8K Display Resolution Market Outlook:

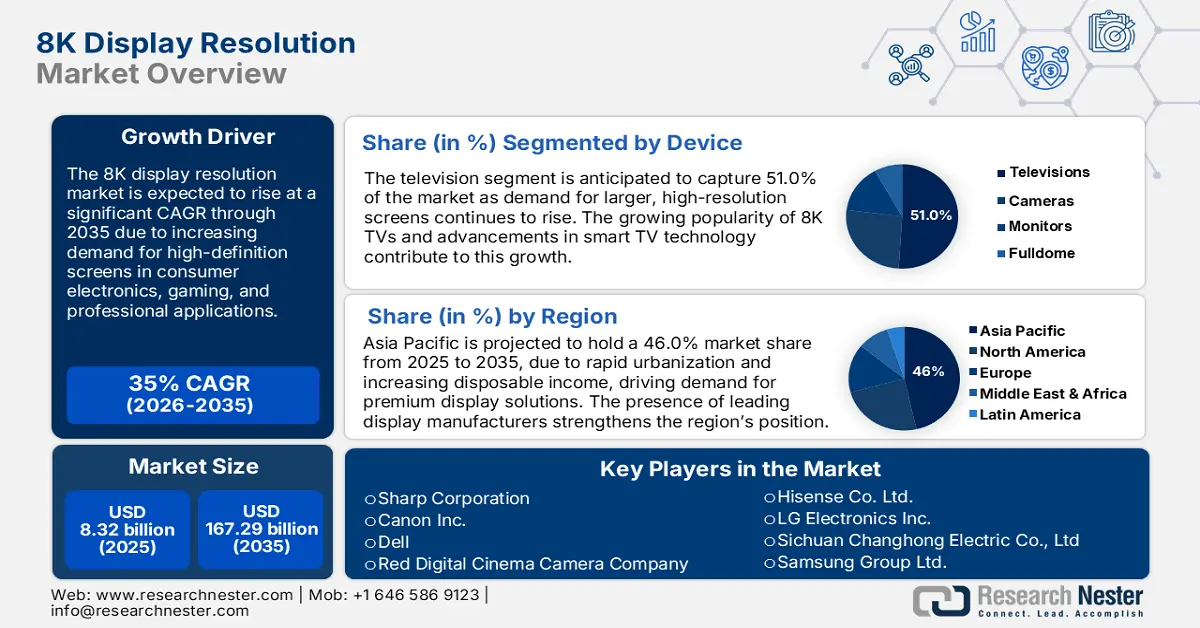

8K Display Resolution Market size was valued at USD 8.32 billion in 2025 and is expected to reach USD 167.29 billion by 2035, expanding at around 35% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 8K display resolution is evaluated at USD 10.94 billion.

The 8K display resolution market is advancing rapidly as manufacturers integrate AI-powered image processing, HDR optimization, and ultra-high refresh rates to enhance picture quality. As consumers increasingly demand immersive home entertainment experiences, companies are innovating display technology to provide improved clarity, color accuracy, and contrast. In January 2024, Samsung launched a Neo QLED 8K lineup (NQ8) with the NQ8 AI Gen3 processor, which boosts neural network processing to a great extent, resulting in better upscaling and image clarity. The 8K display resolution market is further driven by higher adoption of 8K displays across industries, such as gaming, media production, and digital signage.

Governments around the world are vigorously promoting advanced display technologies, especially for broadcasting and public infrastructures. Regulations are being formed to establish 8K streaming and broadcasting standards so that content will be widely available in the future. Furthermore, the rising demand for streaming platforms and gaming consoles propels the adoption of increased resolutions, such as 8K TVs, monitors, and cameras.

Key 8K Display Resolution Market Insights Summary:

Regional Highlights:

