Global Adhesive and Sealants Market

- Introduction

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Competitive Landscape

- Competitive Intelligence

- Outcome: Actionable Insights

- Global Industry Overview

- Market Overview

- Market Segmentation

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- American Chemical Inc.

- Arkema Group

- 3M Co.

- Adhesive Technologies Corp.

- American Biltrite Inc.

- Ashland Inc.

- Beardow & Adams Ltd

- Benson Polymers Ltd.

- DowDuPont

- Ongoing Technological Advancements

- Price Benchmarking

- Technique Type Scenario

- Key End user

- SWOT Analysis

- Case Study Analysis

- Unmet Need Analysis

- Disruption Impacting Customers' Business

- Recent Developments

- Root Cause Analysis (RCA)

- Porter Five Forces Analysis

- Global Outlook and Projections

- Global Overview

- Market Value (USD million), Current and Future Projections, 2026-2037

- Increment $ Opportunity Assessment, 2026-2037

- Global Segmentation (USD million), 2026-2037, By

- Product, Value (USD million)

- Adhesives

- Hot Melt Adhesives

- Polyvinyl Acetate (PVA)

- Epoxy Adhesives (EA)

- Polyurethane Adhesives (PA)

- Others (Cyanoacrylate (CA), Silicones, Pressure-Sensitive, Natural Rubber)

- Sealants

- Silicone

- Polyurethane

- Acrylic

- Others (Butyl, Polysulfide, Bituminous, Hybrid and SMP Sealants)

- Adhesives

- Technology, Value (USD million)

- Water-based

- Solvent-based

- Hot-melt

- Others

- Form, Value (USD million)

- Liquid

- Paste

- Film

- Pellet

- Application, Value (USD million)

- Paper & Packaging

- Building & Construction

- Automotive

- Consumer Goods

- Others (Medical, Transportation, Woodworking, Aerospace)

- Regional Synopsis, Value (USD million), 2026-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Product, Value (USD million)

- Global Overview

- North America Market

- Overview

- Market Value (USD million), Current and Future Projections, 2026-2037

- Increment $ Opportunity Assessment, 2026-2037

- Segmentation (USD million), 2026-2037, By

- Product, Value (USD million)

- Adhesives

- Hot Melt Adhesives

- Polyvinyl Acetate (PVA)

- Epoxy Adhesives (EA)

- Polyurethane Adhesives (PA)

- Others (Cyanoacrylate (CA), Silicones, Pressure-Sensitive, Natural Rubber)

- Sealants

- Silicone

- Polyurethane

- Acrylic

- Others (Butyl, Polysulfide, Bituminous, Hybrid and SMP Sealants)

- Adhesives

- Technology, Value (USD million)

- Water-based

- Solvent-based

- Hot-melt

- Others

- Form, Value (USD million)

- Liquid

- Paste

- Film

- Pellet

- Application, Value (USD million)

- Paper & Packaging

- Building & Construction

- Automotive

- Consumer Goods

- Others (Medical, Transportation, Woodworking, Aerospace)

- Country Level Analysis, Value (USD million)

- U.S.

- Canada

- Product, Value (USD million)

- Overview

- Europe Market

- Overview

- Market Value (USD million), Current and Future Projections, 2026-2037

- Increment $ Opportunity Assessment, 2026-2037

- Segmentation (USD million), 2026-2037, By

- Product, Value (USD million)

- Adhesives

- Hot Melt Adhesives

- Polyvinyl Acetate (PVA)

- Epoxy Adhesives (EA)

- Polyurethane Adhesives (PA)

- Others (Cyanoacrylate (CA), Silicones, Pressure-Sensitive, Natural Rubber)

- Sealants

- Silicone

- Polyurethane

- Acrylic

- Others (Butyl, Polysulfide, Bituminous, Hybrid and SMP Sealants)

- Adhesives

- Technology, Value (USD million)

- Water-based

- Solvent-based

- Hot-melt

- Others

- Form, Value (USD million)

- Liquid

- Paste

- Film

- Pellet

- Application, Value (USD million)

- Paper & Packaging

- Building & Construction

- Automotive

- Consumer Goods

- Others (Medical, Transportation, Woodworking, Aerospace)

