AI Sales Assistant Software Market Outlook:

AI Sales Assistant Software Market size was over USD 2.9 billion in 2025 and is poised to exceed USD 20.5 billion by 2035, witnessing over 21.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of AI sales assistant software is estimated at USD 3.46 billion.

The rising demand for tailored, sector-specific AI solutions is a major driver of the AI sales assistant software sector. The rapid proliferation of generative AI solutions in various industries, such as BFSI, IT, retail, healthcare, telecommunications, etc., has enabled businesses to automate tasks. The trends indicate a growing demand for AI-integrated automation of lead qualification and follow-ups while providing analytics that boost sales leading to a robust growth curve of the sector. For instance, in December 2024, Amazon introduced their new generation of foundation novels, i.e., Amazon Nova to deliver advanced generative AI solutions that can process text, video, and image as prompts which customers can leverage for multimedia content. Such advanced AI sales assistant software is poised to assist customer retention and boost lead generation.

A key trend in the AI sales assistant software market is the proliferation of natural language processing (NLP) and voice-enabled assistants. Via NLP, AI sales assistants are able to mimic humanized interactions with various customer queries across channels such as chat, email, and voice platforms. Furthermore, the global push to create a digital ecosystem is positioned to drive demand for advanced AI sales assistant software solutions, with businesses positioned to expand their portfolios to leverage the B2B supply chain for software.

The growing advancements in AI ensure intuitive interfaces that can boost customer engagement by offering targeted personalized recommendations from a user’s buying behavior patterns. In October 2023, AiAdvertising Inc. published the AI for Advertising Blueprint whitepaper indicating how brands can leverage AI to optimize ad campaigns and boost results, and further states that AI-driven advertising boosts hyper-personalization at scale. Additionally, AI sales assistant software has ensured transformation in customer engagement strategies. For instance, in December 2024, Air India announced plans to introduce innovative booking features on their digital channels based on generative AI banking on the success of their AI-driven booking feature that won the Red Dot Design award. The trends indicate growing investments in AI, and with opportunities arising in emerging AI sales assistant software markets, the AI sales assistant software is poised to maintain its robust growth by the end of the forecast period.

Key AI Sales Assistant Software Market Insights Summary:

Regional Highlights:

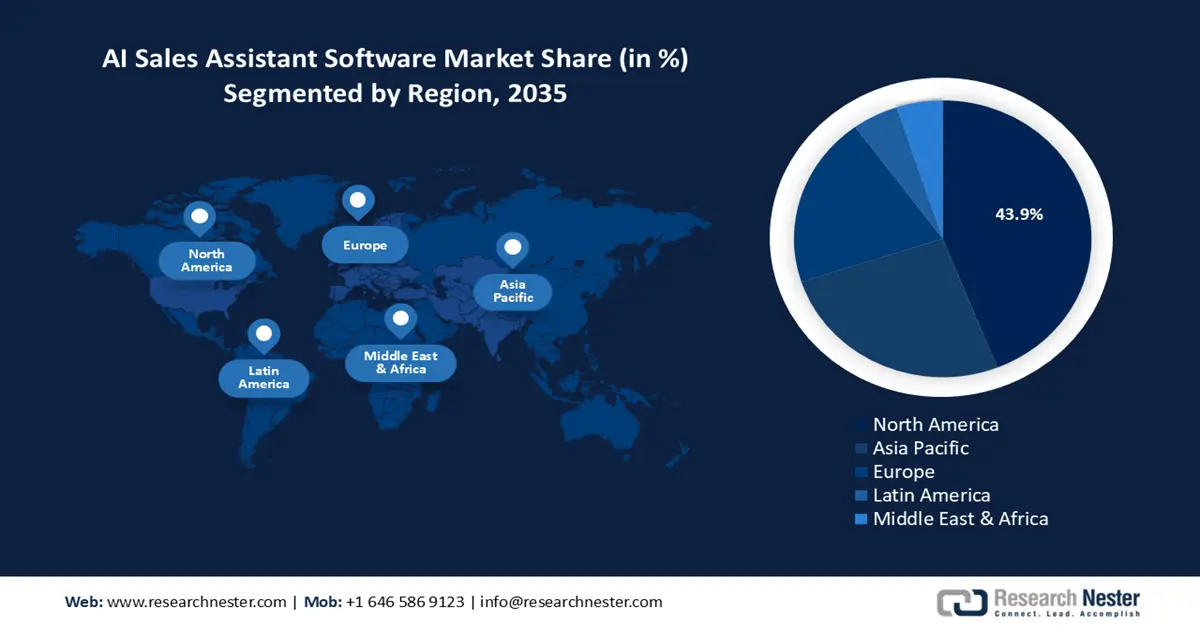

- North America dominates the AI sales assistant software market with a 43.9% share, fueled by rising adoption across various industries to streamline sales while improving customer engagement, driving growth through 2035.

