AI Infrastructure Market Outlook:

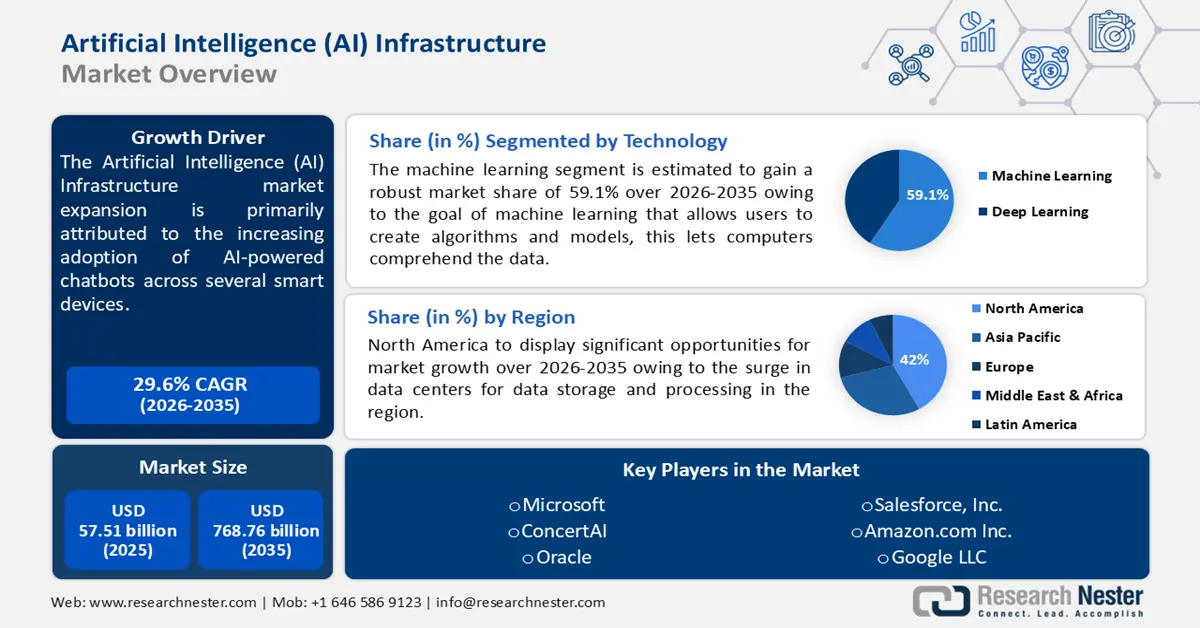

AI Infrastructure Market size was over USD 57.51 billion in 2025 and is projected to reach USD 768.76 billion by 2035, witnessing around 29.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of AI infrastructure is evaluated at USD 72.83 billion.

The market expansion is primarily attributed to the increasing adoption of AI-powered chatbots across several smart devices. In July 2024, Google announced that Gemini will be incorporated into Samsung devices such as Z Fold6, Galaxy Watches, and the latest Galaxy Z Flip6. The Gemini application is available in about 200 countries and in over 29 languages. Moreover, AI is useful for handling Big Data, this includes hardware comprising graphics processing units (GPUs), Tensor Processing Units (TPUs), specialized AI chips, software frameworks, and tools for developing and implementing AI.

The available AI-powered chatbots cater to a wide array of applications. For instance, detailed, consistent, accurate, and human-like outputs are provided as a response that can be incorporated by interconnecting various workspace applications such as Google Meet, Sheets, Docs, and Slides using chatbots such as ChatGPT and Gemini. This will impact the chatbot during the forecast period.

Key AI Infrastructure Market Insights Summary:

Regional Highlights:

