Air Leak Testing Market Outlook:

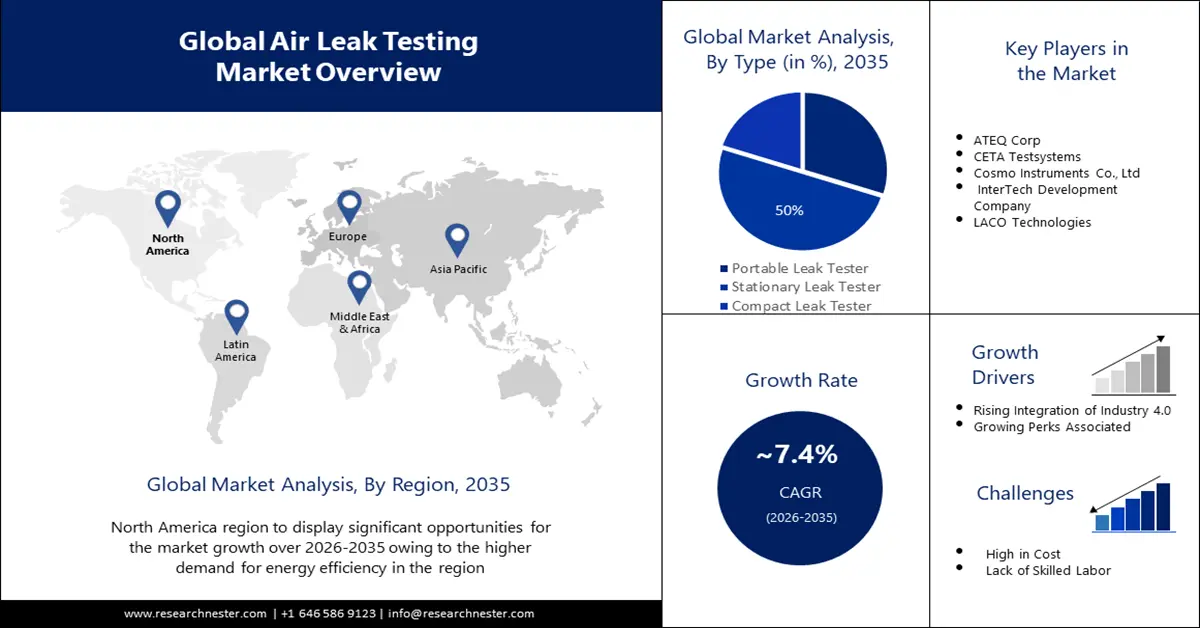

Air Leak Testing Market size was over USD 720.26 million in 2025 and is poised to exceed USD 1.47 billion by 2035, growing at over 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of air leak testing is estimated at USD 768.23 million.

Air leak testing and other real-time production process monitoring are made possible by Industry 4.0 technologies. Continuous data on leak rates, pressure differentials, and other pertinent metrics can be obtained with air leak testers that are fitted with sensors and connectivity. Real-time analysis of this data can help spot possible problems, fine-tune testing specifications, and enhance quality control in general. Air leak testers linked to Industry 4.0 systems can detect leaks in predictable ways by using machine learning algorithms and data analytics. Preventive maintenance procedures, better product design, and testing process optimization can all be accomplished with the use of this data. Air leak testers are kept in top condition via predictive maintenance, which reduces downtime and increases productivity. For instance, Automated Leak Testing for cylindrical cell automotive cell modules allows data visibility using Industry 4.0.

A few industries that use air leak testing equipment are automotive and transportation, medical and pharmaceutical, packaging, defense, electricity, and energy. The air leak testing market is expected to be driven by the transportation and automotive sectors' increasing adoption of air leak testing. High-quality air leak testing equipment is used by several automakers to find flaws in car parts and products.

