Acetoacetanilide Market Outlook:

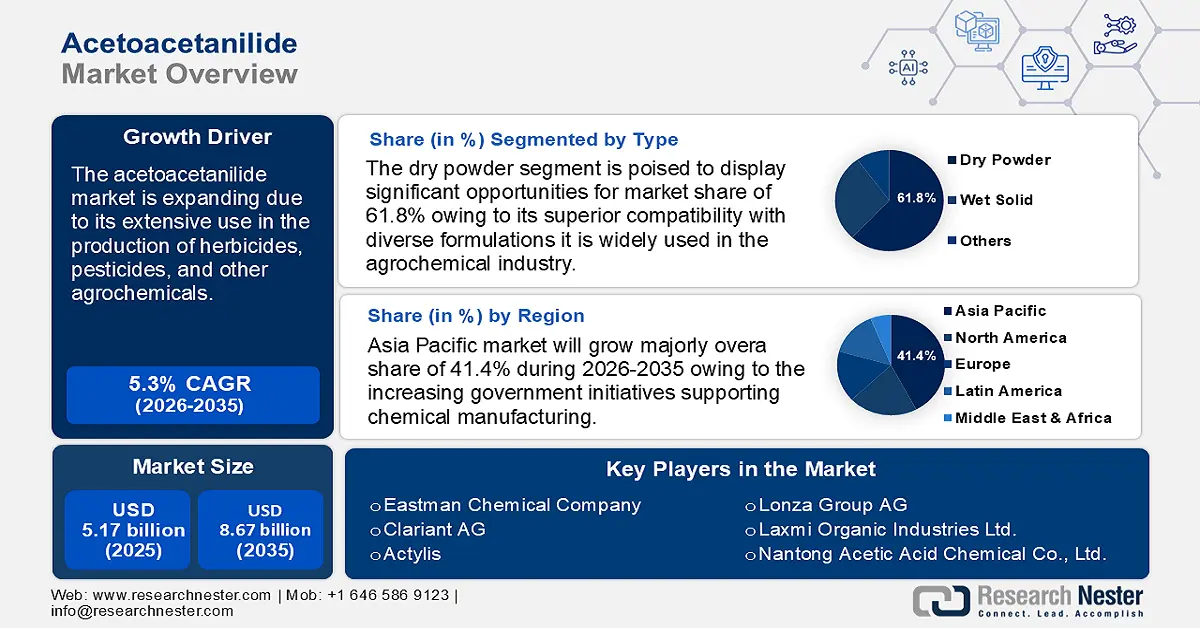

Acetoacetanilide Market size was over USD 5.17 billion in 2025 and is poised to exceed USD 8.67 billion by 2035, growing at over 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acetoacetanilide is estimated at USD 5.42 billion.

The global acetoacetanilide market is thriving due to its extensive use as an intermediate for producing herbicides, pesticides, and other agrochemicals. As the demand for food security rises, more land is being cultivated, leading to a higher need for agrochemicals to maximize crop yields and protect against pests. In September 2023, the World Bank Organization reported that in 2022, up to 783 million people were hungry, and estimates indicate that more than 600 million people will still struggle to provide for their families in 2030. Also, market participants are striving to increase their market share in the agrochemical industry by providing customized formulations that satisfy changing agricultural needs owing to this expanding trend. According to market trends, the compound's use in formulations generates profitable acetoacetanilide market potential.

Acetoacetanilide is a key intermediate in producing widely used herbicides such as Acetochlor and Butachlor, which are crucial for weed control in large-scale farming. Additionally, advancements in pesticide formulations and the adoption of herbicide-tolerant crops have further boosted demand for acetoacetanilide-based chemicals. The agrochemical industry increasingly uses compounds based on acetoacetanilide to create more potent crop protection solutions in response to the global demand for increased agricultural production and the move toward more sustainable and efficient farming methods. According to the USDA, the production, productivity, and resource consumption of the worldwide agricultural sector experienced significant changes between 1961 and 2020. The world's population surged 2.6 times while agricultural productivity nearly quadrupled, resulting in a 53% rise in agricultural output per capita.

