Aerosol Market Outlook:

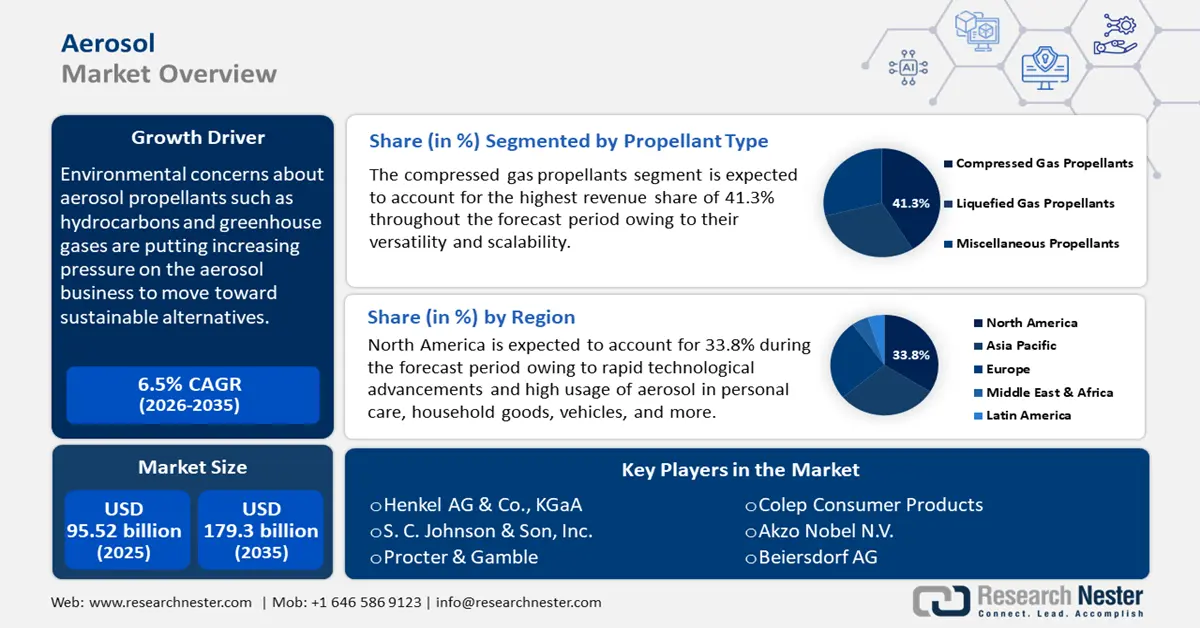

Aerosol Market size was valued at USD 95.52 billion in 2025 and is expected to reach USD 179.3 billion by 2035, registering around 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of aerosol is evaluated at USD 101.11 billion.

The global aerosol market is rapidly expanding due to rising concerns about aerosol propellants such as hydrocarbons and greenhouse gases. This is putting increasing pressure on the aerosol business to move toward sustainable alternatives. Using nitrogen or compressed air as propellants is one possible approach that reduces environmental effects. Major companies in the aerosol industry are increasingly concentrating on making recyclable aerosols to lessen their carbon impact and increase demand for their goods. In June 2022, Ball Corporation unveiled a new aluminum aerosol can with a low carbon footprint to its science-based 2030 targets and goal of net-zero emissions before 2050. The recently released cans contain low-carbon aluminum and are made using renewable energy sources, including, hydroelectric electricity, and up to 50% recycled material.

Moreover, the DIY and automotive industries are seeing a sharp increase in the use of aerosol products, essential for convenience and innovation. Aerosols simplify car maintenance activities including lubrication, corrosion prevention, and cleaning by providing accurate application and effortless handling. Aerosol products are popular among consumers who prefer DIY as these are easy to use and make a variety of household jobs, from painting and applying adhesive to cleaning and sealing, efficient. Aerosols are considered essential tools in both professional and amateur settings, due to the growing trend toward hassle-free solutions that save time and effort. Manufacturers are broadening their product offerings in response to the growing demand, which is driving the aerosol market's growth into these important industries.