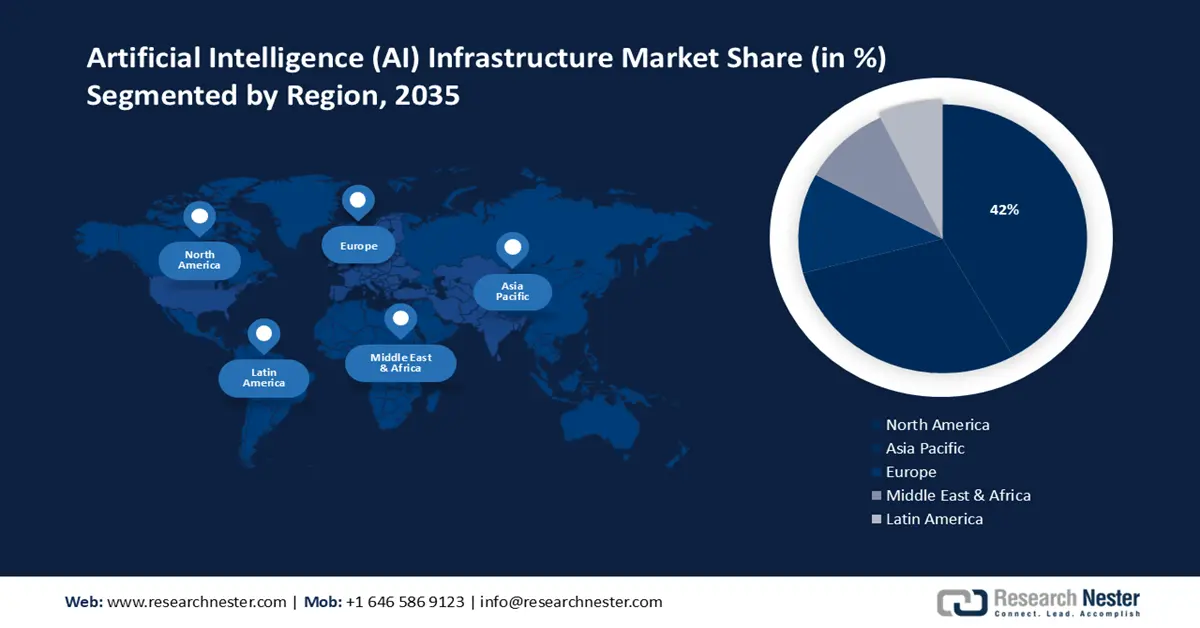

- The North America AI infrastructure market will account for 42% share by 2035, driven by the surge in data centers for its storage and processing.

- The Asia Pacific market will exhibit the highest CAGR during 2026-2035, driven by the increasing digitization in various sectors such as banking, telecommunication, healthcare, and automotive.

Segment Insights:

- The machine learning segment in the ai infrastructure market is projected to hold a significant share by 2035, augmented by ML’s ability to create algorithms for data comprehension and prediction without programming.

- The hardware segment in the ai infrastructure market is anticipated to achieve substantial growth till 2035, driven by hardware’s ability for parallel processing, speeding up AI model training and processing tasks.

Key Growth Trends:

- Tremendous investments in computer-intensive chips

- Ease of handling high computational demand

Major Challenges:

- Threat of alternatives

- Security and privacy concerns

Key Players: Alibaba, NVIDIA, AIBrain, IBM, Microsoft, ConcertAI, Oracle, Salesforce, Inc., Amazon.com Inc., Google LLC.

Global AI Infrastructure Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 57.51 billion

- 2026 Market Size: USD 72.83 billion

- Projected Market Size: USD 768.76 billion by 2035

- Growth Forecasts: 29.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

AI Infrastructure Market Growth Drivers and Challenges:

Growth Drivers

-

Tremendous investments in computer-intensive chips: AI infrastructure market revenue is growing rapidly as GPU & CPU manufacturers such as Qualcomm, AMD, NVIDIA, and Intel have increased their investments in developing chips compatible with AI solutions. For instance, in April 2024, Google announced an investment of USD 75.0 million to provide AI skills to more than 1 million Americans while working in the education and nonprofit sectors. Furthermore, the revenue share is also driven by the development of Application-Specific Integrated Circuits (ASICs) and Field-Programmable Gate Arrays (FPGAs).

-

Ease of handling high computational demand: AI-integrated infrastructure provides enhanced scalability and flexibility as it is cloud-based and not on-premise. The advanced visibility it offers can easily pool TPU, GPU, and CPU which can help increase resources. Additionally, there is widespread adoption of real-time AI and Internet of Things (IoT) systems owing to their affordability, compact size, and energy efficiency. AI tools such as Google Kubernetes Engine (GKE) allow real-time control, manufacturing, and monitoring options that help to reduce downtime, optimize production efficiency, and improve overall productivity.

In addition, to meet the long-term demand for chips, the Global Semiconductor Industry Association continued to make significant capital expenditures. They invested about USD 166.0 billion in 2022 for the manufacturing and R&D of chips for automotive, electronics, and other industries.

Challenges

-

Threat of alternatives: IT infrastructure such as traditional CPUs are readily available at an affordable price as they work on on-premise data centers, software, and desktops. Moreover, there is a need for outsourcing solutions for repurposing existing software to ensure enhanced efficiency and to meet AI infrastructure needs. This makes it difficult to improve operators’ skills, especially in data science as it may limit its scope, application, and longevity.

-

Security and privacy concerns: AI infrastructure providers need to ensure that their offerings adhere to legal frameworks, this often includes requirements for data encryption, user consent, and deletion rights. Strong access control mechanisms are expensive but can ensure that only authorized users can access sensitive data and AI models. This includes role-based access control (RBAC), multi-factor authentication (MFA), and regular audits of user permissions. thus, hindering market growth.