Key Acetoacetanilide Market Insights Summary:

Regional Highlights:

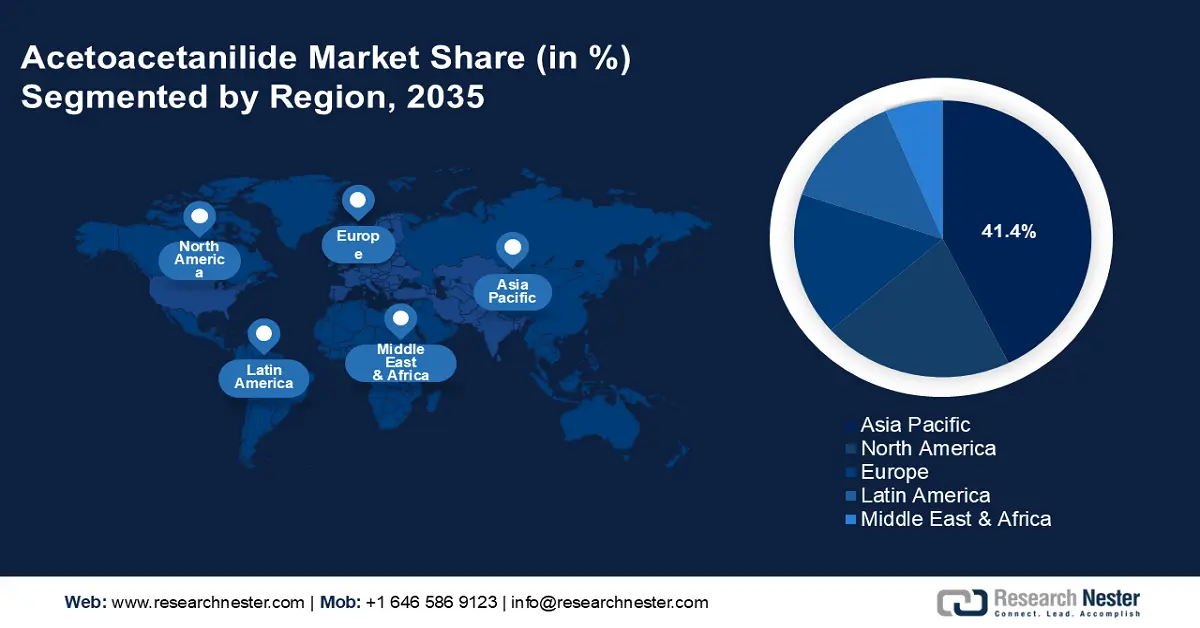

- Asia Pacific acetoacetanilide market will account for 41.40% share by 2035, fueled by fast growth in chemical sector, pharmaceutical industry, and government support.

Segment Insights:

- The dry powder segment in the acetoacetanilide market is anticipated to achieve a 61.80% share by 2035, driven by its superior stability, ease of handling, and broad applicability in high-performance sectors.

- The pigments & dyes segment in the acetoacetanilide market is projected to exhibit significant growth over 2026-2035, driven by rising demand for organic pigments in coatings, textiles, and automotive industries.

Key Growth Trends:

- Increasing demand in the production of organic pigments

- Rising demand for effective wastewater management

Major Challenges:

- Fluctuations in raw material prices

- Competition from alternative products

Key Players: Eastman Chemical Company, Clariant AG, Actylis, Nantong Acetic Acid Chemical Co. Ltd, Jiangyan Yangtze River Chemical Co., Ltd., Lonza Group AG, Laxmi Organic Industries Ltd., Dayang chem (Hangzhou) Co., Ltd., Jiangsu Changyu Chemical Co., Ltd., Cangzhou Goldlion Chemicals Co., Ltd..

Global Acetoacetanilide Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.17 billion

- 2026 Market Size: USD 5.42 billion

- Projected Market Size: USD 8.67 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Acetoacetanilide Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand in the production of organic pigments: The market for acetoacetanilide is experiencing significant growth due to its increasing application in the manufacturing of organic pigments, particularly within the coatings, inks, and plastics industries. The International Union for Conservation of Nature and Natural Resources reported that more than 460 million metric tons of plastic are produced for a wide range of uses each year. Therefore, the growing production of plastic is consequently driving the acetoacetanilide market. This substance serves as a vital precursor in the production of azo pigments, which are widely recognized for their stability, heat resistance, and vibrant colors.

