Artificial Intelligence in Warehousing Market Outlook:

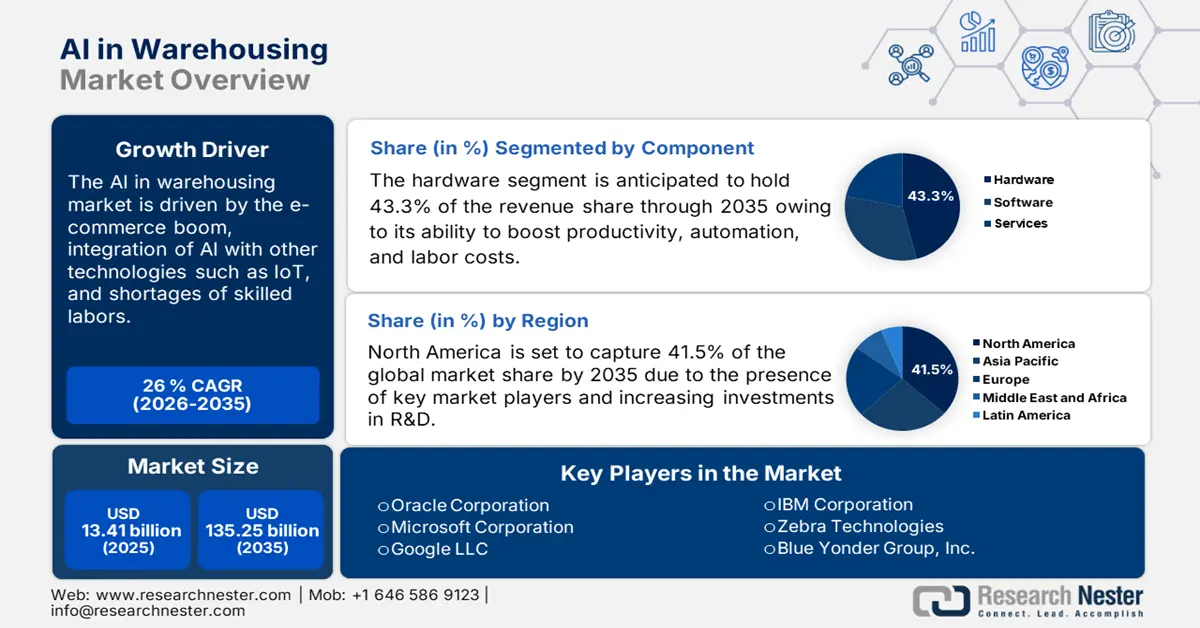

Artificial Intelligence in Warehousing Market size was valued at USD 13.41 billion in 2025 and is likely to cross USD 135.25 billion by 2035, registering more than 26% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of artificial intelligence in warehousing is estimated at USD 16.55 billion.

The gradual digital shift is primarily fuelling the adoption of artificial intelligence (AI) and other digital technologies such as machine learning, big data analytics, cloud computing, edge computing, and the Internet of Things in warehousing applications. Warehouse operators across the globe are widely adopting AI to streamline workflow, reduce operational costs, and increase automation. AI also reduces the need for labor as it increases the working speed level, mitigates errors, maximizes resource utilization, boosts order processing, and improves inventory management by effectively coordinating with logistics.

According to McKinsey and DHL industry studies, about one-third of logistics and transportation companies are already using AI to enhance operations, while more than half of warehouses employ robotics and nearly half are adopting drones to boost efficiency. Thus, to move from process automation to smarter automation many companies are investing in AI technologies.

Key Artificial Intelligence in Warehousing Market Insights Summary:

Regional Highlights:

