AdBlue Market Outlook:

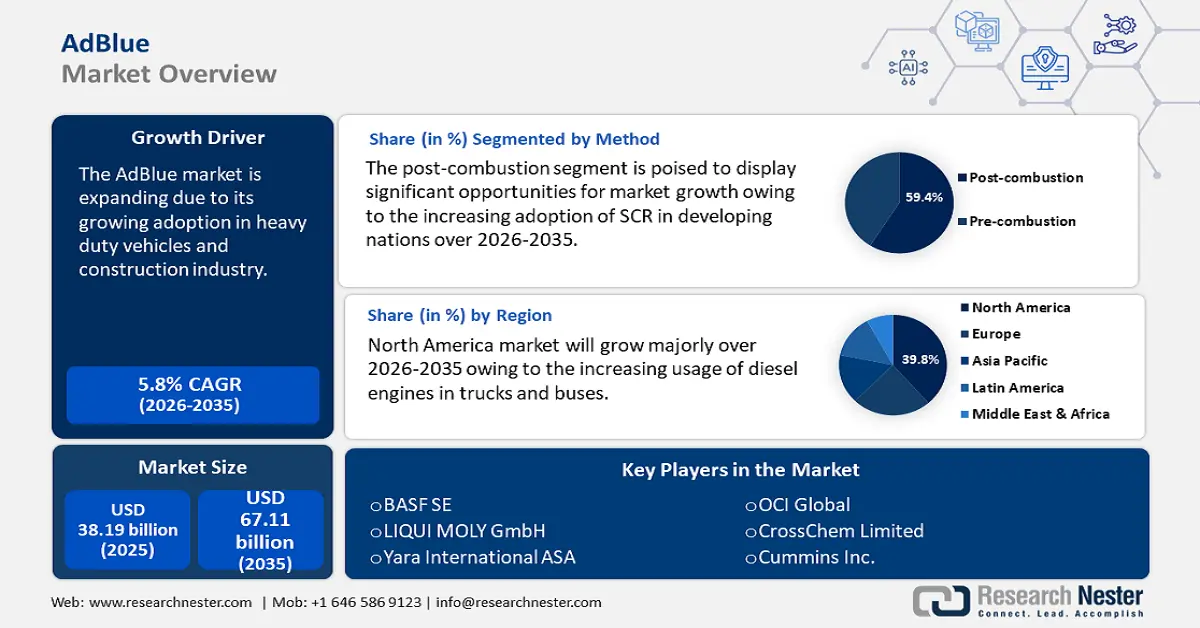

AdBlue Market size was over USD 38.19 billion in 2025 and is projected to reach USD 67.11 billion by 2035, growing at around 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of adblue is evaluated at USD 40.18 billion.

AdBlue also known as diesel exhaust fluid (DEF) is essential for reducing nitrogen oxide (Nox) emissions in diesel engines equipped with Selective Catalytic Reduction (SCR) technology. The global demand for AdBlue is on the rise, driven by stringent environmental regulations and the expanding automotive sector. Leading manufacturers are expanding their global production capacity to meet the rising demand influenced by stringent emission regulations.

With the world's largest AdBlue production capacity of 2.8 million tons annually, Yara International, a Norwegian chemical company leads the market. This AdBlue is made from a solution of virgin, high-purity urea and is marketed worldwide. It contains the largest AdBlue storage tank in the world, holding 17,500 m³ of high-quality AdBlue solution. Also, up to 300,000 tons of AdBlue can be produced annually in Europe by OCI Global, with room to grow. The five AdBlue production facilities that makeup Yara's global network are located in Sluiskil, Netherlands; Le Havre, France; Belle Plaine, Canada; Ferrara, Italy; and Brunsbüttel, Germany.

Moreover, CrossChem’s new production plant in Hong Kong can produce 1.5 million liters monthly. Two new AdBlue production facilities were opened in Central Europe by the Latvian chemical firm CrossChem. The first is in the Czech Republic and can produce 1.5 million liters per month; the second is already in Poland and can produce 5 million liters per month. Additionally, companies such as OMV Petrom and ITOCHU ENEX have invested in new production facilities, further strengthening the supply chain and supporting the AdBlue market’s growth amid stringent emission regulations.

Vehicles and industries have different daily AdBlue requirements. AdBlue consumption typically ranges between 3% and 5% of the total diesel fuel used. A heavy-duty truck that uses 100 liters of diesel requires 3 to 5 liters of AdBlue daily. AdBlue's contribution to cleaner air and eco-friendly activities will grow in importance as the world's attention turns toward sustainability. Businesses investing in AdBlue can help create a healthier earth for coming generations adhering to legislation.

