AI in Medical Imaging Market Outlook:

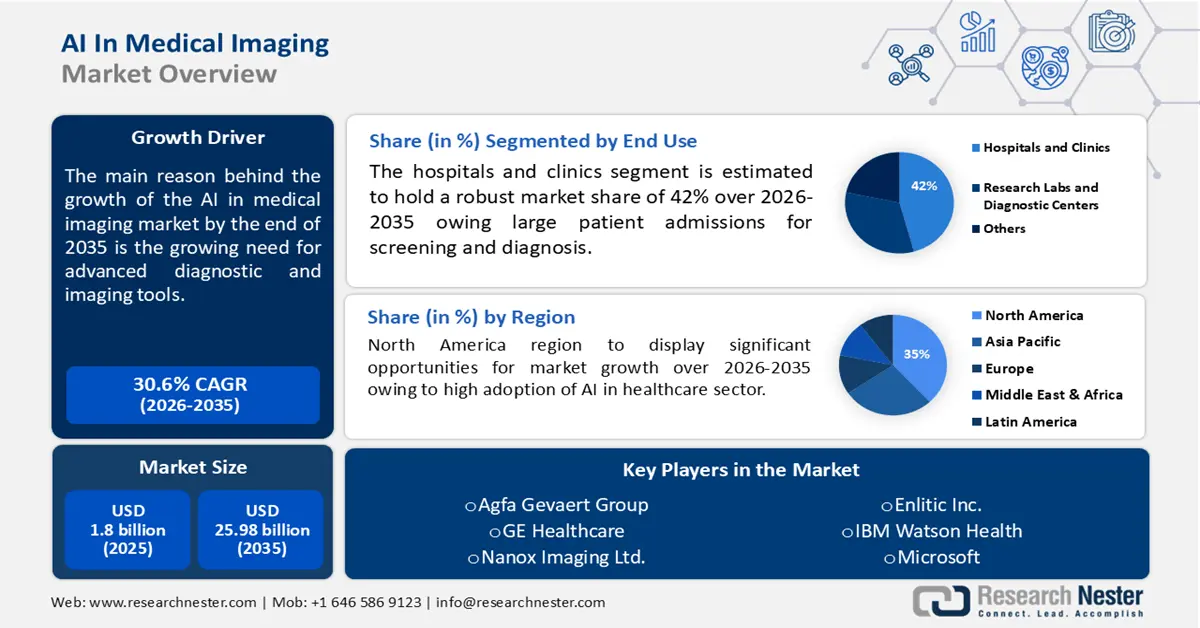

AI in Medical Imaging Market size was over USD 1.8 billion in 2025 and is poised to exceed USD 25.98 billion by 2035, growing at over 30.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of AI in medical imaging is estimated at USD 2.3 billion.

The growth of AI in medical imaging market is driven by the rising prevalence of different types of chronic disorders across the globe. According to a report published by the World Health Organization (WHO) in May 2023, the prevalence of chronic diseases such as cardiovascular diseases, neurological disorders, cancer, diabetes, and respiratory illnesses is estimated to account for 86% of the 90 million each year. This has resulted in growing need for advanced diagnostic and imaging tools to detect these diseases.

The integration of Artificial Intelligence (AI) into medical imaging has been a critical transformation in the healthcare industry. The sector is steadily investing in AI-based imaging tools and equipment for enhanced accuracy, fewer errors, and automation. Companies in healthcare and pharmaceutical sector are also emphasizing on developing and launching novel and effective imaging tools and software powered by AI.

Key AI in Medical Imaging Market Insights Summary:

Regional Highlights:

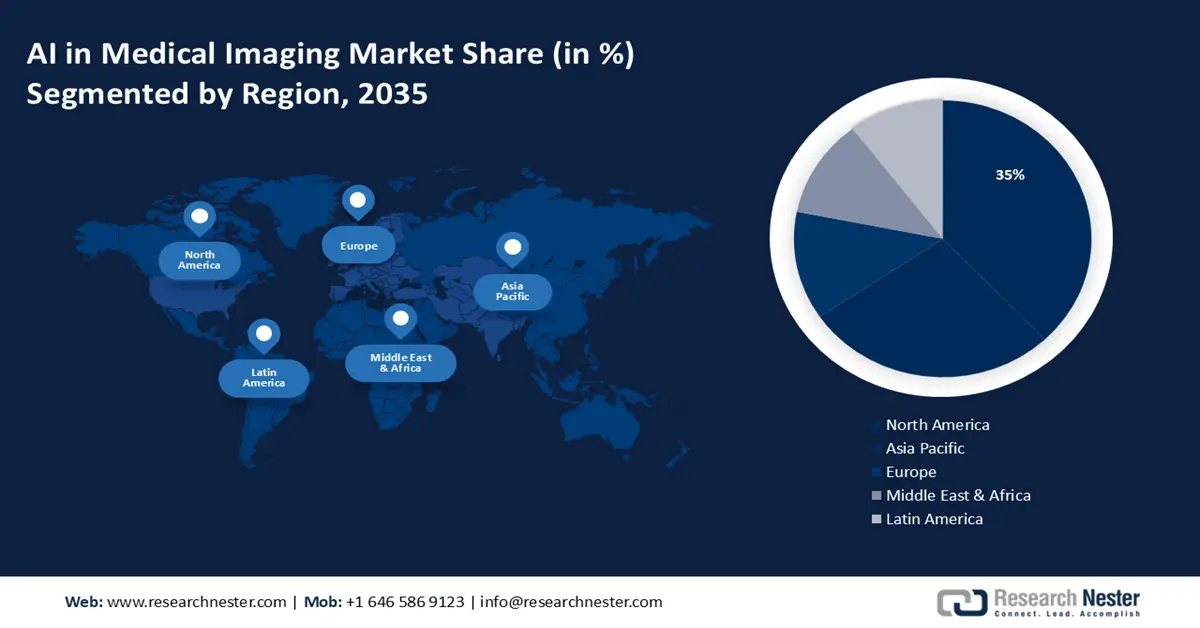

- The North America AI in medical imaging market is anticipated to capture 35% share by 2035, driven by high investment in AI-based healthcare diagnostics and technology integration.

- The Asia Pacific market will exhibit the fastest growth during the forecast timeline, driven by rising elderly population and government-led AI healthcare initiatives across key countries.

Segment Insights:

- The hospitals and clinics segment in the ai in medical imaging market is projected to see significant growth till 2035, driven by increased hospital admissions and the adoption of AI-based diagnostic tools post-COVID.

Key Growth Trends:

- Need for effective and accurate diagnostics tools

- Increasing investments by government and private sectors

Major Challenges:

- Issues associated with data privacy and security

- Resource Constraint for Smaller Healthcare Centers

Key Players: Agfa-Gevaert Group, GE Healthcare, Nanox Imaging Ltd., Ada Health, Enlitic Inc., IBM Watson Health, Intel Corporation, General Electric Company, Microsoft, Koninklijke Philips N.V, Siemens and Abbott Laboratories.

Global AI in Medical Imaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 2.3 billion

- Projected Market Size: USD 25.98 billion by 2035

- Growth Forecasts: 30.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 17 September, 2025

AI in Medical Imaging Market Growth Drivers and Challenges:

Growth Drivers

- Need for effective and accurate diagnostics tools- To cater to high volumes of data, hospitals, clinics, diagnostic centers, and other healthcare centers are adopting advanced AI-powered medical imaging tools. AI can easily process large volumes of data and images in less time, without compromising on the quality, thereby decreasing the time required for diagnosis. It also helps in lowering human error and provides more accurate and reliable data.

As AI provides accurate results, it can significantly decrease the need for multiple follow-up scans. This can be a crucial aspect in cases where early detection can prevent progression of the disease. Moreover, it can help radiologists to focus on complex cases as it automates the process of initial mage sorting and pre-screening. - Increasing investments by government and private sectors- Governments worldwide are steadily recognizing the potential benefits of AI in healthcare and diagnostics. They are investing in R&D activities and also offering favorable subsidies, grants, and funding programs to support advancements in medical imaging. For instance, UK Research and Innovation, a non-departmental public body of the Government of the United Kingdom offered 13 million Pounds of funding to revolutionize AI healthcare research. Moreover, many private enterprises and tech giants are heavily investing in AI for medical imaging. This is steadily accelerating the development and adoption of AI solutions in healthcare and diagnostics.

Challenges

- Issues associated with data privacy and security: AI relies on large amounts of patient-sensitive data which can be targeted for data breaching if not protected properly. It can result in unauthorized access to patient information such as personal data, disease history, and financial records.

- Resource Constraint for Smaller Healthcare Centers: Many small hospitals and clinics may lack financial recourses needed for deploying advanced AI technologies. This can result in low adoption of AI, hampering overall market growth.

AI in Medical Imaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

30.6% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 25.98 billion |

|

Regional Scope |

|

AI in Medical Imaging Market Segmentation:

Image Acquisition Technology Segment Analysis

The computed tomography segment in AI in medical imaging market is expected to register a staggering revenue growth till 2035. Computed tomography (CT) with AI offers greater accuracy and speed than other imaging tools and detailed cross-sectional areas and is used for different applications in orthopedics, neurology, oncology, emergency medicine, and cardiology. AI helps in providing improved image quality, automated detection, and analysis.

Many healthcare centers are adopting advanced AI-CT tools for quick and accurate diagnosis, workflow optimization, and cost-effectiveness. Leading companies are investing in R&D activities to launch advanced CT tools. For instance, In May 2024, Elekta announced the launch of Evo, a CT-Linac equipped with AI-enhanced imaging. It is a highly versatile radiation therapy technique, capable of delivering online and offline adaptive radiation therapy along with enhanced image-guided radiation therapy treatments.

Application Segment Analysis

The neurology segment in AI in medical imaging market is projected to hold robust revenue share during the forecast period owing to rising prevalence of neurological diseases such as Alzheimer's, Parkinson's, epilepsy, and brain tumor across the globe. A report released in 2021 by the Lancet Neurology stated that more than 3 billion people suffered from a neurological condition. Contributing to this, the WHO in its 2024 publications stated that over 1 in 3 individuals are affected by neurological disorders which is a leading cause of disability and illness globally.