Key Air Leak Testing Market Insights Summary:

Regional Highlights:

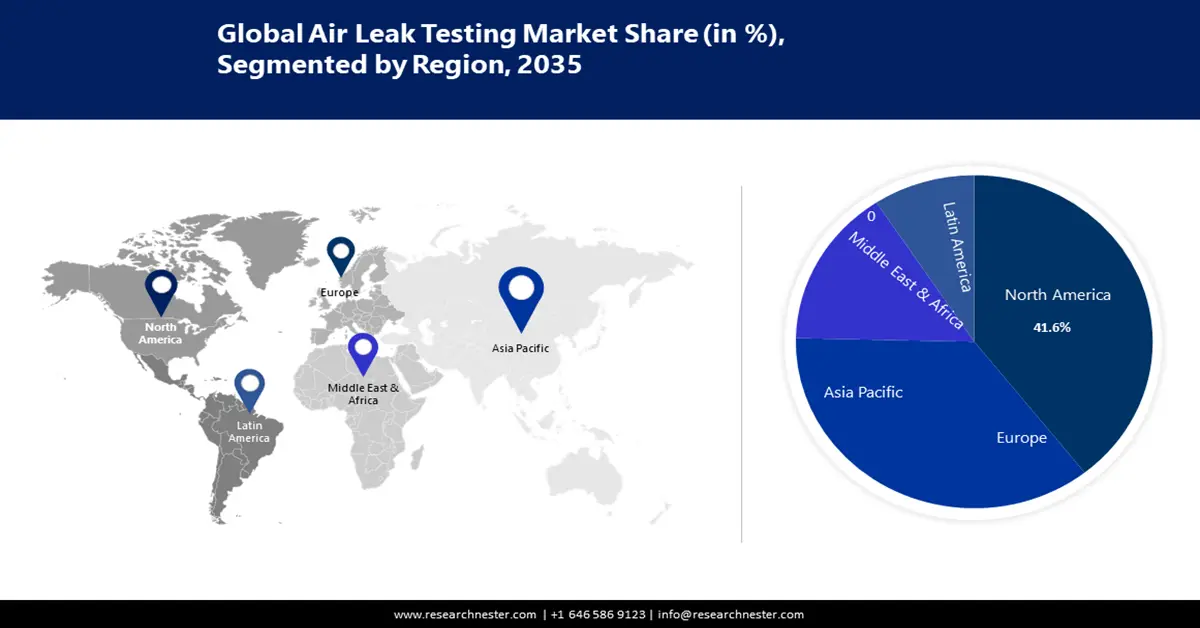

- North America air leak testing market will hold more than 41.6% share, driven by growing demand for air leak testing services in manufacturing and industrial sectors for safety, quality assurance, and energy efficiency compliance, forecast period 2026–2035.

- Asia Pacific market will command a significant revenue share, fueled by increasing demand for air leak testing services in manufacturing and industrial sectors, particularly in major manufacturing hubs like China, Japan, South Korea, and India, forecast period 2026–2035.

Segment Insights:

- The stationary leak tester segment in the air leak testing market is projected to achieve a 50% share by 2035, driven by precision requirements in high-volume production environments like automotive and aerospace.

- The automotive and transportation segment in the air leak testing market is expected to capture a significant share by 2035, driven by the need for high-quality testing to ensure safety and reduce warranty costs.

Key Growth Trends:

- Growing Sustainable Standards

- Significant Perks Associated

Major Challenges:

- Growing Sustainable Standards

- Significant Perks Associated

Key Players: ATEQ Corp, CETA Testsystems, Cosmo Instruments Co., Ltd, InterTech Development Company, LACO Technologies. .

Global Air Leak Testing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 720.26 million

- 2026 Market Size: USD 768.23 million

- Projected Market Size: USD 1.47 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 16 September, 2025

Air Leak Testing Market Growth Drivers and Challenges:

Growth Drivers

- Growing Sustainable Standards - Indeed, the air leak testing market is driven by increasing stringent quality standards. The need to verify and measure the leakage of air is increasingly important given the industry's increased focus on product quality and safety. The integrity and performance of a variety of products, such as parts for vehicles or electronics pharmaceutical packaging, etc. can be compromised by leakages in the air. Specific leakage limits and rigorous testing procedures are often required by stringent quality standards, regulations, and industry certificates to ensure compliance. The need for advanced air leak testing equipment that can detect even the smallest leakages and provide accurate measurements is due to this.

- Significant Perks Associated - Air leak testing market gear has noteworthy preferences over spill testing strategies, such as time investment funds, work investment funds, quality change, and taken a toll decrease. Discuss spill testing forms can be completely or in part computerized, simple to utilize, and don't require specific mastery. Discuss spill testing requires exceptionally small upkeep. Discuss spill testing techniques that can minimize the blame rate and spill estimation information can be utilized in measurable preparing for future item enhancements.

