Global Acai Berry Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROTs

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How They Would Aid The Business?

- Competitive Landscape

- Acai Berry Foods

- Acai Exotic

- Acai Roots

- Fruta Fruta Inc.

- Oisix ra daichi Inc.

- Organique

- SAMBAZON

- Sine Global Link

- Sunfood

- THE BERRY COMPANY

- Tropical Acai

- Ongoing Technological Advancements

- SWOT Analysis

- Price Benchmarking

- Application Analysis

- Consumer Dynamics Unveiled: Exploring Acai Berry

- Market

- Root Cause Analysis

- PESTLE Analysis

- Porter Five Forces Analysis

- Industry Risk Assessment

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2024-2035, By

- Type, Value (USD Million), Volume (Thousand Tons)

- Pulp

- Drying

- Distribution Channel, Value (USD Million)

- Hypermarket

- Online Store

- Convenience stores

- Application, Value (USD Million)

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Nutritional Supplements

- Confectionery

- Type, Value (USD Million), Volume (Thousand Tons)

- Regional Synopsis, Value (USD Million), 2024-2035

- North America, Value (USD Million)

- Europe, Value (USD Million)

- Asia Pacific, Value (USD Million)

- Latin America, Value (USD Million)

- Middle East and Africa, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2035,

- Type, Value (USD Million), Volume (Thousand Tons)

- Pulp

- Drying

- Distribution Channel, Value (USD Million)

- Hypermarket

- Online Store

- Convenience stores

- Application, Value (USD Million)

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Nutritional Supplements

- Confectionery

- Country Level Analysis Value (USD Million), 2024-2035

- U.S.

- Canada

- Type, Value (USD Million), Volume (Thousand Tons)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2035,

- Type, Value (USD Million), Volume (Thousand Tons)

- Pulp

- Drying

- Distribution Channel, Value (USD Million)

- Hypermarket

- Online Store

- Convenience stores

- Application, Value (USD Million)

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Nutritional Supplements

- Confectionery

- Country Level Analysis Value (USD Million), 2024-2035

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Type, Value (USD Million), Volume (Thousand Tons)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2035,

- Type, Value (USD Million), Volume (Thousand Tons)

- Pulp

- Drying

- Distribution Channel, Value (USD Million)

- Hypermarket

- Online Store

- Convenience stores

- Application, Value (USD Million)

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Nutritional Supplements

- Confectionery

- Country Level Analysis Value (USD Million), 2024-2035

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Type, Value (USD Million), Volume (Thousand Tons)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2035,

- Type, Value (USD Million), Volume (Thousand Tons)

- Pulp

- Drying

- Distribution Channel, Value (USD Million)

- Hypermarket

- Online Store

- Convenience stores

- Application, Value (USD Million)

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Nutritional Supplements

- Confectionery

- Country Level Analysis Value (USD Million), 2024-2035

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Type, Value (USD Million), Volume (Thousand Tons)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2035

- Increment $ Opportunity Assessment, 2024-2035

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2024-2035,

- Type, Value (USD Million), Volume (Thousand Tons)

- Pulp

- Drying

- Distribution Channel, Value (USD Million)

- Hypermarket

- Online Store

- Convenience stores

- Application, Value (USD Million)

- Food and Beverage

- Pharmaceuticals

- Cosmetics

- Nutritional Supplements

- Confectionery

- Type, Value (USD Million), Volume (Thousand Tons)

