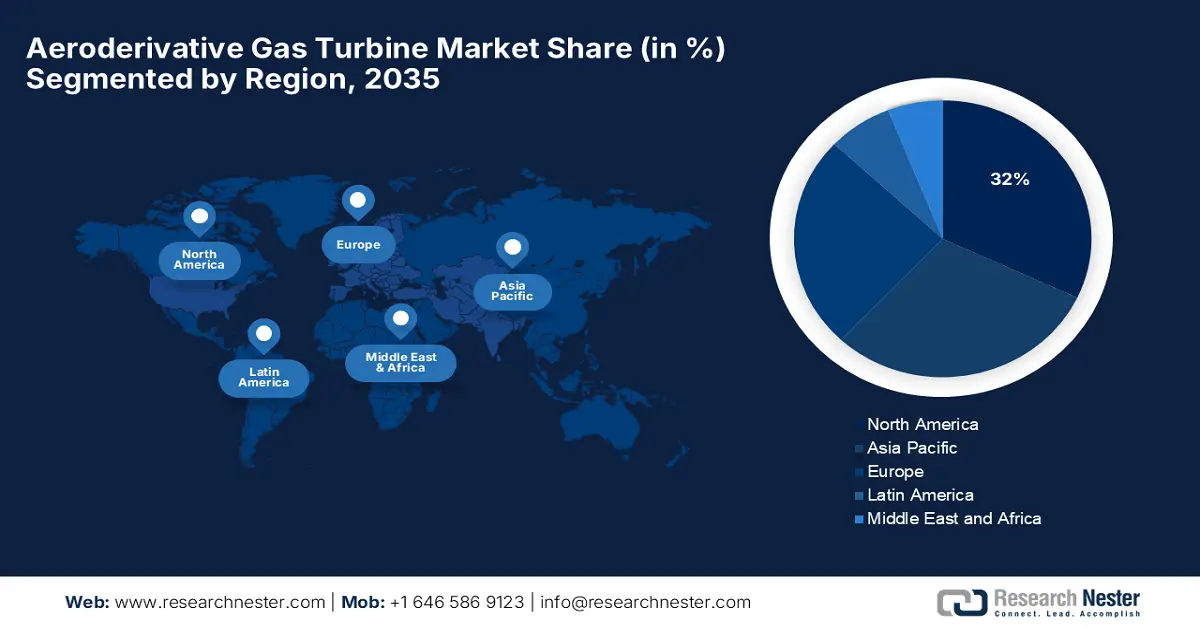

Aeroderivative Gas Turbine Market - Regional Analysis

North America Market Insights

North America's aeroderivative gas turbine market is expected to account for around 32% of the overall market share by 2035 and grow at a CAGR of 5.8% during the forecast period of 2026-2035. The demand is driven by growing needs for low-emission, flexible power generation capability to enhance flexibility and foster renewable integration and resiliency of the grid. Infrastructure upgrades and tough environmental regulations continue driving the installation of rapid-ramping, hydrogen-compatible turbines into utility and industrial applications. The growth of the aerospace sector is set to push the sales of aeroderivative gas turbines in the years ahead. The overall business output of the A&D sector in 2023 was $955 billion. The industry produced $533 billion in direct output, and the domestic A&D supply chain created an additional $422 billion in indirect activity. The A&D sector produced $425 billion in economic value, or 1.6% of the nominal GDP of the United States in 2023. The U.S. A&D sector supports jobs that account for 1.4% of all jobs in the country.

The U.S. aeroderivative gas turbine market is expected to lead the regional demand with nearly 85% of North America by 2035. Six hydrogen research and development projects, mostly centered on gas turbine technology, have received $24.9 million from the U.S. Department of Energy, with more than $11 million coming from private funding. Raytheon was awarded $3 million to create a low-NOx ammonia-fired turbine combustor and $4.5 million to test hydrogen-natural gas mixtures. General Electric received approximately $7 million for additional turbine research and $5.9 million to test hydrogen blends up to 100% in turbine components. 8 Rivers Capital was awarded $1.4 million for a design study of a hydrogen production and carbon capture plant, and the Gas Technology Institute was awarded $3 million to investigate ammonia-hydrogen fuel mixtures. Increments of utility-scale installations, distributed generation, and CHP installations fuel the turbine buys. Besides, energy resilience and security as a priority by the United States government is driving the updating of turbines in strategic facilities and defense bases.

