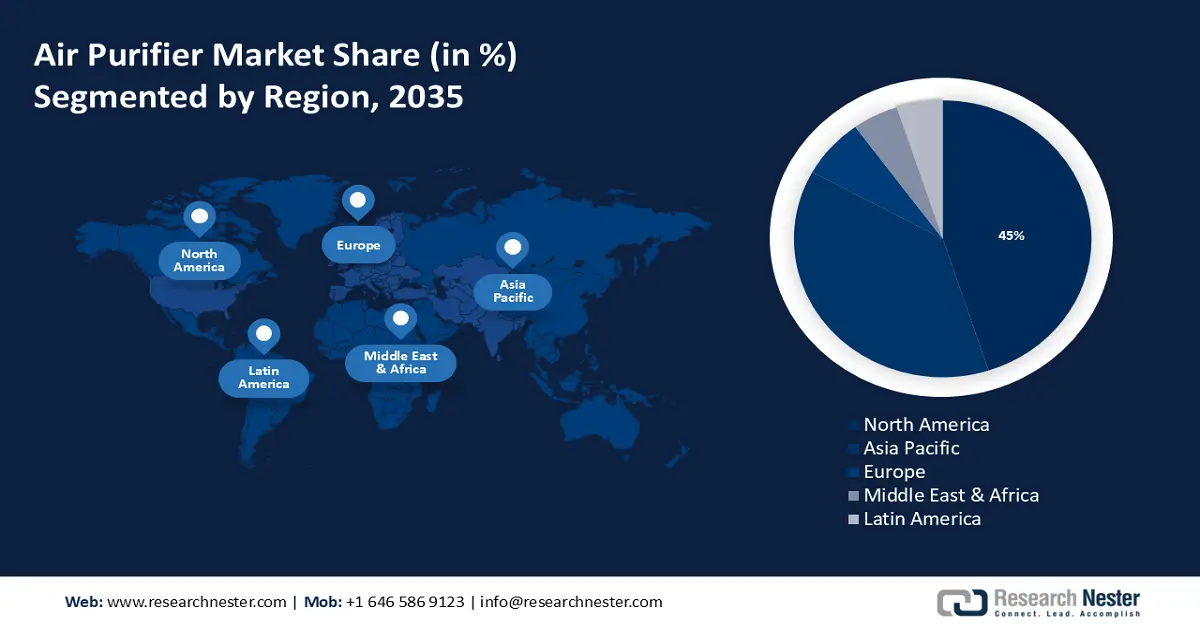

Air Purifier Market Regional Analysis:

North America Market Insights

North America industry is predicted to hold largest revenue share of 45% by 2035. The region’s growth is attributed to the air quality policies, the rise in the air pollution level and industrial activities. In North America, the worst air quality station is FNSB NP Fire, Alaska.

The market in the U.S. is driven by the growth in residential and commercial real estate. According to an April 2024 report by the Census, the privately-owned housing sector has witnessed 5.7% growth than the revised March estimate. The steady growth in the housing sector is expected to propel the demand for air purifiers in the country.

The market is flourishing in Canada due to the emergence of new air purifier distributors and the integration of the latest technologies such as UV-LEDs. A Canada-based startup – CleanAir offers an energy-efficient advanced air purifier named ALVI SMART which also lasts longer and provides cleaner air.

Asia Pacific Market Insights

The Asia Pacific region is poised to hold the substantial market share in the air purifier market in the coming years. The region’s growth is attributed to the increasing air pollution and prevalence of airborne infections.

In Asia Pacific, over 2.3 billion people, which is 92% of the population are exposed to high levels of air toxins. As per the 2020 World Air Quality Report, 37 out of 40 most polluted cities globally were in South Asia.

The air purifier market in China has observed remarkable growth, with the growing expenditure on air purifiers in public spaces including hospitals and offices. The prevalence of high air pollution and the subsequent demand for air purifiers have attracted noteworthy foreign investments. For instance, in October 2021, Freudenberg Filtration Technologies opened its largest manufacturing facility in Shunde, China. This has enabled the company to strengthen its global footprint and capitalize on the booming opportunity.

The market is growing in India owing to the increased focus on consumer health and rising awareness concerning serious diseases that may be caused by harmful particles. Additionally, the presence of a large number of air purifier manufacturers in India is also driving growth in the market. Electrolux expanded its product portfolio with the launch of UltimateHome 500 air purifier which has 4-stage filters for 570ft² room coverage that claims to efficiently neutralize airborne particulates with its 4-step filter.