8K Technology Market Outlook:

8K Technology Market size was valued at USD 20.03 billion in 2025 and is expected to reach USD 360.16 billion by 2035, expanding at around 33.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 8K technology is evaluated at USD 26.07 billion.

The global 8K technology market growth can be attributed to the rising demand for large and immersive displays at public spaces and events as 8K displays provide sharper images and better details, enhancing the visuals for large crowds. Sports arenas, concert venues, or public spaces use large screens to broadcast live events, and 8K displays are preferred as they provide a superior experience compared to HD and 4K screens. This can also help in clearer replays, close-up shorts, and enhanced graphics for sports and is more likely to attract a larger audience. One of the recent examples is the 8K live-streaming feature launched by Intel at the Paris Olympics in 2024. This demonstration of 8K live streaming across Paris has been the largest deployment of 8K and VVC till now, putting 8K live streaming one step closer to the buyers.

Companies in the market are heavily investing in research and development activities to cater to the growing demand across several sectors. For instance, in September 2021, Sharp announced the expansion of its 8K display ecosystem by launching the world’s largest 8K screen, a 120-inch ultra-high-resolution monitor, designed especially for professional use. In addition, the advancements in display panels such as OLED, QLED, and MicroLED and the rising need for high-resolution solutions to combat increasing content consumption across several platforms are leading to the increasing adoption of consumer electronics with 8K technology.

Key 8K Technology Market Insights Summary:

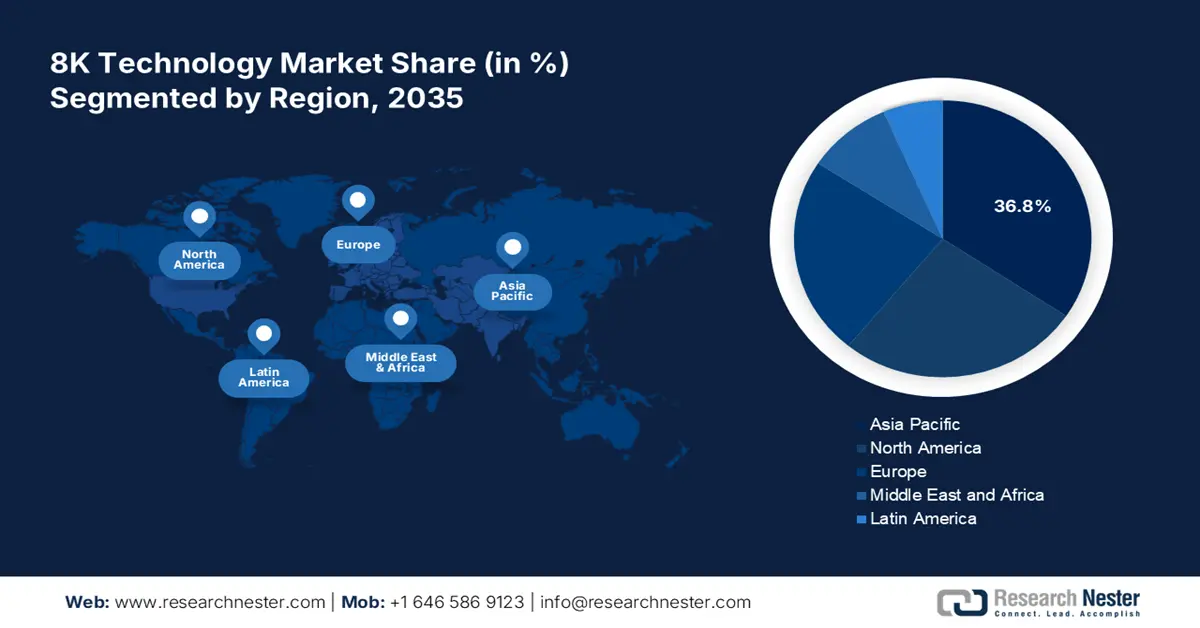

Regional Highlights:

- Asia Pacific holds a 36.8% share in the 8K technology market, led by rising demand for high-resolution content and increasing adoption of 8K technology, supporting robust growth through 2026–2035.

- North America's 8K Technology Market is projected to see rapid growth by 2035, driven by rising consumer interest in ultra-high-resolution content and advancements in 8K technology.

