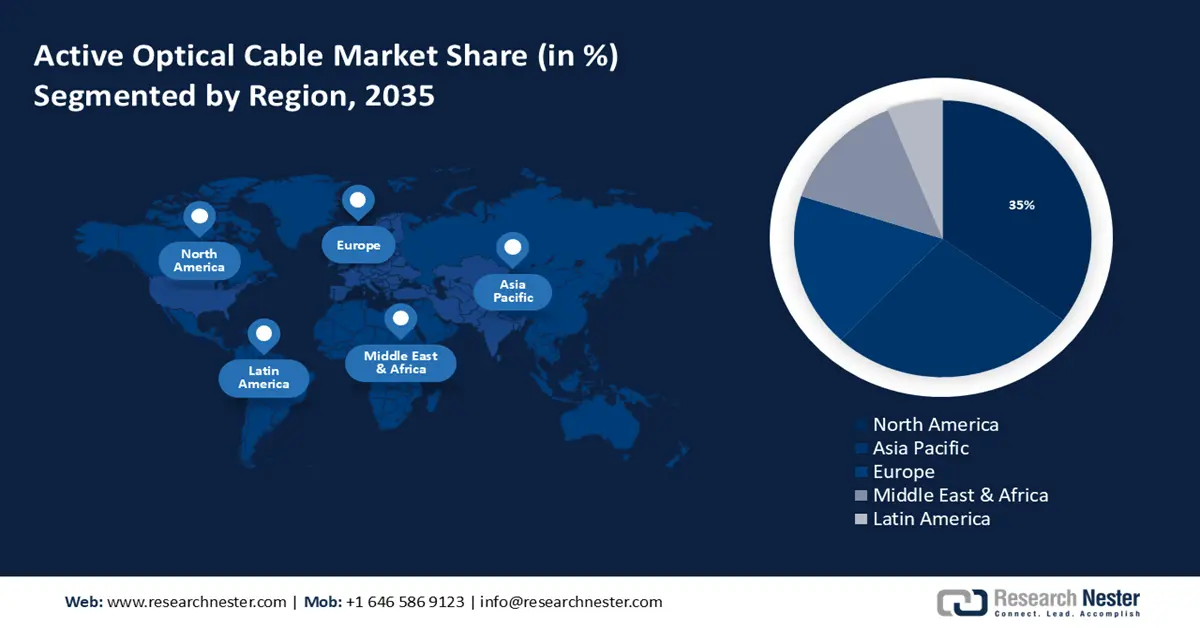

Active Optical Cable Market Regional Analysis:

North American Market Insights

The active optical cable market in North America is projected to hold the largest share of 35% by 2035. The growth can be attributed to the increasing need for active optical cables in data centers. Fibre optics is the broadband technology with the fastest rate of growth in North America. The interconnect is becoming a more vital component of modern data centers as it provides the necessary communications connectivity across several servers, memory, and computational resources.

'Plain old telephone service' (POTS) is made possible by telecom service providers in the area via active optical connections that connect their nationwide networks, and they convey data over vast distances via active optical connections. The region's concentration of large corporations, academic institutions, governmental organizations, and banks encourages the usage of active optic cables.

APAC Market Insights

Asia Pacific active optical cable market is poised to hold the second-largest share of 27% during the foreseen period. Due to the quick development of data centers and cloud computing facilities, the active optical cable and extender market in Asia Pacific has experienced significant growth. From 1.08 million cabinets in 2015 to 2.39 million cabinets in 2020, China's data center cabinet count has grown significantly. A significant rise in power usage is correlated with the number of data center cabinets. The use of AOCs and extenders has been accelerated by this rise in demand for high-speed, dependable, and efficient connectivity options. The increasing dependence of businesses and customers on online services has made the need for seamless data transmission and low latency critical in the region.