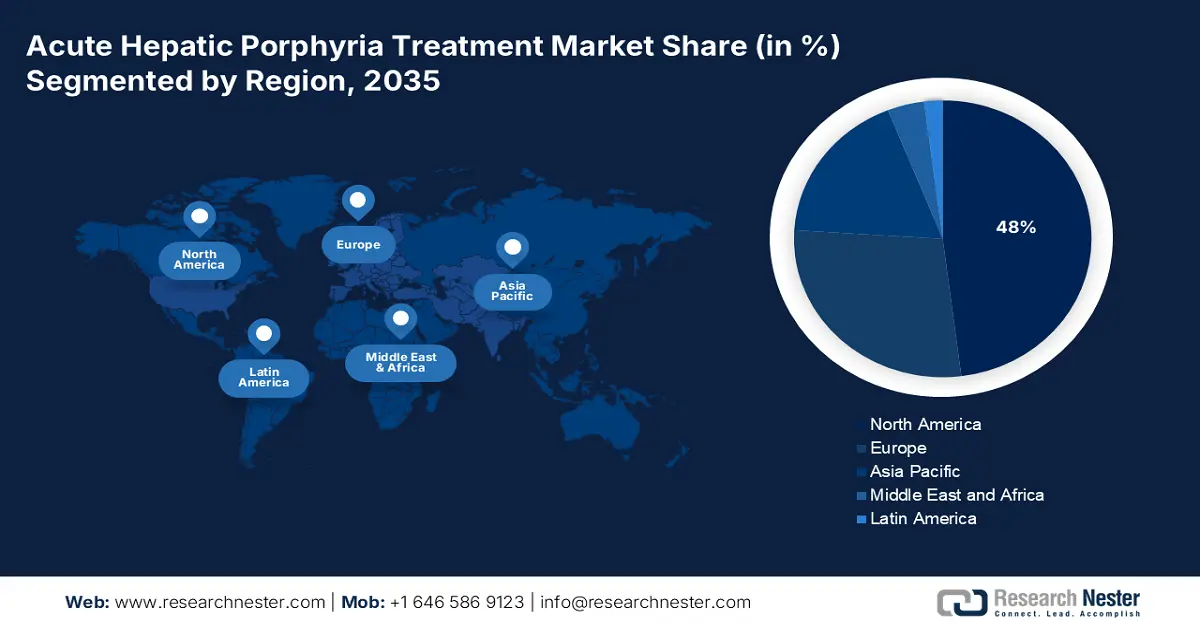

Acute Hepatic Porphyria Treatment Market - Regional Analysis

North America Market Insights

The North America acute hepatic porphyria treatment market is projected to register the highest share of 48% during the forecast period. The region benefits from an advanced healthcare infrastructure and higher disease prevalence that necessitate effective treatment procedures. The main drivers of the market include favorable FDA orphan drug policies, huge commercial and federal insurance coverage, and robust patient advocacy. A primary trend is the strategic shift from acute attack management to prophylactic therapies that reduce attack frequency, improving long-term patient outcomes and quality of life. This is further driving the interest of domestic players to develop more innovative formulations in the sector.

The acute hepatic porphyria treatment market in the U.S. is driven by rapid innovation, high-cost treatments and robust federal support for orphan diseases. The key trend is the incorporation of RNAi-based prophylactic therapies into mainstream treatment, dramatically lessening disabling attacks and changing the treatment model from reactive to preventive. As per the NLM report in May 2023, 1 in 25,000 people have porphyria. CMS data shows expanding Medicare Part D coverage for these specialty drugs, though high out-of-pocket costs remain a concern.

Canada's acute hepatic porphyria treatment market is experiencing a rapid growth due to government-backed funding and rising healthcare access across. The NLM study in August 2024 depicts that the Canada government has announced a three-year funding amount of USD 1.5 billion, which is for rare disease drug access starting in 2023, highlighting its increasing demand. To minimize the differences in treatment availability, patient advocacy groups are emerging and becoming powerful for a national rare disease strategy that would standardize care and enhance access across provinces.

Prevalence of Acute Hepatic Porphyria in U.S. and Canada

|

Year |

Country |

Prevalence Estimate |

Notes |

|

2023 |

U.S. |

Approximately 1 in 20,000 |

Diagnosed symptomatic population prevalence estimate |

|

2024 |

U.S. |

Estimated 5 to 10 cases per 100,000 population |

Range for Acute Intermittent Porphyria (AIP) |

|

2023 |

Canada |

1 in 500 to 1 in 50,000 |

Based on epidemiological parallels and population size |

Source: NLM December 2024, NLM May 2023, Canadian Association for Porphyria 2023

APAC Market Insights

Asia Pacific acute hepatic porphyria treatment market is anticipated to witness the fastest growth during the forecast timeline, owing to its increased awareness of disease detection and the innovation of targeted therapies. The thriving growth in the region is mainly due to the contribution of developing countries such as Japan, China, India, Malaysia, and South Korea. Besides the government support and collaborations between leading pharmaceutical firms are enhancing patient outcomes. This adoption of innovative treatment options is expected to propel market growth across the region.

India's acute hepatic porphyria treatment market is unfolding remarkable growth opportunities during mainly fueled by the public and private healthcare collaborations and the government healthcare spending for the rare disease. In this regard, the Indian Organization for Rare Diseases report in December 2024 has announced the budget of ₹974 crore for the years 2024 to 2025 and 2025 to 2026, including the research on acute hepatic porphyria. Furthermore, the expansion of medical services and awareness campaigns is contributing to growth in India.

The acute hepatic porphyria treatment market in Japan is growing gradually due to the robust regulatory framework for orphan drugs that surges the approval and provides significant incentives for manufacturers. The AHP cases in Japan patient experience a high clinical burden due to the acute attacks and long-term complications. According to the NLM study in December 2024, nearly 88% of the study population experienced acute attacks, and 77% of patients required treatment at a healthcare facility. Widespread patient access to approved therapies is guaranteed by government support via NHI reimbursement, and continued research and growing awareness of diagnostics are expected to propel steady market growth with Japan's larger rare disease strategy.

Europe Market Insights

The acute hepatic porphyria treatment market in Europe is actively driven by a strong regulatory framework led by the European Medicines Agency (EMA), which facilitates accelerated approval pathways for orphan drugs like givosiran. Key growth drivers include rising disease cases, enhanced diagnostic capabilities, and the adoption of high-cost, innovative prophylactic therapies used to reduce attack frequency. As per the NLM report in December 2023, the prevalece of AHP in Europe is 0.5 per 100,000 population. The extension of reimbursement policies within national healthcare systems is driving the market, although market access differs among nations because of different cost-containment strategies and health technology assessment (HTA) bodies.

The UK's acute hepatic porphyria treatment market is growing and is driven by NHS England's commitment to improving rare disease care. The NHS England data in February 2025 states that the estimated people affected with acute hepatic porphyria is 1 in 100,000 people. On the other hand, according to the NHS Long Term Plan, specialized services for rare conditions are a key focus. The UK allocates significant resources to its Highly Specialised Technologies (HST) pathway for ultra-rare diseases, through which AHP treatments are evaluated.

Germany is dominating the acute hepatic porphyria treatment market in Europe. The market is driven due to its early market access system and strong orphan drug focus. The Federal Joint Committee (G-BA) provides orphan drugs with accelerated review and value-based reimbursement. Germany's expenditure on specialty pharmaceuticals include AHP treatments keeps increasing dramatically. The German healthcare system’s willingness to rapidly adopt innovative treatments, as reported by the Federal Ministry of Health (BMG), makes it a critical market for manufacturers.