Key Aerosol Market Insights Summary:

Regional Highlights:

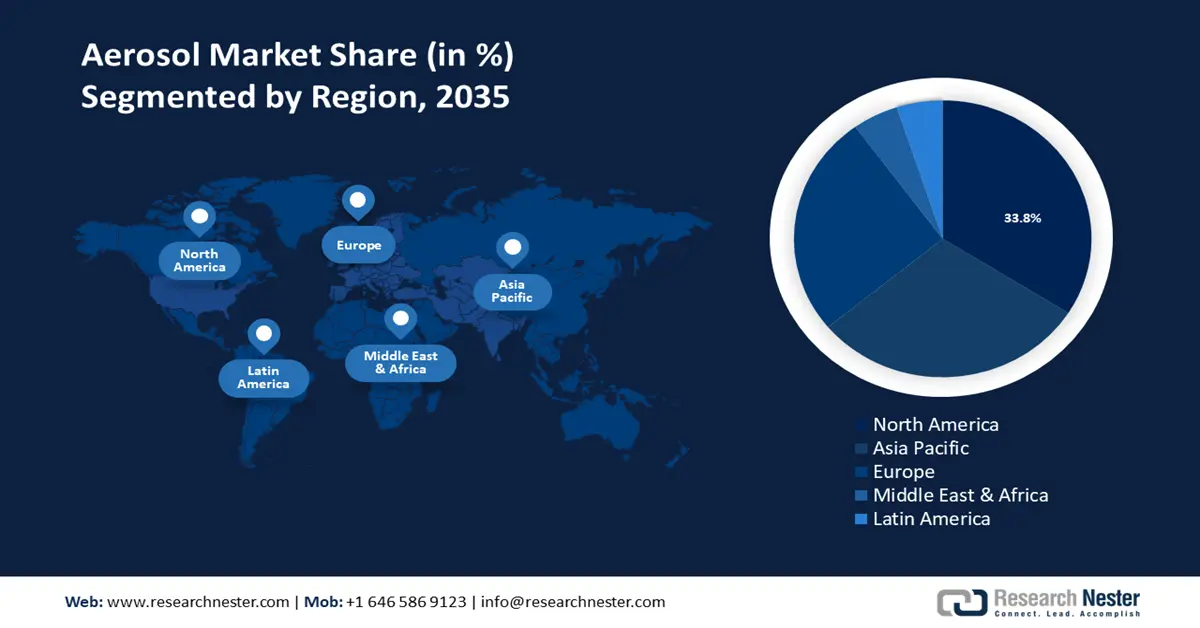

- North America's dominance in the aerosol market, with a 33.8% share, is propelled by creative product offers and strong demand, sustaining growth through 2026–2035.

- The Aerosol Market in Asia Pacific is projected to maintain stable growth through 2026–2035, driven by the considerable growth of the middle-class millennial population.

Segment Insights:

- The Compressed Gas Propellants segment is expected to exhibit significant growth with a 41.3% share from 2026-2035, fueled by their versatility, scalability, and compatibility with diverse formulations.

- The Aluminum segment of the Aerosol Market is expected to capture a 45.90% share by 2035, propelled by its lightweight, corrosion-resistant, and fully recyclable properties.

Key Growth Trends:

- Increasing need for personal hygiene products

- Growing utilization of respiratory equipment in the medical field

Major Challenges:

- Tight regulatory environment

- Alternatives that are available and the dangers associated with product recalls

Key Players: Henkel AG & Co., KgaA, S. C. Johnson & Son, Inc., Procter & Gamble, Colep Consumer Products, Akzo Nobel N.V., Beiersdorf AG, Estée Lauder Inc, Oriflame Cosmetics S.A., and Ball Corporation.

Global Aerosol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 95.52 billion

- 2026 Market Size: USD 101.11 billion

- Projected Market Size: USD 179.3 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Aerosol Market Growth Drivers and Challenges:

Growth Drivers:

- Increasing need for personal hygiene products: The aerosol market is anticipated to expand due to the increasing usage of aerosol propellants in deodorants, antiperspirants, styling mousses, hair sprays, insecticides, shaving gels, fabric care, air fresheners, furniture polish, oven cleaners, and leather care products. Growing consumer demand for skin care products, cutting-edge beauty procedures, and marketing tactics used by companies including, L'Oréal, Unilever, and P&G are some of the major factors propelling the global market. Furthermore, macroeconomic variables including consumers' growing disposable income are predicted to drive up demand for cosmetics and personal hygiene items.