Canada supplies about 15% of the home market, with growing industrial cogeneration and gas-fired generators. Provincial regulation in Alberta and Ontario stimulates lower emissions through combined cycle retrofits and renewable fuel blending. Canada's huge natural gas reserves and export operations are perfect cases of the unabated relevance of aero derivative turbines to balancing environmental issues with the requirement for energy. By 2025 or 2026, Canada's first large-scale LNG project is expected to begin operations. The pipeline expenses for the 14-MTPA LNG Canada project, which is led by Shell, PetroChina, Mitsubishi Corporation, and KOGAS, more than doubled. The price of Woodfibre LNG, a smaller project, has increased from CAD1.6 billion to CAD6.8 billion.

Asia Pacific Market Insights

The Asia Pacific aeroderivative gas turbine market is expected to account for around 30% of the global share by 2035 and expand at an estimated CAGR of 6.2% from 2026 to 2035. Industrialization, rising power requirements, and ambitious renewable energy proposals are the prime growth drivers. Focus of regional governments on grid stability has prompted investment in rapid-start, compact turbines that enable co-firing to facilitate hydrogen. Energy infrastructure upgrades and capacity expansion are the growth drivers for long-term markets.

China leads the aeroderivative gas turbine market, with more than 48% Asia Pacific revenue market share by 2035. China's 14th Five-Year Plan is focused on energy transformation, with targets for hydrogen and renewables integration set high. Provincial manufacturing centers like Jiangsu and Guangdong increased the capacity of turbine manufacturing. In 2023, China regained its position as the world's biggest importer of LNG. Imports reached 72.1 MTPA, a 12.4% rise. However, LNG purchases are still 10% below 2021 imports and have not fully recovered to levels prior to the Russian invasion of Ukraine. Government subsidies back R&D for future-generation gas turbine technology, driving domestic innovation. Mass-scale utility development is leading to a need for efficient and flexible power solutions that comply with emissions targets.

India is the Asia Pacific's second-largest market and accounted for nearly 20% of demand by 2035. The National Infrastructure Pipeline (NIP) was introduced by the Indian government for the fiscal years 2020-2025 to expedite the execution of outstanding infrastructure projects. NIP was introduced with a 2020-2025 infrastructure investment budget of Rs. 111 lakh crore ($1.5 trillion). Sectors with a significant participation in the NIP include energy, roads, urban infrastructure, and railroads. India's aviation industry is among the fastest-growing globally. From about 61 million in FY14 to approximately 137 million in FY20, India's domestic traffic has more than doubled, representing an annual growth of more than 14%. Growing penetration of combined heat and power (CHP) units, facilitated by government incentives, is driving the adoption of aeroderivative turbines in industrial and commercial applications.

Europe Market Insights

The aeroderivative gas turbine market of Europe is expected to have a market share of approximately 25.3% by 2035, growing at a CAGR of 4.8% from 2026 to 2035. The growth is supported by rigorous emission regulations by the EU and its green commitment to renewable-energy integration under the European Green Deal. Demand for this also comes from investments into hydrogen-capable turbines and combined heat and power systems in Germany, France, and the UK. These capacity enhancement and grid balancing projects have been vital to keep the regional market resilient through the ongoing energy transition.

Germany is driven by the National Hydrogen Strategy and the establishment of partnerships with industries. Russia supplied 55% of Germany's natural gas in 2020. Denmark, Norway, Belgium, and the Netherlands supplied 40% of Germany's residual natural gas consumption. The expected daily exports of 7.1 billion cubic feet of US LNG to EU nations in 2023 were worth more than $14.6 billion. About 48% of imports into the EU came from exports.