Additive Manufacturing Market Outlook:

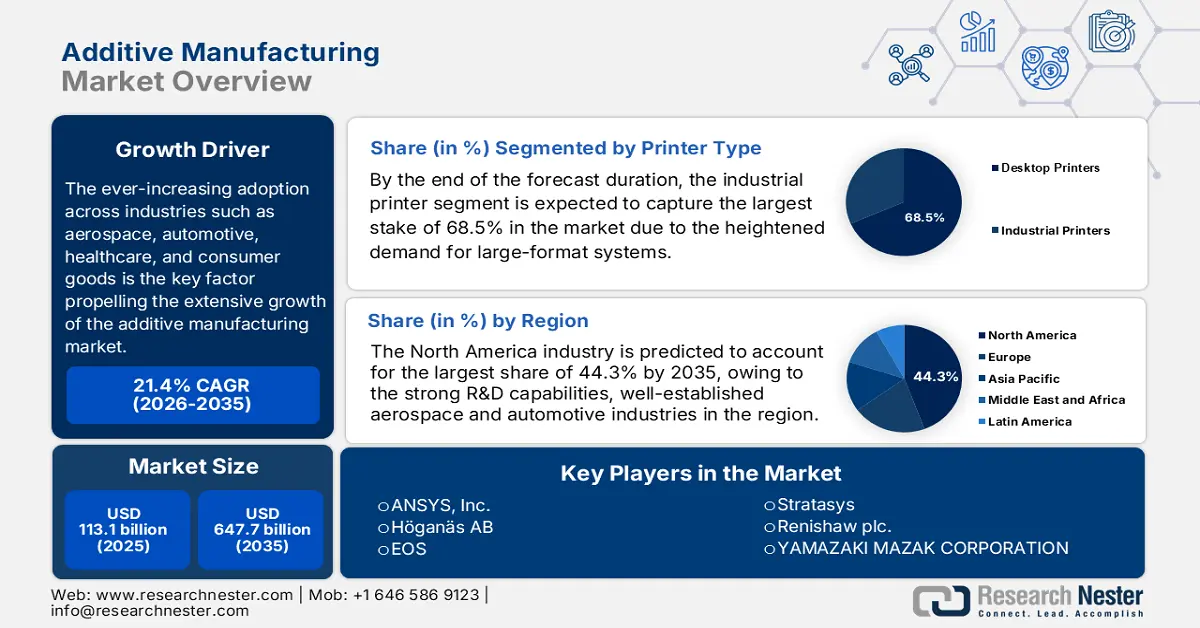

Additive Manufacturing Market size was valued at USD 113.1 billion in 2025 and is projected to reach USD 647.7 billion by the end of 2035, growing at a CAGR of 21.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of additive manufacturing is evaluated at USD 137.3 billion.

The adoption across industries has been increasing, with industries such as aerospace, automotive, healthcare, and consumer goods, which is the key factor propelling the extensive growth of the additive manufacturing market. Meanwhile, on the supply chain aspect, companies in this field are leveraging 3D printing to reduce lead times, minimize inventory, and enable domestic production, which mitigates disruptions caused by worldwide logistics. In this regard Ministry of Electronics & IT India, in February 2022, reported that it has released the national strategy on additive manufacturing, which mainly focuses on digital manufacturing and strengthening domestic production under the Make in India as well as Atmanirbhar Bharat initiatives. The report also highlighted that it aims for increased innovation through a National Centre, sector-specific hubs, and PPP-driven R&D to develop AM machines, materials, and products across various industries such as electronics, medical devices, and food processing, thus positively influencing market upliftment.

Furthermore, the trade dynamics in the market are shifting as the regions with extensive manufacturing are making investments in 3D printing infrastructure, whereas the emerging economies are seeking partnerships and technology transfers to accelerate adoption. In November 2024, the U.S. Defense Logistics Agency stated that it awarded its first competitive contract for an additively manufactured pylon bumper for F-15 aircraft, which marks a major shift from sole-source to open-source procurement and fostering vendor competition. It also noted that the initiative was supported by DLA’s additive manufacturing integrated product team, which integrates 3D printing into the military supply chain, enabling faster, on-demand production of critical parts by reducing storage and transportation needs, hence enhancing logistics agility and collaboration between the DoD and industry vendors.

Global Trade Statistics for Machine Parts for Additive Manufacturing - 2023

|

Metric |

Value |

Details |

|

Global Trade Value |

USD 9.94 Billion |

Total exports + imports in 2023 |

|

Share of World Trade |

0.044% |

Rank 367 out of 4644 products |

|

Product Complexity Index (PCI) |

1.16 |

Rank 279 out of 2913 products |

|

Export Growth (2022-2023) |

0.35% |

Nominal increase from USD 9.91 B in 2022 |

|

Leading Exporter |

Germany (USD 2.04 Billion) |

Followed by the USA (USD 1.28 B) and China (USD 1.24 B) |

|

Leading Importer |

Germany (USD 987 Million) |

Followed by the USA (USD 870 M) and China (USD 734 M) |

|

Top 5 Exporting Countries |

1. Germany - USD 2.04 Billion |

Data for 2023 |

|

Top 5 Importing Countries |

1. Germany - USD 987 Million |

Data for 2023 |

|

Countries with the Largest Trade Surpluses |

Germany (USD 1.06 Billion), China (USD 507 Million), U.S. (USD 411 Million) |

Exports > Imports |

|

Trade Growth (5-year annualized) |

1.38% |

Average annual growth rate over the past five years |

Source: OEC