AI Server Market Outlook:

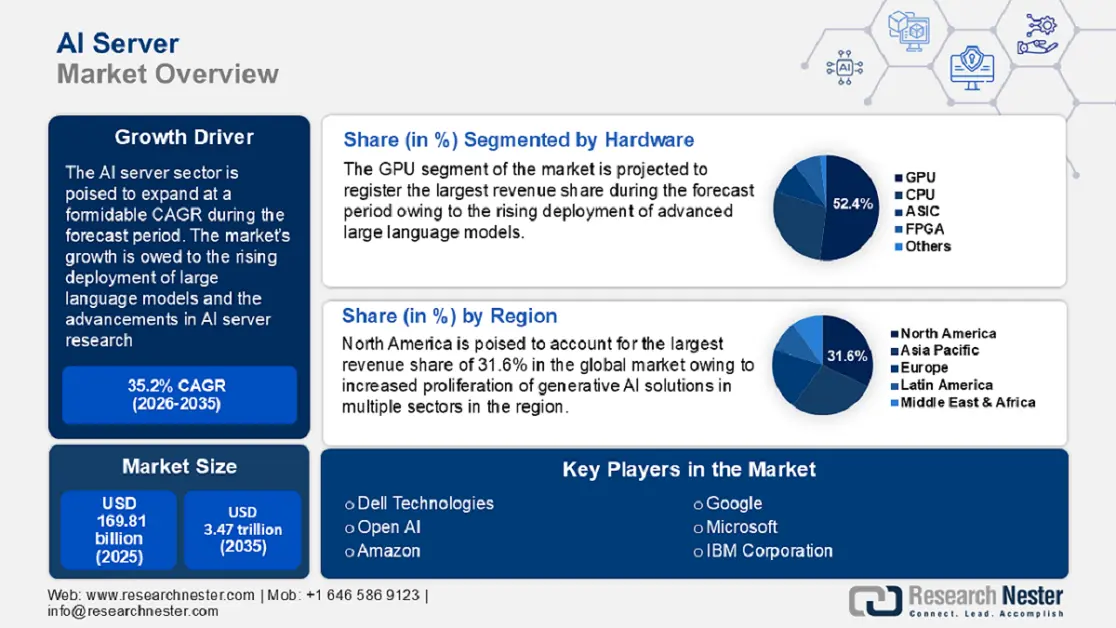

AI Server Market size was valued at USD 169.81 billion in 2025 and is expected to reach USD 3.47 trillion by 2035, registering around 35.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of AI server is evaluated at USD 223.61 billion.

The surge in demand for generative AI applications is a major driver of the sector’s growth. Companies are investing in AI servers equipped with high-performance GPUs to train and deploy advanced models. The surge in popularity of ChatGPT and DALL E has catalyzed major investments in data center expansion globally, benefiting the AI server market. Furthermore, major companies are laying the groundwork for company-wide generative AI solutions to streamline operations and serve customers better. For instance, in September 2024, GE Aerospace announced working with Azure AI of Microsoft to launch a new AI assistant, AI Wingmate, throughout the company, and the company states that the new generative AI tool received around 500,000 queries, search, and employee interactions.

The AI server market is poised to expand owing to the rising adoption of AI in cloud computing. Industry leaders such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud are at the forefront of deploying AI-optimized servers to cater to various enterprise needs. Here are a few instances of how the industry leaders are leveraging the opportunities in the market; For instance, in November 2024, IBM and AWS announced the decision to accelerate their partnership to scale responsible generative AI while in February 2024, Google Cloud and Kyndryl expanded partnership to deliver enterprise-ready generative AI solutions. The trends indicate the requirement for scalable AI server infrastructure to effectively handle the intensive computational requirements of AI.

