Acetic Acid Market Outlook:

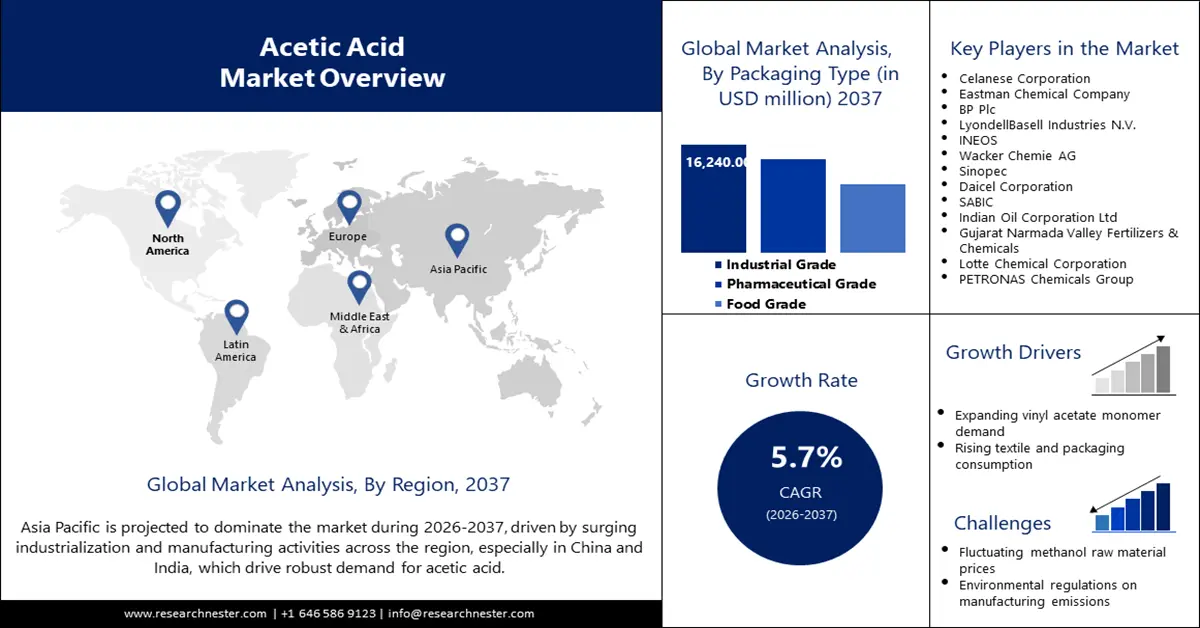

Acetic Acid Market size was valued at USD 17.2 billion in 2025 and is projected to reach a valuation of USD 40.1 billion by the end of 2037, rising at a CAGR of 5.7% during the forecast period, i.e., 2026-2037. In 2026, the industry size of acetic acid is evaluated at USD 18.2 billion.

The acetic acid market is witnessing a drastic change due to rising focus on sustainability and supply chain optimization. Suppliers are investing more in low-carbon production and circular economies to meet strict environmental regulations and corporate sustainability practices. In February 2024, climate-tech firm Again signed a record 10-year agreement with global chemical distributor HELM AG to supply 50,000 tonnes of low-carbon acetic acid made through CO₂ fermentation. The agreement is the industry's transition to new, green solutions. The industry is also seeing strategic capacity build-outs and CAPEX to optimize efficiency and meet regional supply gaps, setting producers up for long-term growth.

The raw material supply chain for acetic acid is heavily dependent on the carbonylation process of methanol, utilizing methanol and carbon monoxide as primary feedstocks. The comparative price of these feeds is directly tied to volatile markets for crude oil and natural gas and their resulting direct impact on chemical prices. To cater to rising demand from the rest of the world, several companies are focused on increasing their production capacity. As per the Independent Commodity Intelligence Services (ICIS), the production capacity of acetic acid increased from 17.3 million tons in 2019 to 20.0 million tons in 2023. This increase, together with large new capacities installed in Asia in recent years, is indicative of the industry responding to protracted demand.