Key AdBlue Market Insights Summary:

Regional Highlights:

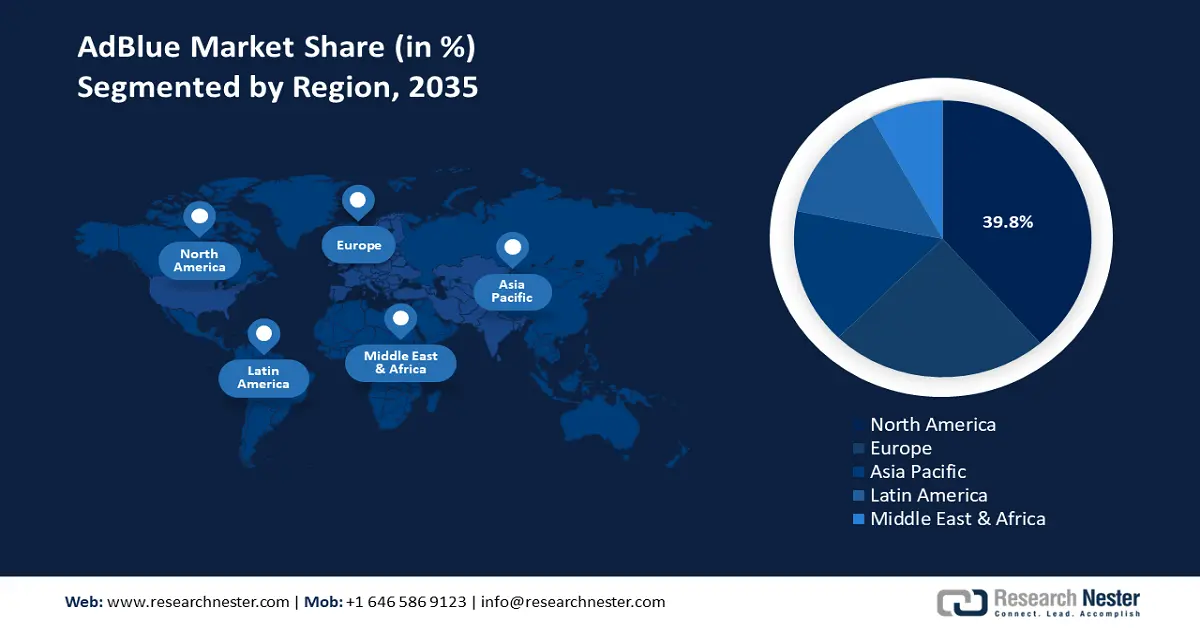

- North America dominates the AdBlue Market with a 38.9% share, propelled by strict emissions regulations and increasing diesel vehicle usage, ensuring sustained growth through 2035.

- Europe's AdBlue Market is anticipated to grow significantly by 2035, driven by stringent car regulations and growing public awareness of DEF.

Segment Insights:

- Cars & Passenger Vehicles segment are projected to hold a notable share by 2035, fueled by growing automobile demand driven by urbanization and rising salaries.

- Post-combustion systems segment are expected to capture a 59.4% share by 2035, driven by the increasing adoption of SCR in developing nations for emission reduction.

Key Growth Trends:

- Growing applications across various industries

- Government incentives to promote the adoption of emission-reducing technologies

Major Challenges:

- Rising adoption of electronic vehicles and fluctuating raw material prices

- Availability of alternatives

- Key Players: BASF SE, LIQUI MOLY GmbH, CF Industries Holdings, Inc., Cummins Inc., Bharat Petroleum Corporation, Fertiberia, Yara International ASA, OCI Global, CrossChem Limited, ENI S.p.A..

Global AdBlue Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 38.19 billion

- 2026 Market Size: USD 40.18 billion

- Projected Market Size: USD 67.11 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 13 August, 2025

AdBlue Market Growth Drivers and Challenges:

Growth Drivers

- Growing applications across various industries: Commercial vehicles using SCR technology, including trucks, buses, and vans, employ AdBlue in the automotive industry. AdBlue is injected into the exhaust stream by the SCR system, which transforms dangerous NOx gases into innocuous nitrogen and water vapor. Tractors, harvesters, and other diesel-powered equipment in the agricultural sector depend on AdBlue to lower emissions. Diesel machinery's environmental impact increases with the size of farms and agricultural activities.

AdBlue has also been used by the construction industry, which is well-known for using large machinery, to adhere to more stringent environmental standards. SCR technology is used by cranes, loaders, bulldozers, and excavators, greatly lowering NOx emissions on building sites. Moreover, non-road mobile machinery (NRMM), including generators and compressors, also relies on AdBlue to minimize emissions. - Government incentives to promote the adoption of emission-reducing technologies: As governments worldwide realize the importance of reducing air pollution and fighting climate change, they are providing financial incentives, tax breaks, and regulatory support to promote the use of AdBlue. These incentives, which offer financial incentives for using SCR technology which needs AdBlue for efficient emission control are frequently directed toward automakers, owners, and operators. These government incentives act as a stimulus for the growth of the AdBlue business as nations impose more stringent emission requirements and tighten their environmental rules.

