Aerospace Parts Manufacturing Market Outlook:

Aerospace Parts Manufacturing Market size was over USD 994.56 billion in 2025 and is poised to exceed USD 1.54 trillion by 2035, witnessing over 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aerospace parts manufacturing is estimated at USD 1.03 trillion.

The aerospace parts manufacturing market growth is driven by the global demand for satellite-based services in applications such as defense, navigation, communication, and earth observation. The market’s growth prospects are marked by strategic initiatives that cater to growing satellite demand. For instance, the Asia Pacific Satellite Communications Council (APSCC) in December 2023 announced the partnership of Thai Aerospace Industries (TAI) and Rivada Space Networks for a secure and reliable connectivity service in military, commercial, and general aviation. Additionally, this increased demand drives the revenue share for aerospace companies such as Stanley Black & Decker Inc., and Boeing engaged in satellite manufacturing and associated technologies.

Key Aerospace Parts Manufacturing Market Insights Summary:

Regional Highlights:

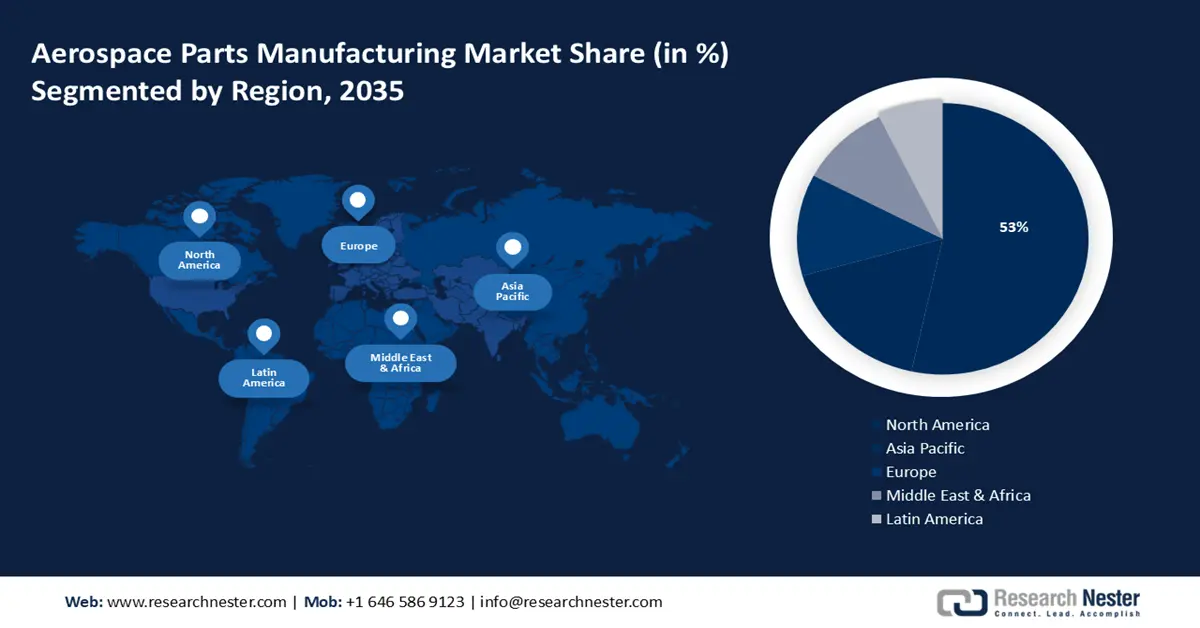

- The North America aerospace parts manufacturing market will account for 53% share by 2035, driven by increased defense spending and strong aircraft manufacturing capabilities in the region.

Segment Insights:

- The aircraft manufacturing segment in the aerospace parts manufacturing market is expected to secure a 51.40% share by 2035, driven by significant revenue growth from manufacturing complete aircraft and integral components.

- The commercial aviation segment in the aerospace parts manufacturing market is expected to experience staggering CAGR from 2026-2035, driven by rising demand for new aircraft and parts due to increased air travel and better international trade relations.

Key Growth Trends:

- Increasing air travel

- Demand for lightweight aerospace materials

Major Challenges:

- High rates of raw materials

- Long approval and certification process

Key Players: Elbit Systems Ltd., Intrex Aerospace, Rolls Royce plc, CAMAR Aircraft Parts Company, Safran Group, Woodward, Inc., Engineered Propulsion System, Eaton Corporation plc, Aequs.

Global Aerospace Parts Manufacturing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 994.56 billion

- 2026 Market Size: USD 1.03 trillion

- Projected Market Size: USD 1.54 trillion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (53% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, France, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Aerospace Parts Manufacturing Market Growth Drivers and Challenges:

Growth Drivers

- Increasing air travel: Airlines worldwide are trying to increase their fleet sizes to accommodate the growing number of passengers who are choosing to travel by air. The market for aerospace parts is impacted by the increased demand for new aircraft because manufacturers need to produce a wide range of parts to build and maintain these aircraft. According to the International Air Transport Association 2024, the amount of cargo flown by air is predicted to increase by 5% by 2024. Moreover, parts ranging from engines to avionics and structural elements are needed by airlines to maintain the operations and safety of their fleets. Additionally, the aerospace forging revenue has increased tremendously, augmented by the high adoption and growing usage of aerospace parts manufacturing.