AI Infrastructure Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

29.6% |

|

Base Year Market Size (2025) |

USD 57.51 billion |

|

Forecast Year Market Size (2035) |

USD 768.76 billion |

|

Regional Scope |

|

AI Infrastructure Market Segmentation:

Technology Segment Analysis

The machine learning segment in the AI infrastructure market is poised to capture a share of 59.1% in the coming years. This segment growth is augmented by the goal of machine learning (ML) which allows users to create algorithms and models. Attributed to which, computers comprehend the data to make predictions and judgments accordingly without the need to be programmed. Growth in this sector will boost machine learning in the near future.

Furthermore, the scalable cloud computing resources, allow businesses to easily implement ML models without having to invest in on-premises infrastructure. Because of various governmental regulatory standards such as HIPAA (Health Insurance Portability and Accountability Act) in the U.S. and GDPR (General Data Protection Regulation) in Europe, ML solutions are being adopted for data privacy, security, and reasons.

Offering Segment Analysis

The hardware segment is expected to be the fastest-growing segment with a substantial size during the forecast period. This growth is propelled by their ability to parallel processing, which makes several processes like training an AI model interface faster. For example, the NVIDIA AI GPU-accelerated AI platform serves as the foundation for the NVIDIA AI Workbench. Their Quadro and Tesla series are specially made to handle AI workloads. Additionally, in contrast to the fixed hardware structures of CPUs, GPUs, and FPGAs are made up of a variety of interconnected and programmable logic blocks that can be set up to perform specific hardware functions.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Offering |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AI Infrastructure Market Regional Analysis:

North America Market Insights

North America industry is set to account for largest revenue share of 42% by 2035. The growth in this region is driven by the surge in data centers for its storage and processing. For instance, the United States International Trade Commission published a report in May 2021, estimating a 50% increase in the creation of new data as compared to 2020, surpassing 1.2 trillion gigabytes of data production. Owing to this the data center construction will show a tremendous growth rate in the forecast period.

In the U.S., there is a tremendous boost in the emergence of startups, which will act as a rising factor for the AI infrastructure industry as they will need more IoT. Additionally, the Center for American Progress in 2024 estimated an influence in the growth rate of about 16% between 2019 and 2023 in the number of startups and firms.

The prevalence of various cloud-based service providers in Canada such as Sync.com, Leonovus, and Eleks will demand AI infrastructure for enhanced functioning. According to the Cloud Computing Statistics in Canada 2024, about 92% of companies in Canada use some type of cloud computing. They set about 29% of the IT budget for cloud computing.

APAC Market Insights

The AI infrastructure market in Asia Pacific will also encounter huge growth during the forecast period with a notable size, accounting for the second position. This growth is led by the increasing digitization in various sectors such as banking, telecommunication, healthcare, and automotive. American Medical Association in January 2024 surveyed 1091 physicians, and about 56.0% witnessed improved patient convenience, coordination, and safety after AI was incorporated into healthcare.

In China, investments from private and government sectors in digital infrastructure are boosting AI infrastructure. World Economic Forum 2023 estimated that by 2030 the internet economy in Asia is fueled to surpass USD 1 trillion, credited to the slated base of digital applications and consumers. This will significantly drive the AI infrastructure market.

Japan is predicted to have a high rise in technology coupled with several advancements and innovations in storage management software. A report published by the World Intellectual Organization in 2022 concluded that Japan ranked 11th for its inputs in innovation both in 2022 and 2021. Japan also ranks 12th in the top 48 economies of the high-income group.

AI Infrastructure Market Players:

- Alibaba

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NVIDIA

- AIBrain

- IBM

- Microsoft

- ConcertAI

- Oracle

- Salesforce, Inc.

- Amazon.com Inc.

- Google LLC

The AI infrastructure market expansion is predicted to grow impelled by these companies occupying a lucrative share. Most of these companies are continuously collaborating, making agreements, expanding, and joining ventures for the growth of this industry. With the increasing presence of chatbots, and investments in computer-intensive chips various companies are adapting to the latest trends and are set to be the major key players in this sector.

Some of the key players include:

Recent Developments

- In March 2024, AWS and NVIDIA announced a collaboration to develop the next generation of cloud-based infrastructure with the express purpose of creating generative AI applications and training robust machine learning models.

- In October 2023, Alibaba Cloud and Futureverse, a metaverse and AI content company collaborated to bring cloud computing services to the Jen Music AI platform. By creating the JEN-1 text-to-music generation model, the partnership aims to advance AI generative music technology.

- Report ID: 6332

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AI Infrastructure Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.