- Country Level Analysis Value (USD Million), 2024-2035

- Saudi Arabia

- UAE

- Oman

- South Africa

- Morocco

- Tunisia

- Algeria

- Rest of Middle East & Africa

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

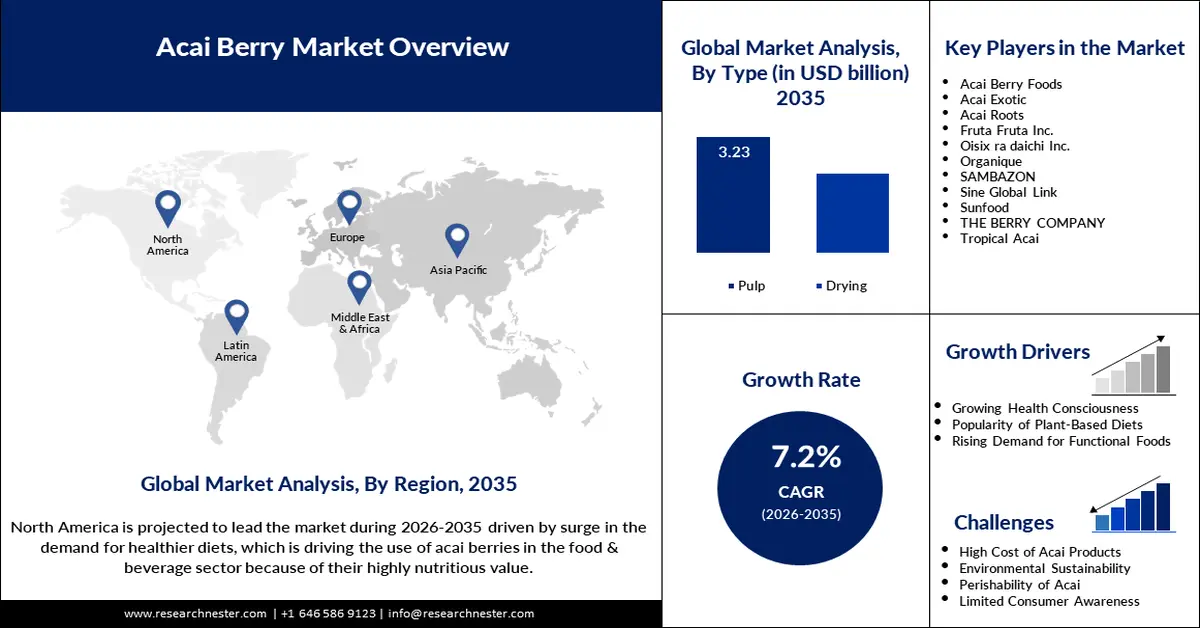

Acai Berry Market Outlook:

Acai Berry Market size was valued at USD 1.61 billion in 2025 and is expected to reach USD 3.23 billion by 2035, expanding at around 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of acai berry is evaluated at USD 1.71 billion.

The acai berry market is witnessing steady growth due to increasing consumer demand for health conscious food and antioxidant rich superfood. Acai berries are well known for their nutritional benefits and have become popular in the wellness and dietary supplement industries. For example, the Australian Trade and Investment Commission says China’s health food market is worth 35.0% nutritional supplements. The growth in this area reflects the growing interest of consumers in preventive health and natural products such as acai berry. Due to the global health and wellness trends, acai can be integrated into smoothies, bowls, and functional beverages, which is likely to promote the market growth through 2035.

The acai berry market is also being driven by government initiatives to encourage sustainable farming and fair trade practices. In December 2023, Brazilian municipality Feijo became the first to get a certificate of origin for its acai berries, adding value to local production and giving the region a boost economically. The acai-growing region was also awarded geographical identification by the National Institute of Industrial Property (INPI) in September 2023, cementing the area as one of the world’s best acai-producing regions. This is a reflection of acai's growing importance to traceability and sustainability in the acai supply chain amid a growing consumer interest in ethically sourced items.

Key Acai Berry Market Insights Summary:

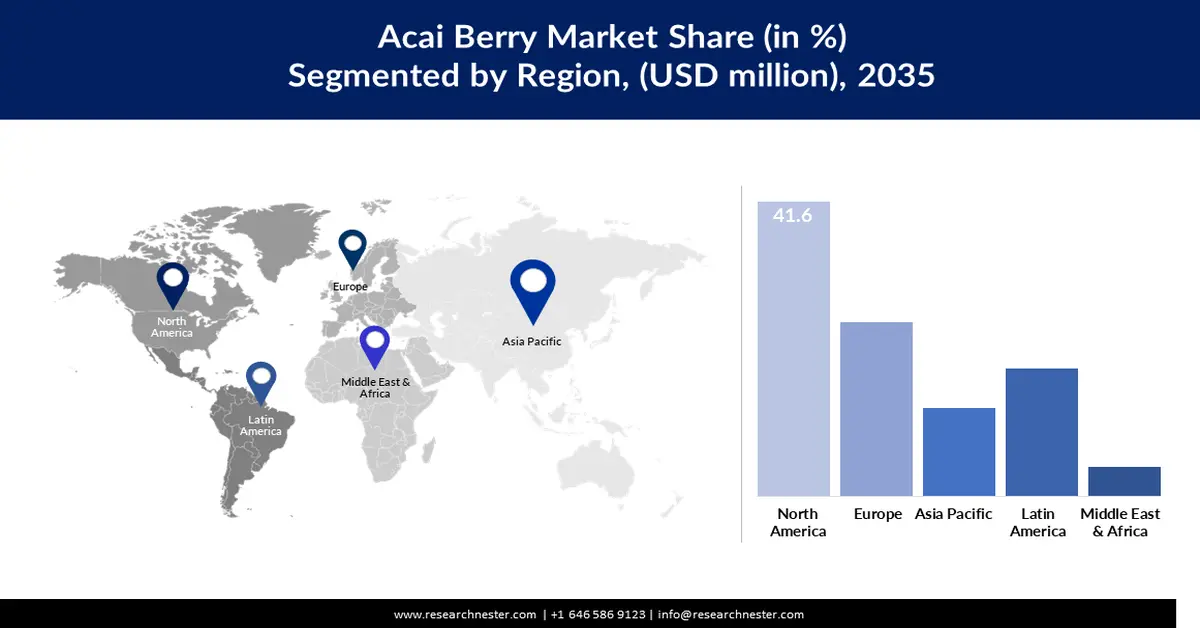

Regional Highlights:

- North America holds a 41.6% share in the acai berry market, driven by rising health consciousness and growing demand for antioxidant-rich superfoods, ensuring strong growth prospects through 2035.

- Asia Pacific’s acai berry market is expected to achieve significant growth by 2035, driven by the rising middle class and growing preference for natural health products.

Segment Insights:

- The Pulp segment is expected to exceed 59.8% market share by 2035, fueled by growing demand for ready-to-eat acai products that maintain rich antioxidant properties.

- The Hypermarkets segment is projected to achieve robust growth by 2035, fueled by the convenience and extensive product range offered by hypermarkets.

Key Growth Trends:

- Consumer demand for superfoods and healthier alternatives

- Untapped markets expansion

Major Challenges:

- Environmental impact and deforestation concerns

- Supply chain and harvesting limitations

- Key Players: Acai Berry Foods, Acai Exotic, Acai Roots, Fruta Fruta Inc., Oisix ra daichi Inc., Organique, SAMBAZON, Sine Global Link, Sunfood, THE BERRY COMPANY, Tropical Acai.

Global Acai Berry Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.61 billion

- 2026 Market Size: USD 1.71 billion

- Projected Market Size: USD 3.23 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Brazil, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 13 August, 2025

Acai Berry Market Growth Drivers and Challenges:

Growth Drivers

- Consumer demand for superfoods and healthier alternatives: Acai berries are dominating the global trend toward healthier lifestyles and plant-based diets as the demand for superfoods rises. Consumers are looking for natural, nutrient-dense options to add to their diet. In January 2024, Oakberry Acai secured USD 67 million in Series C funding to fuel its U.S. expansion, underlining investor confidence in the growing acai berry market for health-centric products. This funding will help build out new stores in major U.S. cities that service the rising demand for acai bowls and beverages on the go.

- Untapped markets expansion: Acai manufacturers are diversifying, and the fruit’s low awareness in some regions is helping to drive market growth. In June 2024, SAMBAZON announced its entry into the Middle East, where the market remains relatively untapped. The company is making this strategic move to bring acai-based products to new demographics using its existing supply chain, which operates in 50 countries. The expansion reflects the untapped opportunity of acai berry in emerging acai berry markets.