- Country Level Analysis, Value (USD million)

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Product, Value (USD million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD million), Current and Future Projections, 2026-2037

- Increment $ Opportunity Assessment, 2026-2037

- Segmentation (USD million), 2026-2037, By

- Product, Value (USD million)

- Adhesives

- Hot Melt Adhesives

- Polyvinyl Acetate (PVA)

- Epoxy Adhesives (EA)

- Polyurethane Adhesives (PA)

- Others (Cyanoacrylate (CA), Silicones, Pressure-Sensitive, Natural Rubber)

- Sealants

- Silicone

- Polyurethane

- Acrylic

- Others (Butyl, Polysulfide, Bituminous, Hybrid and SMP Sealants)

- Adhesives

- Technology, Value (USD million)

- Water-based

- Solvent-based

- Hot-melt

- Others

- Form, Value (USD million)

- Liquid

- Paste

- Film

- Pellet

- Application, Value (USD million)

- Paper & Packaging

- Building & Construction

- Automotive

- Consumer Goods

- Others (Medical, Transportation, Woodworking, Aerospace)

- Country Level Analysis, Value (USD million)

- China

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Thailand

- Singapore

- New Zeeland

- Rest of Asia Pacific Excluding Japan

- Product, Value (USD million)

- Overview

- Latin America Market

- Overview

- Market Value (USD million), Current and Future Projections, 2026-2037

- Increment $ Opportunity Assessment, 2026-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2037, By

- Product, Value (USD million)

- Adhesives

- Hot Melt Adhesives

- Polyvinyl Acetate (PVA)

- Epoxy Adhesives (EA)

- Polyurethane Adhesives (PA)

- Others (Cyanoacrylate (CA), Silicones, Pressure-Sensitive, Natural Rubber)

- Sealants

- Silicone

- Polyurethane

- Acrylic

- Others (Butyl, Polysulfide, Bituminous, Hybrid and SMP Sealants)

- Adhesives

- Technology, Value (USD million)

- Water-based

- Solvent-based

- Hot-melt

- Others

- Form, Value (USD million)

- Liquid

- Paste

- Film

- Pellet

- Application, Value (USD million)

- Paper & Packaging

- Building & Construction

- Automotive

- Consumer Goods

- Others (Medical, Transportation, Woodworking, Aerospace)

- Country Level Analysis, Value (USD million)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Product, Value (USD million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD million), Current and Future Projections, 2026-2037

- Increment $ Opportunity Assessment, 2026-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2037, By

- Product, Value (USD million)

- Adhesives

- Hot Melt Adhesives

- Polyvinyl Acetate (PVA)

- Epoxy Adhesives (EA)

- Polyurethane Adhesives (PA)

- Others (Cyanoacrylate (CA), Silicones, Pressure-Sensitive, Natural Rubber)

- Sealants

- Silicone

- Polyurethane

- Acrylic

- Others (Butyl, Polysulfide, Bituminous, Hybrid and SMP Sealants)

- Adhesives

- Technology, Value (USD million)

- Water-based

- Solvent-based

- Hot-melt

- Others

- Form, Value (USD million)

- Liquid

- Paste

- Film

- Pellet

- Application, Value (USD million)

- Paper & Packaging

- Building & Construction

- Automotive

- Consumer Goods

- Others (Medical, Transportation, Woodworking, Aerospace)

- Country Level Analysis, Value (USD million)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Product, Value (USD million)

