Aerospace Maintenance Chemicals Market Outlook:

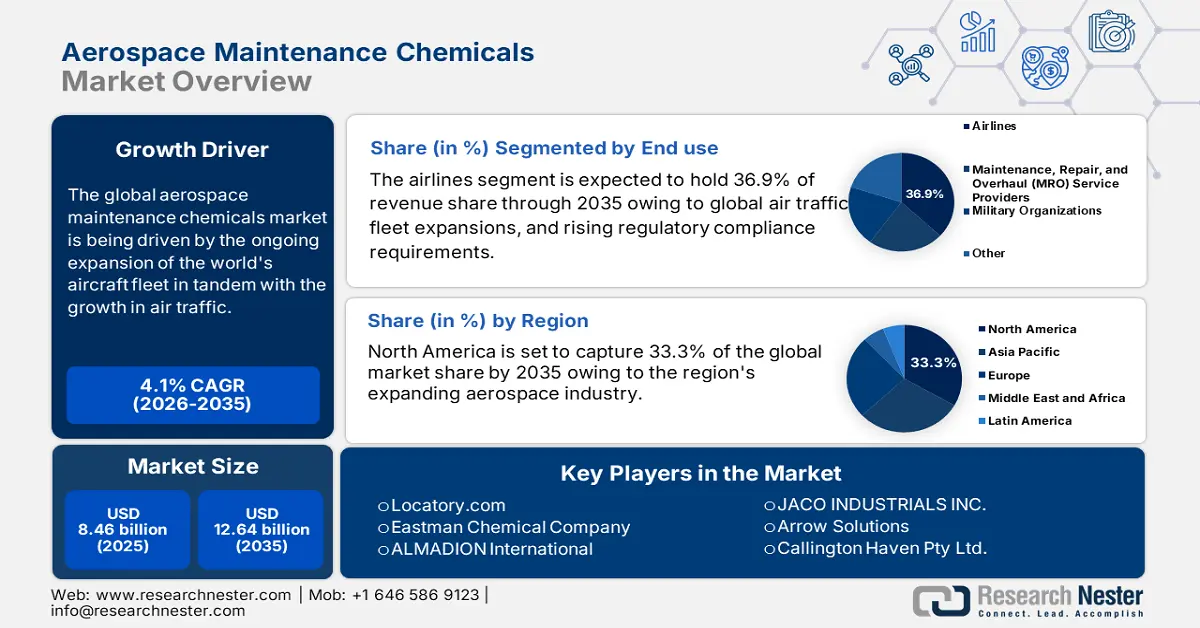

Aerospace Maintenance Chemicals Market size was valued at USD 8.46 billion in 2025 and is set to exceed USD 12.64 billion by 2035, registering over 4.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aerospace maintenance chemicals is estimated at USD 8.77 billion.

The aerospace maintenance chemicals market is driven by the ongoing expansion of the world's aircraft fleet in tandem with the growth in air traffic. For instance, across more than 29 million square miles of airspace, the Federal Aviation Administration’s (FAA) Air Traffic Organization (ATO) serves over 45,000 aircraft and 2.9 million airline passengers daily. In comparison to 2022, total traffic increased by 36.9% in 2023 whereas, traffic for 2023 was 94.1% of what it was before the outbreak in 2019. Moreover, compared to December 2022, total traffic increased by 25.3%, in December 2023, reaching 97.5% in December 2019.

The use of non-toxic and biodegradable cleaning products has increased as the aviation sector adopts sustainability. Conventional cleaning agents have the potential to be harsh and damaging to the materials used inside airplanes and the environment. Modern cleaning products are made to be environmentally friendly and efficient at eliminating impurities. Cleaning operations have a smaller environmental impact when biodegradable cleaning chemicals decompose spontaneously. Conversely, non-toxic substances ensure a safer environment by reducing the chance of chemical exposure for both passengers and cleaning personnel.

