Advanced Process Control Market Outlook:

Advanced Process Control Market size was valued at USD 3.24 billion in 2025 and is likely to cross USD 8.56 billion by 2035, expanding at more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of advanced process control is assessed at USD 3.54 billion.

The growth of the market is because advanced process control meets user needs more quickly and at a lower cost, its adoption in the oil and gas, petrochemical, and pharmaceutical industries is expected to continue strong. Fifty percent of manufacturing jobs will be mechanized by 2025. Finding skilled workers is cited as the biggest difficulty by 61% of industrial industries, which has increased reliance on automation.

In addition to these, the market is expected to grow as a result of factors including the major players' strategic alliances and the increased funding for research and development (R&D) projects aimed at bringing energy-efficient process controlling systems to advanced process control market.

Key Advanced Process Control Market Insights Summary:

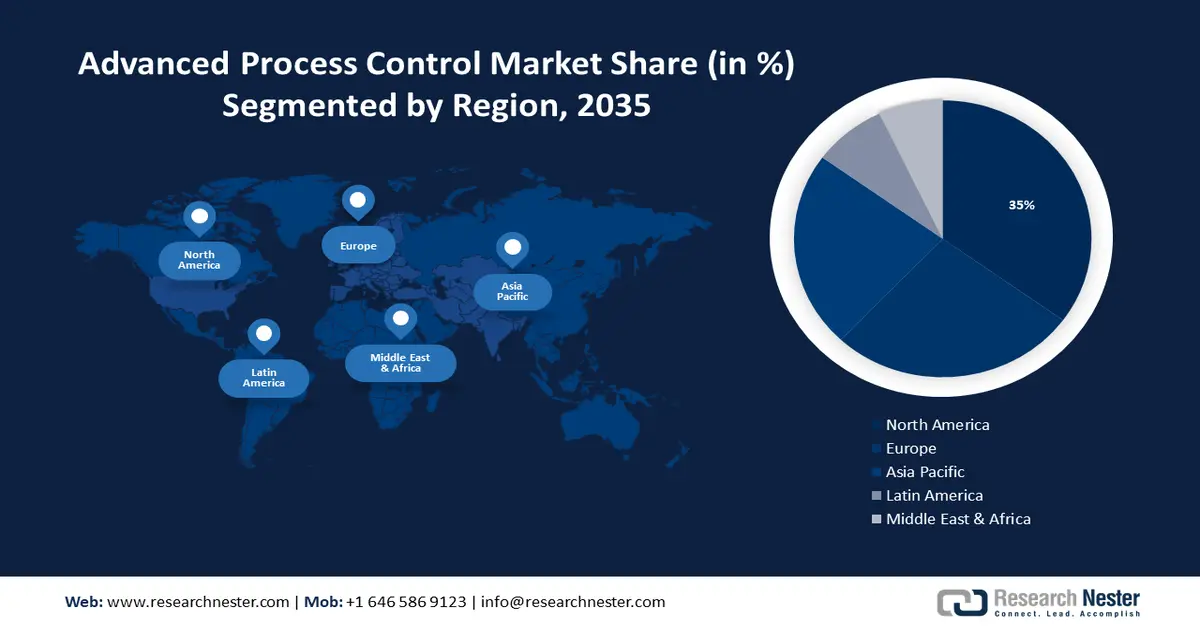

Regional Highlights:

- North America advanced process control (APC) market achieves a 35% share by 2035, driven by demand for industrial automation and reliable nuclear power infrastructure.

- Europe market will account for 27% share by 2035, driven by strong usage of APC systems in multiple industrial sectors.

Segment Insights:

- The services segment in the advanced process control market is anticipated to achieve significant growth through 2035, driven by rising demand for advanced process control services in industrialized regions.

- The oil & gas segment in the advanced process control market is poised for substantial growth through 2035, driven by vital industry operations and higher automation adoption rates.

Key Growth Trends:

- Growing Awareness About Industry 4.0

- Growing Need for Automation Solutions to Support Market Expansion

Major Challenges:

- Growing Awareness About Industry 4.0

- Growing Need for Automation Solutions to Support Market Expansion

Key Players: Aspen Technology Inc., Rockwell Automation, Inc., Honeywell International, Inc., Schneider Electric SE, Siemens AG, General Electric Co., Andhra Paper Ltd, Emersion Electric Corporation, Rudolph Technologies Inc..

Global Advanced Process Control Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.24 billion

- 2026 Market Size: USD 3.54 billion

- Projected Market Size: USD 8.56 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 16 September, 2025

Advanced Process Control Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Awareness About Industry 4.0- Industry 4.0's quick adoption is driving the advanced process control market's compound annual growth rate. Industry 4.0 has altered the digital supply chain in many industries. Companies must adopt industry 4.0 in response to customers' changing requirements, which include quick and individualized service. The market players work with tech-savvy companies to offer innovative solutions built on quickly advancing technologies. Businesses are focused on utilizing 5G, industry 4.0, digital transformation, and software capabilities to assist manufacturers scale up their growth and realize the potential of these technologies and solutions. More generally, it is anticipated that the rollout of 5G would coincide with a rise in global data consumption; estimates indicate that by 2028, mobile data traffic will reach about 330 exabytes per month, more than tripling the amount used in 2022.

