- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview Market Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- Donau Chemie AG

- Norit (One Equity Partners)

- Puragen Activated Carbons

- CarboTech

- Activated Carbon Technologies Pty Ltd

- Silcarbon Aktivkohle GmbH

- Ingevity Corporation

- DESOTEC

- Haycarb PLC

- Western Carbon & Chemicals

- Carbon Activated Corporation

- Ongoing Technological Advancements

- Patent Analysis

- SWOT Analysis

- Porter Fiver Forces Analysis

- Strategic Initiatives Adopted by Key Players

- Type Analysis for Activated Carbon Market

- Merger’s and Acquisition Analysis

- Recent Developments Analysis

- Industry Risk Assessment

- Gobal Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2037, By

- Raw Material, Value (USD Million)

- Coal

- Coconut Shell

- Wood Based

- Type, Value (USD Million)

- Powdered

- Granular

- Extruded Activated Carbon

- Application, Value (USD Million)

- Liquid Phase

- Gas Phase

- End use, Value (USD Million)

- Water Treatment

- Air Purification

- Pharmaceutical

- Others

- Regional Synopsis (USD Million), 2024-2037

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Raw Material, Value (USD Million)

- Global Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Raw Material, Value (USD Million)

- Coal

- Coconut Shell

- Wood Based

- Type, Value (USD Million)

- Powdered

- Granular

- Extruded Activated Carbon

- Application, Value (USD Million)

- Liquid Phase

- Gas Phase

- End use, Value (USD Million)

- Water Treatment

- Air Purification

- Pharmaceutical

- Others

- Country Level Analysis, Value (USD Million)

- China

- Japan

- India

- Indonesia

- Malaysia

- Australia

- Thailand

- Vietnam

- South Korea

- Rest of Asia Pacific

- Raw Material, Value (USD Million)

- Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Raw Material, Value (USD Million)

- Coal

- Coconut Shell

- Wood Based

- Type, Value (USD Million)

- Powdered

- Granular

- Extruded Activated Carbon

- Application, Value (USD Million)

- Liquid Phase

- Gas Phase

- End use, Value (USD Million)

- Water Treatment

- Air Purification

- Pharmaceutical

- Others

- Country Level Analysis, Value (USD Million)

- U.S.

- Canada

- Raw Material, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2037, By

- Raw Material, Value (USD Million)

- Coal

- Coconut Shell

- Wood Based

- Type, Value (USD Million)

- Powdered

- Granular

- Extruded Activated Carbon

- Application, Value (USD Million)

- Liquid Phase

- Gas Phase

- End use, Value (USD Million)

- Water Treatment

- Air Purification

- Pharmaceutical

- Others

- Country Level Analysis, Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Raw Material, Value (USD Million)

- Overview

- Latin America Market

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Raw Material, Value (USD Million)

- Coal

- Coconut Shell

- Wood Based

- Type, Value (USD Million)

- Powdered

- Granular

- Extruded Activated Carbon

- Application, Value (USD Million)

- Liquid Phase

- Gas Phase

- End use, Value (USD Million)

- Water Treatment

- Air Purification

- Pharmaceutical

- Others

- Country Level Analysis, Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Raw Material, Value (USD Million)

- Global Overview

- Middle East & Africa Market

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), By

- Raw Material, Value (USD Million)

- Coal

- Coconut Shell

- Wood Based

- Type, Value (USD Million)

- Powdered

- Granular

- Extruded Activated Carbon

- Application, Value (USD Million)

- Liquid Phase

- Gas Phase

- End use, Value (USD Million)

- Water Treatment

- Air Purification

- Pharmaceutical

- Others

- Country Level Analysis, Value (USD Million)

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Raw Material, Value (USD Million)

- Global Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Activated Carbon Market Outlook:

