Abrasives Market Outlook:

Abrasives Market size was over USD 47.15 Billion in 2025 and is projected to reach USD 79.78 Billion by 2035, witnessing around 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of abrasives is evaluated at USD 49.44 Billion.

The growing use of furniture and more use of interior raw materials are some of the major factors anticipated to drive the growth of the market during the forecast period. Abrasives are a key requirement in the production of furniture, as they are often required during the key stages of their manufacture. In 2018, the furniture and home furnishing stores in the United States generated a revenue of USD 110 billion tons approximately. Also, the percentage expenditure on household furniture and equipment grew from 3.3% in 2017 to 3.8% in 2020.

Besides this, the rapid expansion of the automotive industry across the world and growing industrialization and urbanization are expected to fuel the growth of the abrasives market during the forecast period. As per the World Bank, more than 50% of the world’s population is living in urban areas and is estimated that this will rise by 1.5 to reach 6 billion populations by 2045. Abrasives are used in the repair processes of engine parts, and auto bodies, and the cleaning of pipes, welds, edges, and surfaces for oiling, fitting, polishing, and painting. Furthermore, the growth in the construction sector is also attributed to bringing in lucrative opportunities for market growth in the forecast period owing to the high utilization rate of abrasives in several applications in the construction industry including woodworking & fabrication, metal fabrications, and maintaining metal components. In addition to the aforementioned factors, the escalation in demand for grinding and polishing processes in a wide range of end-use industries such as metal fabrication, automotive, electrical equipment (E&E) and machinery, and electronics is anticipated to create a positive outlook for market expansion in the upcoming years.

Key Abrasives Market Insights Summary:

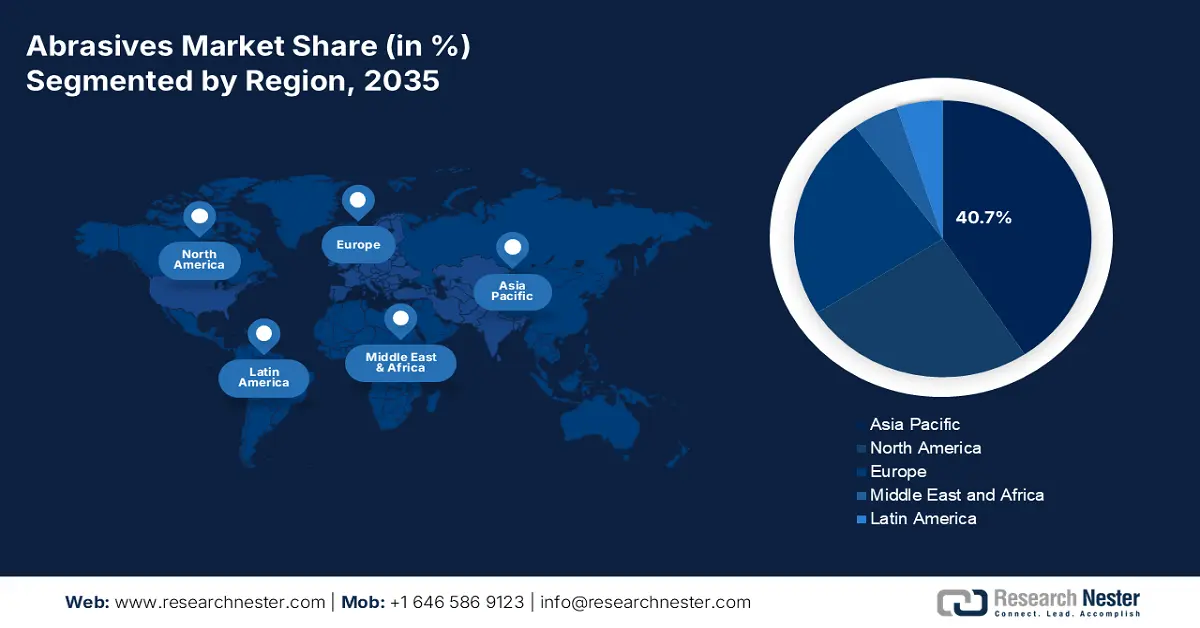

Regional Highlights:

- North America abrasives market will hold over 40.70% share by 2035, attributed to increasing use by end-use industries and rising vehicle demand.

- Asia Pacific market will exhibit noteworthy CAGR during 2026-2035, driven by infrastructural development and rapid growth of the construction industry.

Segment Insights:

- The automotive segment in the abrasives market is forecasted to attain the largest share by 2035, fueled by the rising automotive industry and growing use of abrasives in machinery cleaning.

- The bonded segment in the abrasives market is projected to secure a significant share by 2035, driven by the high demand for bonded abrasives in automotive and electronics industries.

Key Growth Trends:

- Growing Disposable Income

- Elevation in the Number of Telecommunication Companies

Major Challenges:

- Shortage of Raw Materials

- Strict Government Rules on the Use of Silica Abrasives

Key Players: 3M, Jason Industrial, KREBS & RIEDEL Schleifscheibenfabrik GmbH & Co. KG, DEERFOS Co. Ltd, DuPont Inc., sia Abrasives Industries AG, Carborundum Universal Limited, Noritake Co., Limited, Schaffner Holding AG, Tyrolit Schleifmittelwerke Swarovski KG.

