Activewear Market Outlook:

Activewear Market size was valued at USD 397.5 billion in 2025 and is expected to reach USD 819.26 billion by 2035, registering around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of activewear is assessed at USD 424.33 billion.

The market is driven by evolving consumer preferences for multifunctional apparel that transitions seamlessly from workouts to everyday wear. For instance, in March 2022, Van Heusen announced the launch of a new sub-brand Flex, for consumers who seek a seamless shift between work and play.

Additionally, the growing popularity of smart wearables integrated with fitness apparel is creating new growth opportunities in the tech-driven augment. Consumer demand for inclusivity and customization is reshaping the activewear market landscape further. Brands are offering size-inclusive ranges and personalized options, allowing customers to tailor products to their specific needs. Furthermore, niche markets such as adaptive activewear for people with disabilities and maternity activewear are gaining momentum.

With the increasing focus on mental wellness, brands are also tapping into mindfulness-driven activities, introducing apparel designed to support each of the activities. In April 2022, Walmart launched a private label activewear line, Love & Sports, created in partnership with fashion designer Michelle Smith and SoulCycle instructor Stacey Griffith, with products priced between USD 12 and USD 42. Furthermore, in August 2024, ASICS introduced the NAGINO collection, designed for women to enhance their active lifestyles with performance-driven solutions.

Key Activewear Market Insights Summary:

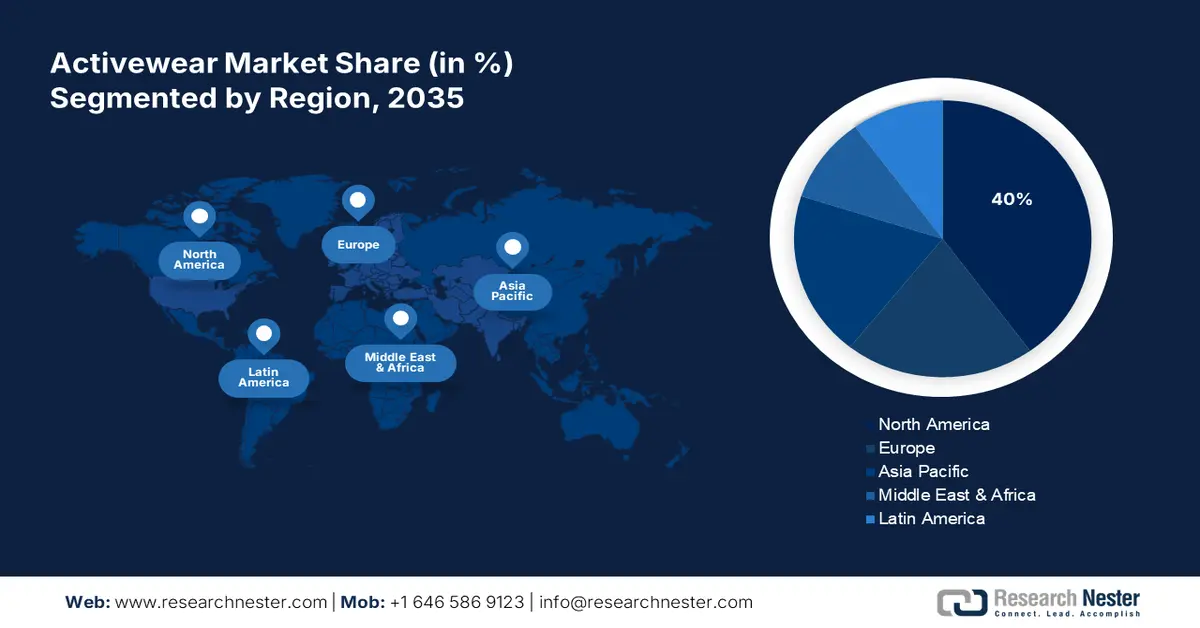

Regional Highlights:

- North America holds a 40% share of the Activewear Market, propelled by athleisure trends, sustainability focus, and fabric innovations, positioning it as a market leader through 2026–2035.

- The Asia Pacific Activewear Market is set for robust growth by 2035, driven by youth population, urbanization, and rising health awareness.

Segment Insights:

- The Footwear segment of the Activewear Market is expected to command a 47.6% share by 2035, fueled by rising demand for athletic shoes with advanced features and the growing popularity of athleisure.

Key Growth Trends:

- E-commerce growth and expansion

- Rise of athleisure

Major Challenges:

- Seasonal demand fluctuations

- Consumer expectations

- Key Players: NIKE, PUMA SE, Sketchers, Squat Wolf.

Global Activewear Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 397.5 billion

- 2026 Market Size: USD 424.33 billion

- Projected Market Size: USD 819.26 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Activewear Market Growth Drivers and Challenges:

Growth Drivers

-

E-commerce growth and expansion: The rapid rise in online shopping is a key driver in the global activewear market, enabling brands to reach broader audiences and cater to the rising demand for convenience and accessibility. Online platforms allow consumers to explore diverse product offerings from multiple brands, compare prices, and access personalized recommendations. Additionally, the integration of AR for virtual try-ons and AI-driven chatbots for customer support has enhanced the online shopping experience, driving higher engagement and sales.

-

Rise of athleisure: It is reshaping the global activewear market by blurring the boundaries between sportswear and casual fashion. This trend is particularly strong among millennials and GenZ, who prioritize comfort and versatility. Brands are also launching activewear specific to the needs of the women. In April 2023, ASICS launched a global campaign highlighting the power of exercise to help women cope with everyday stresses. The campaign was launched as a response to the ASICS 2022 State of Mind Index, which revealed that women globally tend to exercise less in comparison to men, resulting in a lower state of mind experience.