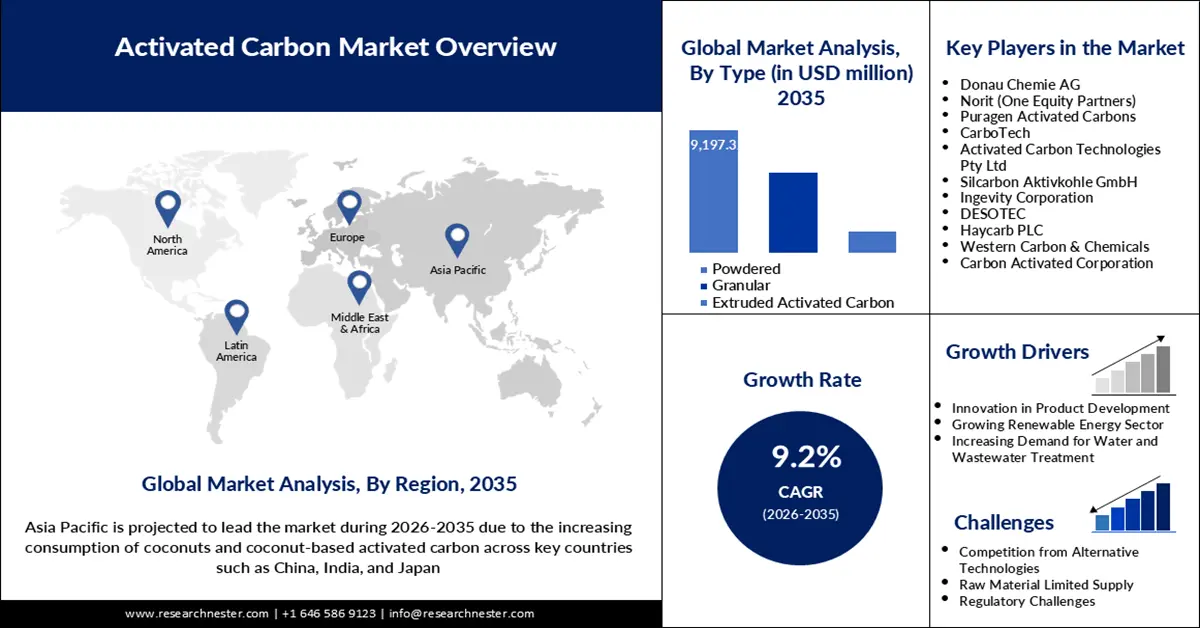

Activated Carbon Market size was over USD 5.58 Billion in 2025 and is poised to exceed USD 13.45 Billion by 2035, witnessing over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of activated carbon is estimated at USD 6.04 Billion.

The activated carbon market is expected to record considerable growth due to rising demand from various industries, including water purification, air filtration, and energy storage. Environmental sustainability concerns and increased stringency of regulatory requirements are further accelerating the adoption of activated carbon solutions. In September 2024, the Jacobi Group invested in sustainable production related to coconut shell charcoal, part of the strategic development of 'Go Green' aimed at decreasing the level of dependence on fossil-based raw materials and its further influence on the environment. Such developments are setting a path for the market players toward greener and more productive methods.

Government initiatives also contribute to market growth. In July 2024, for example, the Singapore Economic Development Board (EDB) partnered with the International Emissions Trading Association to establish the Singapore Carbon Market Alliance, which is a platform that brings buyers and sellers of carbon credits together to advance sustainable practices across industries that also involve activated carbon. Such efforts underline the importance of sustainability in driving innovation and activated carbon market growth while offering solutions to global environmental challenges.

Key Activated Carbon Market Insights Summary:

Regional Highlights:

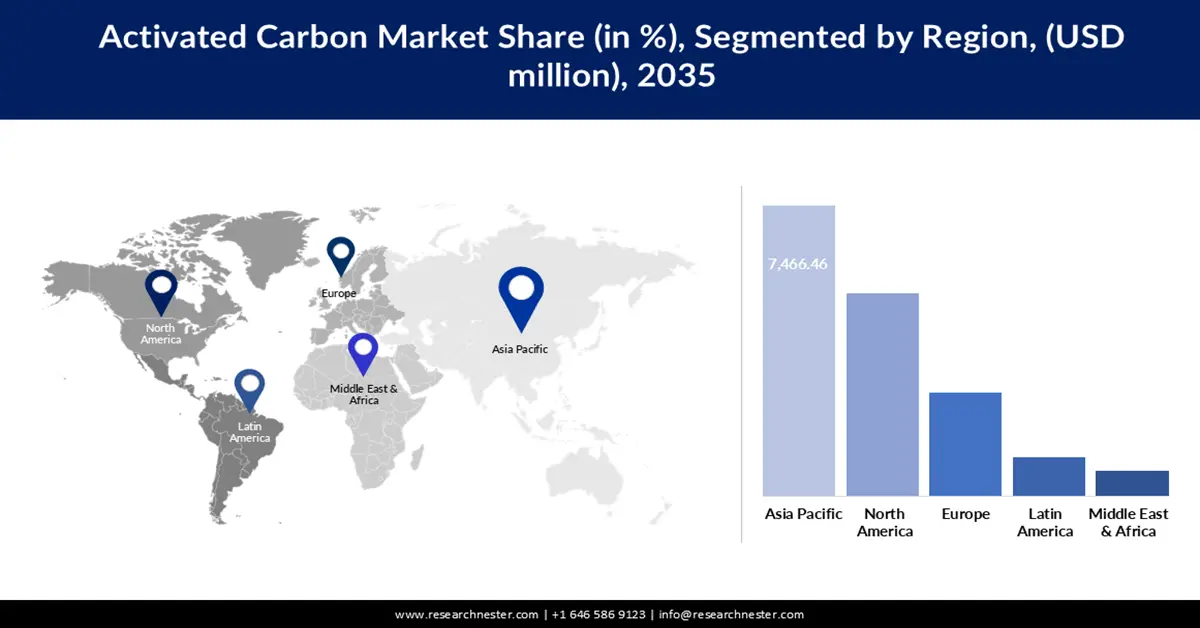

- The Asia Pacific activated carbon market will dominate over 43.9% share by 2035, fueled by rapid industrialization, urbanization, and demand for water & air purification.

- The North America market will achieve significant growth from 2026 to 2035, attributed to strict environmental regulations and higher adoption of advanced purification technologies.

Segment Insights:

- The coal segment in the activated carbon market is forecasted to hold a 55.10% share by 2035, driven by coal's high adsorption capacity for water and air purification.

- The powdered segment in the activated carbon market is forecasted to secure a 53.70% share by 2035, driven by its fine particle size supporting a wide range of environmental uses.

Key Growth Trends:

- Increase in demand for water purification solutions

- Growth in air filtration applications

Major Challenges:

- Increase in demand for water purification solutions

- Growth in air filtration applications

Key Players: Donau Chemie AG, Norit (One Equity Partners), Puragen Activated Carbons, CarboTech, Activated Carbon Technologies Pty Ltd, Silcarbon Aktivkohle GmbH, Ingevity Corporation, DESOTEC, Haycarb PLC, Western Carbon & Chemicals, Carbon Activated Corporation.

Global Activated Carbon Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.58 Billion

- 2026 Market Size: USD 6.04 Billion

- Projected Market Size: USD 13.45 Billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, India, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Activated Carbon Market Growth Drivers and Challenges:

Growth Drivers

- Increase in demand for water purification solutions: The lack of clean water globally has driven the demand for activated carbon in water purification and treatment of wastewater to a significant level. Hence, these applications are expected to grow at a high rate in urban areas because the population and industries are increasing at a higher rate in these areas. In March 2023, Evoqua Water Technologies LLC acquired Kemco Systems' industrial water treatment business, positioning itself strongly in the competitive activated carbon market. These strategic steps highlight the growing reliance on activated carbon towards solving worldwide water challenges commensurate with strict standards set for the environment.

- Growth in air filtration applications: The overall increasing levels of air pollution on the planet hastened the increased usage of activated carbon in air filtration systems. Its ability to trap pollutants, harmful gases, and odors makes it an indispensable component in improving air quality. This demand is particularly acute in regions with dense urban populations and industrial activity. In October 2022, Cabot Corporation announced a global price increase for its specialty carbon black products, reflecting the growing pressure on supply chains to meet surging demand. This trend underlines the material's importance in furthering environmental and public health initiatives.

