Advanced Glycation End Products Market Outlook:

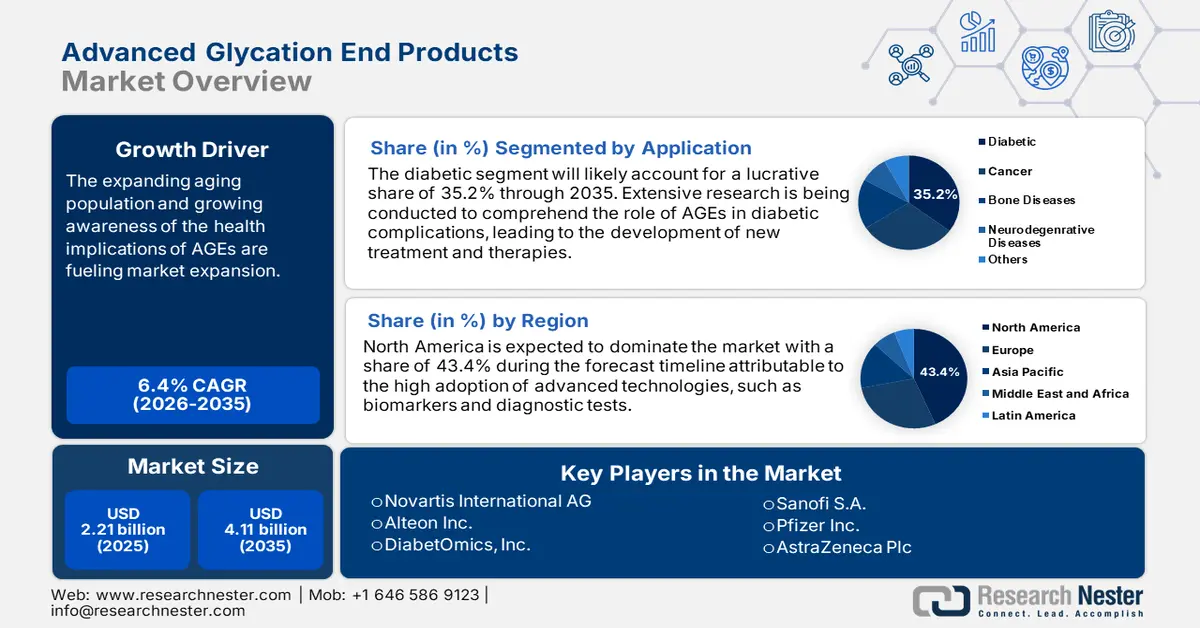

Advanced Glycation End Products Market size was valued at USD 2.21 billion in 2025 and is likely to cross USD 4.11 billion by 2035, expanding at more than 6.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of advanced glycation end products is assessed at USD 2.34 billion.

The advanced glycation end products market is witnessing lucrative growth owing to the increasing awareness of the adverse health effects associated with AGEs, and prevailing chronic diseases such as diabetes and cardiovascular disorders. For instance, according to the report published in January 2024, by the American Heart Association, in 2021, coronary heart disease (CHD) accounted for 40.3% of all deaths in the US. Moreover, heart failure (9.1%), high blood pressure (13.4%), artery diseases (2.6%), stroke (17.5%), and other CVD (17.1%) were some other causes. In addition, in the country, 127.9 million adults (48.6%) experienced some kind of cardiovascular disease between 2017 and 2020.

AGEs are generated by the non-enzymatic interaction of sugars with proteins or lipids and contribute to various pathologies, making dietary intervention in AGE generation more desirable to consumers. Furthermore, advances in food processing technologies to decrease AGEs in food products are of great interest to food manufacturers wishing to offer products consistent with healthy diets. The regulatory bodies are also emphasizing the importance of labeling and monitoring the AGE levels in food products, thereby driving market growth. Hence, these factors collectively represent a strong market opportunity for AGEs-based products in food & beverage, pharmaceutical, and dietary supplement markets.