Segment Insights:

- The Chatbots & Virtual Assistants segment is poised for rapid CAGR growth from 2026 to 2035, driven by increasing innovation in NLP and demand for real-time engagement.

- The Cloud-Based segment of the AI Sales Assistant Software Market is projected to hold over 57.7% share by 2035, driven by the scalability of AI-powered solutions for sales without heavy infrastructure.

Key Growth Trends:

- Rise of generative AI in sales

- The growth of omnichannel strategies

Major Challenges:

- Increasing scrutiny of data mining

- Challenges of contextual understanding in complex sales scenarios

- Key Players: HubSpot, Seamless.AI, OpenAI, ClaySys Technologies, Lavender.ai, Apollo.ai, Avoma, Copy.ai, Otter.ai, Pipedrive, Salesforce Inc..

Global AI Sales Assistant Software Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.9 billion

- 2026 Market Size: USD 3.46 billion

- Projected Market Size: USD 20.5 billion by 2035

- Growth Forecasts: 21.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

AI Sales Assistant Software Market Growth Drivers and Challenges:

Growth Driver

- Rise of generative AI in sales: The AI sales assistant software market has benefited immensely from the proliferation of generative AI. By leveraging unstructured data, generative AI assists sales teams in offering tailored suggestions. Furthermore, real-time insights benefit sales strategies that businesses adopt to expand their revenue shares. Businesses in multiple sectors globally have adopted generative AI solutions to streamline sales funnel at every stage, i.e., top, middle, and bottom. In January 2024, Pegasystems Inc. announced the launch of the Pega GenAI Knowledge Buddy, which is an enterprise-grade, generative AI-powered assistant to assist customers and employees in generating specific answers from content scattered across knowledge bases.

Additionally, conversational AI assistants are playing a key role in the middle of the funnel (MoFu) by personalizing the outreach and offering relevant recommendations to customers. Businesses are leveraging the rising demand by launching advanced generative AI solutions as conversational shopping assistants. For instance, in November 2024, Amazon launched Rufus, i.e., a new gen-AI-powered conversational shopping assistant across Europe in beta.

- The growth of omnichannel strategies: The increase in omnichannel approaches by businesses is a key driver of the AI sales assistant software market. Businesses are seeking to meet consumer demands across various platforms which boosts demand for AI sales assistant software. AI sales assistants can streamline interactions across various platforms, from a brand’s social media to e-mail and e-commerce. The AI sales assistant software market is positioned to benefit from the rising demands of the online retail sector, owing to AI-powered chatbots providing 27/7 customer support, and the ability to solve customer queries efficiently. In September 2024, the Beachbody Company, Inc., announced the evolution of its core business model with an omnichannel sales channel approach that will streamline operations.

Businesses are expanding their portfolio to assist companies in accelerating omnichannel growth, and AI sales assistant software is a key component of such solutions. For instance, in June 2024, Essendant announced the launch of Connected Commerce, which is designed to assist the omnichannel growth of brands.

- Integration of predictive analytics sales strategies: Predictive analysis is a vital component of expanding sales. AI-based predictive analysis is a significant growth drive of the AI sales assistant software market as it allows businesses to identify high-value leads. Actionable insights offered by predictive analytics are vital for businesses to optimize resource optimization and improve sales strategies.

The SaaS industries are key drivers of the demand for predictive analysis solutions owing to high-volume sales cycles. For instance, in February 2023, Aveva announced the release of a new AI-powered software that is poised to advance predictive analytics by making it easier to deploy, validate, maintain, and interpret the results of predictive models.

Challenges

- Increasing scrutiny of data mining: AI sales assistants process large volumes of customer data to offer personalized insights. Over the years, there has been rising scrutiny on the ethics of large-scale data mining due to privacy and security concerns. Additionally, if AI systems are trained on biased datasets, the results can negatively affect the quality of recommendations to customers.

- Challenges of contextual understanding in complex sales scenarios: AI sales assistant software can face challenges in fully comprehending nuanced conversations due to technical limitations. Although advanced generative AI models are solving the pain point, the limitations of AI in understanding subtle cues in customer intent or misinterpreting ambiguous queries are still prevalent. In July 2024, the University of Cambridge published a study indicating an empathy gap in AI chatbots that can emerge as a crucial challenge for the sector.