Furthermore, the AI server market is positioned to provide lucrative opportunities for industry stakeholders. Advancements in edge computing are driving demand for AI servers that are capable of processing data closer to the source. For instance, in October 2024, Cisco launched plug-and-play AI solutions providing customers with the infrastructure pieces they need to accelerate their AI adoption. Additionally, rising AI use in various industries such as healthcare, retail, and automotive, is driving demand for AI servers. Major players in the market are set to leverage rising opportunities in emerging markets, such as APAC, Middle East, and Africa, and assist the global market in the continuation of its robust growth by the end of the forecast period.

Key AI Server Market Insights Summary:

Regional Highlights:

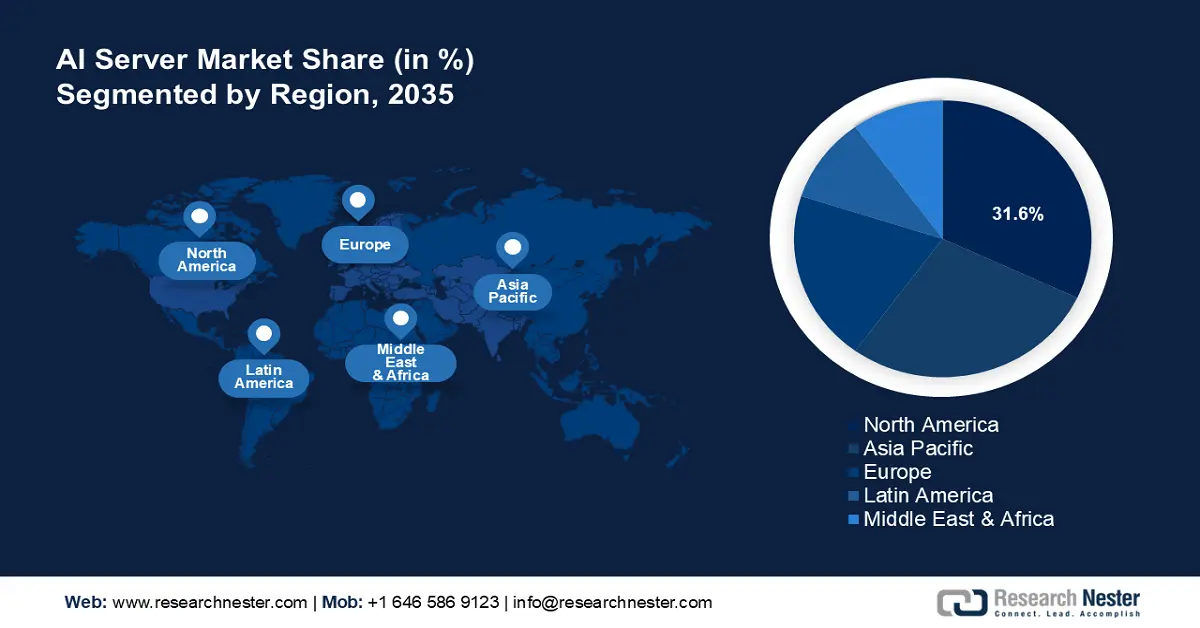

- North America holds a 31.6% share in the AI Server Market, driven by proliferation of generative AI and strong digital infrastructure, ensuring robust growth through 2026–2035.

- Asia Pacific's AI server market is projected to be the fastest-growing through 2026–2035, driven by rapid rise in regional data centers and cloud computing reliance.

Segment Insights:

- The GPU segment of the AI Server Market is anticipated to hold a 52.4% share by 2035, driven by the growing use of generative AI and large language models requiring massive GPU resources.

- The CPU (Hardware) segment of the AI Server Market is poised for increased share through 2035, driven by the emergence of AI-optimized processors with high memory bandwidth and sequential logic capabilities.

Key Growth Trends:

- Rising deployment of large language models (LLM)

- Growth of Edge AI and decentralized computing

Major Challenges:

- Concerns of increasing energy consumption

- Concerns of increasing energy consumption

- Key Players: Dell Technologies, Open AI, Amazon, Google, Huawei, Lenovo, Kyndryl, Cisco, Fujitsu, Advantech, Cohere, IBM Corporation.

