Fourth-Party Logistics Market Outlook:

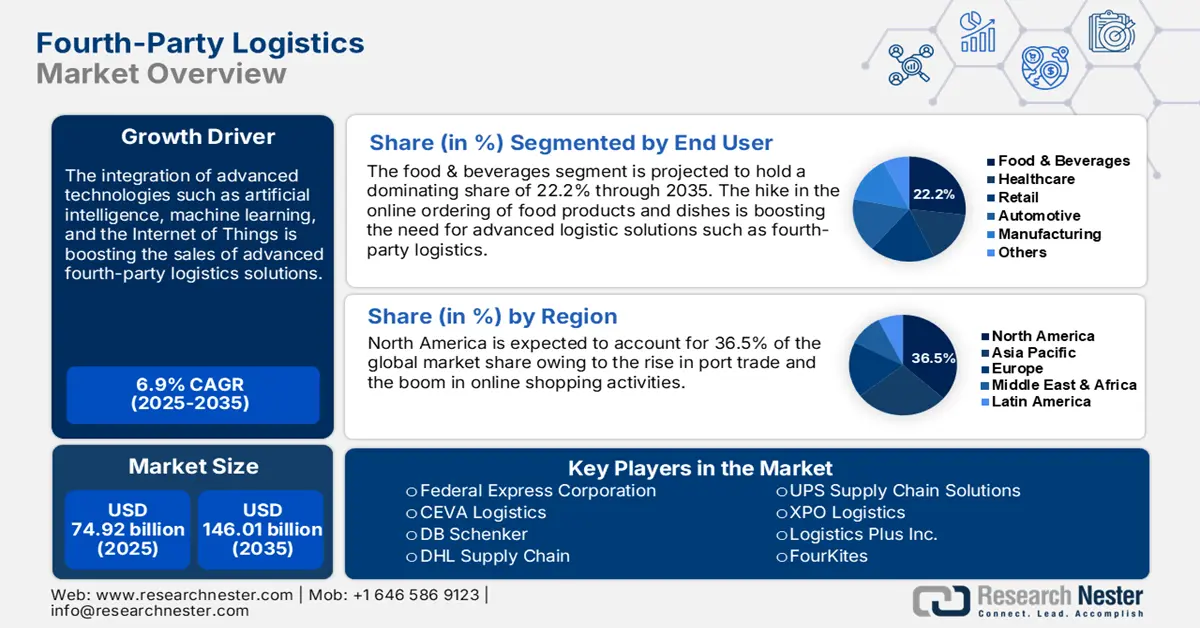

Fourth-Party Logistics Market size was valued at USD 74.92 billion in 2025 and is likely to cross USD 146.01 billion by 2035, expanding at more than 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fourth-party logistics is estimated at USD 79.57 billion.

Modern supply chains are built to strike a balance between high performance and affordability, resulting in some extended conventional systems that are highly complex, lacking critical safeguards against disruption, and low visibility. This has pushed the need for resilient supply chain functions and improved bottom- and top-line results. Thus, the internal maintenance logistics functions or sub-contract external partners are a crucial strategic consideration for companies that are seeking to steer a way through organizational competitiveness. That's where the new 4PL logistics providers with their integrated approach offer optimal resource utilization, infrastructure management, and harness technological innovation for supply chain forecasting.

Sectors such as food & beverages, healthcare, retail, automotive, and manufacturing face complexities in the supply chain of materials and goods due to a lack of appropriate operational management. Furthermore, inflation, changing consumer expectations, port congestion, unpredictable consumer demand, rising freight prices, and restructuring are some other factors creating supply chain challenges in 2025. For instance, according to a report published by the White House, there is a correlation between supply chains and inflation, and as per the Global Supply Chain Pressure Index, produced by the Federal Reserve Bank of New York, which tracks both headline and core goods inflation in the U.S. and the Euro Area, the index surpassed over the first year of the pandemic in April 2020 and since then the index is witnessing the downfall and accounted 1.74 standard deviations in 2023.

To overcome such challenges, businesses need to adopt advanced transport and logistic solutions. Every business differs in size, domain, and structure, thus one-fit-for-all approaches don’t work for effective supply chain planning, which further boosts the demand for customized and innovative operational models. Thus, most companies are investing in 4PL logistics for effective and personalized supply chain optimization, transportation, inventory, warehouse management, order fulfillment, and freight forwarding.