- Development of energy storage technologies: Activated carbon is also witnessing rapid adoption in energy storage applications, especially lithium-ion batteries. Large surface area and conductivity, provided by activated carbon, are needed to improve the performance and efficiency of batteries. This demand is further enhanced by the sudden growth of the renewable energy sector, which has sparked a need for more advanced energy storage solutions using activated carbon. In August 2022, Ingevity announced a USD 60 million investment to develop lithium-ion anode materials and simultaneously firmed up a supply agreement with Nexeon. This strategic investment underlines the increasingly important synergy between the production of activated carbon and sustainable energy innovation.

Challenges

- Environmental concerns about raw material sourcing: Raw materials used in the production of activated carbon, including coal, coconut shells, and wood, have been increasingly scrutinized for environmental reasons. Processes are commonly linked to deforestation, loss of biodiversity, and a significant contribution to carbon emissions. These issues have sparked the demand for greener sourcing and production methods, however, balancing environmental responsibility against growing global demand is one of the most important challenges that manufacturers of activated carbon face.

- Regulatory barriers and compliance costs: Strict environmental regulations concerning the production and disposal of activated carbon also present considerable problems for manufacturers. Compliance generally implies cleaner technologies, lower emissions, and safe handling of waste products. While these are essential, they increase operational costs and may present a barrier to survival for small players in the activated carbon market. Differences in regional regulations further complicate production and export issues for global manufacturers. Surmounting these challenges will require ongoing innovation and investment, straining resources in an already competitive market.

Activated Carbon Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 5.58 Billion |

|

Forecast Year Market Size (2035) |

USD 13.45 Billion |

|

Regional Scope |

|

Activated Carbon Market Segmentation:

Raw Material Segment Analysis

Coal segment is expected to dominate around 55.1% activated carbon market share by the end of 2035. Due to its high adsorption capacity, coal is an indispensable raw material in a number of applications, especially in water and air purification. It finds much demand because of its efficiency in the removal of impurities from drinking water and industrial wastewater by coal-based activated carbon. In November 2024, Indcarb Activated Carbon launched a series of inline water filters using high-quality coal-derived activated carbon, illustrating recent innovations within the category. The growth of the segment reflects its critical contribution towards serving the increasing global demand for effective filtration solutions.

Type Segment Analysis

By the end of 2035, powdered segment is poised to capture around 53.7% activated carbon market share, owing to its usage across different industry applications. The fine particle size makes it suitable for application in water treatment, air purification, and industrial processes. In October 2022, Kuraray Co., Ltd. announced an expansion in the reactivated carbon production facility, further addressing sustainable practices and efficiency in material usage. The investment consolidated the leadership of the company in the category of powdered activated carbon, serving the needs of environmental solution-finding industries. The versatility of the segment has continued to make it a staple in the activated carbon market, as it supports a wide range of applications that are considered critical.

Our in-depth analysis of the global market includes the following segments:

|

Raw Material |

|

|

Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Activated Carbon Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific in activated carbon market is anticipated to account for around 43.9% revenue share by 2035. Rapid industrialization coupled with fast urbanization throughout the region has kept demand for activated carbon high, mainly for water and air purification applications. More than 80% of the wastewater generated in the region is discharged without being treated, which opens immense opportunities for activated carbon solutions in water treatment. Additionally, this demand is driven by increased industrial technologies and environmental awareness. The ability of the region to adopt these solutions to its growing infrastructure underlines its leading position in the global market.

The growing industrial base, added to the rising focus on access to clean water, is driving the activated carbon market in India. In municipal and industrial water treatment, the demand for activated carbon is growing rapidly with a large population and large-scale water scarcity. Furthermore, increased awareness related to air pollution has also increased the demand for air purifiers in which activated carbon is used at a considerable rate. Other factors, such as government initiatives toward adopting better environmental standards and sustainable manufacturing practices, are also driving the market toward growth.