- Demand for lightweight aerospace materials: Advanced lightweight materials are becoming necessary as airlines and aircraft manufacturers place a higher priority on environmental sustainability and fuel efficiency. Attributed to this, manufacturers of aerospace parts have a unique opportunity to lead the industry in innovation and the development of cutting-edge components made of materials like advanced composites and alloys. In addition to saving fuel, these lightweight materials improve the overall performance of the aircraft, which raises demand for aerospace parts manufacturers that adhere to the industry's changing standards.

Challenges

- High rates of raw materials: The accessibility and availability of suppliers' and subcontractors' critical parts, subassemblies, and raw materials are important to any manufacturer. The primary raw materials needed to manufacture an aircraft are plates, composite materials containing carbon and boron, aluminum sheets, forgings, steel, and titanium sheets. These materials can be costly which can hinder the aerospace parts manufacturing market expansion.

- Long approval and certification process: Aerospace part certification and approval procedures can be drawn out and complicated. To make sure that their components fulfill the necessary standards and specifications, manufacturers must put their products through validation, rigorous testing, and verification processes. Production schedules can be slowed down and market value may be impacted by certification acquisition delays.

Aerospace Parts Manufacturing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 994.56 billion |

|

Forecast Year Market Size (2035) |

USD 1.54 trillion |

|

Regional Scope |

|

Aerospace Parts Manufacturing Market Segmentation:

Product Segment Analysis

Aircraft manufacturing segment is predicted to capture around 51.4% aerospace parts manufacturing market share by the end of 2035. Significant growth in the revenue share is driven by the manufacturing of complete aircraft including engines, wings, airframes, and various integral components. In addition, this segment covers the creation of aircraft prototypes, major modifications to existing aircraft, and overhauls and rebuilds of entire aircraft.

A recent report published by the U.S. Government Accountability Office in March 2024 states that since 2020, air travel has increased, which has raised the demand for new aircraft and parts for existing fleets among airlines. Additionally, the construction and assembly of civil aircraft, including big commercial aircraft, business jets, and regional aircraft, is known as aircraft manufacturing. Growth in this sector will fuel the customized avionic systems value in the near future.

End user Segment Analysis

The commercial aviation segment in the aerospace parts manufacturing market is expected to be the fastest-growing segment with a staggering CAGR during the forecast period. The production of parts intended specifically for use in commercial aircraft is referred to as the commercial segment in the aerospace parts manufacturing industry. This covers the production of parts for commercial aircraft, including passenger and cargo aircraft. Airbus in 2024 published a report predicting about 42,000 new aircraft deliveries by the next 20 years. Furthermore, commercial aircraft and its parts are expected to grow as a result of better international trade relations leading to a rise in the demand for cargo services.

Our in-depth analysis of the aerospace parts manufacturing market includes the following segments:

|

Product |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerospace Parts Manufacturing Market Regional Analysis:

North America Market Insights

North America industry is expected to hold largest revenue share of 53% by 2035. The growth in this region is poised due to the increased defense spending as this region is highly favorable in aircraft manufacturing. According to a report published by the Peter G. Peterson Foundation in 2024, defense spending grew by USD 55 billion between 2022 and 2023.

The increasing per capita income in the U.S. is acting as a growth factor for the aerospace parts manufacturing market share in this country. CEIC 2022 estimated that the annual per capita household income surpassed USD 39,167 in December 2022 as compared to 2021 data. Moreover, the need for the operating airlines to generate revenue and operate with reduced efficiency is partly due to the aging fleet of aircraft.

In Canada, an increasing factor contributing to the growth of this industry is the rise in air travel and the number of travelers. According to the International Air Transport Association, Canadian Air Transport is predicted to grow by 51% in the next 20 years. Credited to this, by 2035 about 39 million passengers will be added and can cross this country's GDP by USD 73.3 billion.

APAC Market Insights

Asia Pacific will also encounter huge growth in the aerospace parts manufacturing market share during the forecast period with a notable size and will account for the second position. The increase in international travel in this country will act as a growing factor for this sector. IATA published a report in July 2024 predicting that there had been an increase of more than 22% in Asia Pacific airlines and about a 22.9% increase in passenger capacity.

Increasing disposable income in China is contributing to the growth of the aerospace parts manufacturing market in this country. According to the State of China in July 2024, the national per capita disposable income surpassed USD 2900 in the first half of 2024.

There is an increased international air travel demand in Japan along with a high need for international freight which is expected to be a growth factor for the slated revenue share. According to a recent report by the Japan National Tourism Organization in 2024, there has been an increase in visitors, crossing 46.3% as compared to the data of 2019.

Aerospace Parts Manufacturing Market Players:

- Ametek, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Elbit Systems Ltd.

- Intrex Aerospace

- Rolls Royce plc

- CAMAR Aircraft Parts Company

- Safran Group

- Woodward, Inc.

- Engineered Propulsion System

- Eaton Corporation plc

- Aequs

The aerospace parts manufacturing market growth is predicted to grow led by these companies occupying a lucrative share. Most of these companies are engaged in strategic collaborations, partnerships, and joint ventures to strengthen their customer reach. With the increasing demand for air travel, various companies are adapting to the latest trends and are set to be the major key players in this sector.

Some of the key players include:

Recent Developments

- In April 2021, Elbit Systems Ltd. announced that it had paid approximately USD 31 million to acquire BAE Systems Rokar International Ltd. from BAE Systems, Inc., the BAE Systems plc subsidiary with its U.S. headquarters.

- In March 2020, Ametek, Inc., an electronic instruments manufacturer, announced the sale completion of their Reading Alloys Business to Kymera International, affiliated to Palladium Equity Partners, LLC.

- Report ID: 6354

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.