- Innovations in product offerings and distribution channels: The market expansion is driven by continuous product innovation and diversified retail channels. To respond to changing consumer preferences, brands are reviving old formats, like frozen bowls, juices, and skincare products. For example, frozen acai packs were launched by Amazonia across Coles supermarkets in Australia in March 2022, making acai much more accessible to the mainstream consumer. The growing versatility of acai has been demonstrated in higher sales and broader market penetration of such initiatives across sectors beyond food and beverages.

Challenges

- Environmental impact and deforestation concerns: Biodiversity loss in the Amazon rainforest is occurring due to the rapid growth of acai farming. Cultivation is spreading, and so is deforestation and the destruction of native plant species. A study in recent years revealed that acai exports have soared by 14,380 percent in the past decad,e from 40 tons a year to 6,000 tons annually. This reflects an explosive growth, and raises concerns about sustainability, which is leading to demand for more eco-friendly farming techniques. The rainforest ecosystem is being protected by conservation efforts, but companies are under pressure to balance acai berry market demand.

- Supply chain and harvesting limitations: Despite increasing demand for acai, the industry is challenged with an array of supply chain issues. Acai berries are perishable, and they have short shelf life, so they need to be frozen or processed immediately, which can get in the way of harvesting and shipping. Transportation further complicates the distance to remote harvesting locations in the Amazon, further increasing production costs and scaling, making it difficult. Consequently, suppliers find it impossible to maintain a consistent supply to the international demand.

Acai Berry Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 1.61 billion |

|

Forecast Year Market Size (2035) |

USD 3.23 billion |

|

Regional Scope |

|

Acai Berry Market Segmentation:

Type (Pulp, Drying)

Pulp segment is projected to dominate acai berry market share of over 59.8% by 2035. Acai is consumed most often in the form of pulp used in smoothies, bowls, and beverages. Growing demand for ready-to-eat acai products that maintain the rich antioxidant properties of the fruit is fueling this dominance. Additionally, the rising health awareness and the consumer demand for natural, nutrient dense foods also drive the demand for acai pulp. Acai’s increasing popularity in functional beverages and sports nutrition offers manufacturers a chance to diversify offerings and appeal to a growing health conscious demographic.

Distribution Channel (Hypermarket, Online Store, Convenience stores)

In acai berry market, hypermarkets segment is expected to account for revenue share of around 55.7% by 2035, becoming a primary distribution channel for acai-based products. Hypermarkets offer convenience and extensive product range to the consumers, thus making it easier for brands to access a wider audience. For example, Coca-Cola’s omega-3 superfusion beverages, which include acai flavors, were launched in January 2020 across hypermarkets, as the channel plays an important role in scaling product reach and visibility. Their market dominance is also due to the fact that they can supply promotional deals and bulk discounts. The acai brand awareness expansion and acai product accessibility to a broader population are still very important in this channel.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Distribution Channel |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acai Berry Market Regional Analysis:

North America Market Analysis

North America in acai berry market is set to hold over 41.6% revenue share by the end of 2035. Rising health consciousness and growing demand for superfoods high in antioxidants are fueling this growth. The market has been on an upward trajectory due to the increasing popularity of acai smoothie bowls, beverages, and nutritional supplements. Acai product adoption is driven by the focus of North America consumer demand on organic and plant-based diets.

Furthermore, the acai berry market in North America is led by the U.S., largely on account of high consumer demand for healthy, plant products and a big expansion of wellness-focused food brands. In March 2024, SAMBAZON acquired SunOpta’s frozen acai and smoothie bowl segment to increase its production capacity and broaden its product line. SAMBAZON will be able to diversify into tropical fruits and purees, strengthening its leadership in the U.S. market through this acquisition. The U.S. acai industry is being shaped by the growing preference for clean-label, nutrient-dense foods that lead to innovation in flavors and product formats.