Segment Insights:

- The Healthcare and Medical segment is anticipated to see rapid growth from 2026 to 2035, fueled by demand for advanced imaging and 8K displays in surgical visualization and training.

- The Television segment is projected to hold 45.7% market share by 2035, fueled by the expanding consumer electronics sector and preference for superior image quality.

Key Growth Trends:

- Rising demand for high-resolution displays

- High adoption of 8K technology in the gaming sector

Major Challenges:

- Limited bandwidth and storage capacity

- Delayed upgrade cycles and limited availability of 8K content

- Key Players: Samsung Electronics, LG Electronics, Dell Technologies Inc., SZ DJI Technology Co. Ltd, Canon Inc., Sony Corporation, Panasonic Holdings Corporation, JDI, and Sharp Corporation.

Global 8K Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.03 billion

- 2026 Market Size: USD 26.07 billion

- Projected Market Size: USD 360.16 billion by 2035

- Growth Forecasts: 33.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 14 August, 2025

8K Technology Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand for high-resolution displays: There has been a steady shift from 4k to 8k resolution due to rising demand for superior quality images and larger screen sizes in TVs, gaming monitors, and displays used in advertising, education, healthcare, and other sectors. One such example is the launch of a full range of 8K QLED TVs by TCL India in 2021. With the launch of these TVs, the company underlines its commitment to bring new technologies to the market and cater to consumer demand. Moreover, there have been ongoing advancements in display panel and backlighting technologies, making it easier to produce 8K screens and displays at lower costs. This is another factor expected to drive market growth.

- High adoption of 8K technology in the gaming sector: one of the key factors driving global market growth is the rising demand for next-generation gaming consoles such as PlayStation 5 and Xbox Series X. In September 2020, NVIDIA announced the launch of 8K HDR gaming equipped with the world’s fastest graphic card, the GeForce RTX 3090 to enhance gaming experience and increase user engagement. 8K resolution in the gaming sector offers unmatched visual clarity, enhanced immersive and cinematic experiences, offering competitive advantages for gamers.

Challenges

- Limited bandwidth and storage capacity: High-definition content including 8K, requires a significant bandwidth which poses a challenge in regions with slow internet coverage. 8K technology also requires large storage space which can be a problem for streaming platforms and content creators. Thus, these factors can limit the adoption of 8K technology and hamper the global market to a certain extent going ahead.

- Delayed upgrade cycles and limited availability of 8K content: Though 8K technology is rapidly gaining traction and some content is being produced in 8K, the availability of 8K films, shows, and streaming platforms is still low. Moreover, many consumers have long upgrade cycles for their electronics which can delay the adoption of 8K technology.

8K Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

33.5% |

|

Base Year Market Size (2025) |

USD 20.03 billion |

|

Forecast Year Market Size (2035) |

USD 360.16 billion |

|

Regional Scope |

|

8K Technology Market Segmentation:

Product (Television, Camera, Monitor and Notebook, Projector, Others)

The television segment in the 8K technology market is expected to account for the largest revenue share of 45.7% during the forecast period owing to the rapidly expanding consumer electronics sector, growing preference for superior image quality and immersive at-home experience, and rising availability of a wide range of 8K TVs, including LCDs, OLEDs, ultra-HD, and MicroLEDs. These TVs are preferred more for gaming, streaming, and broadcasting. In May 2023, Samsung India announced the launch of Neo QLED with 4K and 8K resolutions available in 50-inch, 55-inch, 75-inch, and 98-inch sizes that support Q Symphony 3.0, Amazon Alexa, and Bixby, providing an immersive experience.

End use (Consumer Electronics, Commercial, Healthcare and Medical, Sports and Entertainment, Others)

The healthcare and medical segment is poised to expand at a rapid CAGR throughout the forecast period. This growth can be attributed to the rising demand for advanced imaging solutions in the healthcare and diagnostic sector and the need for 8K displays and monitors for surgical visualizations. Apart from this, 8K technology can be used in telemedicine to facilitate better resolution consultations between healthcare providers and patients and to train medical students and professionals in realistic simulations. In September 2019, Air Water Inc. announced the launch of an 8K surgical Microsoft system, Micro Eight to help surgeons accurately detect vessels and nerves.

