Agrochemical Additives Market Outlook:

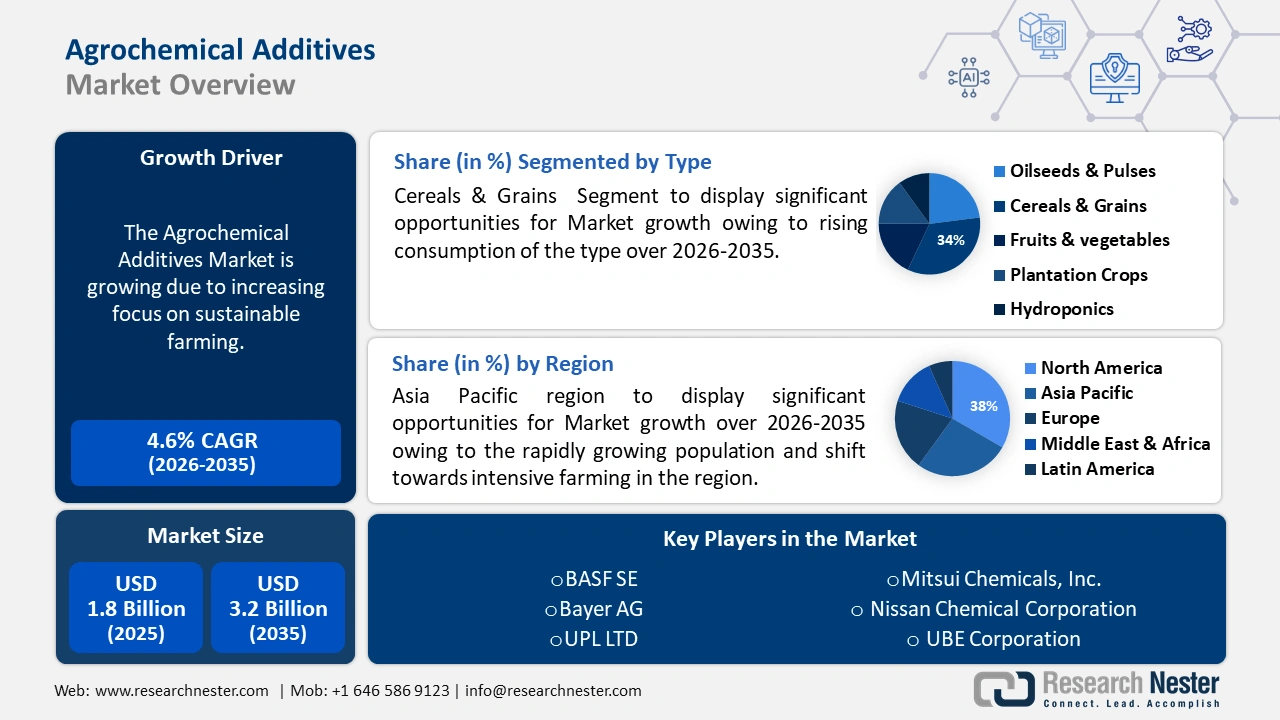

Agrochemical Additives Market size was over USD 1.87 billion in 2025 and is anticipated to cross USD 2.93 billion by 2035, witnessing more than 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of agrochemical additives is assessed at USD 1.95 billion.

The increased need for packaged foods has expanded globally due to population growth, which has also raised demand for agricultural products and agrochemical additives. As observed by Research Nester analyst, U.S Processed Food Products exports in 2023 accounted for a value of around USD 36 Billion. The use of agricultural chemicals to increase crop yield has increased recently. The use of agrochemicals such as fertilizers and pesticides has become vital to meet the increasing demand for food. Agrochemicals are essential for improving plant growth, crop output, and crop quality as well as soil moisture.

Based on their types, agrochemicals are separated into groups such as insecticides, fertilizers, and pesticides. Fertilizers are widely utilized to boost fertility, crop yield, and output of agro goods owing to their capacity to increase the nutritional content of soil and crops. Further, the expansion of the agrochemical industry, fuelled by investments in research and development, is driving the growth of the agrochemical additives market. Manufacturers are developing innovative additives tailored to specific agrochemical formulations, thereby widening the market scope.

Key Agrochemical Additives Market Insights Summary:

Regional Highlights:

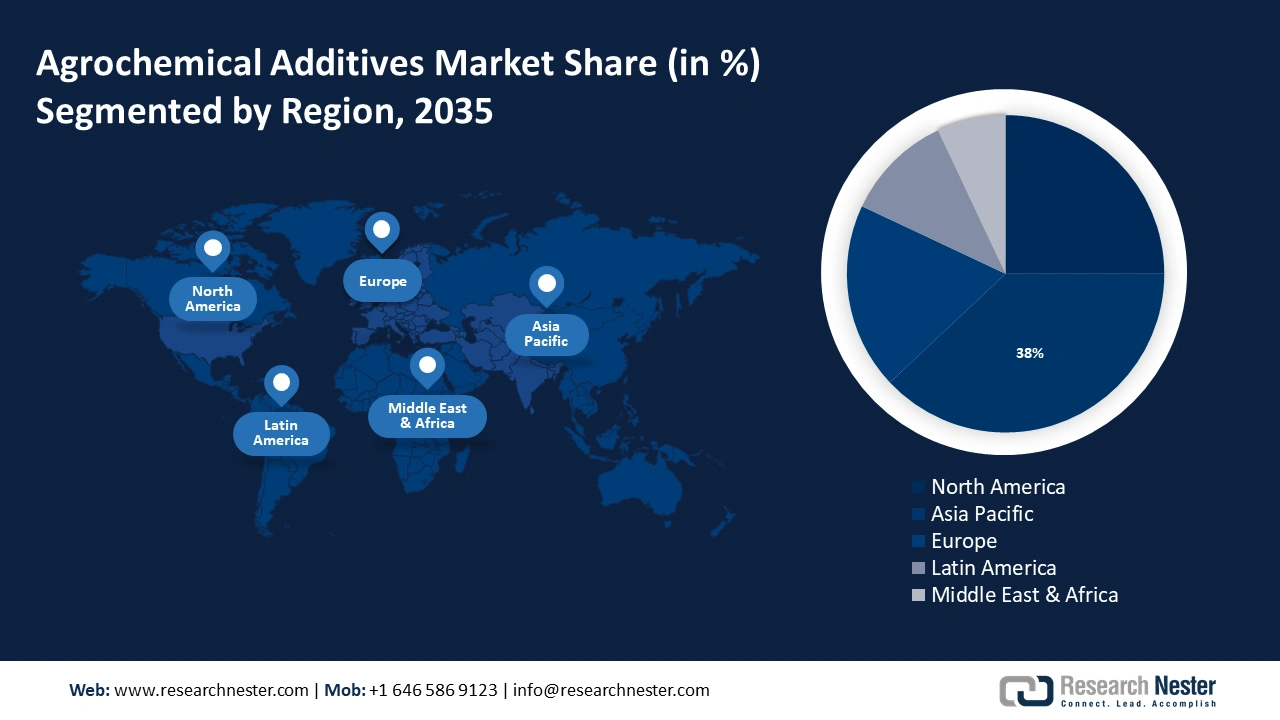

- Asia Pacific agrochemical additives market will dominate around 38% share by 2035, fueled by the growing population and demand for agricultural products.

- North America market will secure significant revenue share by 2035, driven by the demand for eco-friendly and organic agrochemical additives.

Segment Insights:

- The cereals & grains segment in the agrochemical additives market is anticipated to experience significant growth through 2035, driven by the need to enhance yield and nutrient absorption in cereals.

Key Growth Trends:

- Growing focus on sustainable agriculture

- Government initiatives and regulations

Major Challenges:

- Balancing the need for innovation with affordability is a challenge to market expansion.

Key Players: BASF SE, Bayer AG, UPL LTD, FMC Corporation, ADAMA Agricultural Solutions Limited, Solvay, Huntsman International LLC, HELM AG, LANXESS, Sumitomo Chemical Co., Ltd..

Global Agrochemical Additives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.87 billion

- 2026 Market Size: USD 1.95 billion

- Projected Market Size: USD 2.93 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, India, Japan

- Emerging Countries: China, India, Thailand, Indonesia, Brazil

Last updated on : 17 September, 2025

Agrochemical Additives Market Growth Drivers and Challenges:

Growth Drivers

-

Growing focus on sustainable agriculture - According to FAO, livestock contribute 40% of world agricultural production and are responsible for nearly 1.3 million people's livelihoods and food security. It has become important to improve the practices of the livestock sector to make them more sustainable, equitable and less risk to animal and human health. With increasing awareness about environmental sustainability, there’s a shift towards sustainable agricultural practices and sustainable crop protection chemicals. Agrochemical additives that promote eco-friendly solutions, such as bio-based adjuvants and biodegradable surfactants, are witnessing higher demand, leading to development of market.

-

Government initiatives and regulations - Government initiatives aimed at promoting modern agriculture practices ensuring food security are boosting the demand in agrochemical additives market. Regulatory frameworks mandating the use of certain additives for environmental protection and crop safety will also contribute to the market growth.

- Increasing adoption of biotechnology in agriculture - The adoption of biotechnology in agriculture, including genetically modified crops, is creating opportunities for agrochemical additives market. These additives enhance the performance of biotech-derived crop protection products in demand, reflecting the trend toward advanced agricultural solutions. It was observed that, in 2016, the global area of biotech crops increased from 179.7 million hectares to 185.1 million hectares, a 3% increase amounting to 5.4 million ha.

- Rising need for pest and disease management - With the proliferation of pests, weeds, and diseases threatening crop yields, there’s a heightened demand for agrochemical additives such as adjuvants and surfactants to improve the efficacy of pesticides and herbicides, contributing to better pest and disease management.

Challenges

-

Regulatory hurdles - Compliance with stringent regulatory standards poses a significant challenge for agrochemical additive manufacturers. Meeting requirements for safety for safety, environmental impact, and efficacy testing often involves extensive testing and documentation, increasing time and costs.