Key Acetic Acid Market Insights Summary:

Regional Insights:

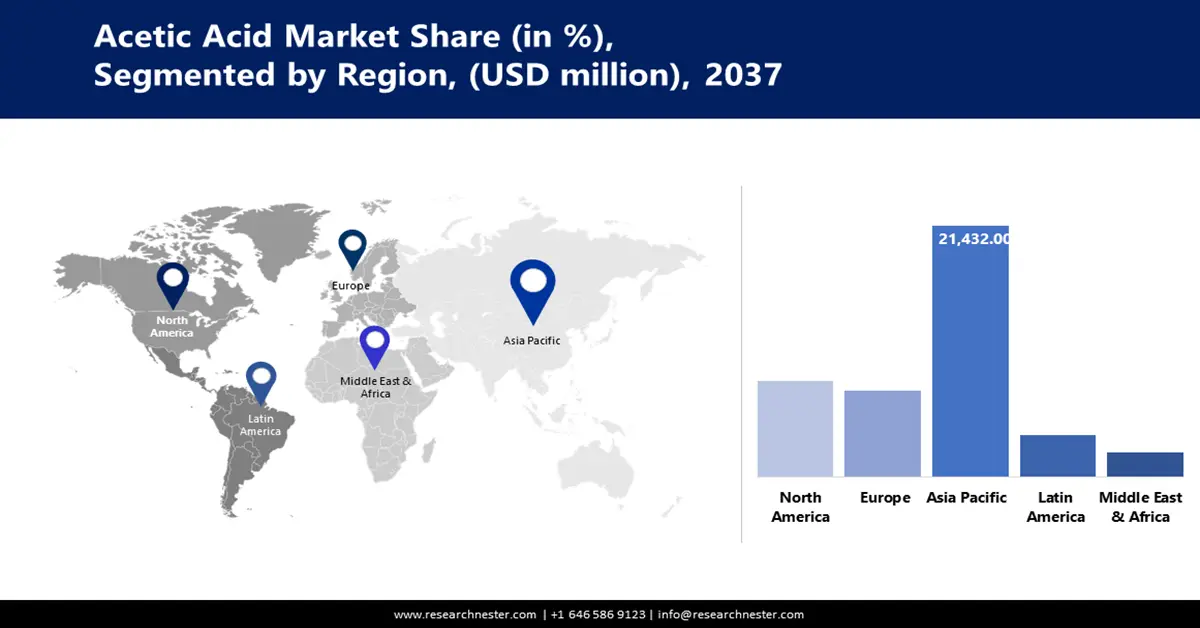

- The Asia Pacific acetic acid market is expected to command a 57% share by 2037, attributed to rapid industrialization, large-scale manufacturing expansion, and increasing investments in new production capacities.

- North America is projected to register a 6.6% CAGR from 2026 to 2037, supported by rising domestic manufacturing investments and a growing emphasis on sustainable production practices.

Segment Insights:

- The industrial-grade segment of the Acetic Acid Market is projected to account for 40.5% share by 2037, propelled by the rising demand for high-purity feedstock in industrial chemical production.

- The vinyl acetate monomer (VAM) segment is expected to secure 34.5% share through 2037, fueled by increasing consumption in paints, adhesives, coatings, and textile manufacturing.

Key Growth Trends:

- Expansion of downstream industries

- Strategic investment in domestic output

Major Challenges:

- Increased stringent environmental regulations

- Supply chain volatility and manufacturing delays

Key Players: Celanese Corporation, Eastman Chemical Company, BP Plc, LyondellBasell Industries N.V., INEOS, Wacker Chemie AG, Sinopec, Daicel Corporation, SABIC, Indian Oil Corporation Ltd, Gujarat Narmada Valley Fertilizers & Chemicals, Lotte Chemical Corporation, HELM AG, Incitec Pivot Limited.