Key Aerospace Maintenance Chemicals Market Insights Summary:

Regional Highlights:

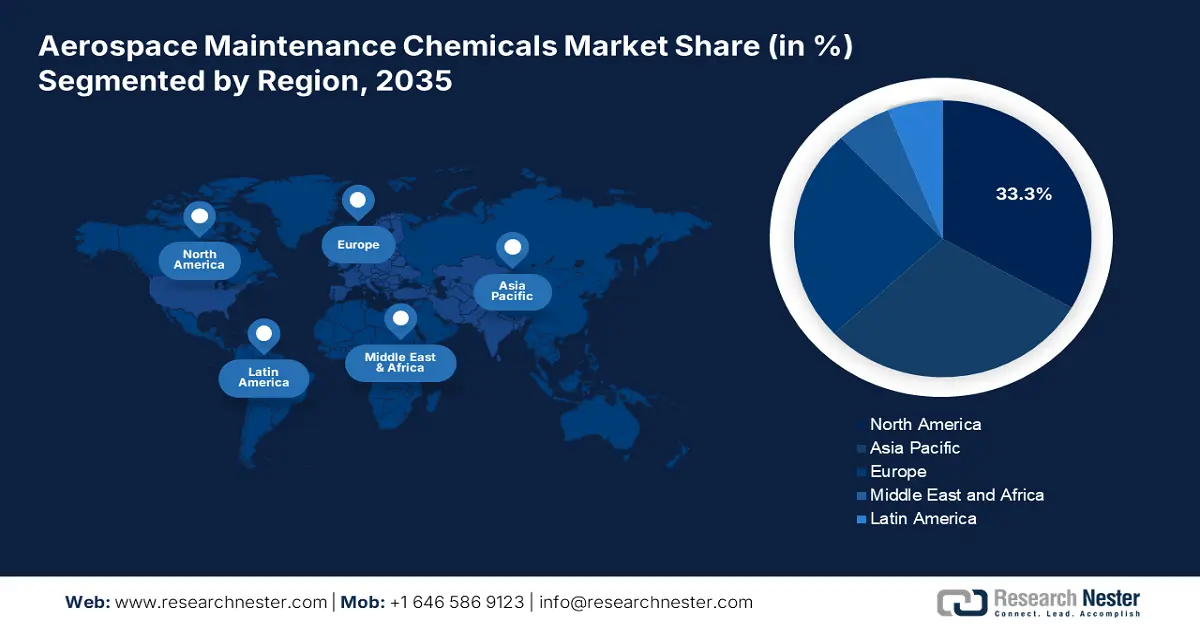

- North America aerospace maintenance chemicals market will account for 33.30% share by 2035, driven by the region’s expanding aerospace industry and demand for specialized chemicals.

- Asia Pacific market will register stable CAGR during the forecast period 2026-2035, attributed to fleet expansion, new aircraft deliveries, and investments in aviation infrastructure.

Segment Insights:

- The airlines segment in the aerospace maintenance chemicals market is projected to attain a 36.90% share by 2035, fueled by routine fleet maintenance, global air traffic growth, and rising regulatory compliance.

Key Growth Trends:

- Increasing aging aircraft fleet

- Growing development of aviation facilities

Major Challenges:

- High costs

Key Players: Exxon Mobil Corporation, Royal Dutch Shell plc, Locatory.com, Eastman Chemical Company, ALMADION International, JACO INDUSTRIALS INC., Arrow Solutions, and Callington Haven Pty Ltd.

Global Aerospace Maintenance Chemicals Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.46 billion

- 2026 Market Size: USD 8.77 billion

- Projected Market Size: USD 12.64 billion by 2035

- Growth Forecasts: 4.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Aerospace Maintenance Chemicals Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing aging aircraft fleet: To maintain their continuous safe operation, several airlines are using older airplanes that need more frequent maintenance and specialized chemicals. According to the FAA, a significant percentage of the world's fleet is approaching or has already exceeded its anticipated operational life, which raises the demand for efficient maintenance solutions. To guarantee the airworthiness and availability of aircraft for the commercial and defense aviation sectors, maintenance, repair, and overhaul (MRO) activities are crucial. India is on track to overtake the U.S. and China as the world's third-largest purchaser of commercial aircraft, with a present fleet of over 713 aircraft and over 1000 more scheduled for addition.

-

Growing development of aviation facilities: Opportunities for aerospace maintenance chemicals market expansion are created by developing aviation infrastructure in emerging regions, especially Asia Pacific and Latin America. The need for maintenance chemicals to support these regions' growing fleets will rise as their aviation industries grow. The need for efficient maintenance solutions is fueled by the International Air Transport Association's (IATA) projections of sharp increases in air traffic and fleet size in these areas.