Global AI Server Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 169.81 billion

- 2026 Market Size: USD 223.61 billion

- Projected Market Size: USD 3.47 trillion by 2035

- Growth Forecasts: 35.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 13 August, 2025

AI Server Market Growth Drivers and Challenges:

Growth Driver

-

Rising deployment of large language models (LLM): The surge in growth of LLMs has driven requirements for powerful AI servers that can handle the training and deployment of cutting-edge LLMs. These servers require specialized TPUs, GPUs, and high-speed interconnects to ensure that the data processing is efficient. Furthermore, the large-scale integration of LLM in diverse applications, such as customer service, web content generation, social media content generation, code development, etc., has diversified the end use applications of AI servers benefiting the sector’s growth.

GPT-4, Llama, LaMDA, etc., are a few LLMs that witnessed large-scale proliferation in this decade. Companies are investing heavily in developing their LLMs to not fall behind in the global AI race, which in turn is heavily favorable to the growth of the AI server sector. In July 2024, Accenture launched the Accenture AI Refinery framework built on Nvidia AI Foundry to assist clients build custom LLM models with the Llama 3.1 collection of openly available models. Additionally, custom LLM models will require significant computational power for training, which is projected to drive demand for AI servers. - Growth of Edge AI and decentralized computing: The rising adoption of edge AI to process data locally for various applications demands powerful AI servers. The proliferation of industrial IoT and growing investments in smart cities drive the use of Edge AI to boost system efficiency. Edge devices generate large amounts of data that are used to train and improve AI models, and the increased data volume requires AI servers. Furthermore, cloud platforms that provide edge AI solutions rely on AI servers to handle the backend infrastructure which boosts demand benefiting the growth of the AI server market.

The market’s surging growth is evident by recent developments in the sector. For instance, in February 2024, Intel announced a new Edge platform to help enterprises develop and manage edge and AI applications at scale with cloud-like simplicity. Again, in July 2024, ADLINK Technology Inc. announced the launch of the new AI Edge Server MEC AI7400 series to advance smart manufacturing and drive AI innovation. The trends augur well for the continued expansion of the AI server market. - Advancements in AI server research & development: The AI server market’s growth is assisted by increasing investment in research & development. For instance, in December 2024, IBM released breakthrough research in optics technology that has the potential to improve how data centers train and run generative AI models. Researchers are exploring photonic chips, which use light instead of electricity for data transmission within servers and its commercial application is poised to significantly benefit the sector. For instance, in November 2024, Q.Ant launched the first commercial photonic processor for real-time AI applications and energy-efficient high-performance computing.

Furthermore, key players in the sector are investing in advanced research to reduce bottlenecks in AI servers. For instance, in December 2024, Ayar Labs announced the securing of USD 155 million in financing led by Advent Global Opportunities and Light Street Capital for its optical technology that can reduce AI bottlenecks. Additionally, the investments by industry-leading players in such ventures reinforce the stakeholder trust in the AI server market and exhibit its lucrative potential. The Ayar Labs venture has investments from AMD Ventures, Intel Capital, and NVIDIA, which augurs well for its potential.

Challenges

- Concerns of increasing energy consumption: AI servers consume a large amount of energy due to the computationally intensive applications while processing substantial datasets. AI servers are one of the most power-intensive components of a data center, and the environmental impact of high-energy use can lead to push back from regulatory organizations which can impact the sector’s growth curve.

- Data privacy risks: The integration of AI servers in data privacy-sensitive sectors such as healthcare requires robust security measures. The large volume of data handled by AI servers can pose risks related to data breaches. Advancements in data security are set to navigate this challenge as cyberattacks become more complex in the digital age.

AI Server Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

35.2% |

|

Base Year Market Size (2025) |

USD 169.81 billion |

|

Forecast Year Market Size (2035) |

USD 3.47 trillion |

|

Regional Scope |

|

AI Server Market Segmentation:

Hardware (GPU, CPU, ASIC, and FPGA)

In AI server market, GPU segment is poised to account for revenue share of more than 52.4% by the end of 2035. A major growth driver of the segment is the increasing deployment of generative AI and LLMs which require thousands of GPUs to process computations. Furthermore, advanced GPUs are uniquely suited for parallel processing demands, by training large neural networks and executing complex deep algorithms.