Challenges

-

Seasonal demand fluctuations: The activewear market experiences notable fluctuations in terms of seasonal demands, with sales typically peaking during warmer months and around the start of the new year, as a result of new year fitness resolutions. Spring and summer witness increased demand as outdoor activities and sports become more popular, while colder months often lead to a decline in sales.

-

Consumer expectations: Modern consumers have high expectations for activewear, demanding a combination of functionality, style, and sustainability. Inclusivity is another critical factor, with consumers seeking diverse sizing options and designs that cater to different body types. Furthermore, growing environmental awareness has led to an increased demand for sustainable materials and ethical production practices, creating a challenge for the market.

Activewear Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 397.5 billion |

|

Forecast Year Market Size (2035) |

USD 819.26 billion |

|

Regional Scope |

|

Activewear Market Segmentation:

Product Type (Apparel, Footwear, Accessories)

Footwear segment is anticipated to dominate around 47.6% activewear market share by the end of 2035. The number of athletic footwear users is expected to amount to more than 922.0 million users globally, by 2029. Consumers prioritize athletic shoes that offer advanced features such as cushioning, arch support, and shock absorption. The rise of athleisure has also boosted demand for stylish, multifunctional footwear that transitions seamlessly from gym to casual wear and has become a wardrobe staple. These factors are boosting the footwear segment’s growth in the global market significantly.

Distribution Channel (Online, Offline)

By distribution channel, the online segment is anticipated to witness steady growth during the forecast period in the global activewear market, driven by the growth of e-commerce and shifting consumer preferences toward digital shopping. Online platforms offer convenience, a wider product selection, and personalized shopping experiences, attracting time-conscious consumers. Brands and retailers are increasingly leveraging their own websites and third-party marketplaces such as Amazon and Rakuten to expand their reach and offer exclusive online collections. The rise of social commerce and influencer marketing further boosts online sales, making digital platforms a critical driver of growth in the market.

Our in-depth analysis of the market includes the following segments:

|

Product Type |

|

|

Consumer Group |

|

|

Pricing |

|

|

Distribution Channel |

|

|

Usage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Activewear Market Regional Analysis:

North America Market Analysis

North America activewear market is poised to account for revenue share of more than 40% by the end of 2035, driven by trends such as athleisure, focus on sustainability, and technological advances in fabric designs. Brands are introducing advanced performance products with moisture-wicking and temperature-regulating technologies. Companies are also expanding their presence in the region to provide consumers with better access to their products. For instance, in October 2022, Vuori announced the opening of its first East Coast, New York City flagship.

The U.S. activewear market is projected to grow steadily by increasing health consciousness and rising participation in physical activities including yoga, gym workouts, and outdoor activities. Social media influencers and celebrity endorsements are significantly shaping consumer preferences, particularly among the country’s younger demographics. Women’s activewear retains an upper hand driven by a rising focus on wellness and style.

Canada activewear market is experiencing rapid expansion owing to the rising popularity of fitness and health benefits, and a growing emphasis on eco-friendly and sustainable apparel. Consumers in the country look for versatile activewear suitable for both fitness and everyday activities. The rise of e-commerce and direct-to-consumer sales channels also play a critical role, offering Canadian consumers access to global brands.

APAC Market Statistics

APAC activewear market is set to experience robust growth, driven by a rising youth population involved in health awareness, and a growing preference for athleisure. Factors including urbanization, rising disposable incomes, and integrating wellness trends into everyday fashion significantly boost the regional market. In September 2022, Vuori announced its expansion in China, Hong Kong, and Singapore. In China, Vuori is available exclusively via Tmall, China's most popular direct-to-consumer website. Similar expansion strategies by other global players are keeping the APAC market highly competitive.

India activewear market is expanding rapidly, fueled by the country’s increasing focus on fitness and wellness. The proliferation of gyms, yoga studios, and digital fitness platforms has significantly boosted demand. Additionally, homegrown brands such as HRX, and Decathlon, along with global players are capitalizing on this growth by offering affordable, high-quality activewear. The market is also influenced by rising e-commerce penetration, enabling broader access to diverse product portfolio.

China activewear market is poised for significant growth, driven by rising health consciousness, increasing disposable incomes, and a growing middle-class population. Government initiatives promoting sports and fitness have boosted participation in a number of physical activities. Additionally, low-tier cities are emerging as key growth areas, outpacing demand in top-tier cities like Beijing, and Shanghai. The market is also seeing a rise in niche sportswear, spurred by the popularity of the Olympics and the shift toward specialized athletic apparel.

Key Activewear Market Players:

- Adidas AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ASOA PLC

- Champion

- Columbia Sportswear Company

- Fila Holdings Corporation

- Gymshark

- Lululemon Athletica Inc.

- New Balance

- NIKE

- PUMA SE

- Sketchers

- Squat Wolf

- Under Armour Inc.

- VF Corporation

- Formative Sports

Global activewear companies are focusing on product innovation with sustainable and high-performance materials, expanding into emerging markets, and leveraging e-commerce and digital marketing for broader reach. For instance, Nike led the industry of athletic apparel, accessories, and footwear, with sales reaching more than USD 50.0 billion, followed by Adidas in second place, in 2023. Strategic collaborations, influencer partnerships, and direct-to-consumer channels also enhance brand visibility and customer engagement. Some of the prominent players in the market are:

Recent Developments

- In July 2024, Pacsun launched its first dedicated men's active apparel line, versatile A.R.C. (Active. Recreation. Comfort.) Collection, tailored to the dynamic lifestyles of Gen Z males.

- In October 2022, California-inspired activewear brand Vuori launched its newest collection of outerwear, EcoOuterlands, made from over 50% recycled materials

- Report ID: 6769

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Activewear Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.