5G Testing Equipment Market Outlook:

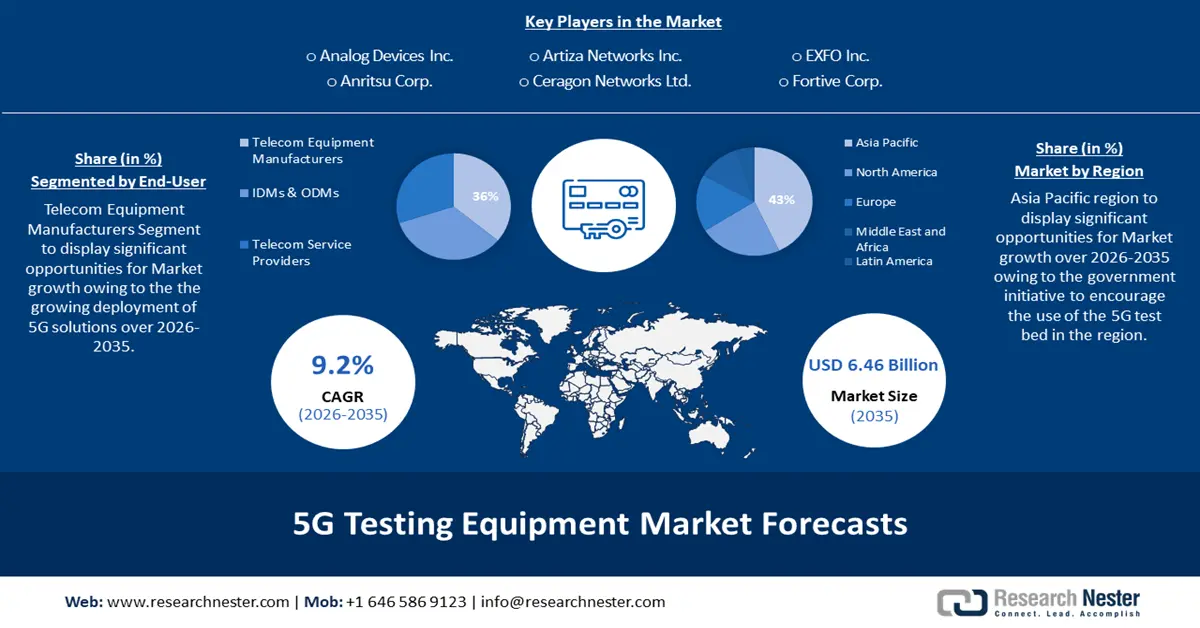

5G Testing Equipment Market size was over USD 2.68 billion in 2025 and is anticipated to cross USD 6.46 billion by 2035, witnessing more than 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of 5G testing equipment is assessed at USD 2.9 billion.

The market growth is due to the rising number of 5G smartphone subscriptions across the globe, leading to a higher need for 5G testing equipment for the verification of the quality of 5G networks.

The number of 5G mobile subscriptions is rising annually led by a rise in the budget segment's penetration, and the availability of 5G networks is increasing as they evolve. For instance, the global count of 5G smartphone subscribers is likely to surpass two billion by the end of this year, having reached over 1 billion by the end of 2023.

In addition, factors that are believed to augment the market share of 5G testing equipment, including the growing usage of artificial intelligence in equipment testing, are believed to fuel market growth. Testing may be automated using AI-powered technologies, which enables CSPs to test their 5G networks more quickly and effectively and also enables self-optimization and predictive analysis.

Key 5G Testing Equipment Market Insights Summary:

Regional Highlights:

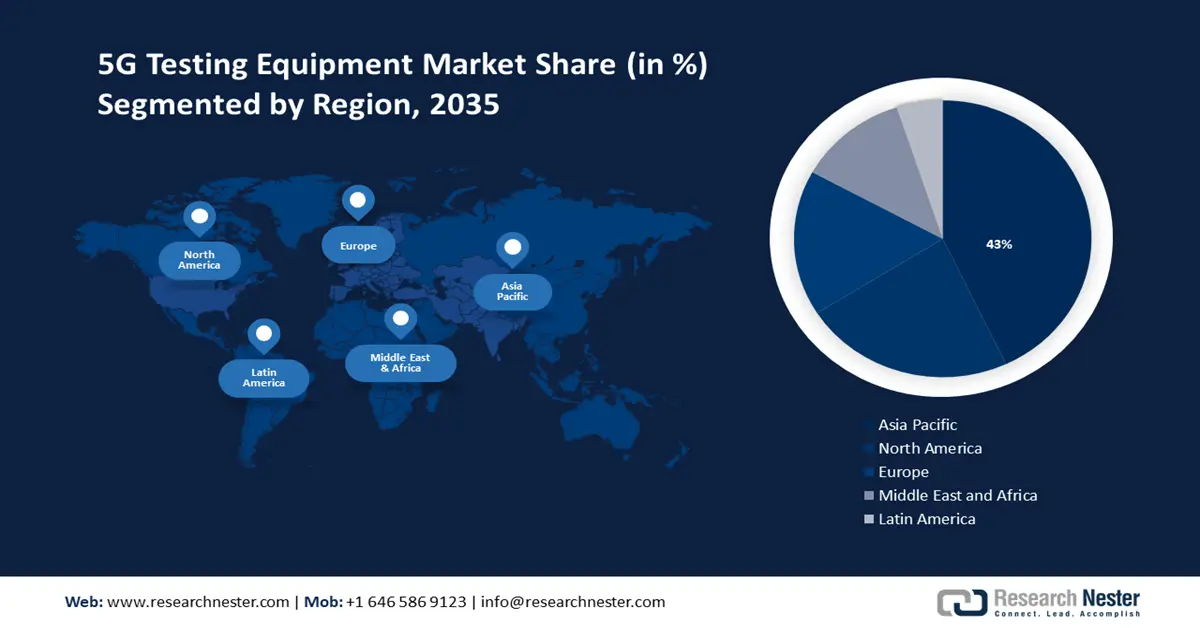

- Asia Pacific 5G testing equipment market is expected to capture 43% share by 2035, driven by government initiatives such as providing the Indigenous 5G Test Bed to accelerate product development and deployment.

- North America market will exhibit enormous growth during the forecast timeline, driven by rising internet user numbers, smartphone-only internet usage, and growing adoption of online services.

Segment Insights:

- The telecom equipment manufacturers segment in the 5g testing equipment market is anticipated to see lucrative growth through 2035, attributed to the growing deployment of 5G solutions and 5G-specific hardware testing.

- The oscilloscopes segment in the 5g testing equipment market is expected to see notable revenue growth through 2035, driven by their use in evaluating 5G NR wireless signals across telecom and other sectors.

Key Growth Trends:

- Growing adoption of IoT and connected devices

- Rising number of data centers

Major Challenges:

- Growing adoption of IoT and connected devices

- Rising number of data centers

Key Players: Analog Devices Inc., Anritsu Corp., Artiza Networks Inc., Ceragon Networks Ltd., CommScope Holding Co. Inc., EXFO Inc., Fortive Corp., GL Communications Inc., Innowireless Co. Ltd., Intertek Group Plc.

Global 5G Testing Equipment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.68 billion

- 2026 Market Size: USD 2.9 billion

- Projected Market Size: USD 6.46 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

5G Testing Equipment Market Growth Drivers and Challenges:

Growth Drivers

-

Growing adoption of IoT and connected devices - It gets harder to prevent product connectivity issues as the Internet of Things (IoT) ecosystem's systems and devices get more complicated; therefore, to confirm call connection, cell selection/reselection, access control, and any mobility implications in NPN contexts, 5G IoT devices need to be properly tested with the help of 5G testing equipment. As per estimates, there will be more than 25 billion IoT devices in use globally by 2030.

-

Rising number of data centers - An important trend driving the development of a "decentralized small cell network of edge data centers to provide low cost, low latency support for high device density" use case is 5G, which puts more strain on resources and already-existing infrastructure in 5G data centers. For instance, in December 2023, there were more than 10,975 data center locations worldwide.

- Surging need for testing in radios - Radios and other 5G infrastructure components with 5G testing equipment since testing sophisticated technologies is necessary for 5G New Radio (5G NR), which includes front-haul (CPRI/eCPRI), mid-haul (eCPRI/25GE/50GE), back-haul (100GE, 400GE), optical technologies (Single lambda/CWDM/DWDM), and higher bandwidth modulation methods.

- Increasing chipset manufacturing - There will be a list of tests to be completed for each new gadget sporting a 5G chipset since it is necessary to ensure the quality and stability of 5G chipset, terminal, and module products.

