Active Oxygens Market Outlook:

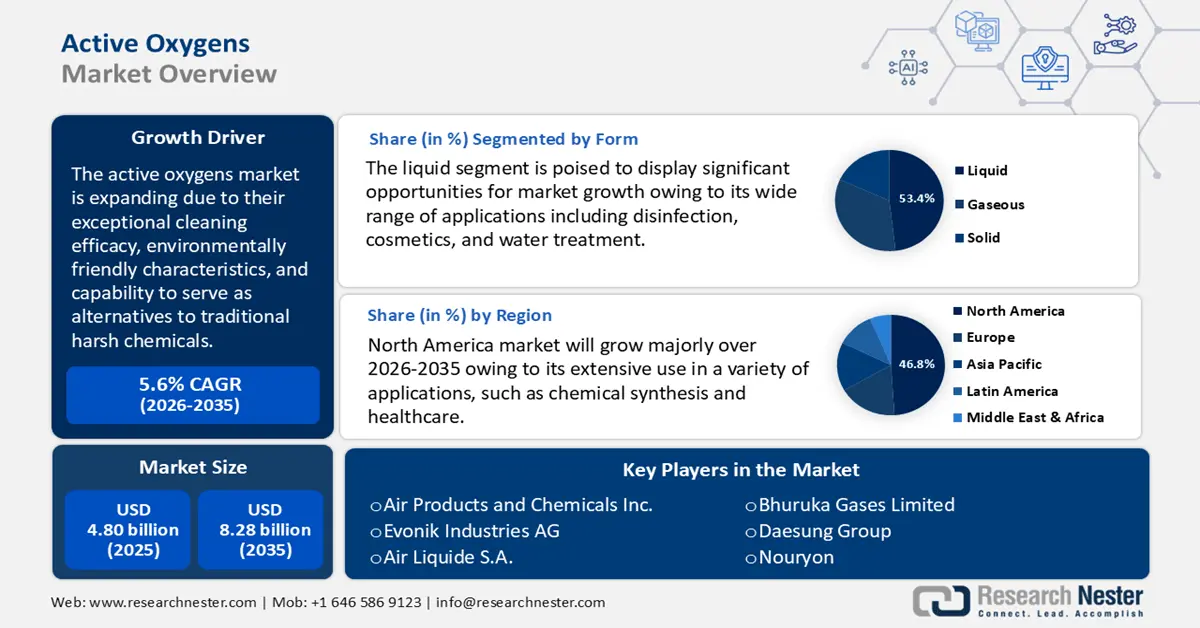

Active Oxygens Market size was valued at USD 4.80 billion in 2025 and is set to exceed USD 8.28 billion by 2035, registering over 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of active oxygens is estimated at USD 5.04 billion.

The global active oxygens market is expected to experience significant growth due to their exceptional cleaning efficacy, environmentally friendly characteristics, and capability to serve as alternatives to traditional harsh chemicals. These active oxygens are prominently utilized in a variety of detergents and cleaning products. Active oxygen compounds present a sustainable alternative for whitening, brightening, and eliminating microorganisms, as they do not contain phosphorus or nitrogen.

Unlike traditional bleach, these compounds such as sodium percarbonate lack harmful toxins, making them a safer choice for various applications. They are suitable for cleaning a wide range of materials, including plastics, fiberglass, porcelain, ceramics, wood, carpets, asphalt, and concrete. Oxygen bleach effectively dissolves dirt and can be applied to surfaces such as brick, shower walls, and the grout between tiles. Furthermore, it is particularly effective in the removal of mildew and the remediation of water damage.

Key Active Oxygens Market Insights Summary:

Regional Insights:

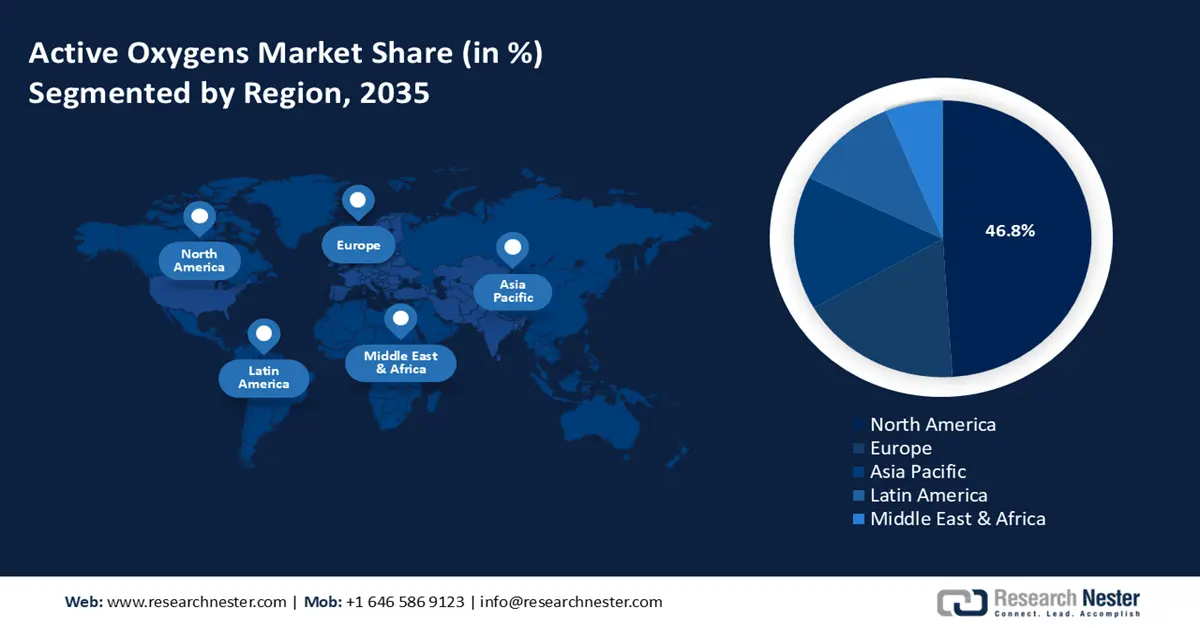

- North America is projected to command around 46.8% share of the active oxygens market by 2035, supported by a thriving healthcare sector that prioritizes infection control.

- Europe is anticipated to expand strongly through 2026–2035, underpinned by a focus on healthcare hygiene standards.

Segment Insights:

- The liquid segment is expected to secure over 53.4% share by 2035 in the active oxygens market, fueled by its wide range of applications.

- The cosmetic segment is set to witness substantial growth during 2026–2035, sustained by increasing demand for skincare and cosmetic products.

Key Growth Trends:

- Growing demand for anti aging treatments

- Increasing global trade of hydrogen peroxide

Major Challenges:

- Supply chain disruptions

- Lack of awareness & high costs

Key Players: Air Products and Chemicals Inc., Evonik Industries AG, Air Liquide S.A., Bhuruka Gases Limited, Daesung Group, Nouryon, Gulf Cryo, Linde PLC, Arkema S.A., Matheson Tri-Gas, Inc.

Global Active Oxygens Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.80 billion

- 2026 Market Size: USD 5.04 billion

- Projected Market Size: USD 8.28 billion by 2035

- Growth Forecasts: 5.6%

Key Regional Dynamics:

- Largest Region: North America (46.8% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 3 December, 2025

Active Oxygens Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand for anti-aging treatments: Active oxygens such as hydrogen peroxide and ozone are being incorporated into many anti-aging therapies on account of their capacity to revitalize skin by promoting the creation of collagen and reducing the visibility of wrinkles and fine lines. Innovative skincare solutions based on active oxygen have been created in response to consumer demand for non-invasive, effective ways to maintain youthful-looking skin, which is driving the market's compound annual growth rate. Therefore, the growing demand for facial skin care is driving the growth of the active oxygens market.

Also, natural active oxygens, such as hydrogen peroxide derived from plant extracts, are becoming popular since consumers consider them safer and better for the environment than their synthetic counterparts. Furthermore, improvements in encapsulation and delivery techniques allow for the controlled release of active oxygens in skincare products, increasing their stability and efficacy. Active oxygens are protected from deterioration through microencapsulation and nanotechnology, maintaining their potency throughout the product's shelf life. Additionally, oxygenating serums and masks are gaining popularity due to their ability to give the skin an oxygen boost, which promotes a glowing complexion. As a result of these technological advancements that encourage product diversity and enhance the customer experience, the active oxygens market is growing. - Increasing global trade of hydrogen peroxide: The expanding use of active oxygens, including hydrogen peroxide (H2O2), in water treatment applications is accelerating the market growth. These chemicals are used to treat drinking water, swimming pool water, industrial wastewater, and municipal wastewater. The World Health Organization (WHO) reported that three billion people lack basic handwashing facilities, 4.2 billion lack securely managed sanitation services, and 2.2 billion lack safely managed drinking water services worldwide. One of the most sought-after antibacterial in recent years is active oxygen sterilization, which works 3,000 times faster than chlorine and removes over 99% of bacteria and germs. H2O2 works well as a broad-spectrum disinfectant against a variety of pathogens, such as bacteria, viruses, and fungi. It is a great option for keeping water systems safe and clean because of its capacity to eliminate biofilms, which are populations of microorganisms that can grow on plumbing fixtures and water pipelines.