The aviation industry is expanding quickly and will do so in the future. The demand for air travel is expected to rise by an average of 4.3% year over the next 20 years, according to the most recent projections. By 2035, if this development trajectory is maintained, the aviation sector will have directly created 15.5 million jobs and generated USD 1.5 trillion in global GDP. These figures might increase to USD 5.7 trillion in GDP and 97.8 million jobs once the effects of international tourism are considered. At least 200,000 flights per day are anticipated to take off and land worldwide by the middle of the 2030s. -

Growing military expenditure: The aerospace maintenance chemicals market is expected to increase as a result of the rising demand for military aircraft and other aerospace equipment. The need for specialized maintenance chemicals increased in 2023 as worldwide military spending hit USD 1.98 trillion, a 3.7% rise from the year before. This cost increase is a result of increased military equipment investment, which necessitates more frequent and thorough maintenance to ensure operational readiness and prolong aircraft lifespan. As military spending increases, so does the demand for aerospace maintenance chemicals like lubricants, cleaners, and corrosion inhibitors, propelling the sector forward.

Challenges

-

Regulatory challenges: The aircraft industry is subject to stringent regulations regarding the use and disposal of chemicals. Adhering to these rules can be expensive and difficult. The Environmental Protection Agency (EPA) and other regulatory bodies may impose stringent rules on the use of particular chemicals, which could limit their supply and increase their price.

-

High costs: For smaller maintenance firms or airlines with limited resources, the high cost of sophisticated airplane maintenance chemicals may be a turn off. The high expenses are associated with the development of specialty chemicals and the intensive testing required to ensure their safety and performance.

Aerospace Maintenance Chemicals Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 8.46 billion |

|

Forecast Year Market Size (2035) |

USD 12.64 billion |

|

Regional Scope |

|

Aerospace Maintenance Chemicals Market Segmentation:

End use Segment Analysis

By 2035, airlines segment is estimated to capture over 36.9% aerospace maintenance chemicals market share. The segment growth is attributed to growth as they manage the routine maintenance of their fleets to guarantee operational effectiveness and passenger safety. For example, when repair expenditures on specialty procedures and service parts are taken into account, the civil MRO sector contributes USD 80 billion to the economy. The U.S. is heavily involved in this activity, its suppliers provide an estimated USD 39 billion, or over half of the total. North America is a major exporter with a USD 2.4 billion positive trade surplus and is a significant net exporter of aviation maintenance services. North America maintains USD 1.4B and USD 1.2B trade surpluses in the engine overhaul and component maintenance services markets, respectively, despite being a small net importer of heavy airframe maintenance services.

The segment is also driven by the growth of global air traffic, fleet expansions, and rising regulatory compliance requirements. Growth is further supported by airlines' increasing emphasis on sustainability and the use of environmentally friendly chemicals.

The market is dominated by airlines due to their need to maintain their fleets, which is reinforced by growing fleets and increased demands for regulatory compliance.

Aircraft Type Segment Analysis

Based on the aircraft type, the commercial aircraft segment in aerospace maintenance chemicals market is likely to hold a notable share by the end of 2035. The segment is growing as commercial airplanes are the biggest users of maintenance chemicals due to their frequent maintenance cycles, which include line, base, and engine maintenance. This segment's dominance is supported by the quick recovery of international air traffic following the pandemic, fleet expansions, and rising demand for next-generation, fuel-efficient aircraft.

The need for maintenance chemicals in this area is also fueled by airlines' emphasis on improving operational efficiency. Due to their sizable fleets, regular maintenance requirements, and increasing use of next-generation aircraft, commercial aircraft dominate the industry. For instance, the Federal Aviation Administration’s modernization effort to revamp the U.S. National Airspace System (NAS) is called NextGen, or Next Generation Air Transportation System. The majority of the updated infrastructure is now in place, and between 2010 and 2022, NextGen generated advantages totaling more than USD 9.5 billion, with further benefits anticipated in the future.

Our in-depth analysis of the global aerospace maintenance chemicals market includes the following segments:

|

Product Type |

|

|

Nature |

|

|

Aircraft Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerospace Maintenance Chemicals Market Regional Analysis:

North America Market insights

North America in aerospace maintenance chemicals market is set to capture over 33.3% revenue share by 2035, owing to the region's expanding aerospace industry. Manufacturers are creating environmentally friendly and compliant products due to strict environmental and safety requirements enforced by organizations such as the EPA and FAA. Additionally, there are more prospects for product invention and development in the area owing to the growing demand for specialized chemicals for innovative materials like carbon composites utilized in contemporary airplanes.