Additionally, advancements in CUDA programming are poised to allow developers to harness GPU capabilities more effectively benefiting the segment’s continued growth. Two recent instances in the market are indicative of the growth of the GPU segment in the AI server market. For instance, in November 2024, Nvidia announced that it is working with Google Quantum AI to accelerate the design of its next-generation quantum computing devices using simulations powered by the NVIDIA CUDA-Q platform. Again, in November 2024, IonQ announced leveraging NVIDIA CUDA-Q to advance hybrid quantum computing.

The CPU segment of the AI server market is positioned to increase its revenue share during the forecast period. A major driver of the segment’s growth is the development of specialized AI-optimized processors that provide support for large memory bandwidths. Furthermore, innovations in chip design enable CPUs to handle AI-specific workloads efficiently, which positions them as a key component in next-generation AI servers. For instance, in July 2024, Applied Systems Inc. launched innovations in materials engineering designed to enhance the performance-per-watt of computer systems by enabling copper wiring to scale to a 2nm logic node and beyond.

Additionally, CPUs are essential for tasks requiring sequential logic in AI and businesses are launching advanced CPUs that can seamlessly handle end-to-end AI workloads. For instance, in October 2024, AMD launched the 5th Gen AMD EPYC CPUs, and is tailor-made for GPU-powered AI solutions that need in-host CPU capabilities.

Servers (AI Training Server, AI Data Server, and AI Inference Server)

The AI training server segment of the AI server market is poised to register a large revenue share in the market. A major driver of the segment’s growth is owed to the exponential growth of generative AI, along with LLMs and computer vision applications. Such applications require processing abilities for model training that the AI training server provides. Furthermore, AI training servers help organizations to train LLM models faster benefiting the segment’s growth.

AI training servers for specific use cases such as natural language processing are poised to experience heightened demand as globally, countries invest large amounts to boost AI capabilities. Additionally, businesses can leverage the rising demand by positioning scalable AI training servers. For instance, in August 2024, Bitdeer AI launched its advanced AI Training Platform that is designed to provide fast and scalable AI/ML inference with serverless GPU infrastructure.

Our in-depth analysis of the global AI server market includes the following segments:

|

Hardware |

|

|

Servers |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AI Server Market Regional Analysis:

North America Market Forecast

North America in AI server market is set to hold more than 31.6% revenue share by 2035. The market’s growth is attributed to the large-scale proliferation of generative AI in various sectors, ranging from healthcare to finance. The robust technological ecosystem in the region drives demand for AI servers as the U.S. and Canada strive to make leaps in the global AI race. Furthermore, government-backed initiatives such as the National Artificial Intelligence Research Institute foster innovation in the market.

Furthermore, the presence of industry leaders in North America benefits the sector’s growth by ensuring early availability in launches, and the entrance of new players is poised to create a competitive sector boosting revenue streams. For instance, in June 2023, Hewlett Packard Enterprise launched the AI cloud HPE GreenLake for LLMs poised to assist any enterprise to privately train, tune, and deploy large-scale AI.

The U.S. holds the largest revenue share in the North America AI server market. The sector’s profitable expansion in the U.S. is owed to the presence of a vast digital infrastructure. The government has played a proactive role in backing AI-driven solutions, that drive demand for AI servers in the country. Additionally, the rapid growth of generative AI along with autonomous systems requires servers that are capable of processing large-scale data volume.

Major players in the U.S. market are expanding the scope of their applications which is beneficial for the AI server market, as it drives demand. For instance, in September 2024, Deloitte announced the launch of a turnkey generative AI solution and AI factory as a service, powered by NVIDIA and Oracle. Deloitte’s standing in the global market is promising for the success of the generative AI solution, and adoption by businesses will drive the necessity for AI servers.