- Overview

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

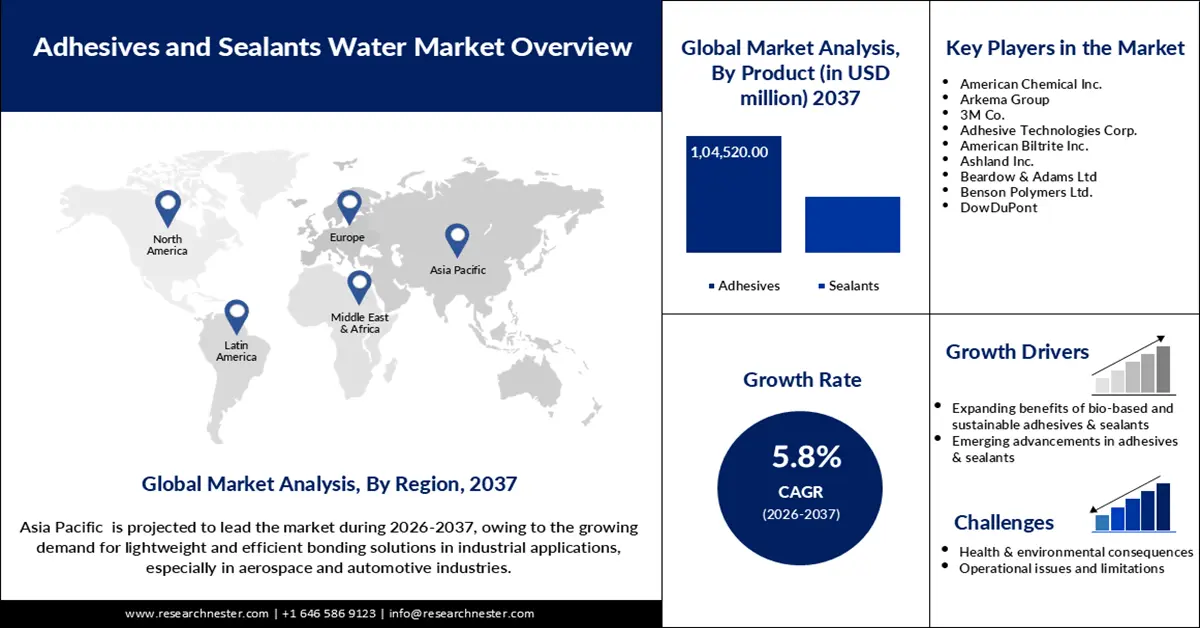

Adhesives and Sealants Market Outlook:

Adhesives and Sealants Market size was valued at USD 79.3 billion in 2025 and is projected to reach a valuation of USD 156.2 billion by the end of 2037, rising at a CAGR of 5.8% during the forecast period, i.e., 2026-2037. In 2026, the industry size of adhesive and sealants is assessed at USD 83.9 billion.

The global market is currently undergoing considerable expansion due to strategic mergers and acquisitions, as well as portfolio adjustments. In August 2024, H.B. Fuller acquired HS Butyl Limited to expand in the high-performance sealing segment and gain a better handle on sustainable construction markets. The shift toward specialty and high-performance adhesives is also stimulated by the international regulations on green buildings. There is increasing demand for energy-efficient systems in automobiles, aerospace, and construction industries. On the other hand, sustainability certifications such as the International Sustainability and Carbon Certification PLUS (ISCC PLUS) are emerging to promote the use of environmentally friendly adhesives. Consumer trends towards bio-based and low-emission products further strengthen the market momentum. In general, innovation and consolidation are establishing new growth trends.

The expansion of the construction industry is also a key factor that is influencing growth opportunities for the market. For example, the implementation of the Chips Act 2023 of the EU in September 2023 encourages the construction of new semiconductor factories and the expansion of existing factories. Construction materials, such as glass, concrete, plastics, and others, need adhesives to show effective adhesion, easier application techniques, and improved performance. Similarly, sealants are used to close gaps and joints in construction structures, so that leaks of water and air can be prevented.

Key Adhesives and Sealants Market Insights Summary:

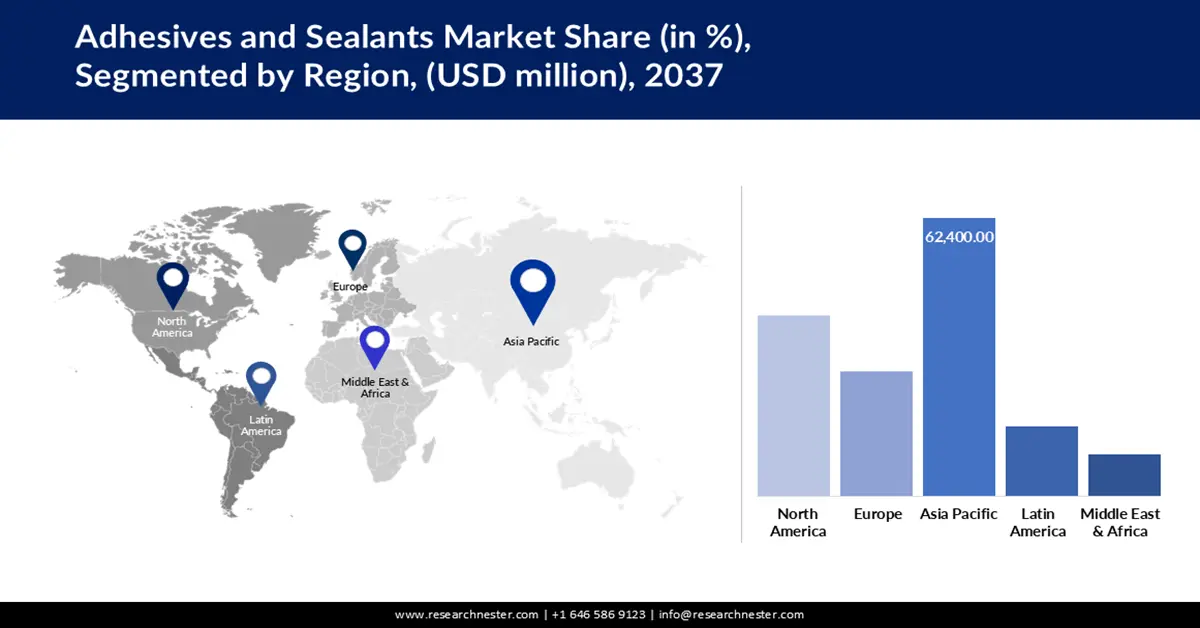

Regional Highlights:

- Asia Pacific is projected to secure more than 40.2% revenue share by 2037 in the adhesives and sealants market, reflecting its manufacturing and infrastructure-led dominance, supported by rapid urbanization, green building initiatives, and expanding construction and automotive activities

- North America is expected to witness strong growth through 2037, underscoring its innovation-driven market trajectory, reinforced by rising demand from electronics, healthcare, and automotive sectors alongside sustainability-focused policies and reshoring initiatives

Segment Insights:

- Adhesives Segment in the adhesives and sealants market is projected to hold over 67% share by 2037, reflecting its broad adoption across automotive, electronics, packaging, and construction applications, strengthened by design flexibility advantages over mechanical fasteners and accelerating investments in advanced adhesive solutions

- Water-Based Segment is expected to account for around 39.5% share by 2037, highlighting its rising preference across industries as sustainability regulations tighten and demand grows for low-VOC, environmentally compliant bonding technologies

Key Growth Trends:

- Sustainability and bio-based innovations

- Construction and infrastructure boom

Major Challenges:

- Challenges of the supply chain and shortage of materials

- Regulatory complexity and compliance pressures

Key Players: American Chemical Inc., Arkema Group, 3M Co., Adhesive Technologies Corp., American Biltrite Inc., Ashland Inc., Beardow & Adams Ltd, Benson Polymers Ltd., DowDuPont, Huntsman International LLC, LANXESS AG

Global Adhesives and Sealants Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 79.3 billion

- 2026 Market Size: USD 83.9 billion

- Projected Market Size: USD 156.2 billion by 2037

- Growth Forecasts: 5.8% CAGR (2026-2037)

Key Regional Dynamics:

- Largest Region: Asia Pacific (more than 40.2% revenue share by 2037)

- Fastest Growing Region: Europe

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: India, Vietnam, Indonesia, Mexico, Brazil

Last updated on : 25 August, 2025

Adhesives and Sealants Market - Growth Drivers and Challenges

Growth Drivers

- Sustainability and bio-based innovations: The adhesive industry is gradually moving toward bio-based and environmentally friendly products to cater to the market demands and regulatory policies. International policies such as the European Green Deal are now putting pressure on chemical firms to reduce emission intensity. Water-based and solvent-free formulations are becoming more common, which means that they release fewer VOCs. Certification like the ISCC PLUS helps enhance the credibility of sustainability claims and gain the trust of the customer.