The U.S. is the largest consumer of aerospace maintenance chemicals due to the growing aircraft production in the country. The U.S. is the world's greatest producer of aircraft with Boeing, Lockheed Martin, Sikorsky Aircraft, and Gulfstream Aerospace at the forefront of the industry. For example, all aircraft segments showed improvements in shipping and billings for general aviation in 2023 compared to 2022, with preliminary aircraft deliveries totaling USD 28.3 billion, a 3.3% rise. Delivery of piston airplanes increased 11.8% to 1,682 in 2023 compared to 2022; deliveries of turboprop airplanes increased 9.6% to 638; and deliveries of business jets increased from 712 to 730. In 2023, airplane deliveries totaled USD 23.4 billion, an increase of 2.2%.

Canada contributes to its expanding MRO industry, which specializes in cutting-edge maintenance solutions for both domestic and foreign airlines. Key players are investing in research and development, fostering innovation, improving competitiveness, and facilitating long-term sustainability. For instance, 3M made a combined investment of USD 3.6 billion in capital expenditures and research & development to speed up our innovation pipeline. Their scientists have received 3,500 patents annually on average over the last five years.

Asia Pacific Market Insights

Asia Pacific in aerospace maintenance chemicals market is expected to experience a stable CAGR during the forecast period. Fleet expansion and new aircraft deliveries are booming in nations like China, India, and Japan, which is driving up MRO activity and raising demand for maintenance chemicals. Additionally, due to significant investments in aviation infrastructure and reduced labor costs, the region is emerging as a major hub for MRO services. The aerospace maintenance chemicals market is expanding as a result of the increasing use of composite-material aircraft of the new generation, which calls for sophisticated chemical solutions.

With large investments in MRO facilities and a burgeoning market for cleaning and anti-corrosion chemicals to service its growing fleet of aircraft. The usage of maintenance chemicals in defense and regional airlines is fueled by India's expanding aviation industry, which is aided by government initiatives. For instance, approximately 69% of all aircraft traffic in South Asia is domestic, and by 2023, India's airport capacity is predicted to accommodate 1 billion trips yearly. The air traffic flow in FY23 was 327.28 million, up from 188.89 million in FY22.

Technological developments in maintenance chemicals also provide prospects in China. Improved performance and efficiency are provided by innovations including multipurpose lubricants, sophisticated corrosion inhibitors, and high-performance cleaning agents. A new trend that gives businesses the chance to provide innovative solutions is the creation of smart chemicals that can track and report on their state.

Aerospace Maintenance Chemicals Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Exxon Mobil Corporation

- Royal Dutch Shell plc

- Locatory.com

- Eastman Chemical Company

- ALMADION International

- JACO INDUSTRIALS INC.

- Arrow Solutions

- Callington Haven Pty Ltd.

Major companies in the fiercely competitive market offer goods and services to both domestic and foreign consumers. For a dominant position in the global aerospace maintenance chemicals market, major players are using several strategies in R&D, product innovation, and end-user launches.

Here are some leading players in the aerospace maintenance chemicals market:

Recent Developments

- In June 2024, Locatory.com, which specializes in aviation-related goods, recently announced the opening of a specialized marketplace segment for aviation chemicals and consumables. This cutting-edge addition seeks to transform the procurement procedure for companies in the aviation sector by offering a smooth and effective platform for locating a wide range of chemicals essential for aircraft operations and maintenance.

- In May 2023, the successful completion of India's first commercial passenger flight utilizing a domestically manufactured Sustainable Aviation Fuel (SAF) blend earlier represents a major milestone in the decarbonization of the aviation industry. Using a blend of domestic Sustainable Aviation Fuel (SAF) provided by Indian Oil Corporation Ltd. (IOCL) in collaboration with Praj Industries Ltd. (Praj), AirAsia India flight i5-767 took off from Pune for New Delhi. This special flight was met at the airport by Hon. Hardeep Singh Puri, the Union Minister of Petroleum and Natural Gas.

- Report ID: 6968

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.