The growing acceptance of these pigments is largely driven by the demand for environmentally friendly and non-toxic options in paints and coatings, especially in the construction and automotive sectors. Acetoacetanilide is positioned as an essential component in these industries, as it enhances pigment quality while ensuring adherence to environmental safety regulations. The analysis indicates that the compound's role as an intermediate is a key factor propelling the expansion of the acetoacetanilide market. - Rising demand for effective wastewater management: The European Investment Bank revealed that 380 billion m3 of municipal wastewater is produced worldwide each year. It is anticipated that wastewater production will rise by 51% by 2050 and 24% by 2030. However, wastewater is seen as an increasing issue rather than a beneficial and sustainable source of water, energy, and nutrients since it is still widely believed to be a source of pollution that needs to be cleaned and disposed of. To address this a recent study demonstrated the efficient biodegradation of acetoacetanilide in hypersaline wastewater using a synthetic halotolerant bacterial consortium. This breakthrough addresses a critical environmental challenge by enabling the sustainable treatment of industrial effluents with high salinity, particularly from dye, pharmaceutical, and agrochemical sectors where acetoacetanilide is widely used.

The development of such bioremediation strategies not only mitigates ecological risks but also enhances regulatory compliance for industries, fostering increased adoption of acetoacetanilide-based products. As a result, this advancement is expected to drive market growth by improving the sustainability credentials of manufacturers, reducing environmental treatment costs, and expanding applications in industries seeking eco-friendly production processes. The rising confidence in effective wastewater management is likely to boost demand, further propelling the market growth.

Challenges

-

Fluctuations in raw material prices: Aniline and diketene, which are used to manufacture acetoacetanilide, are both susceptible to price swings as a result of supply chain interruptions and changes in the chemical industry's market dynamics. Price uncertainty for end consumers results from the direct impact of this raw material cost volatility on production costs. Additionally, some production processes' reliance on chemicals derived from petroleum also adds to market instability, especially in areas where oil prices fluctuate. According to the analysis of market trends, the reliance on different raw materials impedes the growth of the acetoacetanilide market.

-

Competition from alternative products: The existence of alternative products, especially in the chemical and pharmaceutical industries, presents serious obstacles for the acetoacetanilide business. Potential clients may be turned off by these alternatives since they frequently provide comparable functional qualities at cheaper prices than acetoacetanilide-based solutions. Since manufacturers and end users are increasingly choosing alternative compounds that offer equivalent performance but superior cost-effectiveness, the market's growth trajectory is hampered. Companies in the acetoacetanilide industry are under constant pressure from competitors to innovate or lower prices, which is squeezing profit margins and restricting market growth overall.

Acetoacetanilide Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 5.17 billion |

|

Forecast Year Market Size (2035) |

USD 8.67 billion |

|

Regional Scope |

|

Acetoacetanilide Market Segmentation:

Type Segment Analysis

Dry powder segment is set to account for around 61.8% acetoacetanilide market share by 2035. Due to its superior compatibility with diverse formulations, excellent stability, and ease of handling, dry powder acetoacetanilide finds extensive use across a range of sectors.It is essential for synthesizing organic and high-performance pigments (HPPs). As a result of its effective dispersion in formulations, the dry form is also favored in the agrochemical industry. Its consistent quality makes it ideal for high-precision applications such as polymer additives and pharmaceutical intermediates. The increasing use in sectors needing precise chemical characteristics and regulated reactivity is driving this segment's growth. Also, its exceptional stability and increased demand in high-performance sectors including pigments and agrochemicals is propelling the expansion of the acetoacetanilide market.

Application Segment Analysis

Based on application, the pigments & dyes segment in acetoacetanilide market is anticipated to grow significantly by 2035. Acetoacetanilide is a crucial component in the synthesis of azo dyes and organic pigments, which are used extensively in several industries, including paints, coatings, and textiles.

It is essential to the manufacturing of high-performance pigments (HPP) owing to its function in maintaining and improving pigment performance. The market is boosted by the notable increase in demand for organic pigments, especially in industries such as printing inks and automotive coatings. Additionally, there is a growing demand for customized cars with unique colors and designs due to the rising sales of automobiles, escalating the acetoacetanilide market. Its highly sophisticated use in pigments guarantees constant color purity and heat stability, both of which are necessary to uphold product requirements in cutting-edge industrial applications.