- Growing utilization of respiratory equipment in the medical field: Pain relief drugs such as inhalers for asthma or other sprays for sunburn, bug bites, and itching are packed in the presence of aerosol, making them easier to handle and apply. This is a key factor boosting aerosol market growth. The demand for medical aerosol is anticipated to rise in the upcoming years due to the expansion of sporting events across the globe. In addition, the rising prevalence of respiratory conditions such as obstructive sleep apnea (OSA) and chronic obstructive pulmonary disease (COPD), the increasing geriatric population, and the rising rate of environmental pollution have fueled the aerosol market for aerosol.

Aerosol is likely to become more significant in check valves, DPI devices, and MDI valves in the coming years due to the growing need for respiratory equipment.In July 2023, Viatris Inc. partnered with Kindeva Drug Delivery L.P. to launch Breyna, an inhalation aerosol for people with COPD and asthma. This is the first generic version of Symbicort launched by AstraZeneca. - Increasing aerosol content in a range of food products: High usage of aerosols in a variety of food products, such as chocolates, whipped cream, ketchup, olive oil, and vinegar, is anticipated to drive market growth. By forming a barrier between the food product and the outside environment, aerosols assist preserve food products 100% intact and extend their shelf life by preventing contamination. In addition, it is projected that in the upcoming years, the expanding whipped cream market will help the expansion of the global aerosol market. In May 2019, Anchor Food Professionals announced the launch of a new aerosol whipped cream product which is a ready-to-use cream in canister format.

Growing disposable income and rapidly urbanizing consumers' changing lifestyles are anticipated to have a favorable impact on the market. The market is anticipated to develop as a result of ongoing product innovation, consumer preferences for high-quality goods, and tighter government food restrictions.

Challenges:

- Tight regulatory environment: The aerosol market strives to offer its consumers safe products, and to prevent consumer pain, the products are regularly inspected and verified for inconsistencies. Due to this, the players in the market have to abide by several laws about product safety, environmental effects, manufacturing and storage, and transportation.

- Alternatives that are available and the dangers associated with product recalls: Cans for aerosols are more costly than alternatives for conventional packaging. Additional production expenses impact the price of finished goods. Instead of using aerosol propellant, manufacturers are switching to continuous spraying options including bag-in-bottle container solutions. These sprayers are more economical, effective, and have great performance when it comes to the environment.

Aerosol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 95.52 billion |

|

Forecast Year Market Size (2035) |

USD 179.3 billion |

|

Regional Scope |

|

Aerosol Market Segmentation:

Propellant Type (Compressed Gas Propellants, Liquefied Gas Propellants, Miscellaneous Propellants)

Compressed gas propellants segment is expected to capture over 41.3% aerosol market share by 2035. Due to their versatility and scalability, compressed gas propellants are the industry standard in the aerosol sector. They are perfect for a variety of applications, such as pharmaceuticals, personal care items, cosmetics, and home cleaners, due to their dependable and effective performance. By providing exact control over dispensing, these propellants guarantee reliable product delivery and save waste.

Furthermore, due to their inert nature, they can be used with a wide range of formulations, including liquids and foams, without sacrificing the integrity of the final product. Furthermore, as these propellants are non-toxic, non-flammable, and blend in with strict regulatory requirements, they are preferred across several applications. In October 2023, Coster Group announced the launch of CosterEco, a novel technology to enhance the transition of aerosol to compressed gases.

Can Type (Aluminum, Steel, Plastic)

By the end of 2035, aluminum segment is set to account for more than 45.9% aerosol market share. Aluminum's favorable qualities are the main reason it dominates the market. Aluminum is a strong, lightweight material with an excellent strength-to-weight ratio, aerosol products can be handled and transported with efficiency. Its resistance to oxygen, light, and moisture maintains product stability and extends shelf life.