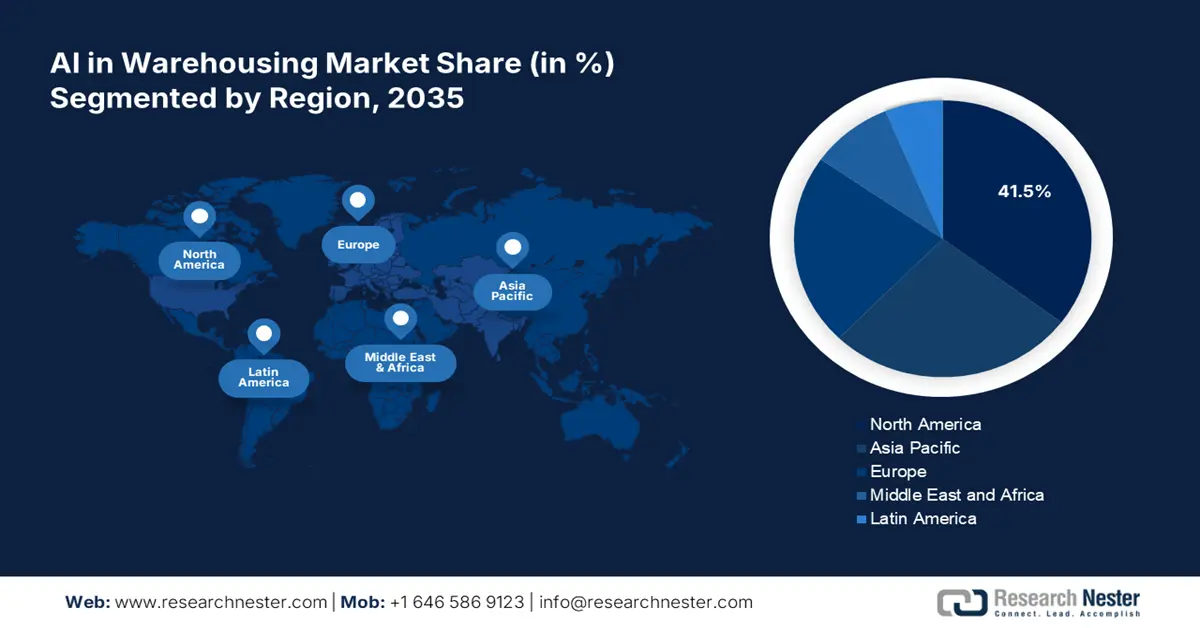

- North America commands the Artificial Intelligence in Warehousing Market with a 41.5% share, fueled by the early introduction of online shopping, e-commerce boom, and continuous investments in AI technologies for warehouse optimization, driving growth through 2026–2035.

- The Asia Pacific AI in warehousing market is expanding rapidly through 2035, fueled by the entry of new start-ups in the e-commerce sector, increasing the load on warehouses and driving AI adoption for improved operational efficiency.

Segment Insights:

- The Hardware segment is set to achieve a 43.3% market share by 2035, driven by the efficiency and versatility of AI-enabled solutions like cameras, sensors, and robots in warehouse operations.

- Cloud-based platforms segment are expected to achieve a 65.2% share by 2035, driven by flexibility, cost-effectiveness, and scalability in warehouse management.

Key Growth Trends:

- Rapidly increasing e-shopping activities

- Automation and robotics

Major Challenges:

- Complexity increases investment costs

- Misconception hampering adoption rates

- Key Players: Amazon Web Services (AWS), Microsoft Corporation, Google LLC, IBM Corporation, Honeywell International, and Siemens AG.

Global Artificial Intelligence in Warehousing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.41 billion

- 2026 Market Size: USD 16.55 billion

- Projected Market Size: USD 135.25 billion by 2035

- Growth Forecasts: 26% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Artificial Intelligence in Warehousing Market Growth Drivers and Challenges:

Growth Drivers

-

Rapidly increasing e-shopping activities: The expanding online shopping activities and e-commerce boom globally are significantly increasing the workload at the logistics, transportation, and warehousing end. To mitigate the workload and increase operation efficiency and automation, these segments use digital technologies including artificial intelligence.

-

Automation and robotics: The integration of robotics technology is one of the latest trends in the AI in warehousing market. Several autonomous robots including drones are equipped with AI to assist in material handling, identifying issues, and material checks. AI along with simultaneous localization and mapping (SLAM) technology offers effective results in finding goods in complex warehousing infrastructure. AI-enabled drones with advanced sensors and cameras also aid in navigating and material transporting purposes within the warehouse.

Challenges

-

Complexity increases investment costs: One of the major factors limiting the use of AI in warehousing is the high initial investment required. The advanced technologies are complex to integrate with existing infrastructure and need skilled technicians, which also contributes to overall costs. The majority of small warehouses or those working on limited budgets resist adopting advanced technologies such as AI.

-

Misconception hampering adoption rates: Lack of knowledge of digital technologies particularly among warehouse operators in poor economies is estimated to hamper the artificial intelligence (AI) in warehousing market growth to some extent going ahead. The misconception of AI-enabled devices and equipment also contributes to this.

Artificial Intelligence in Warehousing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

26% |

|

Base Year Market Size (2025) |

USD 13.41 billion |

|

Forecast Year Market Size (2035) |

USD 135.25 billion |

|

Regional Scope |

|

Artificial Intelligence in Warehousing Market Segmentation:

Component (Hardware, Software, Services)

Hardware segment is expected to hold over 43.3% AI in warehousing market share by the end of 2035, owing to its efficiency and versatility in operational handling in warehouses. Hardware solutions such as cameras, sensors, and robots enabled with AI technology have the capabilities to significantly transform warehouse operations. Many market players are highly concentrated on introducing advanced hardware solutions and for the same, they are employing various tactics. For instance, in July 2024, Mytra came up with USD 78 million in Series B funding and other commercial investors including Albertsons Companies, Inc. for its first-of-kind three-dimensional robotics and AI for warehouses to enhance productivity.