Our in-depth analysis of the global acetoacetanilide market includes the following segments:

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acetoacetanilide Market Regional Analysis:

APAC Market Insights

Asia Pacific acetoacetanilide market is expected to capture revenue share of over 41.4% by 2035. Asia Pacific is the region with the fastest rate of growth, with China, India, and Japan at the top of the market. China leads the market due to its extensive chemical sector and lower production costs, and the region's expanding pharmaceutical sector also contributes to demand since it is used in various active pharmaceutical ingredients (APIs). Also, government initiatives supporting chemical manufacturing and relaxed environmental regulations in some regions further encourage production.

Moreover, advancements in bioremediation and wastewater treatment solutions are helping industries comply with stricter environmental policies, ensuring sustainable growth. With ongoing industrialization, technological advancements, and increasing R&D investments, China’s acetoacetanilide market is set to expand further in the coming years. Furthermore, as China strengthens its position as a leading exporter of aniline, global manufacturers of dyes, pigments, agrochemicals, and pharmaceuticals benefit from the stable and cost-effective supply of this essential intermediate. Therefore, growing exports of aniline from China will drive market growth in the region. The Observatory of Economic Complexity reported that China is the world's second-largest supplier of aniline and its salts, with USD 443 million in exports in 2022. Aniline and its salts were China's 1141st most exported goods that year.

|

Importers |

Import Value of Aniline and its salts (USD million) |

|

Belgium |

139 |

|

India |

138 |

|

Spain |

96.3 |

|

Russia |

20.9 |

|

South Korea |

14.1 |

Source: OEC

Additionally, as India's agricultural and textile industries grow, so does the country's use of acetoacetanilide, a crucial intermediate in the manufacturing of pigments, insecticides, and herbicides. The country’s growing pharmaceutical industry, driven by increased healthcare needs and exports, further boosts demand. Also, with India emerging as a major hub for chemical synthesis and exports, the market is poised for steady expansion. According to the India Brand Equity Foundation, India is third in Asia and sixth globally in terms of chemical production, which accounts for 7% of the country's GDP. Between April and September of 2024, organic and inorganic chemical exports totaled USD 14.09 billion USD.

North America Market Insights

North America acetoacetanilide market is expected to grow at a significant rate during the projected period. The demand from the coating and agrochemical sectors is the main factor driving North America's sizeable market share. Acetoacetanilide is widely used in pesticides and herbicides, and as a middleman in the manufacturing of pigments and dyes for the paint and coatings industry, making the U.S. a major player in this market. The region gains from a robust industrial base and significant agrochemical consumption. Also, the growing emphasis on eco-friendly manufacturing and technological innovations in chemical synthesis further contribute to market expansion.

Similarly, in Canada, the increasing demand for high-performance coatings in the construction and automotive sectors has significantly boosted the need for acetoacetanilide-based pigments and stabilizers. Additionally, the country’s focus on research and development, along with stringent environmental regulations, has also encouraged the adoption of innovative and sustainable chemical processes.

Acetoacetanilide Market Players:

- Eastman Chemical Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Clariant AG

- Actylis

- Nantong Acetic Acid Chemical Co. Ltd

- Jiangyan Yangtze River Chemical Co., Ltd.

- Lonza Group AG

- Laxmi Organic Industries Ltd.

- Dayang chem (Hangzhou) Co., Ltd.

- Jiangsu Changyu Chemical Co., Ltd.

- Cangzhou Goldlion Chemicals Co., Ltd.

Major companies in the fiercely competitive acetoacetanilide market provide both domestic and foreign markets. To maintain a dominant position in the worldwide acetoacetanilide market, major manufacturers are using several strategies in product innovation, end-user launches, and research and development (R&D). The following are key players in the acetoacetanilide market:

Recent Developments

- In March 2024, Clariant, a specialty chemical company focused on sustainability, showcased a variety of innovative paint and coatings solutions at the American Coatings Show 2024, North America's premier coatings industry event. Clariant's technical experts discussed industry-leading solutions that reduce environmental footprints and optimize product performance while meeting or exceeding the most recent regulatory requirements.

- In October 2021, Aceto, a major global distributor of specialty materials for life sciences and advanced technologies, acquired A&C BioBuffer Ltd, a GMP maker of custom buffers and chemical blends. Products used in the manufacture of biopharmaceutical drugs.

- Report ID: 7105

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acetoacetanilide Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.