AI Sales Assistant Software Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.6% |

|

Base Year Market Size (2025) |

USD 2.9 billion |

|

Forecast Year Market Size (2035) |

USD 20.5 billion |

|

Regional Scope |

|

AI Sales Assistant Software Market Segmentation:

Deployment (Cloud-Based, On-Premises)

Cloud-based segment is set to hold AI sales assistant software market share of over 57.7% by the end of 2035. The scalability of cloud-based AI software increases demand and adoption, leading to the robust growth curve exhibited by the segment. Cloud-based solutions allow businesses to invest in AI-powered solutions to improve sales, without heavy investments in IT infrastructure.

Furthermore, cloud-based AI solutions are lucrative for small and medium-sized enterprises bolstering adoption rates. The segment’s profitability can be discerned from the entry of established players. For instance, in September 2024, Hewlett Packard Enterprise (HPE) introduced a one-click deploy AI application in the HPE private cloud AI. The HPE private cloud AI will assist businesses in launching generative AI virtual assistants in seconds using private data. Such advanced solutions in the business-to-business solution segment of the market are poised to drive further demand for cloud-based AI sales assistant software.

The on-premises segment of the AI sales assistant software market is positioned to expand its revenue share during the forecast period. Large enterprises in regulated sectors such as healthcare and BFSI drive demand for on-premises AI software solutions to maintain complete ownership over sensitive customer data. The on-premises model eliminates the need to rely on third-party cloud providers, mitigating the risk of data breaches. Furthermore, rising demand for on-premises AI solutions in countries with strong data privacy regulations, such as the Act on the Protection of Personal Information (APPI) in Japan, is poised to create emerging opportunities within the segment.

Key players operating in the segment are leveraging partnerships to launch on-premise generative AI solutions. For instance, in June 2024, Wipro launched an on-premise generative AI solution with Hewlett Packard Enterprise to serve customers globally. Such launches are poised to assist industries heavily reliant on customer service.

Functionality (Chatbots and Virtual Assistants, Lead Generation and Qualification, Sales Forecasting and Analytics, Customer Relationship Management (CRM) Integration, Automated Email and Phone Outreach)

By functionality, the chatbots and virtual assistants’ segment in AI sales assistant software market is projected to register rapid growth during the forecast period. The rising demand for chatbots and virtual assistants, coupled with increasing innovation in NLP is poised to boost the segment’s continued growth. Businesses are seeking solutions that can provide context-aware communication to users across various platforms while effectively handling routine queries.

Furthermore, chatbots and virtual assistants enable lead generation and are experiencing rapid integration in sectors with real-time customer engagement. In November 2024, TeleVox announced that it was awarded a national group purchasing agreement for AI chatbots with Premier, Inc, and as per the agreement, Premier members can take advantage of special pricing for TeleVox’s SMART Web, SMART Voice, and SMART SMS powered by Iris, the conversational AI virtual agent for healthcare. The trends indicate that the rising digitization globally is positioned to create a sustained demand for sales assistant chatbots and virtual assistants for businesses.

Our in-depth analysis of the global AI sales assistant software market includes the following segments:

|

Deployment |

|

|

Functionality |

|

|

Industry Vertical |

|

|

Organization |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AI Sales Assistant Software Market Regional Analysis:

North America Market Forecast

North America in AI sales assistant market is anticipated to account for around 43.9% revenue share by 2035. The regional sector’s growth is attributed to rising adoption across various industries to streamline sales while improving customer engagement. Additionally, the widespread adoption in the well-established retail industry in North America drives the AI sales assistant software market’s expansion. For instance, in April 2024, Home Depot, a major retail sector player in the region, and Google Cloud announced the extension of their relationship that is poised to benefit customers by assisting them with home improvement projects efficiently.

Additionally, the U.S. and Canada lead the revenue share in the region, and rising AI solution startups backed by venture capital investments fuel innovation in the sector. The high digital literacy rate in the region is poised to ensure quicker adoption of AI sales assistant technologies in comparison to emerging markets.

The U.S. holds a prominent revenue share in the North America AI sales assistant software market. The rapid digital transformation of core industries in the U.S. creates a burgeoning demand for AI sales assistant software solutions. Large enterprises and SMEs leverage AI-powered tools to optimize sales funnels, starting from lead generation to closing deals. Furthermore, the changing consumer trends seeking personalized shopping experiences have hastened adoption across the country.

The presence of AI leaders such as OpenAI and Google supporting the integration of AI technologies for businesses has created a burgeoning domestic AI sales assistant software market in the country. Businesses in the sector can leverage the profit share by offering advanced Gen AI models for businesses to boost sales. In September 2024, Walmart, a leader in the retail sector, announced plans to scale AI, generative AI, augmented reality, and immersive commerce experiences. The move by the retail chain is poised to create hyper-personalized and engaging shopping experiences across Walmart stores driven by AI sales assistant software.

