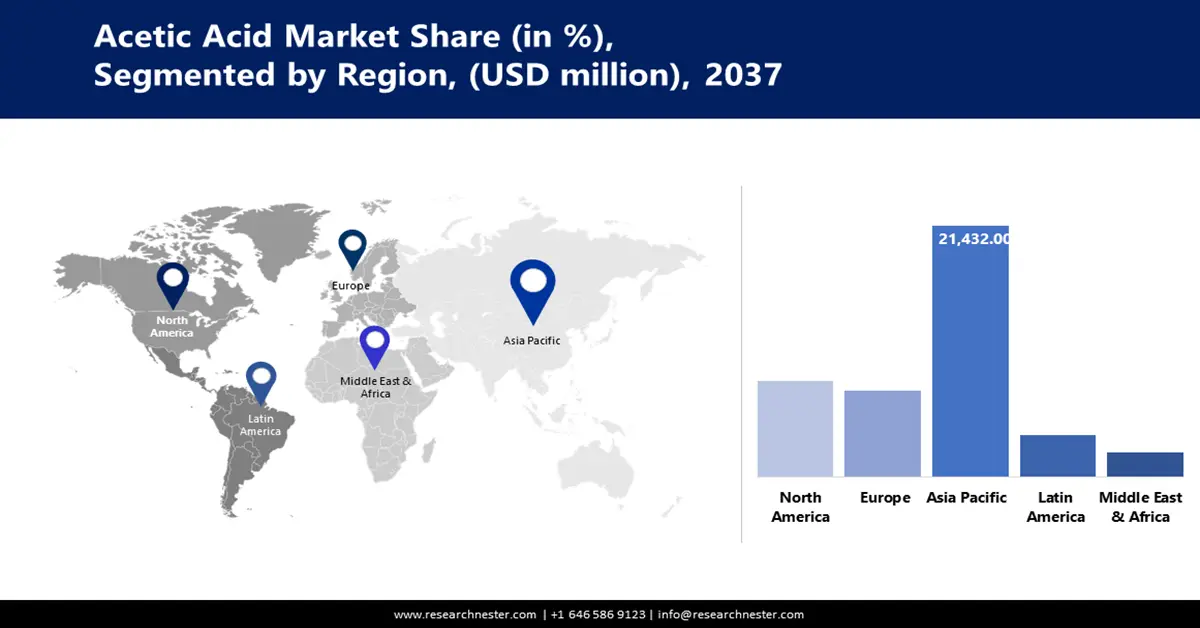

Acetic Acid Market - Regional Analysis

APAC Market Insights

Asia Pacific acetic acid market is expected to hold 57% of the market during the forecast period. This is due to the region's enormous manufacturing platform, accelerated industrialization, and huge investment in new production capabilities. In December 2024, China was reported to be spearheading global acetic acid capacity additions to 2028 at more than 90% of the global supply. This is due to the accelerated growth of the textile, plastics, and pharmaceutical industries in the region, positioning APAC as the hub of the global acetic acid market.

China acetic acid market is expanding at a rapid pace, with massive new-build schemes reinforcing its leadership of the world supply. Guangdong Shengyuanda Technology's new Jieyang acetic acid facility, scheduled to come on stream in March 2026 with a planned capacity of 1.5 million tonnes annually, is the largest new capacity addition to the nation. It is facilitated by the China government's pursuit of industrial self-sufficiency and stricter environmental standards that are rallying the market behind higher, more efficient producers.

India acetic acid market is characterized by a strategic push to develop domestic production and reduce imports. In January 2025, Indian demand for acetic acid was reported to be increasing steeply, partially driven by outages at major local units, such as GNFC, indicating the country's desire for supply chain security. This has highlighted the strategic importance of initiatives like the November 2024 Memorandum of Understanding between INEOS Acetyls and GNFC, which aims to build a new 600,000-tonne-a-year acetic acid facility in Gujarat. This project is designed to make India more self-sufficient.

North America Market Insights

North America acetic acid market is predicted to rise at a CAGR of 6.6% between 2026 and 2037, driven by massive investment in new manufacturing capacity and a strong focus on sustainable manufacturing. In June 2022, INEOS Acetyls announced that it had initiated a study to assess the feasibility of a new world-scale acetic acid plant on the U.S. Gulf Coast, utilizing competitively priced feedstocks in the region. This is part of a series of trends of onshoring and increasing domestic manufacturing to supply the growing demand from the chemicals, plastics, and automotive sectors. The regional market is also driven by a favorable regulatory climate that encourages innovation in green chemistry and the development of low-carbon technologies.

The U.S. acetic acid market is advancing with great focus on sustainability and technology innovation. In April 2024, the Celanese Corporation finished strategic upgrades to its worldwide acetyl chain network, including the startup of a new low-carbon production plant for acetic acid at its Clear Lake, Texas, facility. The project enhances manufacturing efficiency and aligns with the company's vision for the sustainable development of core acetyl derivatives markets. The U.S. market is also supported by policies of the government that are favorable to green manufacturing and the development of bio-based substitutes, which makes the country a global leader in clean chemical production.

Canada market for acetic acid is growing in synchrony with North American trends towards sustainability and high-purity chemical solutions. In August 2024, Avantor, Inc. broadened its high-purity chemical solutions for the biopharma and advanced technology markets, such as specialized acetic acid for applications such as HPLC and trace metal analysis. The expansion, fueled by a customer-centric innovation strategy and global supply chain, addresses growing demand in Canada for high-quality, reliable chemical inputs. Canada market is also gaining from its proximity to key U.S. production centers and shared emphasis on regulatory harmonization and environmental responsibility.

Europe Market Insights

Europe acetic acid market is anticipated to experience significant growth between 2026 and 2037, owing to a high commitment towards the circular economy and the establishment of bio-based chemicals. In May 2023, Swedish bio-chemicals producer Sekab announced a significant rise in its production of bio-based acetic acid, driven by growing demand for fossil-free chemicals in Europe. The company's product, certified with ISCC+, offers a carbon footprint decrease of up to 50%, in line with the region's ambitious sustainability goals. The European market is also driven by stringent environmental policies, such as the Carbon Border Adjustment Mechanism (CBAM), in favor of the adoption of low-carbon production methods.

Germany acetic acid market is thriving, spurred by its position as a global leader in the chemicals industry and by its focus on the efficiency of the supply chain. HELM AG, the Hamburg-based group, reaffirmed its solid and resilient position in the chemicals market in July 2024, with its Base Chemicals division continuing to provide essential industrial inputs, such as acetic acid and acetic anhydride, to customers worldwide through its extensive global network. German companies are also among the green technology and sustainable production processes leading adopters, keeping the country's position as a leading driver of demand and innovation in the European market for acetic acid.

The UK acetic acid market is led by European policy drives and mounting emphasis on sustainable chemical production. European Union policymakers launched the transitional period of its Carbon Border Adjustment Mechanism (CBAM) in October 2023, a policy that will eventually charge a carbon price on certain imports. The policy will encourage UK production and encourage low-carbon production methods for chemicals like acetic acid to remain competitive in the Europe marketplace. The UK also witnesses growing demand for green chemicals, driven by consumer trends and corporate sustainability initiatives.