Acrylic Resins Market Outlook:

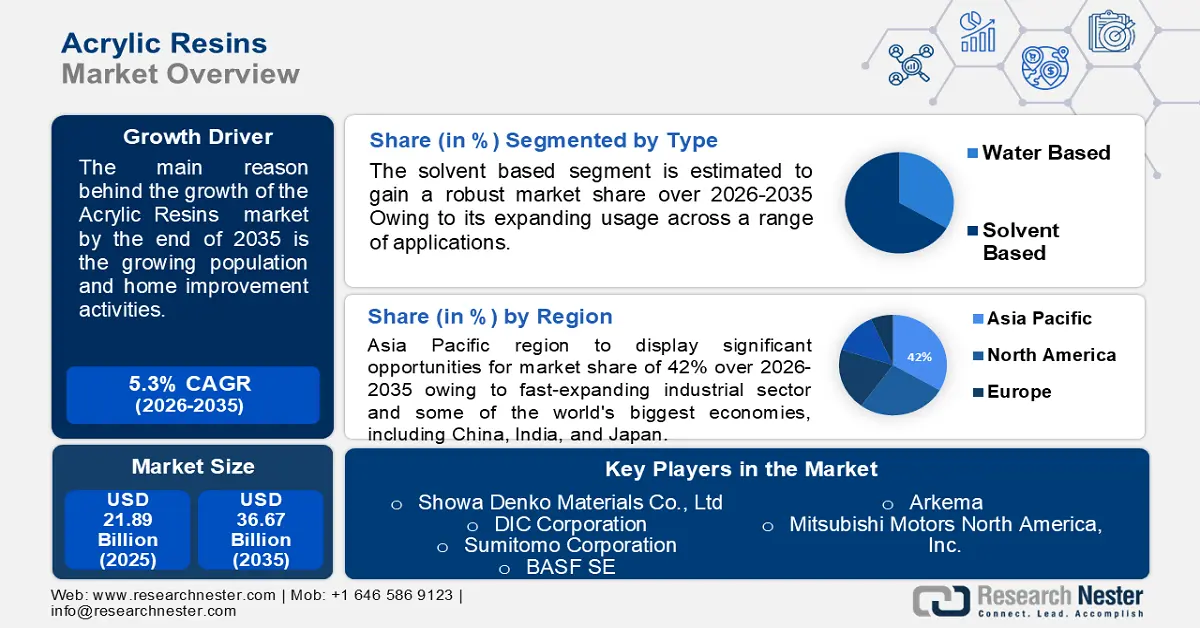

Acrylic Resins Market size was valued at USD 21.89 Billion in 2025 and is likely to cross USD 36.69 Billion by 2035, expanding at more than 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acrylic resins is assessed at USD 22.93 Billion.

Growing population and home improvement activities are estimated to propel market growth. The need for housing rises in tandem with the expansion of the world's population, fueling a surge in building activities and home renovation initiatives. The demand for acrylic resins, which are frequently employed in construction as sealants, adhesives, and in the production of other building materials, is therefore increased. As per the estimations of the United States Census Bureau, the global population reached 7 billion in 2011 and may reach 8 billion in 2023.

Increasing demand for antimicrobial and antiviral coating and rapid urbanization is estimated to fuel the acrylic resins market size in the coming years. The need for antimicrobial and antiviral coatings in a variety of settings, including hospitals, schools, and public transportation, has increased as a result of the COVID-19 epidemic, and this is projected to fuel demand for acrylic resins. The construction sector is also expanding quickly due to rapid urbanization, particularly in emerging nations, and this has increased demand for acrylic resins used in building and construction products. More than half the world’s population i.e., 55% of the population lived in urban areas in 2017 and more than 4.3 billion live in urban areas now in 2022.