Aluminum is also completely recyclable, which makes it an environmentally acceptable material best suited to cater to consumer demands for more eco-friendly packaging. Due to its adaptability, manufacturers have more options to enhance their brand through elaborate and customizable designs. Furthermore, the ability of aluminum to resist corrosion maintains product integrity, upholding the caliber of formulations across a range of applications.

Our in-depth analysis of the global aerosol market includes the following segments:

|

Propellant Type |

|

|

Type |

|

|

Propulsion |

|

|

Can Type |

|

|

Valve Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Aerosol Market Regional Analysis:

North America Market Analysis

North America industry is poised to account for largest revenue share of 33.8% by 2035. North America is a prominent player due to its creative product offers and strong demand. The region is home to a well-established aerosol sector with a broad range of uses including personal care, household goods, vehicles, and more. The rising usage of aerosols in inhalers is a result of respiratory illnesses including asthma becoming more common in North America. For instance, the Asthma and Allergy Foundation of America (AAFA) updated data as of September 2023, showing that almost 26 million Americans suffer from asthma.

The aerosol industry in the U.S. is expanding due to its substantial consumer base and established industrial infrastructure. The U.S. is a leading aerosol innovator, serving a wide range of industries including cosmetics, pharmaceuticals, and industrial uses. It is renowned for its broad range of products and technological innovations. Furthermore, the nation's adoption of environmentally responsible aerosol products is fueled by strict regulatory standards and a growing awareness of environmental issues.

Asia Pacific Market Analysis

Asia Pacific is expected to experience a stable CAGR during the forecast period due to the considerable growth of the middle-class millennial population in countries such as China and India over the past few years, Asia Pacific has emerged as the aerosol market's fastest-growing region. For example, in 2022, millennials made up the majority of India's working population. High levels of discretionary income and strong internet connections are traits that define millennials. Due to this, this demographic is well-informed and a sizable user of a variety of personal care products, including shaving foam, hair mousse, hair spray, and deodorants.

The aerosol market in China is expected to register robust growth during the forecast period. In metropolitan areas where people seek efficiency and convenience, China's fast urbanization has resulted in lifestyle changes and rising demand for aerosol products. Aerosol-based cosmetics, air fresheners, and cleaning supplies will see a surge in demand as the population tends to spend on home and personal hygiene items.

Owing to its sizable population and rising rate of aerosol product acceptance, India is becoming one of the biggest markets for personal care products. The use of aerosol products in domestic settings is rising due to rising awareness of personal hygiene and social media presence.

Key Aerosol Market Players:

- Honeywell International Inc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Henkel AG & Co., KGaA

- S. C. Johnson & Son, Inc.

- Procter & Gamble

- Colep Consumer Products

- Akzo Nobel N.V.

- Beiersdorf AG

- Estée Lauder Inc

- Oriflame Cosmetics S.A.

- Ball Corporation

Together, the aerosol market leaders mold the competitive environment of the global market, fostering innovation, establishing benchmarks for the sector, and satisfying the changing needs of consumers throughout the globe. By prioritizing research and development, technical innovations, and strategic alliances, these businesses keep growing their market share and solidifying their positions in important areas. Their unwavering commitment to quality and customer-focused methodology establish them as Aerosol's preferred suppliers, making a substantial contribution to the expansion and advancement of the world's construction sector. Here are some leading players in the aerosol market:

Recent Developments

- In March 2024, Procter & Gamble patented an aerosol package design that uses adsorbent materials as propellants to maintain pressure. A bag, can, and valve with an adsorption matrix of MOF and carbon dioxide are included in the package, which guarantees pressure stability throughout its useful life.

- In September 2023, Beiersdorf announced that every deodorant can in the European selection of NIVEA, 8X4, Hidrofugal, and Hansaplast would weigh 11.6% less and contain at least 50% recycled aluminum. As a result, the aerosol can value chain's CO2 emissions will drop by almost 58%. This translates to an annual decrease of about 30 tons of CO2.

- Report ID: 6513

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Aerosol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.