The Central Government launched the National Clean Air Program (NCAP) under the Central Sector Control of Pollution Scheme as a long-term, time-bound national-level approach to solving the country’s air pollution problem. The goal is to reduce PM10 by 20% to 30%. Moreover, in the U.S., nearly USD 5 billion in funds are awarded by the Climate Pollution Reduction Funds (CPRG) program to states, municipalities, tribes, and territories to help them create and carry out aggressive programs to cut greenhouse gas emissions and other dangerous air pollutants. - Rising trade in raw materials like Urea: AdBlue is a colorless blend of deionized water (67.5%) and high-purity urea (32.5%). Ammonia, the active component of AdBlue, is found in urea and reacts with NOx to neutralize it before it enters the atmosphere. Therefore, the increasing availability of high-purity urea, tailored specifically for AdBlue production, ensures a steady supply chain and supports the expansion of manufacturing capacities.

The Observatory of Economic Complexity (OEC) reported that with a total trade of USD 37.4 billion in 2022, urea, including aqueous solution in containers weighing more than 10 kg, was the 79th most traded product worldwide. Urea exports, comprising aqueous solution in packs weighing more than 10 kg, increased by 58.2% between 2021 and 2022, from USD 23.6 billion to USD 37.4 billion.

|

Country |

Urea Value in Exports (USD Billion) |

Country |

Urea Value in Imports (USD Billion) |

|

Oman |

4.01 |

India |

6.7 |

|

Russia |

4.01 |

Brazil |

3.97 |

|

Qatar |

3.41 |

U.S |

3.2 |

|

Egypt |

3.07 |

Australia |

1.95 |

|

Saudi Arabia |

2.58 |

France |

1.51 |

Source: OEC

Challenges

- Rising adoption of electronic vehicles and fluctuating raw material prices: Despite the rapid developments in the automotive sector, a few factors can impact the AdBlue market, including the growing popularity of electric cars as a result of consumer’s increased awareness of environmental issues, concerns about the volatile price of oil, the growing demand for automobiles that run on alternative energy sources, and difficulties in processing urea. Also, AdBlue is made with urea, an essential fertilizer ingredient. The weather and political upheaval in the main producing nations can affect urea supply and price volatility.

- Availability of alternatives: Additional options are available on the AdBlue market that can be used to reduce emissions including diesel particulate filters and exhaust gas recirculation systems. AdBlue competes with these products in terms of pricing and functionality. Moreover, AdBlue is a highly corrosive chemical that needs to be handled and transported carefully to avoid harm. This can lead to price increases and difficulties for AdBlue solution providers.

AdBlue Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 38.19 billion |

|

Forecast Year Market Size (2035) |

USD 67.11 billion |

|

Regional Scope |

|

AdBlue Market Segmentation:

Method (Pre-combustion and Post-combustion)

By 2035, post-combustion segment is estimated to capture AdBlue market share of over 59.4%. The segment growth can be attributed to the increasing adoption of SCR in developing nations. Hazardous nitrogen oxides are transformed into innocuous nitrogen and water by the SCR catalytic converter. Additionally, it is used in large vehicles like trains, lorries, and taxis, which is advancing the industry. Post-combustion capture can be introduced directly to the plant with minimal changes to the entire process, unlike pre-combustion capture and oxy-fuel carbon capture.

The goal of a post-combustion capture facility is to capture as much CO2 as possible from combustion plants and transport it to geological strata for safe retention. A plant will normally strive for a CO2 capture rate greater than 95%. Post-combustion systems' adaptability also makes it possible to retrofit them into already-existing cars, lowering emissions without requiring significant engine changes. This promotes their use in both the automotive and industrial sectors.

Application (Commercial Vehicles, Non-road Mobile Machines, Cars & Passenger Vehicles, Railways)

The cars & passenger vehicles segment in AdBlue market will garner a notable share in the forecast period. The market growth can be attributed to the rising demand for automobiles and other passenger vehicles. In 2023, the European Automobile Manufacturers Association reported that Europe comprised 19.5% of global passenger car sales, Asia, accounted for 51.6%, and the North America and Latin America at 23.7%. Additionally, the Middle East and Africa represented 5.2% of total sales. The economic expansion and rising salaries have made car ownership more accessible to a larger segment of the population. Additionally, urbanization has heightened the demand for transportation, while evolving preferences and lifestyles further promote the acquisition of vehicles. The allure of new features and technological developments also motivates demand, as well as the need for individual transportation for work, leisure, and daily living. All of these factors are rising demand for automobiles and other passenger vehicles in modern society.