Key Advanced Glycation End Products Market Insights Summary:

Regional Highlights:

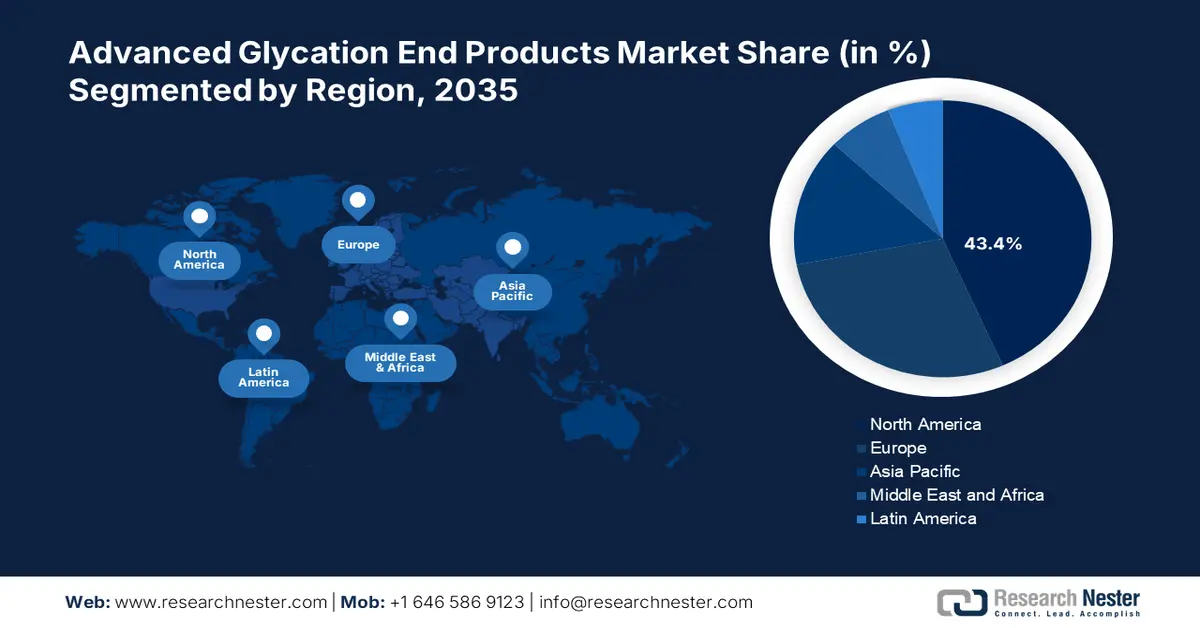

- North America holds a 43.4% share in the Advanced Glycation End Products Market, driven by cutting-edge AGE inhibitors and customized dietary plans preventing AGE formation, sustaining leadership through 2026–2035.

- The Asia Pacific advanced glycation end products market is anticipated to experience rapid growth through 2035, fueled by creation of biomarkers, non-invasive measurement, and demand for functional foods.

Segment Insights:

- Non-Fluorescent AGEs segment are expected to dominate by 2035, propelled by their accuracy in clinical and research AGE quantification applications.

- The Diabetic segment is expected to capture over a 35.2% share by 2035, driven by the strong association between elevated AGE levels and diabetes-related complications.

Key Growth Trends:

- Consistent research and development

- Rising inclination towards functional food

Major Challenges:

- Market competition

- Complexity of measurements

- Key Players: AstraZeneca PLC, Bayer AG, Merck & Co., Inc., Eli Lilly and Company, Sanofi S.A., and more.

Global Advanced Glycation End Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.21 billion

- 2026 Market Size: USD 2.34 billion

- Projected Market Size: USD 4.11 billion by 2035

- Growth Forecasts: 6.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, India, South Korea, Singapore

Last updated on : 13 August, 2025

Advanced Glycation End Products Market Growth Drivers and Challenges:

Growth Drivers

- Consistent research and development: A prominent growth enabler in the advanced glycation end products market is the continuous research effort. As the knowledge of AGEs grows, research and development on novel dietary interventions as well as functional food products are underway to effectively reduce the formation of AGEs and the consequent associated risks. For instance, in March 2023, Cargill and CUBIQ FOODS collaborated on cutting-edge fat technology to support consumer innovation in plant-based foods. These inventions enhance product performance and allow consumers to have confidence and place demand on scientific-based solutions for optimizing health and preventing disease.