Canada exhibits rapid growth in the AI sales assistant software market. The country’s push to create a digitalized ecosystem coupled with a thriving e-commerce landscape drives the market’s growth. In June 2024, Sendbird Inc announced a new AI chatbot for Shopify powered by GPT-4o, and the no-code AI chatbot is poised to enable merchants to store data through Shopify’s APIs and answer frequently asked questions effectively.

Furthermore, government programs such as the Pan-Canadian Artificial Intelligence Strategy boost advancements in generative AI in the country, and with improvements in conversational AI, the domestic AI sales assistant software market is poised to continue its growth. Key players seeking to expand revenue share in Canada can invest in improving NLP to support English and French customer interactions within the country to assist sales.

APAC Market Forecast

The Asia Pacific AI sales assistant software market is poised to register the fastest growth during the forecast period. The booming e-commerce sector across APAC is a major driver of AI sales assistant solutions. China, Japan, India, South Korea, and Australia hold significant revenue shares in the APAC AI sales assistant software market. Tech giants such as Alibaba and Tencent from China are leading in integrating AI sales assistants to support omnichannel strategies while the burgeoning AI startup ecosystem in India is at the forefront of developing cost-effective AI solutions.

Furthermore, key players operating in the b2b segment of the AI sales assistant software market are leveraging the growing adoption of cloud-based AI software in the region. For instance, in July 2024, Alibaba announced the adoption of its gen AI toolkit solution by around 500 thousand merchants in APAC and overseas, by assisting vendors to boost conversion rates. Additionally, in the same month, Alibaba announced plans to launch the world’s first AI-powered conversational sourcing engine in September 2024 which is expected to assist the SMEs globally.

China is poised to hold a dominant revenue share in the AI sales assistant software market in the Asia Pacific. A major indicator of the growth in China is the surging investments in building an AI-powered economy in the country, with the nation poised to be a global leader in the AI race. Furthermore, the integration of AI tools in social media apps such as WeChat in China enables businesses to engage consumers directly and build sales strategies on buyer behavior.

Additionally, major initiatives such as the New Generation Artificial Intelligence Development Plan ensure innovation in AI technologies tailored for a diverse consumer base in the country. AI sales assistant tools that can engage customers in Mandarin and Cantonese are poised for rapid rollouts across the country boosting opportunities in the domestic AI sales assistant software market. A key indicator of the continued growth of the market in China is the investment by major retail players such as JD. Com and Alibaba with around 40% to 50% of acquisitions being AI-themed to boost retail sales.

India is positioned to expand its revenue share in the AI sales assistant software market owing to a thriving AI-based startup ecosystem in the country creating advanced, cost-effective LLM solutions. For instance, in July 2024, AI sales assistant startup Sybil raised USD 11 million in a series A funding ding round led by Greycroft. Furthermore, the e-commerce sector in the country is driving demand for customer-oriented chatbot solutions. E-commerce giants such as Amazon India, Flipkart, and Myntra along with food delivery giants such as Swiggy and Zomato are leveraging advanced chatbot solutions to boost consumer engagement. Additionally, the rise of quick commerce led by Zepto and Blinkit in the country has created a steady demand for AI sales assistant software. The growing end use sectors in the country are a major driver of the sector’s growth.

Key AI Sales Assistant Software Market Players:

- HubSpot

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Seamless.AI

- OpenAI

- ClaySys Technologies

- Lavender.ai

- Apollo.ai

- Avoma

- Copy.ai

- Otter.ai

- Pipedrive

- Salesforce Inc.

The AI sales assistant software sector is poised to expand during the forecast period. Key players in the sector are investing in AI sales assistant software to improve customer engagement and retention rates. Furthermore, the integration of AI-powered analytics is enabling businesses to rethink sales strategies and prepare ad campaigns based on user behavior. For instance, in August 2024, Lowe's Companies, Inc., announced the expansion of omnichannel advertising solutions. Such advancements open opportunities to provide AI sales assistant solutions to businesses to boost lead generation.

Here are some key players in the AI sales assistant software market:

Recent Developments

- In October 2024, Nooks announced USD 43 million series B funding along with the launch of the first AI Sales Assistant Platform (ASAP). The total funding of Nooks amounts to USD 70 million and the funding was led by Kleiner Perkins alongside participation from existing investors Tola Capital and Lachy Groom.

- In April 2024, Pipedrive announced the launch of Pipedrive AI powered by OpenAI and internally developed AI software engines. The new product suite aims to automate sales and simplify communication by providing features such as AI-powered sales assistant.

- Report ID: 6891

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AI Sales Assistant Software Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.