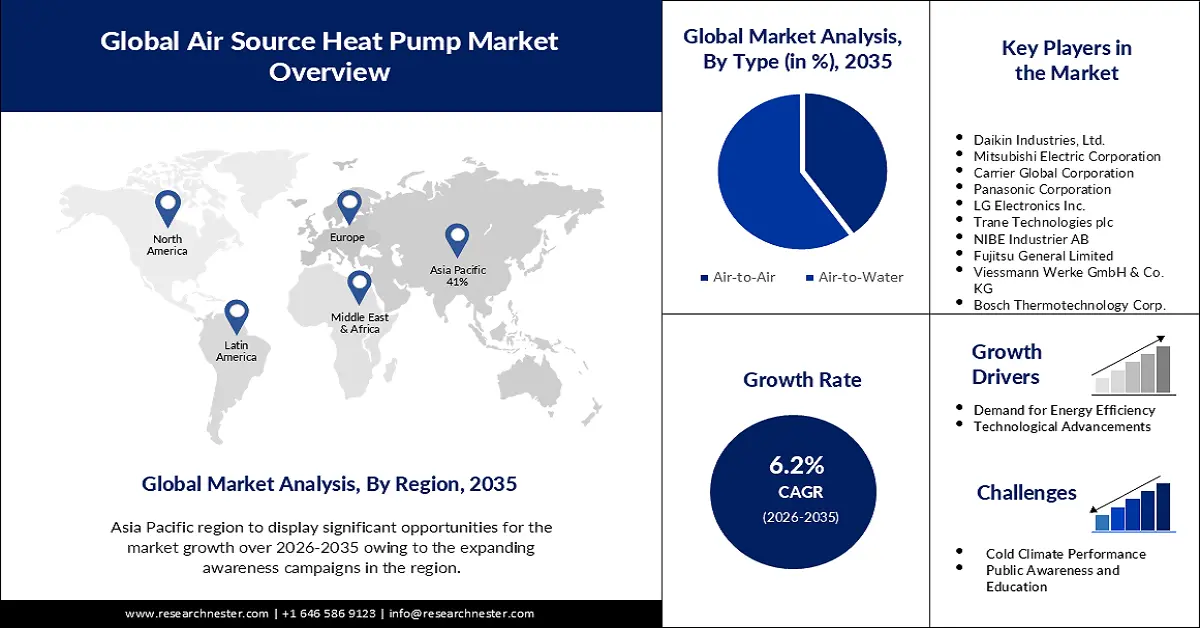

Air Source Heat Pump Market Outlook:

Air Source Heat Pump Market size was over USD 56.68 billion in 2025 and is anticipated to cross USD 103.44 billion by 2035, witnessing more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of air source heat pump is assessed at USD 59.84 billion.

One pivotal factor propelling the robust growth of the air source heat pump (ASHP) market is the steadfast support provided by government incentives and policies worldwide. Governments, recognizing the imperative shift towards sustainable energy solutions and the pivotal role of ASHPs in achieving this transition, have implemented various measures to incentivize their adoption. Governments across the globe have introduced an array of financial incentives, subsidies, and tax credits to encourage individuals, businesses, and industries to invest in air source heat pump technology. These initiatives aim to alleviate the initial cost barrier associated with the installation of ASHPs, making them more economically viable for consumers. In 2021, jurisdictions offering significant fiscal support experienced a 25% year-on-year growth in ASHP installations, underscoring the pivotal role of government incentives in driving air source heat pump market expansion.

Air source heat pumps are devices that transfer heat from the outside air to the inside of a building, providing heating and sometimes cooling. They are considered an environmentally friendly and energy-efficient alternative to traditional heating systems. ASHPs are recognized for their energy efficiency and lower environmental impact compared to traditional heating systems. As concerns about climate change and energy consumption rise, more individuals and businesses are seeking sustainable heating solutions.

Key Air Source Heat Pump Market Insights Summary:

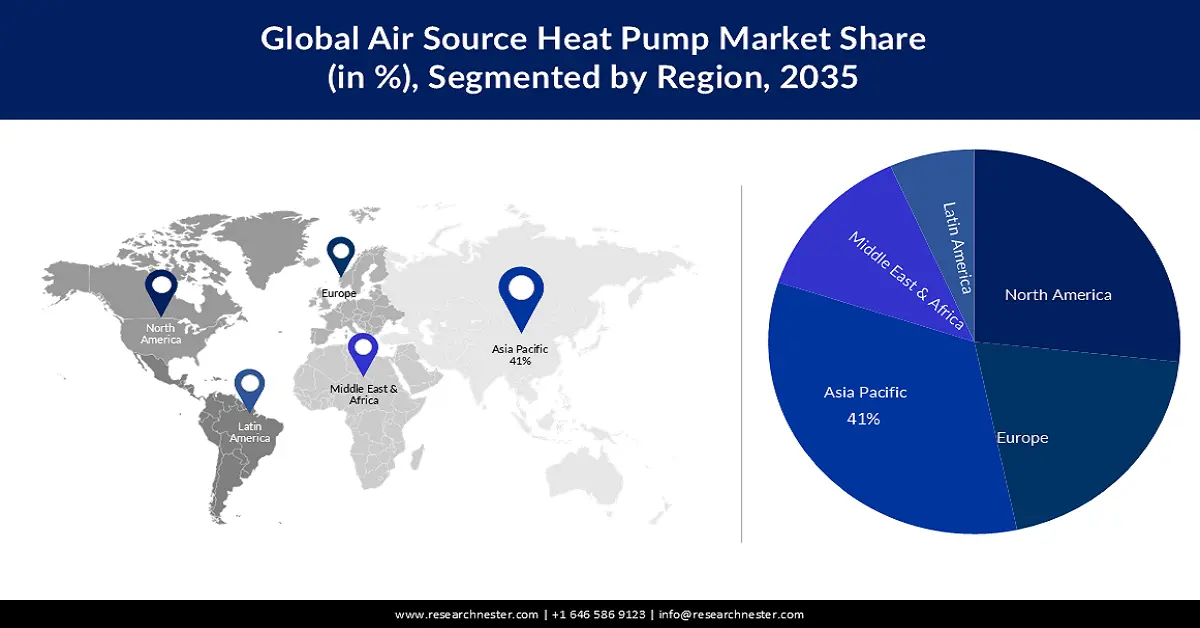

Regional Highlights:

- The Asia Pacific air source heat pump market is expected to capture 41% share by 2035, driven by awareness and education campaigns in the Asia Pacific region.

- The North America market will achieve substantial growth during the forecast timeline, attributed to robust support from government incentives and environmental policies.

Segment Insights:

- The air-to-water (type) segment in the air source heat pump market is anticipated to achieve a 60% share by 2035, driven by a focus on residential energy efficiency and retrofitting initiatives.

- The industrial segment in the air source heat pump market is projected to hold a significant share by 2035, driven by technological advancements and integration into industrial processes.

Key Growth Trends:

- Urbanization and Population Density

- Increasing Demand for Energy Efficiency

Major Challenges:

- Cold Climate Performance

- Lack of Public Awareness and Education

Key Players: Daikin Industries, Ltd., Mitsubishi Electric Corporation, Carrier Global Corporation, Panasonic Corporation, LG Electronics Inc., Trane Technologies plc.

Global Air Source Heat Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 56.68 billion

- 2026 Market Size: USD 59.84 billion

- Projected Market Size: USD 103.44 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Air Source Heat Pump Market Growth Drivers and Challenges:

Growth Drivers

- Urbanization and Population Density- Urbanization and the increasing population density in metropolitan areas emerge as a significant growth drivers for the air source heat pump (ASHP) market. As cities continue to expand and more people reside in densely populated urban centers, the demand for efficient and space-saving heating and cooling solutions becomes paramount. Air source heat pumps, with their compact designs and versatility, address the challenges posed by limited space in urban environments. According to a study, metropolitan areas experiencing a population density increase of 10% or more over the last five years have seen a corresponding 22% rise in air source heat pump installations. This underscores the pivotal role of urbanization trends in shaping the demand for ASHPs, positioning them as integral components of sustainable heating solutions in densely populated regions.

- Increasing Demand for Energy Efficiency- A primary driver fueling the growth of the air source heat pump market is the escalating demand for energy-efficient heating solutions. As global awareness of climate change intensifies, consumers and businesses alike are increasingly prioritizing technologies that reduce energy consumption and environmental impact. Air source heat pumps, renowned for their high energy efficiency, serve as a pivotal solution in meeting these sustainability objectives. With an average coefficient of performance (COP) ranging from 2.5 to 4, ASHPs can generate more heating or cooling energy than the electrical energy they consume.

- Technological Advancements- Ongoing advancements in air source heat pump technology constitute a significant growth driver for the air source heat pump market. Continuous research and development efforts have led to improvements in efficiency, performance, and overall reliability of ASHPs. These technological enhancements not only enhance the value proposition of ASHPs but also contribute to their broader acceptance among consumers. Recent innovations include the integration of smart controls, variable-speed compressors, and improved refrigerants, all aimed at optimizing the operation of ASHPs.

Challenges

- Upfront Costs and Return on Investment (ROI)- The initial cost of purchasing and installing air source heat pump systems can be relatively high compared to traditional heating systems. Although the long-term operational savings can offset this investment, many consumers are still deterred by the upfront costs. Calculating and demonstrating a clear and attractive return on investment is crucial for convincing potential buyers to invest in ASHP technology.