Challenges

- High Cost of Equipment and Testing – Air Leak Testing equipment can be expensive, especially for advanced methods such as acoustic emission testing and tracer gas detection. This can be a barrier to entry for small businesses and startups.

- Lack of Skilled Labor is another Factor Hampering the Market Growth in the Forecast Period

- Complexities Associated with the Test are set to hinder the air leak testing market growth in the upcoming period.

Air Leak Testing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 720.26 million |

|

Forecast Year Market Size (2035) |

USD 1.47 billion |

|

Regional Scope |

|

Air Leak Testing Market Segmentation:

End Users Segment Analysis

In terms of end users, the automotive and transportation segment in the air leak testing market is set to hold a significant share during the period. Many car manufacturers around the world rely on higher-quality leak testing equipment to identify problems with automotive components or products. It can be expensive to produce faulty products because it increases the amount of warranty claims and risks consumer safety. The leak testing protocols for vehicles have been established by several standard organizations.

Type Segment Analysis

Based on type, the stationary leak tester segment is poised to hold 50% share of the global air leak testing market by 2035. To detect even the smallest leaks accurately, stationary leak testers are often designed with a high level of precision and sensitivity. In particular, in industries such as automotive, aeronautics, and medical devices, where strict leakage limits are to be met, this is of particular importance. In dedicated testing facilities, stationary leak detectors can be used to continuously and repetitively test components or products. Therefore, they are suitable for high-volume production environments, ensuring consistent and reliable results.

Our in-depth analysis of the global air leak testing market includes the following segments:

|

Type |

|

|

Component |

|

|

End Users |

|

|

Testing Methods |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Air Leak Testing Market Regional Analysis:

North American Market Insights

The air leak testing market in the North American is anticipated to hold the highest share of 35% during the forecast period. Due to the growing demand for air leak testing services in North America, there has been strong growth in this market. In the manufacturing and industrial sectors, this is due to the need to improve safety and quality assurance. In addition, the need for air leak testing services is being driven by growing demand for energy efficiency as well as compliance with environmental regulations. The North American energy efficiency investment is anticipated to grow by 15% between 2015 to 2022. The increasing adoption of advanced technologies such as automated leak testing systems and digital leak detection systems is also contributing to the North American air leak testing market. The costs and efficiency of the air leakage testing process have been reduced by these technologies. In addition, the North American market is also being driven by growing demand for air leak testing services in the car and aircraft industries.

APAC Market Insights

The air leak testing market in the Asia Pacific is projected to hold a significant share during the estimated period. Due to the increasing demand for air leak testing services in the Asia Pacific region, the market is experiencing significant growth. The need for improved safety and quality assurance in the manufacturing and industrial sectors is a factor driving this. An estimated 1.2 million fatalities and 55 million lost healthy years are attributed to work-related diseases and injuries across Asia and the Pacific region. To improve the accuracy and efficiency of the testing process, the region is also experiencing an increase in the number of companies offering air leak testing services and the development of new technologies and techniques. With countries such as China, Japan, South Korea, and India at the forefront of industrial production, the Asia-Pacific region is a major manufacturing hub. In sectors requiring air leakage testing, for example in the automotive industry, electronics production, and healthcare sector, these countries have an important presence.

Air Leak Testing Market Players:

- INFICON

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ATEQ Corp

- CETA Test systems

- Cosmo Instruments Co., Ltd

- InterTech Development Company

- LACO Technologies

- Pfeiffer Vacuum GmbH

- TASI Group

- Uson L.P

- Vacuum Instruments Corporation LLC

Recent Developments

- INFICON, a specialist in the development of leak detection technology for automotive industries, introduced a new portable probe with hydrogen sensors that will be lighter, quicker, and more user-friendly as compared to existing models in March 2021.

- As a result of the acquisition of Cassel by the TASI Group, this strategic alliance has been announced between the TASI Group and Casimir Messtechnik GmbH. The acquisition will allow the TASI Packaging Integrity segment, which includes ALPS Inspection, Sepha, and Bonfiglioli Engineering, to extend its worldwide reach in product inspection and packaging integrity as well as reinforce its mission of helping customers achieve the highest quality standards for their products.

- Report ID: 5676

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Air Leak Testing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.