Canada is exhibiting rapid growth in the AI server market and is poised to increase its revenue share by the end of the forecast period. A key driver is the rising adoption of AI-powered solutions by domestic businesses. Furthermore, the growth of AI research hubs in the country is projected to benefit the sector. A significant driver of the market is the surging investments by the government to build an advanced AI infrastructure in the country, that is expected to provide steady opportunities in the Canada AI server market. For instance, in December 2024, the government announced plans to invest USD 2 billion to build domestic AI computing capacity, and the investment will also assist small and medium-sized enterprises (SMEs) through the AI access fund.

APAC Market Forecast

The APAC AI server market is positioned to exhibit the fastest growth curve in comparison to other regions apart from North America during the forecast period. The rapid rise in regional data centers is a major market driver. APAC is experiencing a surging reliance on cloud computing that drives demand for AI servers. China, Japan, India, South Korea, and Australia are major markets in the region.

Furthermore, regional businesses are leveraging partnerships to provide advanced generative AI solutions. For instance, in July 2024, Cohere and Fujitsu announced a partnership to provide generative AI for enterprises to improve customer and employee experience. The regional market is well-positioned to expand by the end of the forecast period

China has registered a dominant share in the AI server market. The sector’s growth in China is owed to the integration of AI in strategic sectors, and substantial investments in high-performance computing. The rapid growth of hyperscale data centers in the country drives demand for AI servers. The thriving AI ecosystem in China is positioned to create lucrative opportunities in the market during the forecast period. Ambitious government plans such as the New Generation Artificial Intelligence Development Plan foster innovation. Domestic companies are rapidly positioning AI server solutions for generative AI in the market. For instance, in June 2024, Advantech launched Edge AI server solutions for generative AI, known as the AIR 520 Edge AI Server.

The India AI server market is poised to increase its revenue share during the forecast period. The growth is complemented by the development of AI applications for various sectors in the country coupled with a rapidly expanding digital economy. Furthermore, India is uniquely positioned as a global IT outsourcing hub that has boosted the development of advanced AI server architectures to support cloud-based applications.

Furthermore, the rising investment by established companies in the AI server market in India bodes well for the sector’s future. For instance, in September 2024, Lenovo announced the establishment of high-performance AI server manufacturing in India. Additionally, Lenovo’s investment is an indication of companies leveraging India’s positions as a tech hub and adhering to the government’s initiatives such as the AI for All vision.

Key AI Server Market Players:

- Dell Technologies

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Open AI

- Amazon

- Huawei

- Lenovo

- Kyndryl

- Cisco

- Fujitsu

- Advantech

- Cohere

- IBM Corporation

The AI server market is projected to expand during the forecast period. The leading market players are actively investing in R&D to develop cutting-edge server technologies that are optimized for heavy AI workloads. Additionally, strategic partnerships to utilize resources, with data centers and with cloud providers are enabling major industry players to expand their footprint in the AI server sector. For instance, Red Hat Inc. announced that it has signed a definitive agreement to acquire Neural Magic, to make gen AI more accessible to organizations through the open innovation of vLLM.

Furthermore, major market players are strengthening their solutions portfolio in the sector to expand revenue streams. For instance, in November 2024, Dell Technologies announced the Dell AI Factory which will streamline AI workloads and data management for other businesses. The factory is poised to improve Dell’s standing in the B2B solutions segment of the AI server market.

Here are some key players in the AI server market:

Recent Developments

- In December 2024, Amazon Web Services (AWS) announced innovations for Amazon Bedrock. As per the announcement, AWS is set to become the first cloud provider to offer models from Luma AI and poolside and will add the latest Stability AI model in Amazon Bedrock.

- In November 2024, Data Robot introduced an enterprise AI suite to develop and deliver generative AI applications and agents that can be customized to meet business needs. The new AI suite will offer customized pre-built application templates for a wide range of AI use cases, which include predictive content creation systems and data analysis tools.

- Report ID: 6856

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AI Server Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.