Our in-depth analysis of the 8K technology market includes the following segments:

|

Product |

|

|

Panel Technology |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

8K Technology Market Regional Analysis:

Asia Pacific Market

Asia Pacific industry is poised to hold largest revenue share of 36.8% by 2035, rising demand for high-resolution content particularly in China, India, and Japan, and increasing adoption of 8K technology in consumer electronics, healthcare, sports and entertainment sectors. Moreover, the companies in Asia Pacific are focused on launching advanced 8K TVs, displays, and cameras. This is another factor expected to boost market growth in this region.

In India, the market is poised to register robust growth between 2025 and 2035 owing to rapid advancements in consumer electronics, gaming, and industrial applications, high content consumption on popular streaming apps such as Netflix, Amazon Prime, and Hotstar in India, and increasing consumer interest in advanced gaming consoles and displays. Leading global companies such as Sony, LG, and Samsung are focused on introducing 8K TVs and displays in the India market. For instance, in May 2023, Samsung introduced a new premium Neo QLED 8K series of smart TVs in India.

China is a key player in the 8K technology market, driven by favorable government support for 8K technology adoption, the presence of well-established manufacturers in China, and rising product launches. In August 2024, Kandao Technology, a leader in 3D panoramic VR imaging solutions, announced the launch of QooCam 3 Ultra, a 360-camera. This is the world’s first portable 360 camera that offers 8K 10-bit HDR video recording.

North America Market Analysis

The North America 8K technology market is set to register a rapid CAGR throughout the forecast period. This growth can be attributed to rising consumer interest in ultra-high-resolution content and displays, rapid advancements in 8K technology, and the presence of leading companies. Other factors such as rising sports and event broadcasting and advancements in gaming consoles and graphic cards, and high adoption of 8K technology across several sectors such as healthcare, education and research, and consumer electronics are expected to drive market growth in North America. Moreover, manufacturers in Canada and the U.S. are constantly focused on improving 8K display technologies such as OLED and OLED panes. In May 2021, Hisense announced the launch of 8K TVs in North America.

The 8K technology market in the United States is experiencing significant growth owing to rising demand for cutting-edge consumer electronics, increasing streaming and sports events and activities, and growing adoption of 8K for film production, event broadcasting, and gaming. In September 2019, the Consumer Technology Association (CTA) announced the official display definition and logo for 8K UHD TVs to help consumers and retailers identify products and meet the technology industry’s 8K HD requirements.

In Canada, the market is expected to expand at a steady pace during the forecast period owing to the high adoption of 8K TVs, cameras, and 8K consoles among tech enthusiasts and gamers and rising demand for high-resolution products across several sectors and industrial applications. Key companies in Canada are launching new products to cater to the rising demand. For instance, in August 2024, Teledyne DALSA announced the launch of a new 8K super-resolution camera, the Linea Lite 8K scan camera designed for a wide range of machines.

Key 8K Technology Market Players:

- Samsung Electronics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- LG Electronics

- Dell Technologies Inc.

- SZ DJI Technology Co. Ltd

- Canon Inc.

The global 8K technology market is highly competitive, comprising key players spanning multiple industries, such as consumer electronics, broadcasting, and cameras, operating at both global and regional levels. These companies are focused on product innovation and enhancement of their product portfolio through various strategic partnerships, mergers and acquisitions, and product launches. Key players such as Samsung Electronics, LG, and Sony are focused on developing advanced QLED and microLED displays while emerging players like BOE Technology and Hisense are expanding its presence in niche markets, targeting high-end display panels for TVs and monitors. Here is a list of key players dominating the 8K technology market:

Recent Developments

- In March 2024, Samsung Electronics Singapore announced its 2024 lineup of QLED 8K TVs and OLED displays equipped with AI, offering an enhanced home entertainment experience. These products, along with its latest sound systems were launched at its Unbox and Discover 2024 Singapore event.

- In January 2022, Canon Europe announced the launch of the EOS R5 C, the first full-frame 8K cinema EOS camera that combines professional filmmaking features of the EOS range and the EOS R system’s photo expertise.

- In October 202o, Sony India announced the launch of its first 8K television, Z8H for an incredibly realistic and immersive at-home cinema experience.

- Report ID: 6566

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

8K Technology Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.