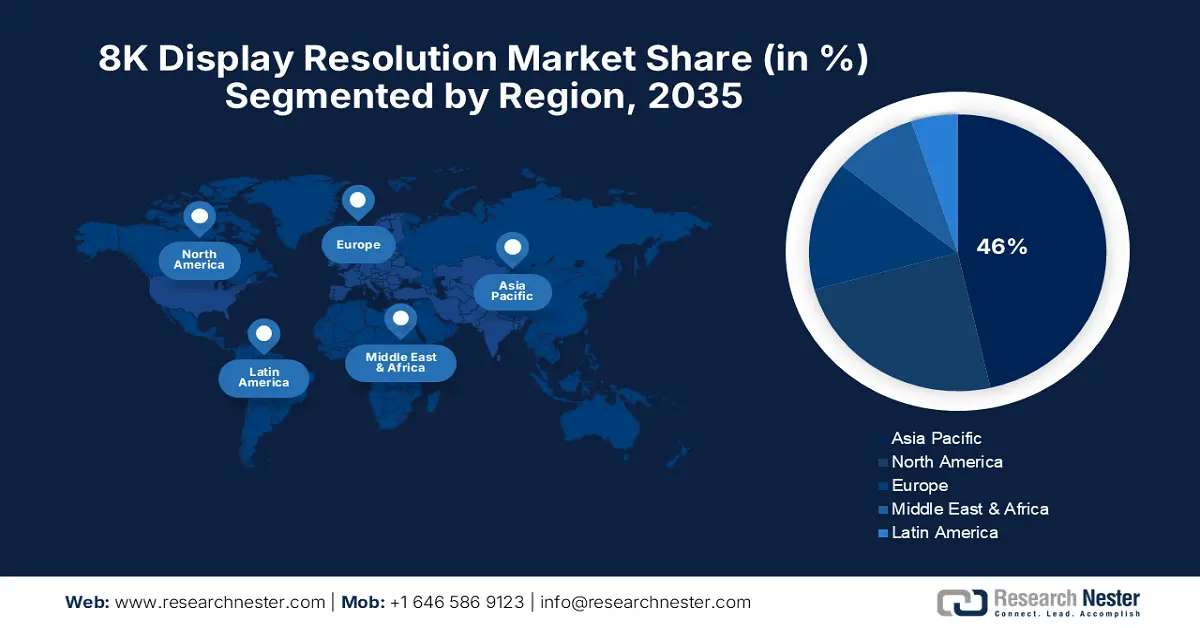

- Asia Pacific dominates the 8K Display Resolution Market with a 46% share, supported by technological advancements, 5G expansion, and government digital initiatives, enhancing growth prospects through 2026–2035.

- North America's 8K Display Resolution Market is set for significant growth through 2026–2035, fueled by adoption in home entertainment, gaming, and healthcare imaging.

Segment Insights:

- The 7680 × 4320 Resolution segment is expected to capture over 37% share by 2035, fueled by growing demand for cinematic quality and professional-grade displays.

- The Television segment is anticipated to hold over 51% share by 2035, driven by consumer adoption and advancements in display technology.

Key Growth Trends:

- Rising consumer demand for premium viewing experiences

- Growth in digital content creation and streaming services

Major Challenges:

- Limited availability of native 8K content

- Bandwidth and storage challenges

- Key Players: Sharp Corporation, Ikegami Tsushinki Co. Ltd., Canon Inc., Dell, Red Digital Cinema Camera Company, Hisense Co. Ltd.

Global 8K Display Resolution Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.32 billion

- 2026 Market Size: USD 10.94 billion

- Projected Market Size: USD 167.29 billion by 2035

- Growth Forecasts: 35% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, South Korea, United States, Germany

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

8K Display Resolution Market Growth Drivers and Challenges:

Growth Drivers

- Rising consumer demand for premium viewing experiences: There is a growing demand for 8K TVs and monitors in the consumer electronics segment due to AI enhanced upscaling and high dynamic range (HDR) technologies, as well as an increasing number of TVs and monitors that are being sold in the market. For example, LG launched a Z3 series of 8K OLED TVs in February 2024, equipped with α9 AI processor designed for cinematic viewing and gaming experience. Premium displays, especially for home entertainment and gaming enthusiasts, are pushing for larger screen sizes and higher refresh rates. With gaming consoles and streaming platforms incorporating support for 8K, consumers are looking for displays capable of high resolution for an immersive experience. Furthermore, 8K technology is gaining popularity among high-end users driven by the improvements in refresh rates and color accuracy.

- Growth in digital content creation and streaming services: Availability of 8K content, films, documentaries and gaming titles for the same is triggering demand for 8K ready displays. TCL CSOT recently unveiled the world’s first 65-inch 8K ink-jet printed OLED display in May 2023, a significant contribution to the development of foldable screen technology. Although cameras, projectors, and monitors equipped with 8K resolution are still quite expensive, as streaming services and gaming platforms begin to support 8K resolution, demand for higher resolution displays is anticipated to grow. 8K cameras are expensive, but the investments in 8K productions by filmmakers, gaming studios, and broadcasters make the transition to ultra-high definition (UHD) media viable. Moreover, the advancements in AI driven upscaling are making it possible to use the existing 4K content optimized for 8K screens and bridge the content availability gap.