Therefore, the growing adoption of active oxygens such as hydrogen peroxide has increased its global trade to meet the surging demand for this compound in wastewater treatment. The Observatory of Economic Complexity revealed that at USD 1.2 billion, hydrogen peroxide was the 907th most traded product in the world in 2022. Hydrogen peroxide exports increased by 24.4% between 2021 and 2022, from USD 963 million to USD 1.2 billion. Hydrogen peroxide trade accounts for 0.0051% of global trade.

|

Exporters |

Export Value of Hydrogen Peroxide (in USD million) |

Importers |

Import Value of Hydrogen Peroxide (in USD million) |

|

Belgium |

133 |

Germany |

112 |

|

South Korea |

92.4 |

Russia |

65.4 |

|

Netherlands |

91.9 |

Italy |

58.6 |

|

Brazil |

77 |

France |

44.5 |

|

Germany |

75.7 |

Chinese Taipei |

43.9 |

Source: OEC

Challenges

- Supply chain disruptions: Supply chain disruptions of hydrogen peroxide and peracetic acid are significantly impeding the active oxygens market by creating shortages, increasing production costs, and limiting the availability of essential cleaning and disinfection products. Factors such as raw material scarcity, logistical challenges, regulatory restrictions, and geopolitical instability have led to inconsistent supply, causing price volatility and reduced market growth. For instance, the production of hydrogen peroxide is impacted by macroeconomic variables such as the U.S. dollar's strengthening, Middle East geopolitical concerns, and OPEC+'s delayed production choices. Therefore, altogether these factors are impeding the active oxygens market.

- Lack of awareness & high costs: The advantages of this product across various application areas remain largely unknown to consumers. Peracetic acid, recognized for its efficacy as a disinfectant and sterilant, has not achieved widespread recognition among potential users, particularly within sectors such as healthcare, agriculture, and water treatment. This lack of awareness may contribute to a hesitance in adopting the chemical for these critical applications. Furthermore, active oxygen is costlier than its alternatives, which include calcium hypochlorite, sodium hypochlorite, and chlorine.

Active Oxygens Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 4.80 billion |

|

Forecast Year Market Size (2035) |

USD 8.28 billion |

|

Regional Scope |

|

Active Oxygens Market Segmentation:

Form Segment Analysis

The liquid segment is expected to capture active oxygens market share of over 53.4% by 2035. Liquid active oxygens such as hydrogen peroxide solutions and peracetic acid are dominating the market owing to their versatility and ease of usage in various sectors. One of the primary factors driving this segment's growth is its wide range of applications, which include disinfection, cosmetics, and water treatment. As they mix easily, liquid forms are preferred for their even distribution and effective application in several procedures. Furthermore, a variety of industries regularly use liquid active oxygens ascribable to their regulated release and security features.

Application Segment Analysis

The cosmetic segment in active oxygens market is witnessing substantial growth during the assessed period. Globally, there is an increasing demand for skincare and cosmetic products, especially those with anti-aging and skin-rejuvenation properties. As per estimates, retail sales in the global beauty sector increased by 10% from 2022 to USD 446 billion in 2023. Active oxygens, such as hydrogen peroxide, ozone, and singlet oxygen, are increasingly used in cosmetic formulations due to their ability to enhance the texture and appearance of skin. Ecological sources of active oxygen also meet consumer needs for ecological and eco-friendly cosmetics, which are growing. Lastly, technological advancements in cosmetic formulations and packaging have made it easier to incorporate and deliver active oxygens, which has increased their attractiveness in the cosmetics industry.

Our in-depth analysis of the global active oxygens market includes the following segments:

|

Form |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Active Oxygens Market - Regional Analysis

North America Market Insights

North America active oxygens market is expected to dominate revenue share of around 46.8% by the end of 2035. The market growth can be ascribed to a thriving healthcare sector that prioritizes infection control, growing consumer demand for eco-friendly cleaning and disinfection products, and a reputable cosmetics business that employs active oxygens in skincare products. The Centers for Disease Control and Prevention reported that the need for better patient care procedures in U.S. healthcare institutions is highlighted by the fact that 1 in 43 nursing home residents and 1 in 31 U.S. patients get at least one infection related to their healthcare every day. Despite significant advancements, additional work must be done to avoid diseases linked to healthcare in several contexts, including the use of disinfectants based on active oxygen.