Global Abrasives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 47.15 Billion

- 2026 Market Size: USD 49.44 Billion

- Projected Market Size: USD 79.78 Billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Abrasives Market Growth Drivers and Challenges:

Growth Drivers

- Growing Disposable Income – With the reduction of taxes and increase in wages, people get more disposable income. When disposable income is raised households have more money to save and spend on luxuries such as vehicles and electronics. Thus, the increasing disposable income is expected to boost significant revenue generation in the next few years. The disposable income of the U.S. as per the Bureau of Economic Analysis raised from -0.4% in June 2022 to 0.15 in Aug 2022.

- Elevation in the Number of Telecommunication Companies – Communication is getting faster and growing in volume every day, as more and more people get connected to the internet every day. As a result, the use of abrasives has also escalated for shaping and/or finishing optical elements, including the end faces of optical fibers and connectors. Therefore, the presence of a high number of telecom enterprises is anticipated to fuel market size. The wireless telecommunications business count raised over 2% each year in the U.S. during 2017-2022.

- Rising Electronics Production – Electronics industry is one of the fastest growing industries across the world as more and more people depend heavily on various appliances to get their job done. As the manufacturing process of the wafer, chip processing, LED, and other optic electronic devices and other parts used in the electronics industry are dependent on abrasives, the surge in electronics production is projected to contribute positively to market growth. The total imported value of electronics across the world as of 2021 was worth USD 3,594,456,634.

- Increasing Manufacturing Industries – As the world is recovering from the effects of the pandemic, the demand for goods and commodities is growing. Abrasives are commonly used in grinding, polishing, buffing, honing, cutting, drilling, sharpening, lapping, and sanding. Hence, the presence of a strong manufacturing industry base in the world is anticipated drive market growth. The manufacturing industry contributed USD 2269.2 to the U.S. GDP in 2020 which is 10.8% of the total GDP.

- Growing Production of Metals - The total worldwide production of crude steel increased gradually but steadily from 1.88 billion tonnes in 2020 to 1.94 billion tonnes in 2021. Iron and steel together account for 95% of the world's and the United States' annual total metal production.

Challenges

- Shortage of Raw Materials – Abrasives are usually produced by using raw materials including aluminum oxide, silicon carbide, cubic boron nitride, synthetic diamond, and ceramics. Most of the raw materials are obtained from renewable resources such as petroleum. As a result of the depletion of renewable resources, the availability of raw materials is lowering the manufacturing rate of abrasives. This trend is expected to restrict market growth.

- Strict Government Rules on the Use of Silica Abrasives

- Lack of Industry Labor

Abrasives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 47.15 Billion |

|

Forecast Year Market Size (2035) |

USD 79.78 Billion |

|

Regional Scope |

|

Abrasives Market Segmentation:

Application Segment Analysis

The global abrasives market is segmented and evaluated for demand and supply based on application, which includes automotive, metal working, machinery, electrical & electronics, and construction. Out of these, the automotive segment is anticipated to hold the largest market size by the end of 2035 on the back of the rising automotive industry and the increasing use of abrasives for various machinery cleaning. The total number of highway-registered vehicles in the world increased from 273,602,100 in 2018 to 275,924,442 in 2020. Abrasives are being highly used in automotive applications mainly in grinding wheels, and grinding segments to smoothen and roughen the surface of vehicle components for polishing, fitting, and paints and coatings among others. In addition, the increased application of abrasives for cleaning, deburring, and repairing auto parts is also estimated to lead to segment growth in the analysis period.

Type Segment Analysis

The global abrasives market is also segmented and analyzed for demand and supply by type into bonded, coated, super, and others. Out of these, the bonded segment is attributed to holding a significant share of the market. Bonded abrasives are composed of a material kept in a matrix called a binder which makes it preferable for sanding and polishing metal products. Furthermore, there is a high demand for bonded abrasives from the automotive and electric & electronics industries is anticipated to impetus the sales of abrasives in the assessment period. Also, bonded abrasives are considered to be an ideal option for grinding wheels, snagging wheels, mounted wheels, and others which are used for precision and harsh grinding applications owing to their efficiency and enhance operational capability.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Source |

|

|

By Material |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Abrasives Market Regional Analysis:

APAC Market Insights

On the other hand, the Asia Pacific abrasives market is also projected to hold a significant market share along with a noteworthy CAGR rate. Infrastructural development along with rapid growth of the construction industry in the region especially in China, India, and Japan is anticipated to be the major factor for market expansion in the region. Furthermore, the high consumption rate of electronics and electrical components in the growing industries of the region is also estimated to bring notable revenue generation. In addition, the massive investments made in the manufacturing sector and the rising focus on electric vehicles in the developing countries of the region are forecasted to bring growth opportunities for market expansion.

North American Market Insights

The North America abrasives market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035, owing to the increasing use of abrasives by numerous end-use industries present in the region including metal fabrication and machinery industries. Also, the rising demand for passenger and commercial vehicles among people is estimated to boost market growth. The value of imported passenger car sales in the United States in 2021 was USD 148,145,016. Moreover, the rapid development in precision tooling and machine part production, along with technological advancements in the United States is expected to bring lucrative growth opportunities for market growth in the region. Furthermore, growing product demand from the automotive, aerospace, and defense industries, in addition to an increase in aircraft manufacturing, is expected to enhance abrasive sales in the region.

Abrasives Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Jason Industrial

- KREBS & RIEDEL Schleifscheibenfabrik GmbH & Co. KG

- DEERFOS Co. Ltd

- DuPont Inc.

- sia Abrasives Industries AG

- Carborundum Universal Limited

- Noritake Co., Limited

- Schaffner Holding AG

- Tyrolit Schleifmittelwerke Swarovski KG

Recent Developments

- Report ID: 4497

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Abrasives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.