- Expansion of 8K in professional and commercial applications: 8K resolution technology is swiftly gaining traction in industries like broadcasting, healthcare imaging, and automotive displays. In January 2023, Sharp NEC introduced the NEC NC603L digital cinema projector, which provides ultra high-definition laser projection for large entertainment venues. The growth in the sector is due to 8K displays being used in medical imaging as well as industrial design for high precision visualization and diagnostics. Additionally, adoption is likely to be driven by the demand for high detail visualization in telemedicine, architecture, and scientific research.

Challenges

-

Limited availability of native 8K content: 8K displays are becoming more common, but there’s still not much native 8K content. Most content is still being produced in 4K or lower, and streaming platforms and broadcasters are slowly moving to higher resolutions. Currently, production costs for native 8K content are too high for widespread adoption amongst filmmakers and studios. Additionaly, the move to 8K necessitates an upgrade of infrastructure in content distribution networks, thus decelerating the pace of mass adoption.

- Bandwidth and storage challenges: 8K video streaming and gaming have high data requirements, which causes high bandwidth and storage challenges. It requires at least 100 Mbps internet speed, which is not yet available in many regions for streaming 8K resolution content. The requirements for cloud storage and local storage are also significantly higher, adding cost and complexity for content creators and service providers. To overcome these problems, companies are investigating new compression algorithms and next generation codecs, such as AV1, to shrink the data load. Also, fiber optic broadband expansion is contributing to making the 8K streaming experience possible.

8K Display Resolution Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

35% |

|

Base Year Market Size (2025) |

USD 8.32 billion |

|

Forecast Year Market Size (2035) |

USD 167.29 billion |

|

Regional Scope |

|

8K Display Resolution Market Segmentation:

Device (Televisions, Cameras, Monitors, Fulldome)

Television segment is set to account for 8K display resolution market share of more than 51% by the end of 2035, due to increasing consumer adoption and advancement in display technology. In January 2024, Sony unveiled the A95L series 8K HDR OLED TV, offering better color accuracy and brightness to home entertainment and professional content creation. With streaming services and gaming consoles becoming more 8K compatible, there is a rise in demand for larger screen sizes and premium home theater systems. AI driven image processing and high refresh rates are making 8K TVs attractive for consumers. Furthermore, it is to be expected that the production costs will decrease, making prices lower and consequently accessible to a larger number of people.

Resolution (8192 × 8192 Resolution, 7680 × 4320 Resolution, 8192 × 5120 Resolution, 10240 × 4320 Resolution, 8192 × 4320 Resolution)

In 8K display resolution market, 7680 × 4320 resolution segment is likely to dominate revenue share of over 37% by 2035, owing to its adoption in televisions, cameras, and professional displays. Hisense unveiled a new 8K ultra short throw projector in February 2024, which is True RGB Triple Laser Light Source and Imax Enhanced Certified. The increasing demand for cinematic quality displays in home entertainment and commercial applications drives this segment’s growth. Demand is being further increased by the push for higher resolutions in broadcasting, gaming, and industrial applications. Furthermore, improvements in micro-LED and mini-LED technologies are increasing 8K displays’ brightness, contrast, and power efficiency.

Our in-depth analysis of the global 8K display resolution market includes the following segments:

|

Device |

|

|

Resolution |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

8K Display Resolution Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in 8K display resolution market is expected to capture around 46% revenue share by the end of 2035, attributed to rapid technological advancements and increasing consumer demand in the region. Leading display manufacturers such as Samsung, BOE, LG, and Sony are situated in the region and are driving innovation in 8K OLED, micro-LED, and QD-OLED technologies. The expansion of 5G infrastructure and improvement in broadband speeds are allowing for seamless 8K content streaming, helping adoption across a broad range of applications. The 8K display resolution market is further strengthened by government initiatives on digital transformation and smart city development. Furthermore, the boom in esports, gaming, and premium home entertainment is propelling the shift towards high resolution displays.

India 8K display resolution market is currently witnessing robust growth on the back of rising smart TV adoption, gaming monitors, and professional applications. Reliance Jio announced in March 2024 to roll out of India’s first 8K streaming service in March 2024, using its extensive fiber-optic network to deliver ultra high definition content. Demand for 8K TVs is rising on the back of higher disposable incomes and consumer preference for a premium entertainment experience. Moreover, the rising OTT (over the top) streaming industry of India is also expected to contribute to the ramp up of 8K adoption. The local market ecosystem is being further strengthened by government-backed digital initiatives such as investments in display panel manufacturing.