Our in-depth analysis of the global AdBlue market includes the following segments:

|

Type |

|

|

Method |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

AdBlue Market Regional Analysis:

North America Market Statistics

In AdBlue market, North America region is likely to capture over 38.9% revenue share by 2035. Adblue is used by commercial vehicles to reduce nitrogen oxide emissions to meet more stringent emissions regulations, which is fueling the region's AdBlue market expansion. For instance, to further reduce harmful air pollutant emissions from light-duty and medium-duty cars beginning with model year 2027, the Environmental Protection Agency (EPA) released new, more protective final regulations on March 20, 2024. Building on EPA's 2021-established federal greenhouse gas emissions standards for passenger cars and light trucks for model years 2023–2026, the final rule uses clean car technology advancements to benefit in several ways, including lowering climate pollution, improving public health by reducing vehicle-generated smog and soot pollution, and saving drivers money by lowering fuel and maintenance costs. Additionally, the region's transportation industry's growth and the increasing usage of diesel engines in trucks and buses have increased the need for Adblue by requiring it to meet these environmental regulations.

Furthermore, the EPA's strict NOx emission regulations in the U.S. required the usage of diesel exhaust fluid at extremely high levels. A rise in the number of heavy-duty trucks and commercial vehicles is accompanied by robust diesel exhaust fluid and supply chain infrastructure, strengthening the country’s position as the market leader. Large truck manufacturers, such as Freightliner and Peterbilt, have integrated cutting-edge SCR technologies into their models, which has had a major impact on the rise in DEF usage. In 2024, Peterbilt announced that Models 579, 567, and 589 now come with a new PACCAR MX-13 engine that complies with CARB's low nitrogen oxide (NOx) regulations. To successfully lower NOx emissions, this engine has internal hardware and the after-treatment system redesigned to comply with the CARB Omnibus Regulation.

In Canada, as diesel consumption continues to rise, the nation's pollution standards will necessitate improved methods for enhancing air quality. This uptick in diesel demand will inevitably boost the AdBlue market for diesel-powered vehicles, a trend seen not only in Canada but also in the U.S. Over the coming years, a significant increase in the need for light commercial vehicles (LCVs) and heavy commercial vehicles (HCVs) can be expected. Consequently, this growing demand will also lead to higher usage of diesel fuel.

Europe Market Analysis

Europe AdBlue market is expected to hold a significant share in the forecast period. Stringent regional car regulations are supporting the market's expansion and will increase demand for SCR technology from automakers. Additionally, it is projected that growing public knowledge of DEF will play a major role in the future expansion of the regional market. Moreover, the growing production of commercial vehicles and passenger cars in the region is another factor driving the growth of the AdBlue market. According to the European Automobile Manufacturer’s Association, the EU produced 2.2 million commercial vehicles in 2022. Also, in 2022, the European Union produced 10.9 million passenger cars, an 8.3% increase over 2021.

Due to the growing demand for AdBlue in the Germany heavy-duty and passenger car markets, Yara International ASA, the largest producer of AdBlue, opened the world’s largest production capacity. About 1.1 million tons of AdBlue will be produced annually at the new plant. A 17,500 m3 AdBlue tank, a fully automated truck loading station with a digitalized unmanned gate that operates around the clock, and a new deep-sea ship loading facility are all part of the expanded production capacity.

Key AdBlue Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LIQUI MOLY GmbH

- CF Industries Holdings, Inc.

- Cummins Inc.

- Bharat Petroleum Corporation

- Fertiberia

- Yara International ASA

- OCI Global

- CrossChem Limited

- ENI S.p.A.

Leading companies in the industry are making significant R&D investments to broaden their product offerings, which will support further growth in the AdBlue market. Important market developments include new product releases, contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. Market participants are also engaging in a variety of strategic initiatives to broaden their presence. The AdBlue market needs to provide affordable products to grow and thrive in a more competitive and expanding market environment.

Recent Developments

- In March 2024, BASF's AdBlue ZeroPCF, the first AdBlue product with a lower carbon footprint, was introduced to the market. This figure covers the CO2 emissions associated with the product from the point of manufacture to the site gate, or cradle-to-gate. In the European market, fossil products must weigh at least 0.4 kg.

- In February 2024, LIQUI MOLY introduced the AdBlue additive to the market. To produce the so-called Leidenfrost effect, the addition lowers the temperature. This phenomenon encourages the AdBlue solution to break down without leaving any traces behind.

- Report ID: 6965

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

AdBlue Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.