Businesses that are adopting renewable raw materials are creating better strategic positions in the adhesives and sealants market. For instance, in July 2023, Henkel reported its achievement of carbon neutrality in the aerospace manufacturing plant situated in Spain. The transformation of three more sites for adhesive production to carbon neutrality was also reported by the company. The shift toward circular economy solutions is already evident in the adhesive industry worldwide. - Construction and infrastructure boom: Growth in the construction industry is fueling steady growth in demand for adhesives and sealants in Asia, North America, and Europe. In December 2024, Soudal acquired a Japanese adhesive firm as it extended its business into Asia, where the construction sector is rapidly growing. Expansion of residential, commercial, and industrial sectors has necessitated the use of better sealing techniques to enhance energy efficiency and product reliability. In addition, smart city development and green building regulations are adding to the growth of the specialty adhesives market. They are used in structural glazing, facade sealing, and as insulating panels and adhesives. Such regional development initiatives as India’s Smart Cities Mission remain crucial sources of growth.

- Automotive lightweighting trends: The increased demand for lightweight materials to enhance fuel economy and emission reduction in the automotive industry is driving adhesive consumption. In September 2024, Ingevity launched the Capa polycaprolactone technology at FEICA, focusing on the sustainable improvement of adhesives’ performance. In automotive assembly, adhesives eliminate the need for mechanical fasteners and result in lighter and stronger structures.

Another factor that is driving the need for more bonding solutions is the increasing manufacturing of electric vehicles, which is supported by regulatory bodies. One such example is the announcement of grants of USD 996 million from the Innovation Fund by the EU for six pioneering projects of EV battery cell manufacturing. In modern vehicles, adhesives are used for noise control and battery integration. Manufacturers are shifting their focus towards eco-friendly and high-performance adhesives in the automotive sector for safety and compliance. This trend suggests strong adhesive consumption throughout the global automotive manufacturing regions.

Challenges

- Challenges of the supply chain and shortage of materials: Raw material availability continues to pose a challenge to adhesive producers by affecting production timelines and costs. The use of specialty chemicals such as isocyanates and acrylates make manufacturers vulnerable to fluctuations in price. For example, in April 2024, Bostic announced a hike of a maximum of 7% in the prices of paper, hygiene, and cardboard specialty adhesives based on their grades and production due to worsening costs and supply of required raw materials. The company decided to raise the prices due to the inflation in costs for manufacturing and transportation. Increasing prices of adhesives can lower the demand for the same, and hamper the expansion across sectors, such as automotive, construction, and others.

- Regulatory complexity and compliance pressures: The pressure on adhesive manufacturers to address emissions, chemical safety, and sustainability reporting is intensifying. The certification standards for bio-content, emissions, and product transparency are steadily increasing. If the rules are not followed, the consequences may include restricted adhesives and sealants market access and loss of customers’ trust. In January 2024, Avery Dennison revealed a loss of sales by 2%, and the revenue of the business stood at USD 1.4 billion. With loss of sales or trust of customers, the revenue of the overall market is reduced, and future opportunities are limited, which hinders the overall market growth.

Adhesives and Sealants Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2037 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 79.3 billion |

|

Forecast Year Market Size (2037) |

USD 156.2 billion |

|

Regional Scope |

|

Adhesives and Sealants Market Segmentation:

Product Segment Analysis

The adhesives segment is likely to hold more than 67% adhesive and sealants market share by 2037, due to its application across verticals. In December 2024, Henkel increased production capacity in India due to increasing adhesive consumption in the automotive and electronics segments. Compared to mechanical fasteners, adhesives are more versatile in the design aspect, often used to support lightweight structures. Advances in the packaging industry, consumer goods, and construction sectors have driven the adoption of adhesives over conventional techniques, and as a result, increasing investments are being initiated by companies for the production of advanced adhesives. For example, in November 2023, Tesa launched Tesa 51345, an adhesive developed through paper-based reinforcement to strengthen packaging and cartons.