Key Acrylic Resins Market Insights Summary:

Regional Highlights:

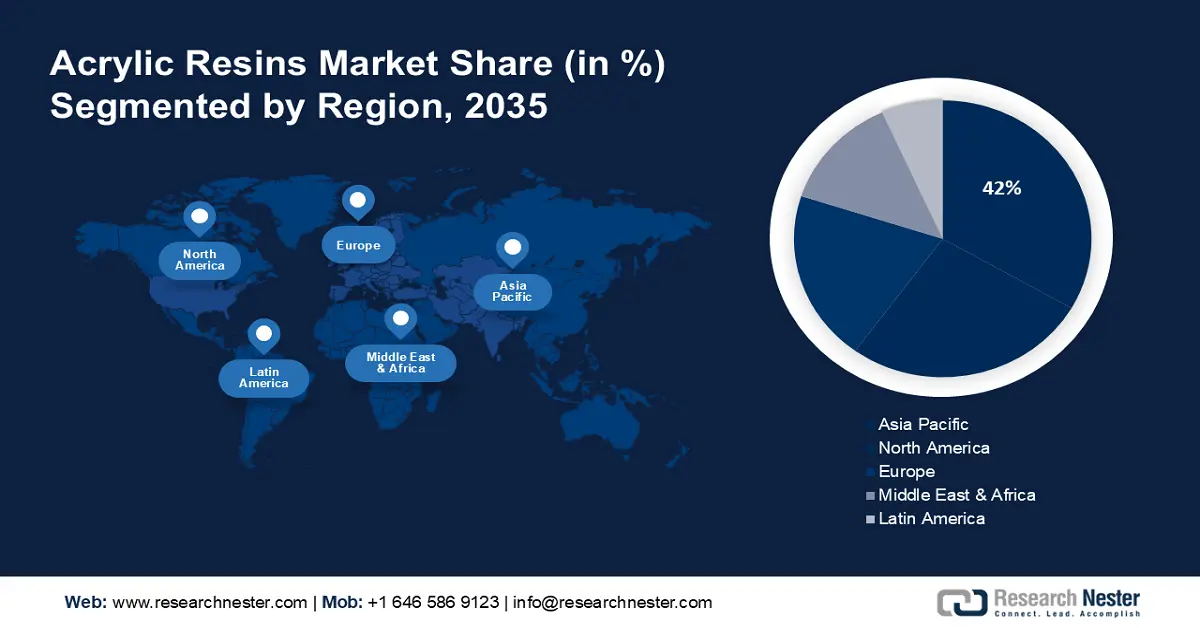

- The Asia Pacific acrylic resins market will secure around 42% share by 2035, fueled by growing consumer goods, automotive, and construction sectors, plus rising disposable income and favorable regulations.

Segment Insights:

- The automotive segment in the acrylic resins market is expected to secure the largest share by 2035, attributed to rising vehicle sales and broad usage of acrylic resins in automotive components.

- The solvent based segment in the acrylic resins market is expected to achieve a dominant share by 2035, fueled by its application in coatings and adhesives and growth in construction.

Key Growth Trends:

- Growing Industrial Manufacturing Sector

- Increasing Disposable Income and Living Standards

Major Challenges:

- Presence of Pollutants

- Increasing Number of Regulations

Key Players: The Dow Chemical Company, BASF SE, Arkema, Mitsubishi Motors North America, Inc., Nippon Shokubai Co., Ltd, DSM N.V., Mitsui Chemicals India Pvt. Ltd., Showa Denko Materials Co., Ltd, DIC Corporation, Sumitomo Corporation.

Global Acrylic Resins Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.89 Billion

- 2026 Market Size: USD 22.93 Billion

- Projected Market Size: USD 36.69 Billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, South Korea, Thailand, Brazil

Last updated on : 10 September, 2025

Acrylic Resins Market Growth Drivers and Challenges:

Growth Drivers

- Rising Use in Medical Sector - Acrylic resins are used in the manufacturing of dental fields for dental liners and denture bases. Also, for the production of test kits, syringes, blood filters, cuvettes, and connecting tubes. All these applications are estimated to boost market growth during the forecast period. The global imported trade value of syringes with or without needles was worth USD 7,723,804 in 2021.

- Growing Industrial Manufacturing Sector – Given its widespread usage in the manufacture of several industrial goods, including machinery and equipment, acrylic resin demand is predicted to increase along with the industrial manufacturing sector. The manufacturing sector contributed about USD 2269.2 to the U.S Gross Domestic Product comprising 10.8% of the total GDP.

- Increasing Disposable Income and Living Standards – The consumption of acrylic resins used in the manufacture of such items is driven by customers' increased propensity to invest in home renovation projects and durable consumer goods as their disposable income and living standards rise. The consumer price index (CPI) of all urban consumers raised 0.1% in Aug 2022, a rise of 8.3% in the last 12 months.

- Rising Need for New Hospitals and Healthcare Facilities – Since acrylic resins are used to make medical devices and equipment like dental fillings and prostheses, the need for new hospitals and healthcare facilities is anticipated to increase. The government of Iraq invested over USD 750 million in healthcare infrastructure with new hospitals as per the estimations.

