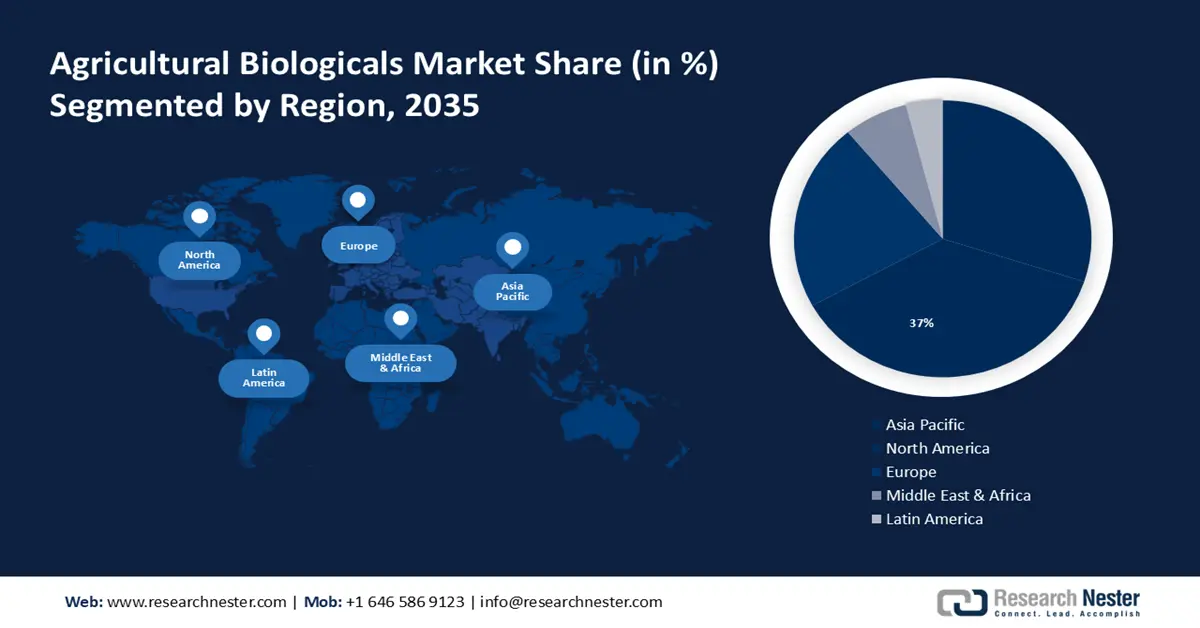

Agriculture Biologicals Market Regional Analysis:

North American Market Insights

North America industry is expected to account for largest revenue share of 37% by 2035. This growth will be noticed mainly due to rising awareness about organic product consumption in this region. According to USDA ERS, growing customer demand for foods produced organically has given producers new market options and is changing the organic food sector.

The market for agriculture biologicals has expanded in the U.S. as a result of the rising government initiatives to empower the production of organic food. The U.S. Department of Agriculture (USDA) is strengthening the market for domestically farmed organic commodities and supporting producers pursuing organic certification, according to a statement made on 10th May 2023 by Agriculture Secretary Tom Vilsack.

The Canadian agriculture biological sector will grow mainly due to the rising investment in organic food and organic flavors. A new analysis from Export Development Canada estimated that in 2020, Canadians spent almost USD 7 billion on organic food.

APAC Market Insights

The Asia Pacific agriculture biologicals market will have a significant expansion through 2035. The presence of the traditional agriculture industry in the APAC region will drive the market of agriculture biologicals in this region. According to the Asia-Pacific Association of Agricultural Research Institute (APAARI) published in the year 2023, APAC produced and consumed more than 90% of the world's rice, 70% of vegetables, 60% of seed cotton, and 45-50% of cereals, oil seeds, and pulses. It is a key provider of most essential food and agricultural commodities.

Agriculture biologicals are especially in actual demand in China, driven by the increasing population in this country and the requirement for grain in this region. Even while China will no longer hold the title of the most populated nation in the world, the UN projects that in 2022, its population will reach 1.426 billion.

In Japan, agriculture biologicals will encounter massive growth because of the quick advancement in biotechnology. Moreover, its growth is mostly attributable to Japan's capacity for quick adaptability and profitably utilizing newly acquired knowledge and talents.

The agriculture biologicals sector will also be huge in India due to the increasing number of organic farmers in this country. The Economic Survey 2022-23 estimates that there are 4.43 million organic farmers in India at the moment. Over the following three years, 10 million farmers are to be assisted in switching to natural farming under the Union Budget 2023-2024.