Canada acai berry market is witnessing healthy growth mainly due to the rising awareness of super foods and their health benefits. Market expansion is driven by Canadian consumers gravitating towards functional beverages and acai based snacks. The rising presence of international acai brands and local distributors is accelerating market penetration. With wellness trends on the rise, acai is set to be infused in health stores and supermarkets. Canada’s focus on organic certification and sustainable sourcing only strengthens market potential for eco-friendly brands.

Asia Pacific Market Statistics

Asia Pacific acai berry market is projected to register significant growth during the forecast period, due to the growing inclination of the region towards superfoods and natural health products. Consumers are increasingly substituting nutrient-rich berries in countries like China, India, and Japan as part of their diet. Acai has become more accessible in urban and semi-urban areas due to the expansion of health food chains and online retail platforms. Furthermore, growing middle class and focus on living healthily continues to drive demand for acai based beverages, supplements ,and snacks in the region.

India acai berry market is on the rise, fueled by the country’s emerging wellness culture and increasing disposable incomes. The popularity of acai products is driven by the fact that consumers are preferring functional foods and drinks that provide added health benefits. The proliferation of juice bars, organic stores, and online wellness platforms further accelerates market growth. International brands are rapidly growing their presence in India, and regional companies are importing acai-based products. Furthermore, growing appetite for superfoods and natural supplements is behind this growth.

The growth of health and wellness trends is helping China become an important player in APAC acai berry market. OAKBERRY announced in July 2024 that it would be entering Hawaii through a partnership with Acai Partners Hawaii and plans to open its first location in Kapolei Commons by the end of 2024. This is part of OAKBERRY’s larger plan to become a multiple-location business in the next five years. The growth of market is being driven by the rise in demand for premium health products and functional beverages in China. As a health-conscious segment, acai's appeal in China is becoming more and more attractive to Chinese consumers because of its anti-aging and immunity boosting properties.

Key Acai Berry Market Players:

- Acai Berry Foods

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Acai Exotic

- Acai Roots

- Fruta Fruta Inc.

- Oisix ra daichi Inc.

- Organique

- SAMBAZON

- Sine Global Link

- Sunfood

- THE BERRY COMPANY

- Tropical Acai

Acai berry market is characterized by intense competition, and key players are pursuing the expansion of their retail footprint and the innovation of product lines in order to gain market share. Strategic partnerships and acquisitions are driving growth in leading companies such as SAMBAZON, Oakberry Acai and Fruta Fruta Inc. Using their global networks, these firms invest into acai products in new regions or broaden product lines and increase the capacity of their production capabilities to meet growing demand.

Oakberry opened its second location in London in July 2024, continuing its aggressive expansion strategy in the Europe market. To tackle the problem, brands are also investing into sustainable sourcing to respond to environmental issues as well as meet the needs of eco friendly consumers. With the number of companies in the acai berry market increasing, so is the competition, and as such, companies are expected to focus on sustainability, traceability, and innovative product development to stay ahead in the market.

Here are some leading companies in the acai berry market:

Recent Developments

- In March 2024, Jamba broadened its bowl offerings by introducing three new items – the Acai Peanut Butter & Chocolate Hazelnut Bowl, the Acai Tropical Bowl, and the Tropical Waffle Bowl. Additionally, the company rolled out special promotions in celebration of National Acai Bowl Day. This initiative aims to strengthen Jamba’s market presence and capture a larger share of the growing acai berry market.

- In February 2024, Oakberry Acai launched two new locations in London, with sites opening in Hammersmith and Battersea. This expansion aligns with the brand’s rapid growth in the UK market, catering to increasing demand for superfood-based snacks. Oakberry’s expansion plan includes leveraging prime retail spaces to strengthen brand visibility in metropolitan areas.

- In August 2023, Oakberry Acai announced plans to debut its first location in London in September 2023. This move signifies Oakberry’s entry into the Europe market, aligning with its strategy to establish flagship stores in key international cities. The brand aims to introduce UK consumers to its signature acai bowls and smoothies, capitalizing on the superfood trend.

- Report ID: 6941

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acai Berry Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.