Furthermore, due to its extensive use in a variety of applications, such as chemical synthesis and healthcare, the active oxygens market in the U.S. is growing. Furthermore, the nation is home to some of the world's largest producers of hydrogen peroxide, guaranteeing a consistent supply for local consumption. According to the U.S. Environmental Protection Agency, in 2019, over 324 million kilograms (M kg) of hydrogen peroxide were produced domestically in the nation. Solvay, MGC Pure Chemicals, and Evonik are the main domestic producers. Furthermore, the need for hydrogen peroxide disinfectants has surged due to the post-pandemic emphasis on hygiene. Additionally, it is anticipated that investments in sustainable practices and improvements in production technologies would spur additional growth in this industry.

Additionally, in September of 2024, the price of hydrogen peroxide in the U.S. was 780 USD/MT. Due to robust orders from the electronics and healthcare sectors, the U.S. market saw a significant price increase in the third quarter of 2024. Price increases were also influenced by seasonal restocking initiatives and demand projections for the holidays.

In Canada, there’s an increase in household cleaning products sales which is driving the active oxygens market. Statistics Canada reported that retail sales of household cleaning products reached USD 1.4 billion countrywide in the second quarter of 2023, during the spring-cleaning frenzy of the previous year. That amount was more than the previous quarter's close to USD 1.3 billion. Also, increasing awareness of sustainability and environmental regulations has driven the shift from traditional chemical-based disinfectants to active oxygen compounds such as hydrogen peroxide, sodium percarbonate, and peracetic acid which offer effective disinfection without harmful residues. Furthermore, government initiatives promoting green chemicals and stringent regulations on chlorine-based bleaches have also fueled the adoption of oxygen-based cleaning agents.

Europe Market Insights

Europe active oxygens market is expected to grow at a significant rate during the projected period. The region's thriving pharmaceutical and cosmetics businesses, stringent laws encouraging sustainable and eco-friendly disinfection practices, and a focus on healthcare hygiene standards all contribute to the demand for active oxygens. Furthermore, the growing demand is supported by its demonstrated efficacy in food processing, water treatment, and healthcare. As a result, active oxygen has become the go-to remedy for preserving high standards of regional cleanliness.

In the UK, stringent environmental regulations and government policies promoting green chemicals are driving manufacturers to adopt active oxygen-based formulations as alternatives to traditional bleach and chlorine-based products. Additionally, the rise in public hygiene awareness has boosted the demand for advanced cleaning and disinfection solutions. The expanding industrial sector, coupled with technological advancements in active oxygen applications, is further fueling the active oxygens market growth.

Furthermore, Germany's robust industrial base and sophisticated manufacturing capabilities are driving the country's active oxygens market expansion. The nation's emphasis on sustainability and innovation encourages the use of hydrogen peroxide in a variety of industries, such as food processing and textiles. Furthermore, manufacturers are encouraged to look for environmentally friendly substitutes such as active oxygen due to Germany's strict chemical usage rules.

Active Oxygens Market Players:

- Air Products and Chemicals Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik Industries AG

- Air Liquide S.A.

- Bhuruka Gases Limited

- Daesung Group

- Nouryon

- Gulf Cryo

- Linde PLC

- Arkema S.A.

- Matheson Tri-Gas, Inc.

Active oxygens market is highly competitive with numerous large players vying for market supremacy. Prominent industry participants are focusing on research and development to create new active oxygen formulations and uses, including industrial processes, disinfection, and cosmetics. Strategic partnerships and acquisitions are often necessary to broaden product offerings and global reach. Businesses are focusing on environmentally friendly production methods and natural sources for active oxygens to meet the growing consumer demand for environmentally friendly products. Environmental friendliness and sustainability are two significant market developments that market participants are pursuing and have emerged as critical competitive advantages.

Recent Developments

- In January 2025, Evonik and Fuhua Tongda Chemicals Company (Fuhua) formed a joint venture in Leshan, Sichuan Province, to manufacture and market hydrogen peroxide (H2O2) in China. Evonik holds a 51% stake in the new firm, Evonik Fuhua New Materials (Sichuan) Co., Ltd., while Fuhua owns the remaining 49%.

- In November 2024, Nouryon declared that it finished expanding its organic peroxide production capacity at its Ningbo, China, manufacturing facility. The capacity to produce Perkadox 14 and Trigonox 101 organic peroxide products has doubled due to the expansion, reaching 6,000 tons each.

- Report ID: 7146

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Active Oxygens Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.