Advanced Driver Assistance Systems Market Outlook:

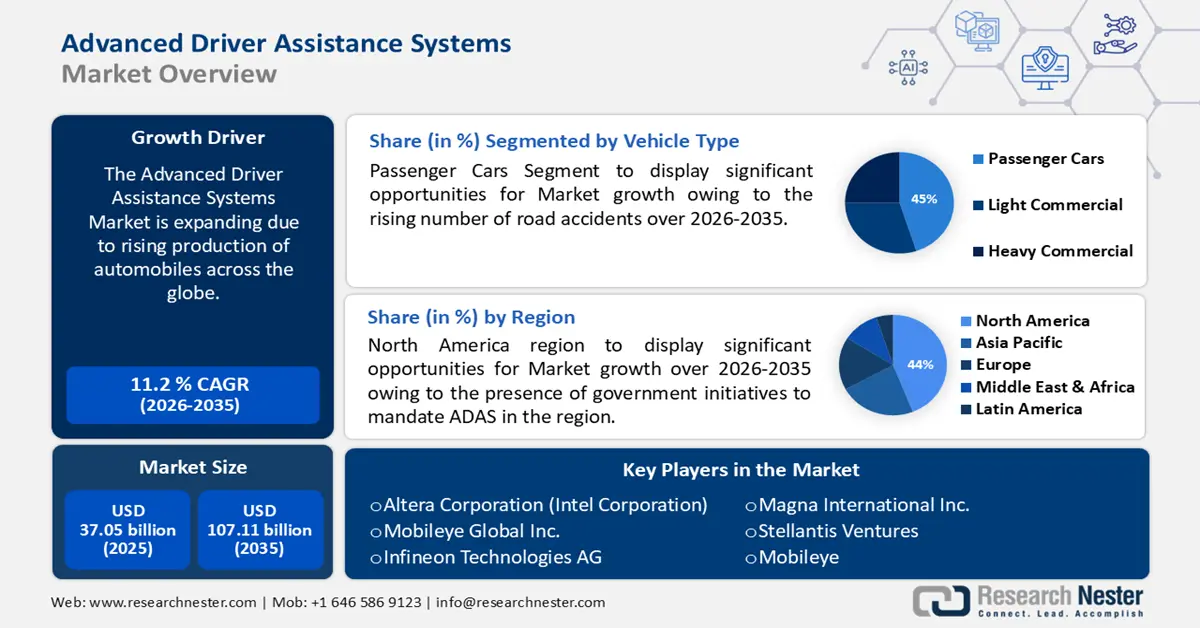

Advanced Driver Assistance Systems Market size was over USD 37.05 billion in 2025 and is poised to exceed USD 107.11 billion by 2035, witnessing over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of advanced driver assistance systems is estimated at USD 40.78 billion.

The reason behind the market expansion is the increasing sales of electric vehicles across the globe, leading to extensive adoption of advanced driver assistance systems (ADAS), as they possess the capacity to significantly increase traffic safety by providing alerts or automated brakes to drivers to prevent or lessen collisions. As per the International Energy Agency, sales of electric vehicles increased by 3.5 million in 2023 compared to 2022, a 35% annual rise.

Key Advanced Driver Assistance Systems Market Insights Summary:

Regional Highlights:

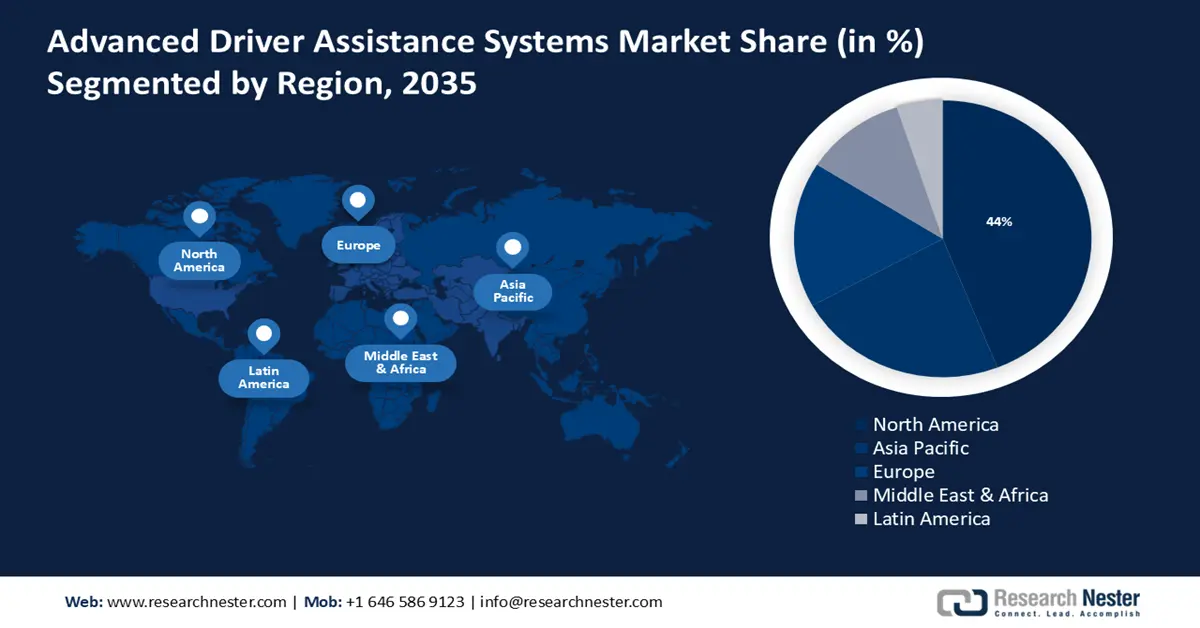

- North America advanced driver assistance systems (adas) market will hold more than 44% share by 2035, driven by government initiatives mandating ADAS and increasing consumer awareness.

- Asia Pacific market will achieve a 25% share by 2035, driven by increasing integration of ADAS and rising road safety importance in India and China.

Segment Insights:

- The passenger cars segment in the advanced driver assistance systems market is projected to achieve significant growth till 2035, driven by the rising number of road accidents.

- The battery segment in the advanced driver assistance systems market is forecasted to achieve the highest market share by 2035, driven by the growing preference for battery-electric vehicles.

Key Growth Trends:

- Growing advancements in sensor technology

- Presence of stringent safety standards

Major Challenges:

- Cybersecurity concerns

- High costs for implementation and maintenance

Key Players: Altera Corporation (Intel Corporation), Mobileye Global Inc., Infineon Technologies AG, Magna International Inc., Stellantis Ventures.

Global Advanced Driver Assistance Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 37.05 billion

- 2026 Market Size: USD 40.78 billion

- Projected Market Size: USD 107.11 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Advanced Driver Assistance Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Growing advancements in sensor technology- A variety of sensor technologies are used by ADAS to sense the environment surrounding the car, and improvements in sensor technology and algorithms enable more accurate braking actions and quicker identification of possible crashes.

For instance, a new artificial intelligence feature that leverages sensor fusion for object identification and processing is part of the camera installation in the car, which can instantly evaluate live streaming video, identify what it reveals, and decide how to respond to it. -

Presence of stringent safety standards - To ensure safety from the outset, governments are establishing strict rules and safety standards that require the integration of advanced driver assistance systems technology into vehicles to increase traffic safety.

For instance, the international standard ISO 26262 addresses functional safety in motor vehicles to oversee the operating safety requirements for trucks and buses. -

Expanding mining industry - Because of the constant danger of collisions, machine malfunctions, and environmental hazards, mining sites are risky by nature, therefore, strict safety requirements are frequently followed by mining activities, which necessitates the use of ADAS technologies to improve safety by implementing features such as autonomous braking and collision avoidance systems.

For instance, the global mining market grew by over 5% in 2023 to reach a value of about USD 2144 billion.

Challenges

-

Cybersecurity concerns - The automotive sector is still having trouble with cybersecurity, and the stakes are a little higher when it comes to autonomous vehicles or cars with advanced driver assistance systems (ADAS).

The Autopilot recall in Tesla is just one illustration of the numerous cybersecurity issues with autonomous driving technologies that happened during a software update on all cars, leading them to malfunction and perhaps collide with static objects.

For instance, The National Highway Traffic Safety Administration (NHTSA) and Tesla jointly announced on December 12, 2023, a voluntary recall of more than 1 million American-sold Tesla vehicles equipped with Autopilot and Autosteer. -

High costs for implementation and maintenance - Since ADAS technology is expensive, it is now more common in premium and luxury vehicles, which acts as an obstacle to the use of ADAS technology.

Owing to the complexity of managing, ADAS repairs and other maintenance item replacements can be expensive for fleets and unaffordable for smaller off-highway vehicle manufacturers.

Advanced Driver Assistance Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 37.05 billion |

|

Forecast Year Market Size (2035) |

USD 107.11 billion |

|

Regional Scope |

|

Advanced Driver Assistance Systems Market Segmentation:

Vehicle Type Segment Analysis

Passenger cars segment is anticipated to capture around 45% advanced driver assistance systems market share by the end of 2035. The segment growth can be credited to the rising number of road accidents. A primary goal for automakers, fleet managers, and individual car owners alike is to enhance passenger car safety due to the growing complexity of road networks, the rise in traffic-related events, and distracted driving. According to the statistics of the World Health Organization (WHO), approximately 1.19 million people lose their lives in automobile accidents each year.

As a result, there are more and more new passenger cars with sophisticated ADAS systems that make use of sophisticated cameras, radar, and sonar to raise the level of traffic safety.

For instance, ADAS system integration can avert around 39% of all passenger vehicle incidents, over 35% of the injuries that follow, and nearly 28% of the fatalities associated with them.