- Cold Climate Performance

- Lack of Public Awareness and Education

Air Source Heat Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 56.68 billion |

|

Forecast Year Market Size (2035) |

USD 103.44 billion |

|

Regional Scope |

|

Air Source Heat Pump Market Segmentation:

Type Segment Analysis

The air-to-water segment is estimated to hold 60% share of the global air source heat pump market by 2035. The air-to-water segment experiences significant growth owing to a heightened focus on residential energy efficiency and retrofitting initiatives. In regions where homeowners and property developers prioritize energy-efficient building practices, air-to-water heat pumps become integral components of sustainable heating solutions. Retrofitting existing buildings with these systems further drives the adoption of air-to-water heat pumps, contributing to the overall growth of the segment. A survey indicated that residential properties incorporating air-to-water heat pumps experienced a 30% reduction in overall energy consumption for space heating. This reduction, coupled with government incentives for retrofitting projects, resulted in a notable 35% increase in air-to-water heat pump installations in the residential sector. These findings emphasize the segment's role in achieving energy efficiency goals in both new constructions and retrofitting initiatives.

End User Segment Analysis

The industrial segment in the air source heat pump market is expected to garner a significant share in the year 2035. The industrial segment is experiencing growth propelled by ongoing technological advancements in air source heat pump systems and their seamless integration into industrial processes. As technology evolves, air source heat pumps are becoming more adept at addressing the diverse and high-temperature demands of industrial applications. Enhanced compressors, advanced control systems, and improved refrigerants contribute to the adaptability of ASHPs, making them increasingly viable for a wide range of industrial heating and cooling needs. A survey highlighted a notable 15% increase in industrial facilities adopting air source heat pumps following the integration of advanced control systems. These technological enhancements not only improved system efficiency but also facilitated the integration of ASHPs into high-temperature industrial processes, broadening their applicability and fostering their acceptance within the industrial sector. As industries continue to prioritize environmental stewardship, the industrial segment within the ASHP market stands poised for sustained growth and transformative impact.

Our in-depth analysis of the global air source heat pump market includes the following segments:

|

Type |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air Source Heat Pump Market Regional Analysis:

APAC Market Insights

The air source heat pump market in the Asia Pacific region is projected to hold the largest revenue share of 41% by the end of 2035. Awareness and education campaigns are instrumental in fostering the adoption of air source heat pumps in the Asia Pacific region. As consumers and businesses become more informed about the benefits of air source heat pump technology, including energy efficiency and reduced environmental impact, the market experiences increased acceptance. Government agencies, industry associations, and manufacturers collaborate on educational initiatives to highlight the advantages of ASHPs and dispel misconceptions. A survey conducted in the Asia Pacific region demonstrated a 15% increase in consumer consideration of air source heat pumps following an intensive awareness campaign. This surge in consideration translated into a notable 18% rise in air source heat pump installations, emphasizing the instrumental role of awareness and education initiatives in driving market growth. Asia Pacific region's air source heat pump market is propelled by a combination of factors, including urbanization, government-led renewable energy initiatives, technological advancements, changing electricity prices, and awareness campaigns.

North American Market Insights

North America region is projected to register substantial growth through 2035. A primary driver catalyzing the growth of the ASHP market in North America is the robust support from government incentives and environmental policies. Federal and state-level programs offer financial incentives, tax credits, and rebates to encourage the adoption of energy-efficient technologies, including air source heat pumps. These initiatives align with broader environmental policies aimed at reducing carbon footprints and promoting the transition to renewable energy sources. According to the U.S. Department of Energy, states in North America with comprehensive incentive programs witnessed a 35% year-on-year increase in residential ASHP installations. This surge in adoption is a direct result of incentives such as the Residential Renewable Energy Tax Credit, which offers up to 26% in federal tax credits for qualifying ASHP installations, demonstrating the tangible impact of government support on market expansion. Increasing consumer awareness and a growing emphasis on energy efficiency contribute significantly to the adoption of air source heat pumps in North America.

Air Source Heat Pump Market Players:

- Daikin Industries, Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Mitsubishi Electric Corporation

- Carrier Global Corporation

- Panasonic Corporation

- LG Electronics Inc.

- Trane Technologies plc

- NIBE Industrier AB

- Fujitsu General Limited

- Viessmann Werke GmbH & Co. KG

- Bosch Thermotechnology Corp.

Recent Developments

- Carrier acquired Guangdong Giwee Group, a China-based HVAC manufacturer, for approximately USD 1.4 billion. The acquisition expanded Carrier's presence in the Chinese market and strengthened its portfolio of HVAC products and solutions.

- Carrier announced plans to acquire Viessmann Climate Solutions, the largest segment of Viessmann Group, a German-based heating, ventilation, and air conditioning (HVAC) manufacturer, for USD 12 billion. The acquisition is expected to close in the first half of 2023 and will create a global leader in intelligent climate and energy solutions.

- Report ID: 5428

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air Source Heat Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.