Technology Segment Analysis

By 2037, water-based segment is predicted to account for around 39.5% adhesive and sealants market share, mainly due to regulations and the environment. In October 2024, Arkema introduced new bio-based additives to improve the performance of waterborne coatings and adhesives. These formulations have low volatile organic compounds emissions that are friendly to the environment in compliance with the global standards. It is a trend that is steadily gaining popularity in packaging, textiles, construction, and automotive industries. Improved performance characteristics make it possible to achieve performance levels of solvent-based adhesive systems with water-based ones. Sustainability certifications and green building standards favor water-based options. With more and more consumers becoming conscious of the environment, water-based adhesives are fast emerging as the most popular technology.

Application Segment Analysis

The building and construction segment is anticipated to expand at a significant CAGR during the forecast period due to the widespread use of adhesives and sealants, such as acrylic, epoxy, silicon, butyl, and others, for molding, flooring, and other purposes. The rapid expansion of the building and construction sector also drives the dominance of the segment, providing scope to use adhesives and sealants increasingly in the accomplishment of different building and construction activities.

Our in-depth analysis of the adhesives and sealants market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Technology |

|

|

Form |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Adhesives and Sealants Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific adhesives and sealants market is expected to hold more than 40.2% revenue share by 2037, attributed to the growth in the infrastructure and manufacturing sectors. In December 2023, Arkema completed the divestment of its adhesives business through the sale of Arc Building Products in Europe, which allowed for more focus on Asia. China, India, and Southeast Asia are the key end-use segments for construction and automotive adhesives in the region. Currently, governments are developing and adopting energy efficiency and green building policies. The interest in sealing solutions is driven by the global trends in urbanization and the introduction of smart city concepts. High production demands in industries continue to drive the consumption of adhesives in various industries.

China has continued to be the leading producer and consumer of adhesives in the world, owing to industrialization. In September 2024, the government revised the industrial policies to embrace adhesive innovation for material security. The demand is in construction, electronics, packaging, automotive industries, and many more. The high-tech adhesive manufacturing is one of the industries that have been encouraged by China’s Made in China 2025” plan. Adhesive manufacturers that target the export adhesives and sealants market capitalize on the increasing consumer demand for low-VOC and environmentally friendly products. Environmental laws and policies are becoming stringent, hence forcing industry to develop environmentally friendly products. The country’s domestic modernization and export competitiveness guarantee its market leadership.

The market in India is expanding due to industrialization, urbanization, and green construction trends. In October 2024, Pidilite forayed into a joint venture to launch superior stone-fixing adhesives in the focused construction segment. Infrastructure development, particularly in affordable housing and commercial business spaces, is one of the main agents of growth. The automotive and electronics industries are the two major industries that have been witnessing high demand for specialty adhesives. Government reforms like Make in India support local manufacturing expansion. Environmental consciousness is on the rise, thus propelling the waterborne adhesive market. The adhesive industry in Asia is expected to grow at a steady pace, and India, with its growing middle class and export orientation, will remain a key driver.

North America Market Insights

North America adhesives and sealants market is set to witness a high growth rate till 2037, attributed to innovations and infrastructural growth. In December 2024, H.B. Fuller made strategic acquisitions to boost its healthcare adhesive portfolio and increase its presence in North America. There is a growing demand in electronics, automotive, and healthcare industries that is driving the research and development spending. The construction adhesives industry is expected to benefit from the U.S. Inflation Reduction Act through increased demand for energy-efficient products. Environmental concerns are also driving more sustainable adhesive solutions and pushing forward water-based and bio-based adhesives. Strategic reshoring initiatives are geared towards ensuring that there is an expansion of local production. North America is the leader in innovation, which contributes to its stable position in the global market.

The growth of the U.S. adhesive market is being driven by technology leadership and end-user segments. In November 2024, DuPont officially opened a new adhesives manufacturing facility to address the increasing needs of the automotive and electronics industries. The construction industry in the U.S., including retrofitting of residential structures, is also driving the need for enhanced sealing solutions. Consumer goods and flexible packaging industries are the two industries that are embracing eco-friendly adhesives at the highest rate. Other government programs related to the reinforcement of manufacturing industries also offer further growth incentives. Businesses are now focusing on automation and smart manufacturing, a trend that has been evident in recent developments. Robust IP protection and innovation environments are critical to sustaining America’s leadership in adhesive technologies and global market power.