-

Growing Need for Automation Solutions to Support Market Expansion- One of the main reasons propelling the growth of the global advanced process control market is the growing need for automation solutions across several industries. Currently, prominent sectors are employing automation technology to enhance their business strategies. In order to enhance the process using simple automation options, many firms are selecting advanced process control (APC) software solutions. The growing need for unique software solutions that can identify component failures at the component level, the growing desire for energy-efficient manufacturing processes, and safety and security concerns are all expected to fuel the growth of the advanced process control (APC) market in the near future.

- The primary factors that lead end-use industries to choose advanced process control are process optimization and quality control- Human mistake is always present in manual processes and human participation, and in complicated industrial processes, errors and miscalculations can be very large and result in significant losses for the company. APC forecasts the error in product estimates in addition to minimizing errors. The only technology that is used everywhere in the world and that industries are willing to invest enormous sums of money in is automation. In addition, by offering remote process automation technologies, it lessens reliance on labour and solves the labour problem.

Challenges

- Growing Consumption to Resist Market Expansion- Implementing advanced process control (APC) needs massive consumption, which could hamper the industry's growth in the years to come. There may be less demand in the worldwide market for these pricey technologies as a result of the abundance of affordable alternatives.

- It is projected that the business's high initial cash outflow and R&D expenditures will constrain market expansion in the upcoming years.

- It is anticipated that the advanced process control market development rate will be further hindered by start-up businesses' reluctance to transition from conventional to sophisticated process controls because they lack funding and qualified personnel.

Advanced Process Control Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 3.24 billion |

|

Forecast Year Market Size (2035) |

USD 8.56 billion |

|

Regional Scope |

|

Advanced Process Control Market Segmentation:

End-User Segment Analysis

Based on end-user, the oil & gas segment is anticipated to hold 38% share of the global advanced process control market by 2035. It is anticipated that the market will be dominated by the oil and gas segment. The need for advanced process control is supported by the industry's vital operations and higher automation adoption rates. The industry is now concentrating on increasing efficiency and delaying expenditures from new projects toward developing the current infrastructure because of the recent decline in oil prices. Businesses in the sector are using more and more cutting-edge solutions that boost productivity and offer other long-term advantages to promote revenue development with little expenditures. Oil businesses are constantly looking for innovative processes that might reduce costs and boost profitability, as their output continues to rise year. The annual production of oil in the world exceeds four billion metric tons. With over 50% of proven oil reserves, the Middle East is home to the largest share.

Revenue Source Segment Analysis

Based on revenue source, services segment is anticipated to hold 55% share of the global advanced process control market by 2035. Because industrialized nations like North America and Europe are home to many deployed advanced process control systems, it is expected that demand for APC services will rise dramatically over the course of the projected decade. During the projected period, the software segment is expected to grow at the highest rate of compound annual growth. Process control applications and advanced platforms are included in this software category. Applications for advanced process control help businesses increase productivity and streamline operations.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Revenue Source |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Advanced Process Control Market Regional Analysis:

North American Market Insights

Advanced process control market in the North America region is attributed to hold the largest revenue share of about 35% during the forecast period. The demand for industrial automation, the building of new power plants, and significant semiconductor manufacturing sectors are expected to improve North American APC systems. In addition, the country has the largest installed capacity for nuclear power and produces the most nuclear energy worldwide. Thirty-one states and 99 nuclear reactors produce around twenty percent of the country's electricity. It is anticipated that new nuclear reactors will be developed by 2021. As nuclear power facilities become more reliable, there is a noticeable growth in the area's requirement for sophisticated process control systems.

European Market Insights

Advanced process control market in Europe region is projected to hold second the largest revenue share of about 27% during the forecast period. The pulp, paper, oil and gas, chemical, and pharmaceutical sectors in the area also make extensive use of APC systems. The German Chemical Industry Association (VCI) represents approximately 1,700 German chemical enterprises as well as German subsidiaries of international corporations. Furthermore, the UK advanced process control (APC) market was increasing at the highest rate in the European region, while the German market retained the largest advanced process control market share.

Advanced Process Control Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aspen Technology Inc.

- Rockwell Automation, Inc.

- Honeywell International, Inc.

- Schneider Electric SE

- Siemens AG

- General Electric Co.

- Andhra Paper Ltd

- Emersion Electric Corporation

- Rudolph Technologies Inc.

Recent Developments

- October 2022: The largest company in the world dedicated to industrial automation and digital transformation, Rockwell Automation, Inc., announced today that it has finalized an acquisition deal to purchase CUBIC, a company that specializes in modular systems for electrical panel assembly. Founded in 1973 and situated in Bronderslev, Denmark, CUBIC catered to rapidly expanding sectors including infrastructure, data centers, and renewable energy.

- August 2022: Andhra Paper Ltd maximizes lime kiln productivity by utilizing ABB's advanced process control. The OPT800 Lime APC system from ABB will be used by APL's Rajahmundry paper mill in India to constantly improve the efficiency and sustainability of lime kiln production. The ABB solution uses less energy and generates less pollutants while producing uniform lime quality.

- Report ID: 5759

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Advanced Process Control Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.