Challenges

-

Exorbitant cost of 5G testing - More than just the purchase price, the sum paid for the hardware and software at installation is also involved in the cost of 5G testing equipment, which also requires 5G radios and antennas. These pieces of equipment need large investments from the telecom operators, which may have an impact on their capacity to maintain a stable financial position.

-

The deployment of 5G requires a significant financial outlay that includes hiring RF engineers with the necessary skills to handle 5G workloads and purchasing sophisticated 5G testing equipment.

- The complexity associated with 5G technology may hamper 5G testing equipment market growth.

- Challenges to ensure interoperability among several 5G equipment vendors

5G Testing Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 2.68 billion |

|

Forecast Year Market Size (2035) |

USD 6.46 billion |

|

Regional Scope |

|

5G Testing Equipment Market Segmentation:

End-User Segment Analysis

The telecom equipment manufacturers segment is expected to hold 36% share of the global 5G testing equipment market by the year 2035. The segment growth can be attributed to the growing deployment of 5G solutions. Manufacturers of telecom equipment create and supply the essential 5G-specific hardware, including 5G base stations, to satisfy the soaring demand for services that require a lot of bandwidth, such as augmented reality and streaming video.

Telecom equipment manufacturers utilize 5G testing equipment during the early stages of product development to ensure the performance, reliability, and interoperability of their products. Manufacturers conduct extensive performance testing using 5G testing equipment to assess the robustness and reliability of their devices and systems.

Moreover, interoperability testing is crucial for ensuring that 5G devices and infrastructure components work seamlessly in varied 5G environments.

Equipment Type Segment Analysis

The oscilloscopes segment in the 5G testing equipment market is set to garner a notable share. Electronic test tools known as oscilloscopes find extensive use in a variety of fields, such as aerospace, engineering, automotive, telecommunications, and medical, and are employed for the evaluation of wireless signals, including 5G NR.

Additionally, for the 4G/5G FR1 and 5G FR2 frequency bands, spectrum analyzers (RTSAs) are compatible and can be used to assess a device's performance and how it affects the system as a whole.

Our in-depth analysis of the global market includes the following segments:

|

Equipment Type |

|

|

Application |

|

|

End-User |

|

|

Offering |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

5G Testing Equipment Market Regional Analysis:

APAC Market Insights

The 5G testing equipment market in the Asia Pacific is poised to hold a share of about 43% by the end of 2035. The market demand in the region is owing to the government's initiative to encourage the use of the 5G test bed. For instance, the Indian government has decided to provide the Indigenous 5G Test Bed to government-recognized start-ups, MSMEs, and other 5G stakeholders, including industry, academia, service providers, R&D institutions, government bodies, and equipment manufacturers, at no cost and at a very low fee to test and expedite the development and deployment of their products in the network.

The Indigenous 5G Test Bed offers an open 5G test bed where research and development teams from academia and industry in India can validate their products, prototypes, and algorithms, help operators plan their future networks, and offer the facilities of 5G networks for testing. This may create a lucrative demand for 5G testing equipment in the region.

North American Market Insights

The North America region will also encounter enormous growth for the 5G testing equipment market in the coming years and will hold the second position, credited to the increasing number of internet users in this region. More than 14% of adult Americans use the internet only on their smartphones these days since many of them find it impossible to live without it, driven by the rising acceptance of online services such as social media, streaming video, and e-commerce. For instance, with more than 330 million internet users as of January 2024, the US has one of the biggest online markets in the world.

5G Testing Equipment Market Players:

- Analog Devices Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Anritsu Corp.

- Artiza Networks Inc.

- Ceragon Networks Ltd.

- CommScope Holding Co. Inc.

- EXFO Inc.

- Fortive Corp.

- GL Communications Inc.

- Innowireless Co. Ltd.

- Intertek Group Plc

Recent Developments

- Analog Devices Inc. along with Keysight Technologies, Inc. announced the development of a test bench to verify the interoperability of a new O-RU that includes ADI's low-PHY baseband, software-defined transceiver, power, and clock integrated with an Intel FPGA to speed development and interoperability testing by assisting service providers in realizing the full potential of the O-RAN specifications and testing solutions and establish a functional bridge between the radio unit and the core network.

- Anritsu Corp. a global provider of innovative communications test and measurement solutions announced the launch of new NR Licensed 6GHz Band Measurement MX800010A-014 software to Support 6 GHz Band RF Test for 5G FR1 Devices.

- Report ID: 5831

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

5G Testing Equipment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.