Acetal Copolymer Market Outlook:

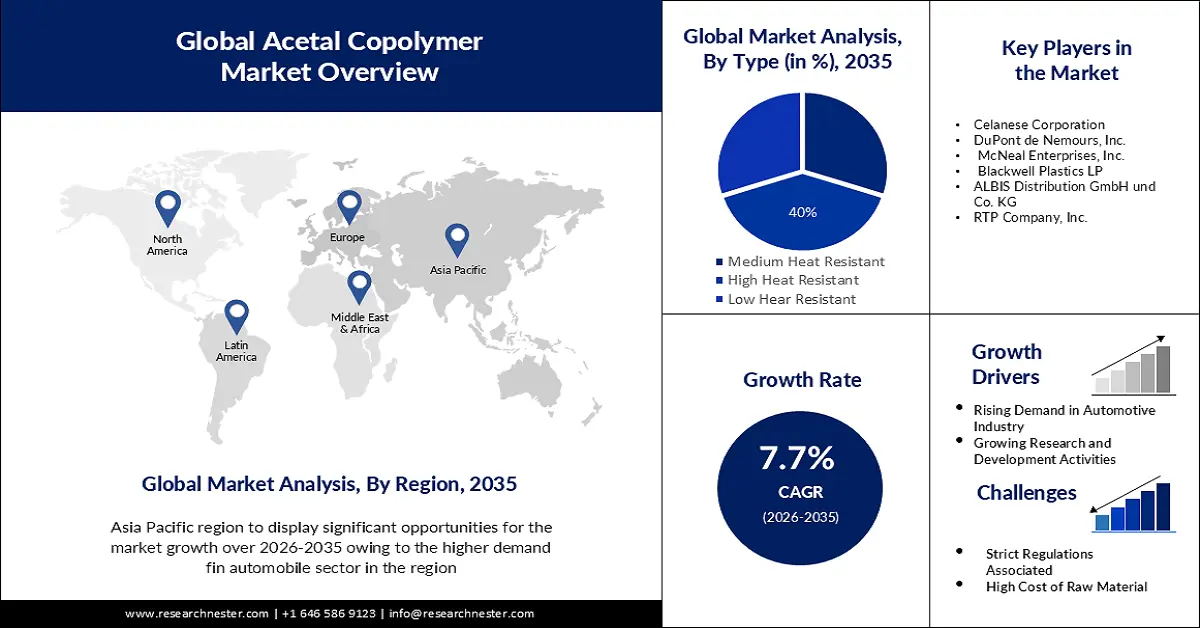

Acetal Copolymer Market size was valued at USD 641.41 million in 2025 and is likely to cross USD 1.35 billion by 2035, expanding at more than 7.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acetal copolymer is assessed at USD 685.86 million.

Due to its high goods quality and purity level, acetal copolymer has become one of the popular additives used in many end-use industries for a variety of applications. It is anticipated that this will lead to product innovation, which will increase acetal copolymer's demand and sales. A few of the major players in the market are allocating roughly 3-5% of their revenue from sales to research and development in order to create novel products and produce new derivatives that will meet the increasing demand from end-use applications.

Because of its superior tensile strength, acetal copolymer is widely used in the automotive industry, which is supporting the market's expansion. Because acetal copolymer are resistant to chemicals and abrasions and have a high dimensional stability, the market is growing because these materials are used in the production of acetal copolymers. Acetal copolymers' excellent performance and tensile strength are driving up demand for their use in door locks, power windows, car tanks, and mechanical gears, among other applications. The industry is expanding as a result of the growing usage of acetal copolymer as a substitute for metals in automobiles to improve energy efficiency.

