Abrasive Blasting Nozzles Market Outlook:

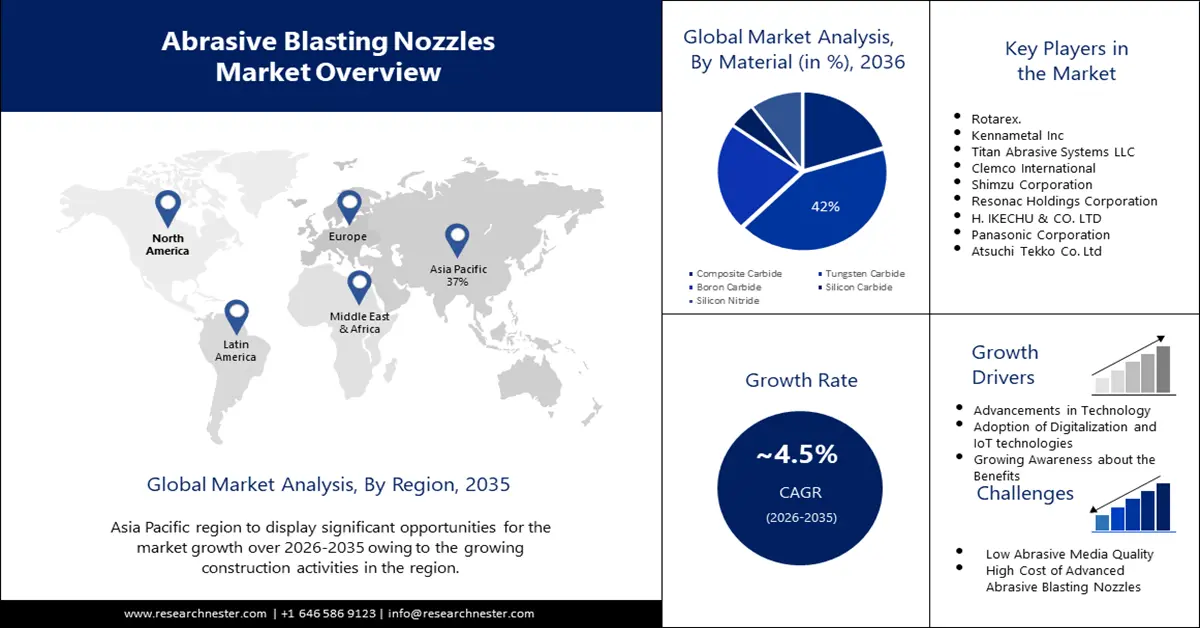

Abrasive Blasting Nozzles Market size was valued at USD 227.92 million in 2025 and is expected to reach USD 353.95 million by 2035, expanding at around 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of abrasive blasting nozzles is evaluated at USD 237.15 million.

Businesses are developing environmentally friendly abrasive blasting nozzle materials since environmental awareness is developing. These materials should be safe for both workers and the environment. This can entail creating substitute materials that are biodegradable or created from recycled materials. Also, according to a survey, 78% of people concur that living in a sustainable manner is vital, that the idea of sustainability appeals to them, and that they desire to do so. This factor is anticipated to accelerate the market growth by the end of 2036.

The integration of robotics and automation into abrasive blasting nozzle equipment presents an opportunity for companies to improve the efficiency and accuracy of surface preparation and cleaning. This can lead to increased productivity, reduced costs, and improved safety for workers.

Key Abrasive Blasting Nozzles Market Insights Summary:

Regional Highlights:

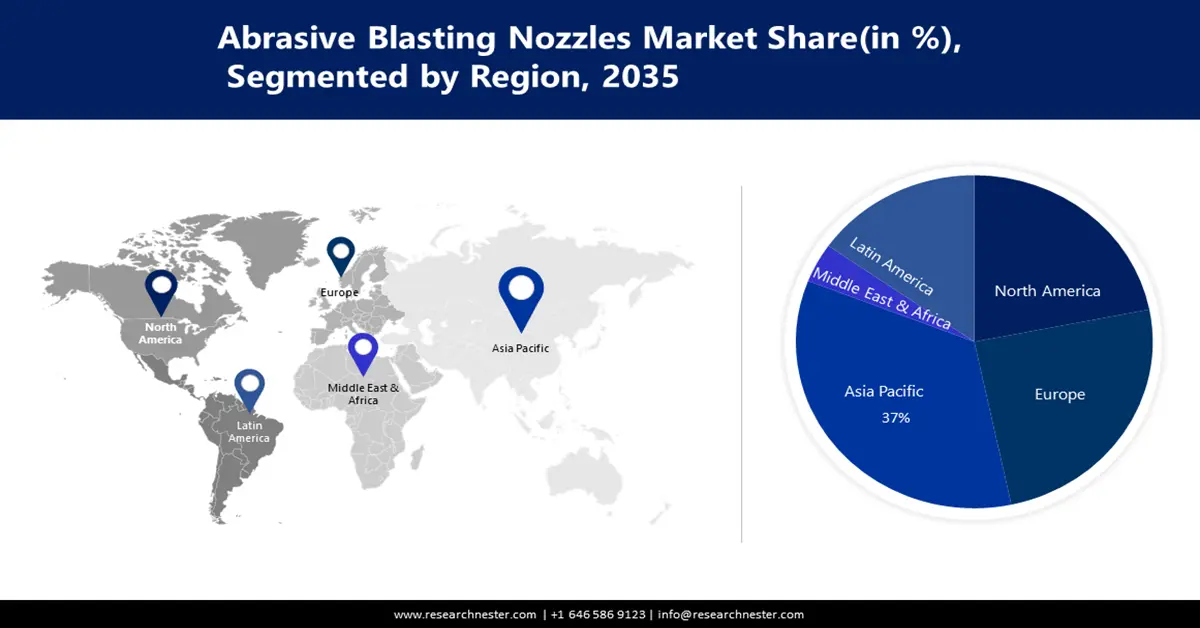

- The Asia Pacific abrasive blasting nozzles market will hold over 37% share by 2035, driven by urban construction boom in nations like China and India.

- The Europe market will secure 26% share by 2035, attributed to industrial use in sectors like auto and aerospace.

Segment Insights:

- The tungsten carbide segment in the abrasive blasting nozzles market is expected to capture a 42% share by 2035, fueled by benefits like lower replacement rate, higher production, and eco-friendliness of tungsten carbide nozzles.

- The wide throat segment in the abrasive blasting nozzles market is projected to capture a 28% share by 2035, driven by its ability to boost production and create larger patterns with lower abrasive usage.

Key Growth Trends:

- Growing Awareness about the Benefits of Abrasive Blasting Nozzles

- Advancements in Technology

Major Challenges:

- Risks Associated with Abrasive Blasting Nozzles

- Low Abrasive Media Quality

Key Players: Dover Corporation, Rotarex., Kennametal Inc, Titan Abrasive Systems LLC, Clemco International, Shimzu Corporation, Resonac Holdings Corporation, H. IKECHU & CO. LTD, Panasonic Corporation, Atsuchi Tekko Co. Ltd.

Global Abrasive Blasting Nozzles Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 227.92 million

- 2026 Market Size: USD 237.15 million

- Projected Market Size: USD 353.95 million by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, South Korea, Japan, Thailand

Last updated on : 11 September, 2025

Abrasive Blasting Nozzles Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Awareness about the Benefits of Abrasive Blasting Nozzles – Use of abrasive blasting nozzles may effectively and affordably clean and prime surfaces for a variety of purposes. More companies are utilizing this method for surface preparation due to the increased understanding of the advantages of abrasive blasting nozzles.

- Advancements in Technology – The abrasive blasting nozzles industry has seen significant advancements in technology, particularly in the development of new materials and equipment. These advancements have made abrasive blasting nozzles more efficient, and safer for workers, which has contributed to the growth of the industry. For instance, within three years, nearly 75% of respondents anticipated that AI would overtake all other technologies. Robotics and automation came in second, accounting for close to 50% of the total.