- Rising inclination towards functional food: The steady upward trend in the demand for functional foods is a major growth driver for the advanced glycation end products market. This is augmented further by increasing health awareness associated with diet-related chronic long-term impacts that incite the innovation capabilities of the manufacturers. For instance, in April 2023, with the launch of the two plant-based chocolate morsels, Semi-Sweet Plant Based Morsels and Dark Chocolate, Nestlé has been exploring other types of vegan chocolate in recent years. These revolutions thereby enable the evolution of functional foods which addresses such requirements increasing the presence as well as customer acceptance for market operations.

Challenges

- Market competition: In the advanced glycation end products market, a significant challenge that exist is strong competitiveness. Numerous businesses have begun to recognize the potential and health effects of AGEs. This has led to the widespread introduction of goods such as pharmaceuticals, functional foods, and dietary supplements, intensifying competition for the available market share. This saturation makes it challenging for new players to penetrate, and thus forces existing players to innovate continuously, to attract such discriminating consumers. As a consequence, firms need to operate in this competitive field through strategic marketing and product development activities that could help them stay relevant and propel growth.

- Complexity of measurements: A significant challenge in the advanced glycation end products market is the complexity of measurement-primarily because of the intricate process of the accurate quantification of AGEs in food products and biological samples. The diverse chemical structures and varying formation pathways of AGEs complicate standardization, making it difficult for manufacturers to ensure consistent quality control and compliance with regulatory standards. This lack of reliable measurement methods can hinder product development efforts and limit the ability to effectively communicate AGE content to consumers, ultimately impacting market growth as stakeholders seek clarity and assurance regarding the health implications associated with AGEs.

Advanced Glycation End Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.4% |

|

Base Year Market Size (2025) |

USD 2.21 billion |

|

Forecast Year Market Size (2035) |

USD 4.11 billion |

|

Regional Scope |

|

Advanced Glycation End Products Market Segmentation:

Application (Diabetic, Cancer, Neurodegenerative Diseases, Bone Diseases)

The diabetic segment is expected to capture advanced glycation end products market share of over 35.2% by 2035 due to the critical link between elevated AGE levels and the progression of diabetes-related complications. Individuals with diabetes are more sensitive to the harmful effects of AGEs because hyperglycemia promotes their formation, resulting in higher oxidative stress and inflammation, which further deteriorate neuropathy, retinopathy, and cardiovascular diseases. For instance, in January 2024, The U.S. FDA authorized the marketing of Lupin's Dapagliflozin and Saxagliptin tablets to treat type 2 diabetes. This product is a generic version of the Qtern tablets made by AstraZeneca plc.

Type (Non-Fluorescent AGEs, Fluorescent AGEs)

The non-fluorescent AGEs segment is anticipated to dominate the advanced glycation end products market throughout 2035 owing to its wide use in clinical and research applications where the quantification of AGEs is required with accuracy. For instance, in August 2022, it was declared that the MassARRAY System is a non-fluorescent detection platform that precisely measures PCR-derived amplicons using mass spectrometry. When combined with end-point PCR, mass spectrometry allows for highly multiplexed reactions under universal cycling conditions, resulting in precise, quick, and economical analysis. With growing awareness of the role of non-fluorescent AGEs in health risk assessment, this segment continues to gain momentum in the market, highlighting its critical role in advancing scientific inquiry and clinical practice.

Our in-depth analysis of the global advanced glycation end products market includes the following segments:

|

Application |

|

|

Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Advanced Glycation End Products Market Regional Analysis:

North America Market Statistics

North America advanced glycation end products market is expected to dominate revenue share of over 43.4% by 2035 due to the creation of cutting-edge AGE inhibitors. Fresh approaches to treat AGE-related illnesses, and customized dietary plans that prevent AGE formation also boost the market. The competitive environment in the region is being shaped by alliances among pharmaceutical firms, academic institutions, and food and beverage producers to improve AGE prevention and management.

The U.S. advanced glycation end products market is expanding significantly attributable to the presence of prominent key players making collaborative efforts in developing innovative products. For instance, in September 2022, L'Oréal agreed to acquire Skinbetter Science. Their deep understanding of skin chemistry and clinical trials conducted by board-certified dermatologists strongly supported the brand. Thus, such innovative steps revolutionize the landscape of advanced glycation end products.