The adhesives and sealants market in Canada continues to expand owing to the green building initiatives and industrialization processes. In September 2024, Unitech North America is putting up its first manufacturing facility in Canada to support regional supply chains. There is are increasing demand for adhesive products in construction, transportation, and renewable energy industries. The consumer is increasingly demanding products that are eco-certified and have low-emission adhesives. Trade with the U.S. and Mexico increases product output and technology transfer across borders. Bio-based and specialty forms of adhesives are also the key strategic focus of firms to meet customer needs. Increased spending on research facilities and a qualified workforce is enhancing the competitiveness of the market in Canada.

Europe Market Insights

Europe is expected to expand at a robust CAGR between 2026 and 2037, owing to increasing initiatives to establish battery factories across the region. One such example is the establishment of the very first LFP battery factory of Europe in April 2023 in Serbia by ElevenES. EIT InnoEnergy is a clean energy investor that can be integrated across applications, such as electric cars, trucks, energy storage, and others. For effective thermal management, strong structural bonds and sealing elements within packs of batteries, adhesives, and sealants are crucial. In addition, pressure from the regulatory bodies to manufacture sustainable adhesives and sealants fosters the market growth.

Germany adhesives and sealants market is expected to register rapid growth by the end of 2037 due to the presence of a vast number of exporters, who supply adhesives and sealants globally. Updated regulations for adhesives and sealants also fuel the market growth. For instance, in June 2025, two new laws were added to the list of restrictions that of EU’s REACH imposes on the use of N, N-dimethylacetamide (DMAC) and 1-ethylpyrrolidin-2-one (NEP) in the production of adhesives and sealants. Restrictions on the use of such substances drive the companies towards innovation and growth.

France market is expanding steadily due to the demand for novel adhesive solutions influenced by the advancements in packaging and preference for energy efficiency. Companies based in France are also engaged in the production of sustainable packaging using proper adhesives. In November 2024, the French packaging solutions supplier Amcor revealed its five years of engagement in manufacturing products, including sustainable packaging solutions by using high-performance Tyek adhesives, such as CR27 and SBP2000 heat seal coatings.

Key Adhesives and Sealants Market Players:

- Henkel GmbH & Co

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- American Chemical Inc.

- Arkema Group

- 3M Co.

- Adhesive Technologies Corp.

- American Biltrite Inc.

- Ashland Inc.

- Beardow & Adams Ltd

- Benson Polymers Ltd.

- DowDuPont

- Huntsman International LLC

- LANXESS AG

The adhesive and sealants industry is highly competitive, and the companies are constantly pushing the boundaries of innovation, specialization, and sustainability. Key players in the market strive for innovations, geographical coverage, and environmental sustainability. Strategic partnerships, acquisitions, and product line diversification are some of the common competitive strategies. Current trends in the adhesive industry are focused on bio-based, lightweight, and smart adhesives.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2025, Sonoco, a manufacturer of sustainable packaging, announced an investment of USD 30 million for the expansion of its organizational production capacity to cater to the rising demand for adhesives and sealants.

- In January 2025, Weicon, an adhesives and sealants producer, received recognition as one of the top mid-sized employers in Germany, surpassing 129 other companies. This indicates the rise of new companies involved in the manufacturing of adhesives and sealants.

- In November 2024, Dow announced capacity expansions in SAS chemicals for the high-performance façade industry. This expansion enhances Dow’s ability to serve growing demand for durable adhesive and sealant solutions. Dow continues to drive innovation for modern construction needs.

- In November 2024, Henkel partnered with Celanese for CCU (carbon capture utilization)-based adhesives development. The partnership reflects Henkel’s ambition to incorporate renewable carbon sources into adhesive technologies, aiming to reduce its environmental impact and support a circular economy. This collaboration has the potential to create more sustainable adhesive solutions for various industries.

- Report ID: 4519

- Published Date: Aug 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Adhesives and Sealants Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.