Strong domestic manufacturing capabilities and government support for display technology ensure that China remains a dominant force in Asia Pacific 8K display resolution market. In November 2024, BOE’s 75-inch 8K mini-LED TV was debuted for the first time in the consumer space by the company. In addition, the country's aggressive push for semiconductor and display self-reliance is speeding up 8k panel production. China is expanding its influence in the global 8K display resolution market as increasing demand for high-resolution displays in automotive, medical imaging, and smart city applications. The growth of the country’s gaming industry and the integration of screens with 8K features in digital signage are also fueling the market’s growth.

North America Market Analysis

North America 8K display resolution market is projected to experience significant growth over the forecast period. Rising adoption in home entertainment, gaming, and professional applications like broadcasting and healthcare imaging is driving the market in the region. Other factors accelerating 8K display resolution market growth include increasing investments in advanced display technologies, AI upscaling, and content production. North America is leading the display innovation as major players such as Samsung, LG, and Sony are present, and tech giants are investing in 8K compatible devices. Also, market expansion is being driven by initiatives of the government for digital transformation and media advancement.

Rising consumer demand and industry innovation continue to drive the U.S. 8K display resolution market. Netflix announced that 8K streaming would be available for some content in April 2024, propelling the shift toward higher resolution displays. Furthermore, the growing adoption of 8K TVs among premium customers and gaming enthusiasts, as well as better internet infrastructure, are strong 8K display resolution market opportunities. Also, major TV manufacturers and gaming console developers are putting effort into AI driven upscaling for the 8K experience. The market growth is also being propelled by the rise of high resolution professional applications, including medical imaging and architectural visualization.

The growth of Canada 8K display resolution market is driven by government technology initiatives, coupled with a growing demand for ultra high definition content. In February 2024, Canadian Broadcasting Corporation (CBC) started trials of 8K broadcasting in some regions to create new standards for digital media quality. Additionally, high resolution screens in commercial settings including digital signage and live event broadcasting, are further driving the demand. In addition, the adoption of 8K gaming monitors is also aided by the rising esports industry, as it seeks to bring competitiveness to the gaming experience in the country. Furthermore, the advancing smart city projects, high resolution public displays, and immersive digital experiences create lucrative opportunities for the players.

Key 8K Display Resolution Market Players:

- Sharp Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Canon Inc.

- Dell

- Red Digital Cinema Camera Company

- Hisense Co. Ltd.

- LG Electronics Inc.

- Sichuan Changhong Electric Co., Ltd

The 8K display resolution market is highly competitive, with major players including Sharp, Canon, Hisense, Samsung, BOE, Sony, Dell, and Red Digital Cinema. In order to enhance 8K adoption in various fields, these companies are concentrating on introducing new display technologies, such as mini-LED, micro-LED, OLED, and ink-jet printed flexible displays. But AI-powered upscaling, and HDR improvements are being invested more and more in order to enhance display quality and performance.

In April 2024, Samsung also introduced its Neo QLED 8K lineup with advanced AI upscaling and deep learning image processing. This launch marks the battle among leading brands to improve resolution quality, refresh rates, and energy efficiency in order to catch the eye of tech-savvy consumers and industry professionals. Moreover, companies are also creating 8K gaming monitors and professional displays to meet changing consumer and enterprise requirements. The ongoing race to achieve superior display technology is anticipated to drive further improvements in 8K displays and make them more available and accepted in many applications.

Here are some leading players in the 8K display resolution market:

Recent Developments

- In January 2024, LG introduced Its 272-Inch 8K MicroLED MAGNIT TV, highlighting the capabilities of MicroLED technology in delivering ultra-large, high-resolution displays. The MAGNIT series offers 2000-nit brightness and 120Hz refresh rates, powered by LG's Alpha 9 AI-enhanced processor and webOS smart TV platform.

- In January 2024, Samsung Electronics launched its latest lineup of QLED, MICRO LED, OLED, and Lifestyle displays ahead of CES 2024. The unveiling marked the start of an AI-powered screen era, featuring a next-generation processor designed to enhance smart display capabilities. The new models provide AI-driven features secured by Samsung Knox, offering enhanced image and sound quality while delivering a personalized viewing experience.

- Report ID: 7077

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

8K Display Resolution Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.