Key Acetal Copolymer Market Insights Summary:

Regional Insights:

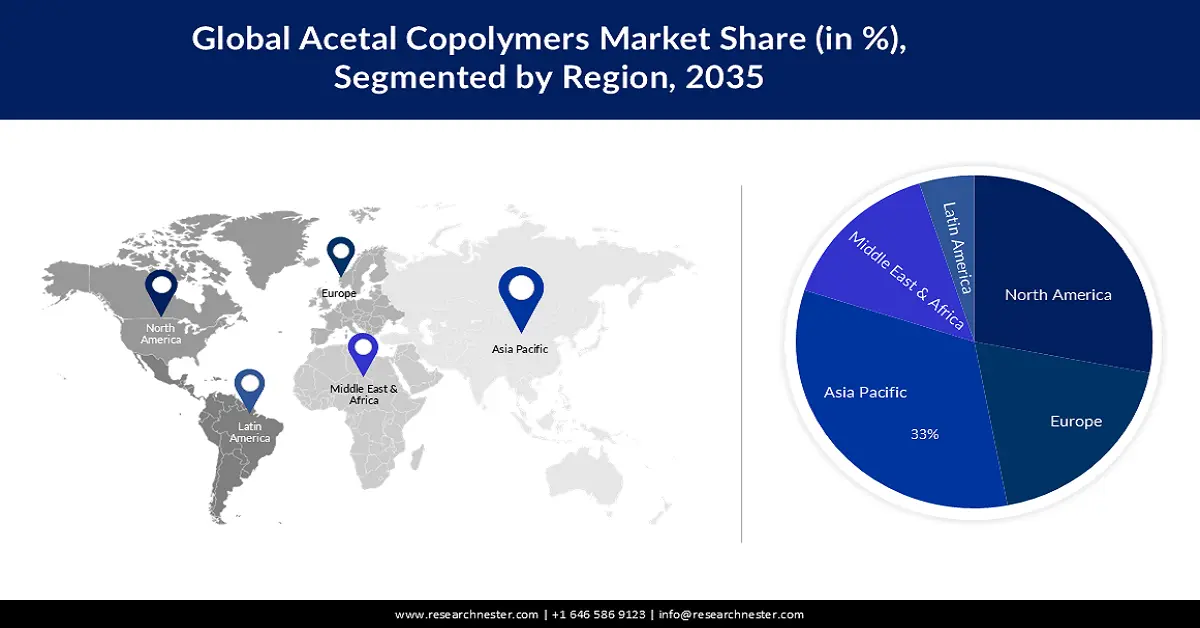

- Asia Pacific: The acetal copolymer market in the Asia Pacific region is projected to hold the largest revenue share of 33% by 2035 owing to strong growth in the vehicle industry.

- North America: The North America market is expected to expand notably by 2035 driven by increasing awareness of acetal copolymers’ strength, stiffness, and chemical resistance.

Segment Insights:

- High Heat Resistant: The high heat resistant segment in the acetal copolymer market is projected to account for significant growth by 2035 owing to increasing demand for high-performance materials.

- Electrical & Electronics: The electrical & electronics segment is estimated to hold a notable market share by 2035 propelled by rising demand for acetal copolymers in electrical components.

Key Growth Trends:

- High Demand in Electronic Sector

- High Usage in Medical Application and Furniture Production

Major Challenges:

- Fluctuation in Raw Material Prices

- Stringent Environmental Regulations Associated with Acetal Copolymer

Key Players: Celanese Corporation, DuPont de Nemours, Inc., McNeal Enterprises, Inc., Blackwell Plastics LP, ALBIS Distribution GmbH und Co. KG, RTP Company, Inc., TriStar, Beijing Ranger Chemical Co.

Global Acetal Copolymer Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 641.41 million

- 2026 Market Size: USD 685.86 million

- Projected Market Size: USD 1.35 billion by 2035

- Growth Forecasts: 7.7%

Key Regional Dynamics:

- Largest Region: Asia Pacific (33% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, India, Canada, United Kingdom

- Emerging Countries: Brazil, Indonesia, Australia, Saudi Arabia, UAE

Last updated on : 26 November, 2025

Acetal Copolymer Market - Growth Drivers and Challenges

Growth Drivers

- High Demand in Electronic Sector - Acetal copolymer's exceptional heat stability and electric conductivity are driving up demand for it in the electronics sector. Acetal copolymer is being used more often in electronic components such as integrated circuits, circuit boards, and insulators due to its great machinability and low friction coefficient. The market for acetal copolymer is expected to rise at a profitable rate because of the increasing demand for consumer electronics such as smartphones, laptops, refrigerators, and televisions.