To cater to the rising burden of neurological diseases, manufacturers are launching novel and highly effective AI-powered imaging tools for detecting and diagnosis of neurological disorders. For instance, in February 2024, Royal Philips partnered with Synthetic MR to launch Smart Quant Neuro 3D to support diagnosis and therapy assessment of several brain disorders. Smart Quant Neuro 3D is a combination of AI-based SmartSpeeed image reconstruction technology and 3D SyntAc clinical application by Philips and MR's SyMRI NEURO 3D quantitative tissue assessment software.

End use Segment Analysis

Hospitals and clinics segment is anticipated to dominate over 42% AI in medical imaging market share by 2035, due to large patient admissions for screening and diagnosis. According to data published by the National Institutes of Health (NIH), the number of hospital admissions for screening and diagnostics has drastically increased post-COVID-19 pandemic. Many hospitals and healthcare centers across the globe are focused on expanding their existing healthcare infrastructure and are adopting AI-based imaging and diagnostic equipment for accurate and quick analysis.

Different types of AI-based tools for CT, MRI, and PET scans help radiologists and healthcare professionals to identify abnormalities and diseases like brain tumors, types of cancers, and neurological conditions with higher precision and speed. Moreover, AI-powered tools help in automating routine tasks like image analysis, reducing the overall workload on radiologists and other healthcare professionals. Other factors such as availability of skilled professionals in many medium-to-large scale hospitals and clinics and favorable reimbursement policies are expected to drive segment revenue growth during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Solution |

|

|

By Image Acquisition Technology |

|

|

By Application |

|

|

By End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AI in Medical Imaging Market Regional Analysis:

North America Market Insights

North America industry is anticipated to account for largest revenue share of 35% by 2035, due to rising investments in AI in healthcare industry. According to a report published by Silicon Valley Bank (SVB), so far in 2024, USD 2.8 billion has been invested in AI healthcare companies, the highest investment since 2021. Hospitals, clinics, and other healthcare centers across the region are focused on adopting novel and advanced AI technology for effective diagnosis and smooth functioning. The AI in medical imaging market in North America is driven by rapid advancements in AI and healthcare and presence of skilled radiologists and healthcare professionals. As per a 2023 report, the number of employed radiologists in the United States ranged from 40 to 3,300 by state.

The government in the United States is encouraging the adoption of AI in healthcare and has announced voluntary commitments from leading healthcare and pharmaceutical companies to deploy AI solutions and services and also manage the potential risks associated with AI. The companies are committed to developing AI solutions for optimizing overall healthcare delivery, making healthcare reachable and affordable. Moreover, many companies are investing and acquiring other companies to enhance their product base. For instance, GE HealthCare acquired MIM Software to leverage MIM’s imaging analytics and digital workflow capabilities and explore its potential to enhance patient care and overall healthcare system.

Asia Pacific Market Insights

Asia Pacific AI in medical imaging market is expected to be the fastest growing segment during the forecast period owing to high focus on improving existing healthcare infrastructure. This is primarily due to increasing elderly population in the region, rising burden of various diseases and health conditions, and growing need for advanced healthcare systems and diagnostic tools and services.

Governments in countries like China, India, Singapore, Japan, and South Korea are encouraging the use of AI tools in the healthcare sector. For instance, during the second edition of the AI Health Summit 2023, the Senior Minister of the Ministry of Health of Singapore delivered a speech highlighting the importance of adopting AI in the healthcare sector for early detection and better diagnosis of diseases. Companies and start-ups in Asia Pacific are developing new tools and techniques to improve overall healthcare infrastructure. In 2024, Indian medical imaging AI company, InMed AI developed and launched Neuroshield CT TBI, an AI enabled tool that automatically screens all head CTs.

AI in Medical Imaging Market Players:

- Agfa-Gevaert Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GE Healthcare

- Nanox Imaging Ltd.

- Ada Health

- Enlitic Inc.

- IBM Watson Health

- Intel Corporation

- General Electric Company

- Microsoft

- Koninklijke Philips N.V

- Siemens

- Abbott Laboratories

The global AI in medical imaging market is quite competitive, comprising key players operating at global and regional levels. The rise in global burden of diseases has resulted in increasing demand for effective and accurate diagnostic tools and solutions. Companies are focused on expanding their product base and strengthening their positing in the market by adopting several strategies such as collaborations, joint ventures, partnerships, and product launches. Some of the key players in the market include:

Recent Developments

- In April 2024, Bayer collaborated with Google Cloud to develop advanced AI solutions and apps to assist radiologists with effective diagnosis. The partnership aims to use Google Cloud’s generative AI technology and develop Bayer’s platform for developing and launching AI-powered healthcare applications, especially in radiology.

- In October 2023, Abbott Laboratories announced the launch of a novel vascular imaging platform powered by AI- Ulteron 1.0 Software in India. This intra-vascular imaging software combines Optical Coherence Tomography with AI to provide a comprehensive view of blood flow and blockages in the arteries.

- Report ID: 6280

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AI in Medical Imaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.