- Adoption of Digitalization and IoT Technologies – The adoption of digitalization and IoT technologies in the abrasive blasting nozzles industry can provide real-time monitoring and data analysis for equipment and processes. According to a report, globally, 15.1 billion Internet of Things (IoT) devices existed in 2020, while more than 29 billion IoT devices are expected to exist in 2030. This can help companies optimize their operations, reduce downtime, and improve overall efficiency.

Challenges

-

Risks Associated with Abrasive Blasting Nozzles - Operations involving abrasive blasting can produce a lot of dust and noise. Both the surface being blasted and the abrasive material may include harmful substances that pose a risk to the workers, such as lead paint and silica. Workers who are exposed to crystalline silica sand run the risk of developing silicosis, lung cancer, and breathing issues.

- Low Abrasive Media Quality

- High Cost of Advanced Abrasive Blasting Nozzles

Abrasive Blasting Nozzles Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 227.92 million |

|

Forecast Year Market Size (2035) |

USD 353.95 million |

|

Regional Scope |

|

Abrasive Blasting Nozzles Market Segmentation:

Product Type

Abrasive blasting nozzles market from the wide throat segment is expected to hold a share of 28% during the forecast period. The long venturi-style nozzle has been improved with this type. It has a sizable exit bore and a generous entering space (throat). Compared to the type with a smaller throat, this kind can boost production by around 15% when used with the same-sized hose. If they have a larger diverging exit bore, they can also be employed at greater pressures to produce up to a 60% larger pattern with less abrasive usage.

Material

The tungsten carbide segment in the abrasive blasting nozzles market is expected to hold a share of 42% during the forecast period. Numerous benefits, including a lower replacement rate, decreased downtime, increased production, and environmental friendliness, are provided by tungsten carbide nozzles. Over the course of the projection period, the steel tips segment is anticipated to experience significant expansion. The siphon sandblaster units are most frequently utilized with steel tips. The nozzle wears down less quickly than other high-pressure nozzles because of the lower pressure.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Abrasive Blasting Nozzles Market Regional Analysis:

APAC Market Insights

Asia Pacific abrasive blasting nozzles market is anticipated to hold a share of 37% during the forecast period. Additionally, due to the aggressive pursuit of construction activities in nations like China, India, and Southeast Asia, it is anticipated that it will become the regional market with the fastest rate of growth throughout the forecast period. For instance, China's construction industry experienced consistent growth, with total output valued at over 27.6 trillion yuan in 2021. As a result of China's increasing urbanization, the construction sector produced more than 31 trillion yuan that year. Over the course of the forecast period, the increased demand for abrasive blasting machines in key end-use sectors and industry verticals, including automotive and aerospace, as well as for industrial applications, is anticipated to further contribute to the expansion of the regional market.

European Market Insights

According to a report, the European Union produced about 16.7 million metric tons of oil in 2022. These factors are driving the market growth rapidly.Europe abrasive blasting nozzles market is expected to hold a share of 26% during the forecast period. Due to the increasing use of abrasive blasting equipment for both home and industrial purposes, the European market is expanding steadily. Some of the largest automakers in the area are based in nations like Germany, the United Kingdom, and Italy, and they use abrasive blasting equipment for a variety of tasks like rust removal, paint removal, and electroplating pre-treatment. Other end-use industries and industry verticals, such aerospace, oil and gas, and marine, are increasingly adopting this equipment, which is opening up huge growth opportunities for the local market.

Abrasive Blasting Nozzles Market Players:

- Dover Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Rotarex.

- Kennametal Inc

- Titan Abrasive Systems LLC

- Clemco Internation

Recent Developments

- March 2023 - The Blast NinjaTM is a significant addition to Kennametal Inc.'s market-leading lineup of abrasive blast nozzles for improved surface preparation. The Blast Ninja is a premium nozzle that offers improved productivity and enhanced hearing protection in a military-grade product that complies with OSHA regulations. It was created by Oceanit, a Honolulu-based 'Mind to Market' innovation company that develops disruptive technologies from fundamental science.

- June 2023 - Titan Abrasive Systems has provided a tailored blast room to Morton Industries, a producer of enclosures, sheet metal fabrications, and tube assemblies.

- Report ID: 5279

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Abrasive Blasting Nozzles Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.