Deployment Mode (Cloud-based, On-premise)

By 2035, cloud-based segment is projected to hold more than 65.2% AI in warehousing market share, mainly due to its flexibility and cost-effectiveness. Without investing in on-site IT infrastructure, these cloud-based platforms offer scalability to end users further helping in resource management depending on demand. In warehouses where product volume keeps fluctuating, cloud-based platforms are the most advantageous and cost-effective. The cloud-based solutions are also easier to integrate with several technologies leading to highly productive outcomes. For instance, in September 2022, Element Logic announced the launch of its cloud-based platform that enables warehouse operations based on real-time data.

Our in-depth analysis of the global AI in warehousing market includes the following segments:

|

Component |

|

|

Application |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Artificial Intelligence in Warehousing Market Regional Analysis:

North America Market

North America industry is expected to account for largest revenue share of 41.5% by 2035. The early introduction of online shopping and e-commerce platforms substantially drives the adoption of AI technologies in warehouses. Furthermore, the digitalization trend coupled with continuous investments in innovations is leading to the development of advanced technologies for inventory management, warehouse optimization, supply chain visibility, and order picking and sorting.

In the U.S., the majority of people prefer buying goods through online platforms and the e-commerce boom in the country is fuelling high demand for AI in warehousing. According to a report, around 284.6 million online shoppers will be recorded in the U.S. in 2025.

In Canada, the rapidly expanding e-commerce platforms and high usage of advanced AI solutions in warehouses, logistics, and transportation applications. The country has some of the best minds in the field of artificial intelligence. One such is the Scale AI based in Montréal which offers excellent digital technologies for several industries including warehouses, logistics, and transportation. The National Research Council of Canada is also supporting Scale AI in developing AI-powered tools to expand the logistic sector in the country.

Asia Pacific Market Statistics

In Asia Pacific, the adoption of AI in warehousing is expected to increase at a fast pace during the forecast period. Several start-ups are entering the e-commerce sector and developing online platforms that offer multiple benefits and discounts, which leads to high online product sales. This further increases the load on warehouses fuelling the adoption of AI technologies to streamline the workflows and enhance productivity.

In India, companies are continuously developing innovative solutions to improve operational efficiency in warehouses. For instance, in June 2024, Affordable Robotic & Automation Ltd. (ARAPL) revealed that in the next 6 months, it is set to develop autonomous forklifts and Latent Lift robots to boost efficiency and safety in warehouse operations. The country also has a massive presence of online shoppers, which is contributing to the AI in warehousing market growth. According to the India Brand Equity Foundation, the country has around 936.16 million active internet users and over 350 million mature online users who continuously engage in transactions.

China with its largest e-commerce sector is significantly driving the adoption of AI in warehousing. AI is drastically helping warehouse operators to forecast demand due to their advanced algorithms. The e-commerce and logistics companies such as Alibaba and Cainiao in the country majorly employ AI technologies to enhance their supply chain operations.

Key Artificial Intelligence in Warehousing Market Players:

- Amazon Web Services (AWS)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Blue Yonder Group, Inc.

- Honeywell International

- Siemens AG

- Oracle Corporation

- SAP SE

- ABB Ltd

- Zebra Technologies

- Mytra

- Scale AI

- Element Logic

- Affordable Robotic & Automation Ltd.

- Lucas Systems

- Fulfilld, Inc.

- Scanco Software, LLC

The key players in the AI in warehousing market are adopting several organic and inorganic tactics to maximize their profit shares. They are collaborating with other players to develop next-gen solutions and attract a wider consumer base. Industry giants are also engaging in regional expansion strategies to grab opportunities in high-potential economies. For instance, Microsoft’s Azure and other cloud services revenue growth accounted for 35% in FY24 Q3.

Some of the key players include:

Recent Developments

- In July 2024, Lucas Systems announced the launch of next-gen AI-powered Dynamic Slotting for warehouses. This solution streamlines warehouse reslotting with just one click of a button.

- In December 2023, Blue Yonder Group, Inc. revealed the launch of a generative AI capability ‘Blue Yonder Orchestrator’. This platform is expected to simplify supply chain management and aid companies to make faster and smarter decisions.

- Report ID: 6608

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Artificial Intelligence in Warehousing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.