Global Acetic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.2 billion

- 2026 Market Size: USD 18.2 billion

- Projected Market Size: USD 40.1 billion by 2037

- Growth Forecasts: 5.7% CAGR (2026-2037)

Key Regional Dynamics:

- Largest Region: Asia Pacific (57% Share by 2037)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, India, Japan, Germany

- Emerging Countries: Indonesia, Vietnam, Brazil, Mexico, South Korea

Last updated on : 23 September, 2025

Acetic Acid Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of downstream industries: Among the most significant growth drivers is the strong growth of downstream industries that use acetic acid as a major raw material. Growth in the polyester business, in turn, is a key demand driver since acetic acid is an essential solvent in the manufacturing of Purified Terephthalic Acid (PTA). A new mega PTA plant was commissioned in Asia in October 2024, a development that should strongly increase regional demand for acetic acid when operational at full capacity. Such explicit linking of polyester manufacturing with acetic acid consumption demonstrates the sensitivity of the market to the health of its end-use industries.

- Strategic investment in domestic output: Governments and companies are strategically investing to develop local production capacity, decrease import dependence, and increase supply chain resilience. INEOS Acetyls and Gujarat Narmada Valley Fertilizers & Chemicals Ltd (GNFC) have signed a Memorandum of Understanding in November 2024 for a joint venture to construct a new 600,000-tonne-per-year acetic acid plant in Gujarat, India. Large-scale project, due to come on stream in around 2028, is a direct response to India's heavy import dependence on acetic acid and is part of a trend towards strategic onshoring of chemical manufacturing globally.

- Innovation in sustainable production practices: Global decarbonization momentum is fueling low-carbon sustainable production innovation of acetic acid, opening the door to sustainable solutions. In February of 2024, Celanese introduced its groundbreaking ECO-CC product series of low-carbon acetic acid with certified CCU technology. By transforming captured CO₂ into productive feedstocks, the solution minimizes lifecycle greenhouse gas emissions. Increasing demand for green chemicals from green consumers and policy leaders is prompting manufacturers to invest in such technology, leading to a more sustainable and competitive industry.

Challenges

- Increased stringent environmental regulations: One of the major issues confronting the acetic acid sector is the tightening of environmental regulations, which entails heavy investment in pollution monitoring and control technology. In April 2024, the U.S. Environmental Protection Agency (EPA) issued new final regulations to cut toxic air pollution from chemical facilities, focusing on toxic pollutants from plants that manufacture or process major chemicals, including acetic acid. Adhering to the tighter standards is likely to demand capital-intensive modernization and raise the cost of operation, which can be problematic for producers with existing plants.

- Supply chain volatility and manufacturing delays: The market is also vulnerable to supply chain disruptions and unexpected production delays, which can cause market instability and price fluctuations. In August 2023, Celanese announced a delay in the startup of its new Clear Lake acetic acid plant due to defects in high-metallurgy parts supplied by a vendor. The delay, which extended the project's contribution to earnings to early 2024, highlighted the intricacy and risks of commissioning world-scale chemical production plants. Such incidents can have a significant domino effect throughout the supply chain, affecting both producers and consumers.

Acetic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2037 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 17.2 billion |

|

Forecast Year Market Size (2037) |

USD 40.1 billion |

|

Regional Scope |

|

Acetic Acid Market Segmentation:

Grade Segment Analysis

The industrial-grade segment is expected to hold a 40.5% acetic acid market share during the forecast period, as it is widely utilized as a primary feedstock for the production of a diverse range of industrial chemicals and products. Uniformity of industrial-grade acetic acid purity and quality is critical to the performance of final products in the plastics, textile, and paint industries. Shandong Aojin Chemical Technology Co., Ltd. has been issued an SGS-certified test report in January 2024 for its acetic acid, which claimed a 99.8% purity and was in accordance with high GB/T 1628-2008 standards. This emphasis on purity further underscores the significance of the segment in industrial applications. The demand for high-purity reagents is a consistent growth driver, and the guarantee of reliability makes it a pillar of the acetic acid market that supports large-scale industrial applications as well as specialized scientific applications.