The advanced glycation end products market in Canada is rapidly advancing due to the rising prevalence of diabetes cases which spurs demand for such novel therapeutics –

|

Prevalence of Diabetes |

2024 |

2035 |

|

Diabetes (type 1 + type 2 diagnosed + type 2 undiagnosed) |

5,883,000/ 15% |

7,417,000/ 17% |

|

Diabetes (type 1 and type 2 diagnosed)

|

4,007,000 / 10% |

5,301,000 / 12% |

|

Diabetes (type 1) |

5-10% of diabetes prevalence |

|

|

Diabetes (type 1 + type 2 diagnosed + type 2 undiagnosed) and prediabetes combined |

11,939,000 / 30% |

14,156,000 / 32% |

|

Increase in diabetes (type 1 and type 2 diagnosed), 2024-2035 |

32% |

|

|

Increase in diabetes (type 1 and type 2 diagnosed + type 2 undiagnosed), 2024-2035 |

17% |

|

|

The direct cost to the Health Care System in 2024 |

USD 5,441 billion |

|

Source: Diabetes Canada

Asia Pacific Market Analysis

The advanced glycation end products market in the Asia Pacific is expected to witness the fastest growth during the projected timeframe. The creation of biomarkers for AGE-related illnesses, the growth of non-invasive AGE measurement techniques, and the rising demand for functional foods and supplements are some recent trends in the AGE market. The need for treatments that focus on AGE-associated disorders is growing as a result of these advancements in our understanding of AGEs and their effects on human health.

China is experiencing lucrative growth in the advanced glycation end products market attributable to the continuous efforts towards findings related to such medical issues. A report by the National Library of Medicine stated in February 2024 that, a hospital-based case-control study with 1072 pairs of newly diagnosed T2D patients (53.9 ± 9.7 years, 56.0% male) and controls were matched for age and sex. It was an ongoing cohort comprising 127 incident T2D cases and 381 well-matched controls (62.2 ± 5.1 years, 71.7% male). Consequently, lower sRAGE concentrations and higher plasma AGEs were associated with higher odds of T2D. The multivariable-adjusted odds ratios for plasma AGEs and plasma sRAGE were 3.28 (95% CI: 2.14, 5.02) and 0.25 (95% CI: 0.16, 0.39), respectively.

In India, the advanced glycation end products market is advancing due to the development of novel therapeutic drugs to manage diabetes disorders. For instance, in January 2024, Glenmark Pharmaceuticals Ltd. launched a biosimilar of the popular 10,11 anti-diabetic drug ligarglutide for the first time in India. The drug is marketed under the LirafitTM brand after being approved by the Drug Controller General of India (DCGI). This has cut therapy costs by roughly 70% at a cost of around INR 100 for a typical dosage of 1.2 mg (daily).

Key Advanced Glycation End Products Market Players:

- Alteon Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Plexxikon Inc.

- Phenomenome Discoveries Inc.

- Kowa Company Ltd.

- Novartis International AG

- OPKO Health, Inc.

- DiabetOmics, Inc.

- Amadori Scientific

- LabCorp

- Quest Diagnostics Incorporated

- AstraZeneca PLC

- Bayer AG

- Merck & Co., Inc.

- Eli Lilly and Company

- Sanofi S.A.

- GlaxoSmithKline

As major players enter the advanced glycation end products market, the environment is growing increasingly cooperative, with food producers, academic institutions, and healthcare organizations toward addressing this intricate problem. The collaborations aim to improve consumer education about the health implications of AGEs and speed up product development innovation by facilitating partnerships that share resources and knowledge. For instance, in February 2022, Cambrian BioPharma and Novartis have inked a licensing agreement for the development of Novartis's distinctive, mTOR pathway-targeting, selective compounds.

Here's the list of some key players:

Recent Developments

- In March 2024, Laboratoire Nuxe crafted Nuxuriance Ultra Alfa [3R], a line of six new products with innovative green technology intended to address the symptoms of aging skin.

- In February 2024, Country Life Vitamins announced the introduction of a range of dietary supplements to promote aging well. The supplements provide a proactive way to support, nourish, and revitalize the entire body.

- Report ID: 7083

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.