Furthermore, adaptive cruise control, lane departure warning, collision warning and avoidance systems, blind-spot detection, and driver fatigue monitoring are a few of the ADAS technologies that are frequently found in commercial vehicles that may benefit workers from increased safety.

System Type Segment Analysis

The blind spot detection segment in ADAS market is set to garner significant revenue by 2035. Additional elements of ADAS include blind spot detection, which can be used with corner radar sensors or ultrasonic sensors, which makes it easier for drivers to see cars or other items that might be in their blind areas to lessen collisions that occur while the driver is changing lanes.

One of the first functions offered by advanced driver assistance systems (ADAS) on cars was blindspot detection for keeping an eye out for pertinent objects within the detecting zone.

Electric Vehicle Segment Analysis

The battery segment in ADAS market is expected to register an enormous share driven by the growing preference for battery-electric vehicles. In 2023, battery-electric vehicles ranked as the third most popular option among consumers owing to the considerable efforts being made to become carbon neutral.

The autopilot ADAS features are available on BEV models like the Tesla Model X, which are algorithms that carry out predetermined tasks based on input data from cameras, radar, LiDAR, and ultrasonic sensors.

For instance, sales of battery-electric vehicles increased from approximately 4 million in 2021 to an expected 7 million in 2022.

Our in-depth analysis of the market includes the following segments:

|

System Type |

|

|

Component Type |

|

|

Offering |

|

|

Vehicle Type |

|

|

Electric Vehicle |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Advanced Driver Assistance Systems Market Regional Analysis:

North American Market Insights

North America industry is predicted to hold largest revenue share of 44% by 2035. The market demand in the region is also expected on account of the presence of government initiatives to mandate ADAS. Agencies such as the National Highway Traffic Safety Administration (NHTSA) in North America increase consumer awareness by emphasizing how ADAS may improve performance and productivity, as well as the benefits of ADAS when weighing costs versus benefits to assist propel mass market deployments and increase uptake.

To guarantee that the United States leads the globe in automated vehicles (AVs), the US government is dedicated to promoting advances in surface transportation and is working to update current laws to assist OEMs in creating and testing essential safety technologies and navigating the more cumbersome regulatory procedures. For instance, as of September 1, 2022, automakers, who account for more than 95% of the new car market in the United States, have promised to make AEB the first ADAS that is standard on all light-duty cars (NHTSA).

Besides this, on Sep. 1, 2020, Transport Canada asked for comments on revising its laws to incorporate advanced driver assistance systems (ADAS) in a notice that stated that new Canada Motor Vehicle Safety Standards would replace the current ones for ADAS safety regulations applied to commercial trucks and school buses, and other types of vehicles such cars, trucks, motorbikes, and passenger buses.

APAC Market Insights

The Asia Pacific region will also register a robust revenue share for the advanced driver assistance systems market during the forecast period and will hold the second position owing to the increasing integration of ADAS in vehicles. The Asia Pacific region's automotive megamarkets in China, India, Japan, and South Korea are contributing to the growth of ADAS enabling automobiles to drive more intelligently and autonomously.

In several Indian cars, ADAS are extensively being installed due to the rising importance of road safety. According to the forecast, by 2030, more than 25% of new cars sold in India will have Level 2 ADAS installed.

Additionally, China aspires to lead the world in advanced driver assistance systems, or ADAS to take advantage of the advantageous advanced driver assistance systems market conditions and contend with international automakers.

Furthermore, the Japanese car ADAS business seems to be doing well, with opportunities in the big, luxury car, crossover, and mid-size vehicle sectors suggesting a shift in focus toward safety and better driving experiences.

Advanced Driver Assistance Systems Market Players:

- Wabco Holdings Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Altera Corporation (Intel Corporation)

- Mobileye Global Inc.

- Infineon Technologies AG

- Magna International Inc.

- Stellantis Ventures

- Mobileye

- Autoliv Inc.

- Continental AG

- Garmin Ltd.

- Robert Bosch GmbH

- Valeo SA

The advanced driver assistance systems market is fragmented by major key players who are adopting several strategies and are establishing long-term contacts with various stakeholders.

Recent Developments

- Mobileye Global Inc. announced to provide cutting-edge driver assistance technologies for Mahindra & Mahindra Ltd.'s upcoming cars to make India's notoriously hazardous roadways safer.

Additionally, the businesses will collaborate to develop a completely autonomous driving system for India, making it unaffordable for the nation's budget-conscious consumers.

- Stellantis Ventures invested in SteerLight, a company developing innovative LiDAR (Light Detection and Ranging) sensing technology that can perceive the 3D environment around them with accuracy, and holds potential for improving autonomous driving features and advanced driver assistance systems (ADAS) in upcoming Stellantis brand vehicles.

Moreover, Stellantis' objectives as stated in its Dare Forward 2030 strategic plan are by its investment in SteerLight making its cutting-edge LiDAR a possible facilitator of ADAS adoption on a large scale.

- Report ID: 6068

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Advanced Driver Assistance Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.