- Increasing Demand in Construction Industry – The rising construction industry is attributed to the growing demand for paints & coatings. The need for acrylic resins used as adhesives, sealants, and plastic goods, is anticipated to increase as the construction industry expands and there is a greater demand for new homes. About USD 300 billion was spent on new public construction in 2018 as per the estimations.

Challenges

- Presence of Pollutants - The manufacture of acrylic resins, which are synthetic polymers, discharges pollutants into the environment, potentially harming both human health and the ecosystem. Pollutant levels may also have an impact on the overall market for acrylic resins if customers choose more ecologically friendly alternatives as they become more aware of the negative effects that synthetic materials have on the environment.

- Increasing Number of Regulations

- High Cost of Labor

Acrylic Resins Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 21.89 Billion |

|

Forecast Year Market Size (2035) |

USD 36.69 Billion |

|

Regional Scope |

|

Acrylic Resins Market Segmentation:

End-user Segment Analysis

The global acrylic resins market is segmented and analyzed for demand and supply by end-user into building & construction, automotive, electronics, packaging, and others. Out of these, the automotive segment is anticipated to hold the largest market size by the end of 2035 on the back of increasing vehicle purchases by individuals. Automotive coatings employ acrylic resins as binders to give the outside of the car durability and protection. They also serve as adhesives to join various parts and elements and are also employed in the production of interior trim, including door panels, dashboard elements, and seat coverings. Their usage is bound to increase with the growth in the automotive industry. For instance, the hybrid electric vehicles sale raised by 76% between 2020-2021.

Type Segment Analysis

The global acrylic resins market is also segmented and analyzed for demand and supply by type into the water and solvent-based. Owing to its expanding usage across a range of applications, the solvent-based sector is predicted to have the greatest market share by the end of 2035. Solvents including ethyl acetate, butyl acetate, and xylene are used to create solvent-based acrylic resins. These resins are utilized in applications like coatings and adhesives, where a thicker and more solid layer is required. Their use will continue to grow with their growing use in metal and wood materials, and the growth of the construction sector. For instance, it is estimated that over 12,000 new buildings will be constructed by the end of 2050, according to projections.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Type |

|

|

By Product |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acrylic Resins Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is poised to account for largest revenue share of 42% by 2035. The region has a fast-expanding industrial sector and some of the world's biggest economies, including China, India, and Japan. The need for acrylic resins is being driven by the expanding consumer goods, automotive, and construction sectors in the region. Aside from that, a rise in the standard of living and an increase in disposable income is driving up demand for home renovation goods, which mostly depend on acrylic resins as raw ingredients. Additionally, the availability of inexpensive labor and raw materials, as well as favorable government regulations, are luring international corporations to locate their operations in the area, further increasing demand for acrylic resins. The growth of the market can be on account of increasing commercial buildings and construction events, and automobile production. 60% of the global construction growth is attributed to India, China, and Indonesia.

North AmericanMarket Insights

The North American acrylic resins market is also expected to garner a sizeable portion of the global acrylic resins market, owing to the existence of a sizable construction industry and an established automotive sector. The market for acrylic resins is also expanding owing to the region's developed industrial infrastructure and increasing demand for high-quality goods. Moreover, in the construction sector in North America, acrylic resins are frequently employed as binders in paints, adhesives, and sealants. The demand for acrylic resins is being driven by the region's robust infrastructure-building activities, particularly in the commercial and residential construction segments.

Acrylic Resins Market Players:

- The Dow Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BASF SE

- Arkema

- Mitsubishi Motors North America, Inc.

- Nippon Shokubai Co., Ltd

- DSM N.V.

- Mitsui Chemicals India Pvt. Ltd.

- Showa Denko Materials Co., Ltd

- DIC Corporation

- Sumitomo Corporation

Recent Developments

-

Arkema planned to acquire Polimeros Especiales to expand the coating solutions segment in developing markets and in low-volatile organic compounds.

-

BASF SE did the installation and start-up of a state-of-the-art acrylic dispersions production line in Dahej, India. The production line complimented the old setup and lets the new dispersion technology production under Styronal PLUS 7918, Styronal ES series, Basonal FCB, Acronal EDGE, and Acronal PLUS product ranges.

- Report ID: 4491

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acrylic Resins Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.