Application Segment Analysis

The vinyl acetate monomer (VAM) segment is projected to hold a 34.5% share through 2037, reflecting its dominant role as an intermediate chemical used in the production of paints, adhesives, coatings, and textiles. The demand and performance of these end products are dependent directly on the supply and quality of VAM, making it a significant acetic acid consumer. In June 2024, Wacker Chemie AG highlighted its closed-loop manufacturing process, where in-house recycling streams efficiently recover acetic acid and yield VAM. The closed-loop process minimizes raw material dependency and enables green manufacturing, making the segment sustainable in the long term. With urbanization and infrastructure development continuing globally, VAM and, therefore, acetic acid demand are expected to be robust.

End use Segment Analysis

The plastics and polymers segment is predicted to retain a 31.5% share by 2037, driven by the widespread application of acetic acid in the manufacture of key polymers, including polyethylene terephthalate (PET) and polyvinyl alcohol (PVA). These products are the backbone of the packaging, textile, and electronics industries. Eastman Chemical Company in January 2022 said it had signed a deal with the French government to invest as much as $1 billion in a material-to-material molecular recycling plant. This convergence in the circular economy is expected to generate new growth opportunities and ensure long-term sustainability going ahead.

Our in-depth analysis of the acetic acid market includes the following segments:

|

Segment |

Subsegments |

|

Grade |

|

|

Application |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acetic Acid Market - Regional Analysis

APAC Market Insights

Asia Pacific acetic acid market is expected to hold 57% of the market during the forecast period. This is due to the region's enormous manufacturing platform, accelerated industrialization, and huge investment in new production capabilities. In December 2024, China was reported to be spearheading global acetic acid capacity additions to 2028 at more than 90% of the global supply. This is due to the accelerated growth of the textile, plastics, and pharmaceutical industries in the region, positioning APAC as the hub of the global acetic acid market.

China acetic acid market is expanding at a rapid pace, with massive new-build schemes reinforcing its leadership of the world supply. Guangdong Shengyuanda Technology's new Jieyang acetic acid facility, scheduled to come on stream in March 2026 with a planned capacity of 1.5 million tonnes annually, is the largest new capacity addition to the nation. It is facilitated by the China government's pursuit of industrial self-sufficiency and stricter environmental standards that are rallying the market behind higher, more efficient producers.

India acetic acid market is characterized by a strategic push to develop domestic production and reduce imports. In January 2025, Indian demand for acetic acid was reported to be increasing steeply, partially driven by outages at major local units, such as GNFC, indicating the country's desire for supply chain security. This has highlighted the strategic importance of initiatives like the November 2024 Memorandum of Understanding between INEOS Acetyls and GNFC, which aims to build a new 600,000-tonne-a-year acetic acid facility in Gujarat. This project is designed to make India more self-sufficient.

North America Market Insights

North America acetic acid market is predicted to rise at a CAGR of 6.6% between 2026 and 2037, driven by massive investment in new manufacturing capacity and a strong focus on sustainable manufacturing. In June 2022, INEOS Acetyls announced that it had initiated a study to assess the feasibility of a new world-scale acetic acid plant on the U.S. Gulf Coast, utilizing competitively priced feedstocks in the region. This is part of a series of trends of onshoring and increasing domestic manufacturing to supply the growing demand from the chemicals, plastics, and automotive sectors. The regional market is also driven by a favorable regulatory climate that encourages innovation in green chemistry and the development of low-carbon technologies.

The U.S. acetic acid market is advancing with great focus on sustainability and technology innovation. In April 2024, the Celanese Corporation finished strategic upgrades to its worldwide acetyl chain network, including the startup of a new low-carbon production plant for acetic acid at its Clear Lake, Texas, facility. The project enhances manufacturing efficiency and aligns with the company's vision for the sustainable development of core acetyl derivatives markets. The U.S. market is also supported by policies of the government that are favorable to green manufacturing and the development of bio-based substitutes, which makes the country a global leader in clean chemical production.

Canada market for acetic acid is growing in synchrony with North American trends towards sustainability and high-purity chemical solutions. In August 2024, Avantor, Inc. broadened its high-purity chemical solutions for the biopharma and advanced technology markets, such as specialized acetic acid for applications such as HPLC and trace metal analysis. The expansion, fueled by a customer-centric innovation strategy and global supply chain, addresses growing demand in Canada for high-quality, reliable chemical inputs. Canada market is also gaining from its proximity to key U.S. production centers and shared emphasis on regulatory harmonization and environmental responsibility.