-

Managing residues from additives and agrochemicals in soil and water bodies presents challenges for sustainable agriculture, hindering agrochemical additives market.

- Balancing the need for innovation with affordability is a challenge to market expansion.

Agrochemical Additives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 1.87 billion |

|

Forecast Year Market Size (2035) |

USD 2.93 billion |

|

Regional Scope |

|

Agrochemical Additives Market Segmentation:

Crop Type Segment Analysis

Cereals & Grains segment is predicted to hold the majority market share by 2035, amounting to 34%. Agrochemical additives tailored for cereals & grains aim to enhance yield, protect against pests & diseases, and optimize nutrient absorption, catering to the essential nature of these crops in global food supply.

It was observed that critical minerals are added to fertilizers to boost rice crop output and grain nutrient content, which is anticipated to propel the demand for agrochemical additives. It was observed that FAO’s new projections for world cereal production in 2023 were slightly raised to 2,840 million tonnes and now stand at 30.4 million tonnes higher than the last year with a 1.1 per cent increase of 31.4 million tonnes.

Type Segment Analysis

Fertilizers segment is expected to witness substantial growth over the forecast period. The need for food and agricultural products will likely increase due to population expansion, which will fuel the use of fertilizers in the agricultural sector. Government subsidies on some fertilizers are expected to help the fertilizers segment to remain a significant end-use in the market.

For cereals & grains, fertilizers including urea, ammonium nitrate, and anhydrous ammonia are recommended. Cereals & grains can be fertilized in three different methods. They can be sprayed on independently or combined with other fertilizers and given to seedlings. They can also be top-dressed separately. Increasing cereal & grain yields requires applying fertilizers at the right rate and in the right quantities. The production of the three main cereal crops—rice, wheat, and maize—uses around 60% of the nitrogen present in Earth's soil. All these factors cumulatively account for the segment growth in the market.

Our in-depth analysis of the global market includes the following segments:

|

Form |

|

|

Type |

|

|

Crop Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Agrochemical Additives Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 38% by 2035. The region is home to a large and rapidly growing population, driving the demand for food & agricultural products. The production value of the agriculture industry in the region accumulated to around USD 2.1 trillion.

Agrochemical additives play a vital role in enhancing crop yields and quality to meet the food demand of growing urban populations. In response to increasing food demand and limited arable land availability, there is a shift towards intensive farming practices in the Asia Pacific region. Agrochemical additives are crucial in optimizing agricultural inputs and maximizing yields in intensive farming systems, fueling market growth.

The Asia Pacific region is witnessing a growing adoption of biotechnology in agriculture, including genetically modified (GM) crops. Agrochemical additives that support the performance of biotech-derived crop protection products, such as adjuvants for GM herbicide-tolerant crops, are experiencing increased demand, contributing to the agrochemical additives market expansion. Biotech crops were grown on 19.5 million hectares, or 10.2% of the world's biotech crop area, in nine countries in Asia Pacific in 2019: India, China, Pakistan, Philippines, Australia, Myanmar, Vietnam, Indonesia, and Bangladesh.

North American Market Insights

North America agrochemical additives market is set to attain significant market share till 2035. The region experiences a consistent demand for crop protection products to sustain its large-scale agricultural operations. Agrochemical additives play a crucial role in enhancing the efficacy of pesticides, herbicides, and fungicides, thereby meeting the demand for higher yields and quality crops.

Also, environmental sustainability is a key concern driving market growth in North America. Agrochemical additives that offer eco-friendly solutions, such as bio-based adjuvants and biodegradable surfactants, are increasingly favored by farmers and regulators alike, contributing to market expansion.

Moreover, the rising consumer demand for organic produce has led to an expansion of organic produce has led to an expansion of organic farming practices in North America. In 2022, organic food sales in the U.S. reached USD 60 billion, making it one of the highest levels for a resilient organic sector.

Additionally, the US organic food market accounted for six percent of its overall sales during the year 2022. Agrochemical additives certified for use in organic agriculture, such as organic adjuvants and plant-based formulations, are witnessing growing demand, driving market development.

Agrochemical Additives Market Players:

- Syngenta Crop Protection, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Bayer AG

- UPL LTD

- FMC Corporation

- ADAMA Agricultural Solutions Limited

- Solvay

- Huntsman International LLC

- HELM AG

- LANXESS

Recent Developments

- Syngenta Crop Protection, LLC launched Victrato®, a novel seed treatment for cotton and soybeans. When the new seed treatment is approved for registration by the Environmental Protection Agency, which should happen by the 2025 growing season, it will introduce targeted technology that prevents nematodes, Cotton Root Rot (CRR), and Sudden Death Syndrome (SDS) without affecting beneficial species.

- Bayer AG, a multinational corporation with core competencies in the life science fields of agriculture and health care signed a collaborative agreement with AgPlenus Ltd., a subsidiary of Evogene Ltd. and a world leader in the design and development of innovative sustainable crop protection products.

- Report ID: 6012

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Agrochemical Additives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.