China dominates the activated carbon market in Asia Pacific, influenced by rapid industrial processing and sustainable material advancement. The country faces significant environmental challenges from untreated wastewater and industrial emissions, creating substantial demand for various technologies in the market. In April 2023, Ningbo Juhua Chemical & Science Co., Ltd. collaborated with Technip Energies for the construction of a PDO and PTT plant. This represents China effort towards greening the industrial base. These developing instances mark the strategic investment of the country in cutting-edge technology, thereby sealing its leading position in the regional as well as global market.

North America Market Insights

North America region is expected to register significant growth till 2035, due to strict environmental regulations and higher adoption of advanced water and air purification technologies. This is attributed to growing interest in sustainability and health safety concerns across the region, driving higher demand for activated carbon solutions in key applications in wastewater treatment and industrial emission control, among others. Further enhancing the capabilities and efficiency of activated carbon products are investments in research and development. Such initiatives reinforce North America position as a key contributor to the global market.

In the U.S., the activated carbon market is driven by pressing environmental concerns and regulatory pressures. According to the Environmental Protection Agency, about a third of rivers and lakes are unsuitable for use. This makes the purification of water a crucial activity on a daily basis. The versatility in the removal of contaminants has made activated carbon indispensable in modern systems. In August 2022, Ingevity strengthened its supply chain with regard to activated carbon products by investing in advanced materials to show innovation and infrastructural development in the country. These factors put the U.S. in an advantageous position to drive market growth in North America.

The high emphasis on environmental sustainability and conservation in natural resources management in Canada contributes to its activated carbon market. The country is also tackling the challenges of water treatment and industrial emissions control, with a range of activated carbon solutions being implemented to meet these goals. Growth in filtration and purification technologies, especially due to the increasing use of sustainable materials, also epitomizes a commitment from Canada to environmental stewardship. Regional partnerships and investment in advanced manufacturing facilities further reinforce the activated carbon market growth in Canada.

Activated Carbon Market Players:

- Donau Chemie AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Norit (One Equity Partners)

- Puragen Activated Carbons

- CarboTech

- Activated Carbon Technologies Pty Ltd

- Silcarbon Aktivkohle GmbH

- Ingevity Corporation

- DESOTEC

- Haycarb PLC

- Western Carbon & Chemicals

- Carbon Activated Corporation

The activated carbon market is highly competitive and consists of leading companies such as Donau Chemie AG, Norit (One Equity Partners), Ingevity Corporation, Haycarb PLC, and DESOTEC, which are driving the developments in the industry. These players are focused on leveraging innovative production techniques and sustainable raw materials to achieve the surging demand for high-performance solutions. Furthermore, the players are garnering market share through strategic expansions and partnerships, boosting their presence in the market. Activated carbon manufacturers are paying greater attention to the sustainability and effectiveness of the processes, thereby showing their commitment to regulatory imperatives with a view toward challenges related to the environment.

The dynamism of the activated carbon market has provoked substantial investments in R&D to enable customized products for a wide range of applications. In March 2023, Cabot Corporation launched the EVOLVE technology program, which marked one of the most important steps forward in the sustainability of production processes within the framework of the activated carbon industry. This program focuses on recovering carbon products from end-of-life tires, creating a circular economy model that minimizes waste and reduces the carbon footprint. This emphasis on closed-loop processes underlines the growing importance of integrating environmental goals into technological advancement within the activated carbon sector.

Here are some leading companies in the activated carbon market:

Recent Developments

- In November 2024, CarbonFree announced the development of a zero-carbon mineralization process aimed at capturing and converting industrial CO₂ emissions into usable products. This innovation has the potential to significantly reduce greenhouse gas emissions across various industries, including the activated carbon sector, by providing sustainable carbon management solutions.

- In May 2024, Organic Recycling Systems Limited unveiled GAC-01, a new grade of activated carbon granules designed for water treatment applications. These granules aim to improve the efficiency and effectiveness of water purification processes, addressing increasing demand for clean water solutions.

- In January 2023, Cabot Corporation committed to investing USD 200 million to expand conductive carbon capacity at its existing facility in Pampa, Texas, over the next five years. This investment aims to support product expansion and meet growing demand in the U.S. market. It is also expected to create jobs and strengthen Cabot’s position in the sustainable materials sector.

- Report ID: 4492

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Activated Carbon Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.