Europe Market Insights

Europe acetic acid market is anticipated to experience significant growth between 2026 and 2037, owing to a high commitment towards the circular economy and the establishment of bio-based chemicals. In May 2023, Swedish bio-chemicals producer Sekab announced a significant rise in its production of bio-based acetic acid, driven by growing demand for fossil-free chemicals in Europe. The company's product, certified with ISCC+, offers a carbon footprint decrease of up to 50%, in line with the region's ambitious sustainability goals. The European market is also driven by stringent environmental policies, such as the Carbon Border Adjustment Mechanism (CBAM), in favor of the adoption of low-carbon production methods.

Germany acetic acid market is thriving, spurred by its position as a global leader in the chemicals industry and by its focus on the efficiency of the supply chain. HELM AG, the Hamburg-based group, reaffirmed its solid and resilient position in the chemicals market in July 2024, with its Base Chemicals division continuing to provide essential industrial inputs, such as acetic acid and acetic anhydride, to customers worldwide through its extensive global network. German companies are also among the green technology and sustainable production processes leading adopters, keeping the country's position as a leading driver of demand and innovation in the European market for acetic acid.

The UK acetic acid market is led by European policy drives and mounting emphasis on sustainable chemical production. European Union policymakers launched the transitional period of its Carbon Border Adjustment Mechanism (CBAM) in October 2023, a policy that will eventually charge a carbon price on certain imports. The policy will encourage UK production and encourage low-carbon production methods for chemicals like acetic acid to remain competitive in the Europe marketplace. The UK also witnesses growing demand for green chemicals, driven by consumer trends and corporate sustainability initiatives.

Key Acetic Acid Market Players:

- Celanese Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eastman Chemical Company

- BP Plc

- LyondellBasell Industries N.V.

- INEOS

- Wacker Chemie AG

- Sinopec

- Daicel Corporation

- SABIC

- Indian Oil Corporation Ltd

- Gujarat Narmada Valley Fertilizers & Chemicals

- Lotte Chemical Corporation

- HELM AG

- Incitec Pivot Limited

The acetic acid market is dominated by a group of large multinational chemical companies competing on technology advancements, strategic capacity expansion, and rising emphasis on sustainability. The leading players are heavily investing in conventional and bio-based production technologies to target different end-use markets and meet shifting regulatory needs.

One of the most significant recent news stories in the competitive news is the February 2024 historic 10-year deal between the climate-tech company Again and international chemical distributor HELM AG. The agreement, which involves the supply of 50,000 tonnes of low-carbon acetic acid made through the use of CO₂ fermentation tech, represents a major turning point toward sustainable, price-efficient options. Not only does this partnership disrupt conventional production methods, but it also sets a new standard for environmental stewardship in the industry, illustrating the way innovation in green chemistry is transforming the future of the acetic acid market.

Here are some leading companies in the acetic acid market:

Recent Developments

- In February 2025, Solberg Industri AS in Norway announced a new partnership to expand its chemical recycling and circular solutions. The company specializes in reusing industrial acid waste, turning it into a valuable resource. This circular-economy model, aligned with UN SDGs, offers a cost-effective and sustainable solution for industrial clients.

- In March 2024, Celanese Corporation announced the successful startup of its new 1.3-million-ton acetic acid expansion at its facility in Clear Lake, Texas. The company highlighted that this is the lowest-cost and lowest-carbon-footprint acetic acid facility in the world. The plant's operation builds upon a carbon capture and utilization (CCU) project that converts captured CO₂ into low-carbon methanol feedstock.

- In March 2024, Linde Gas AB in Sweden introduced a new line of ultra-pure wet-process chemicals for the semiconductor industry. This includes acetic acid with sub-100 ppt impurity levels for critical cleanroom etch and processing applications, highlighting the demand for highly specialized grades in the advanced technology sector.

- Report ID: 4490

- Published Date: Sep 23, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acetic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.