- High Usage in Medical Application and Furniture Production - Acetal copolymer is used in medical applications because it can provide high tensile and thermal resistance. Therefore, the high-performance standards make acetal copolymer a superior choice for various medical applications. The demand for acetal copolymer in the production of furniture components is increasing.

Challenges

- Fluctuation in Raw Material Prices - The primary raw ingredients for the synthesis of acetal copolymers, formaldehyde and methanol, are prone to large price swings. It may be challenging for manufacturers of acetal copolymer to control expenses and retain profitability as a result of this volatility. This is expected to limit the acetal copolymer market's growth in the near future.

- Stringent Environmental Regulations Associated with Acetal Copolymer is Expected to Hamper the Market Growth in the Forecast Period

- Lack of Innovation is Set to Pose Limitation on the Market Growth in the Forecast Period

Acetal Copolymer Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 641.41 million |

|

Forecast Year Market Size (2035) |

USD 1.35 billion |

|

Regional Scope |

|

Acetal Copolymer Market Segmentation:

Product Type Segment Analysis

In terms of product type, the high heat resistant segment in the acetal copolymer market is poised to grow substantially by the end of 2035. The growth of this market can be ascribed owing to the increasing demand for high performance materials in a variety of applications. High heat resistant acetal copolymers are able to withstand temperatures of up to 170 degree Celsius making them ideal for use in applications that require high heat stability. Besides this, other factors such as the growing demand for lightweight materials in the automotive industry are driving the segment growth in the forecast time period.

End Use Segment Analysis

Based on end use, the electrical & electronics segment is estimated to hold a notable market share during the time period between 2024 – 2035. The demand for acetal copolymers for use in various electrical and electronic applications is increasing. Acetal copolymer is an excellent electrical insulator making it an ideal material for use in electrical components such as connectors, wire casings, and circuit boards.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acetal Copolymer Market - Regional Analysis

APAC Market Insights

The acetal copolymer market in the Asia Pacific region is expected to hold the largest revenue share of 33% by the end of 2035. Regional market are expected to be fuelled by strong growth in the vehicle industry in developing economies, like India and China. China sold 26.86 million car units for the calendar year 2022, whereas India exported 21.70 million cars. The market in this region is expected to be driven by the increasing consumption of acetal copolymer for a variety of uses, including cars, electrical & electronics and construction.

North American Market Insights

The acetal copolymer market in North America region is estimated to grow significantly by the end of forecast timeframe. The market is driven by various factors, such as growing demand from several industries, technological advancements, and growing awareness about the benefits of acetal copolymers. United States holds the highest share in market from the North America region trailed by Mexico and Canada. The automotive industry is the primary industrial end-use for acetal copolymer in North America, followed by the electrical and electronics, consumer goods, and healthcare industries. Escalating awareness among the consumers in the region about the benefits offered by acetal copolymers such as stiffness, its strength and chemical resistance is raising its demand in multiple sectors.

Acetal Copolymer Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Celanese Corporation

- DuPont de Nemours, Inc.

- McNeal Enterprises, Inc.

- Blackwell Plastics LP

- ALBIS Distribution GmbH und Co. KG

- RTP Company, Inc.

- TriStar

- Beijing Ranger Chemical Co.

Recent Developments

- SIBUR, a Russian petrochemical company, announced a partnership with BASF, a leading chemical company. The aim of this collaboration is to showcase innovative polymer solutions at the PolyLab Moscow research and development center, SIBUR. The proposed policy is to collaboratively design new high-performance additive alternatives, focusing on highly competitive polymer conversion constraints and explicitly long-term durability commodities.

- According to a company press release, Celanese Corporation, a global specialty chemicals and materials company, announced the launch of Hostaform RF, a low-permeability acetal copolymer designed for engines small off-road and marine fuel tanks, hydraulic tanks and industrial bulk tanks.

- Report ID: 5407

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acetal Copolymer Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.