air to water heat pump in the coming years.

North America Market Insights

The North America air to water heat pump market is foreseen to expand at the fastest pace during the projected period. Technological advancements, the strong presence of key market players, and favorable policy frameworks on energy-efficient technology adoption are augmenting the regional market growth. The U.S. and Canada both are offering win-win strategies for air to water heat pump manufacturers.

In the U.S., the rising electricity prices are driving the attention of consumers to adopt clean energy sources including sustainable air to water heat pump. According to a report by the Rocky Mountain Institute (RMI), over 3.6 million air source heat pump units were sold in 2024. The relative share of air-source heat pumps for space heating accounted for around 55.0%.

In Canada, continuous technological advancements and climatic changes necessitate individuals to invest in advanced heating solutions such as air to water heat pump. To meet the net-zero emissions by 2050 goal many residents are shifting towards energy-efficient heating technologies such as air to water heat pump.

Air to Water Heat Pump Market Players:

- SunEarth, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Electronics, Inc.

- Bosch Thermotechnology Corp.

- Carrier Corporation

- Johnson Controls

- Glen Dimplex Group

- Vaillant Group

- Viessmann Group

- WOLF GmbH

- Guangzhou SPRSUN New Energy Technology Development Co., Ltd.

- LG Electronics INC

- NIBE Industrier AB

- Samsung Electronics Co., Ltd

- Stiebel Eltron GmbH & Co. KG

- EcoFlow

- Trane

Leading companies in the air to water heat pump market are adopting several organic and inorganic tactics to earn high profits. They are continuously investing in research and development activities to develop innovative air to water heat pump solutions. Industry giants are also forming strategic collaborations with research organizations, and academics, and partnerships with other players to develop advanced products and maximize their market reach.

By acquiring smaller companies or start-ups, key players are enhancing their product offerings. Strat-ups often adopt innovative product launch strategies, which attracts industry giants with a motive to expand their product folio. Furthermore, regional expansion tactics are aiding market players to grab high-earning opportunities from untapped markets.

Some of the key players include:

Recent Developments

- In April 2024, Johnson Controls introduced the YORK YMAE 575 V Air-to-Water Inverter Scroll Modular Heat Pump. This high-efficiency heat pump is available in a 575-volt model and meets the Canadian Registration Number (CRN) requirements.

- In April 2024, EcoFlow announced the launch of two new heating solutions PowerHeat and PowerGlow. PowerHeat is an air to water heat pump and PowerGlow is a smart heating element compatible with any rooftop photovoltaic system.

- Report ID: 6812

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air to Water Heat Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.