5G Fixed Wireless Access Market - Growth Drivers and Challenges

Growth Drivers

- Shifts in consumer behavior and increased demand for remote work and education: With increasing work-from-home job opportunities, remote learning, and IoT adoption, the need for reliable high-speed, low-latency internet is rising. According to the U.S. Bureau of Labor Statistics, about 35.5 million people worked remotely or from home for pay in the first quarter of 2024, an increase of 5.1 million as compared to the previous year. Remote workers made up 22.9% of the employed population, rising from 19.6% in Q1 2023. Therefore, the implementation of 5G fixed wireless access is rapidly gaining momentum as a cost-effective alternative to conventional wired broadband, offering fiber-like speed without extensive cable or fiber expansion.

- Use of 5G FWA in modernization of military base: Governments worldwide are increasingly investing in 5G FWA‐style or private 5G networks to modernize military bases, enhance logistics, and improve command and control. For instance, in October 2020, the U.S. Department of Defense pledged USD 600 million for experimentation and large-scale testing at five military installations, using 5G to support dual‐use functions such as smart warehouses, AR/VR training, and distributed command structures. In another project, the DoD granted a USD 18 million contract to launch a standalone private 5G network at Naval Air Station Whidbey Island to support secure base operations, maintenance, and flight line coordination. These investments demonstrate how 5G FWA is becoming a vital enabler of secure, high-speed, and resilient connectivity in defense operations.

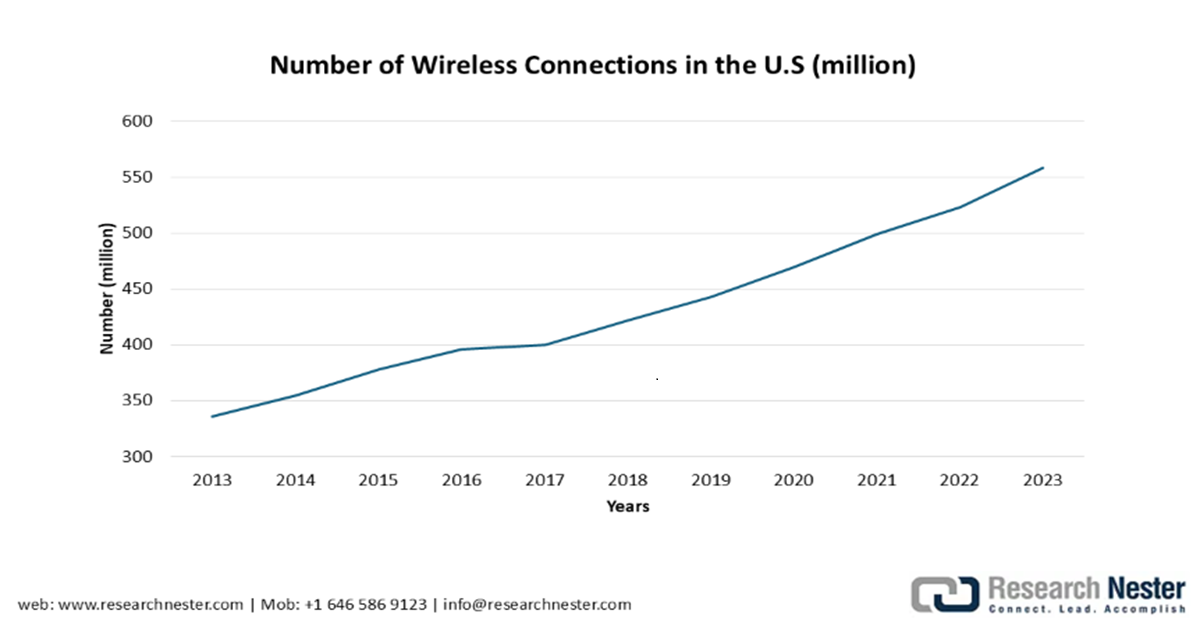

- Booming demand for affordable high-speed internet: Consumer and enterprise demand for fast, reliable, and affordable broadband is increasing, fueled by remote work, online education, streaming, cloud services, and telehealth. In areas where fiber and cable are limited, FWA provides an accessible alternative at competitive prices. According to the CTIA-The Wireless Association report, strong competition and sustained investment in the wireless industry have driven prices down, even amid record inflation. The report states that Americans pay less for wireless services, with unlimited data plans costing nearly 40% less than they did in 2010. This growing need for cost-effective, high-speed connectivity positions fixed wireless access as an important solution in bridging coverage gaps. With falling prices and expanding availability, FWA is set to play a critical role in meeting future digital demand.

Source: CTIA Annual Survey (2024)

Challenges

- Data localization requirements: The data localization guidelines have adversely impacted the market at various points. For instance, countries such as Russia and Indonesia have mandated that the data collected from their citizens must be stored within their national borders. While these guidelines bode well for data sovereignty, they also pose a challenge by increasing investment requirements in local infrastructure, thereby adding to the cost for companies.

- Arbitrary blocking of cross-border data flows: There are regional disparities in the mandates on cross-border data flows. For instance, China requires the filtering of internet traffic, which, in turn, places a substantial burden on the foreign suppliers operating in the country. Furthermore, the challenge may exacerbate in the near future owing to a push for data sovereignty.

5G Fixed Wireless Access Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

40% |

|

Base Year Market Size (2025) |

USD 57.6 billion |

|

Forecast Year Market Size (2035) |

USD 1,666.1 billion |

|

Regional Scope |

|

Browse key industry insights with market data tables & charts from the report:

Frequently Asked Questions (FAQ)

The 5G FWA market was valued at USD 57.6 billion in 2025 and is estimated to reach USD 1,666.1 billion by 2035 at a CAGR of 40% during the anticipated timeline from 2025 to 2035.

The 5G FWA market was valued at USD 57.66 billion in 2025 and is projected to reach USD 1,666.1 billion by 2035. The market is poised to register a CAGR of 40.0% throughout the forecast period from 2026 to 2035.

The major players in the market are Nokia, Samsung Electronics, Huawei Technologies, Ericsson, Verizon Communications, Inseego Corp., Qualcomm Technologies, CommScope, AT&T Inc., and others.

The residential segment is expected to account for a revenue share of 37.3% revenue share by the end of 2035. The segment’s expansion is owed to surging demand for high-speed connectivity from the residential sector.

The APAC 5G FWA market is estimated to account for a dominant revenue share of 39.4% by the end of 2035. The large-scale investments in 5G infrastructures in multiple economies in APAC are a key factor in the regional market’s dominance.