Fourth-Party Logistics Market Outlook:

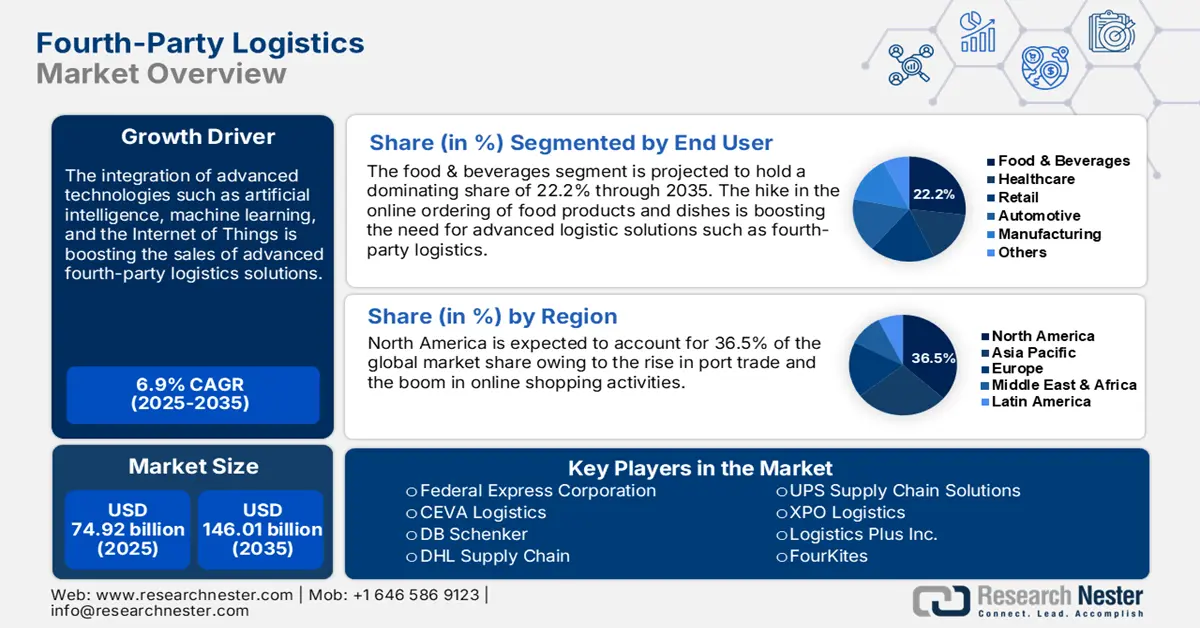

Fourth-Party Logistics Market size was valued at USD 74.92 billion in 2025 and is likely to cross USD 146.01 billion by 2035, expanding at more than 6.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of fourth-party logistics is estimated at USD 79.57 billion.

Modern supply chains are built to strike a balance between high performance and affordability, resulting in some extended conventional systems that are highly complex, lacking critical safeguards against disruption, and low visibility. This has pushed the need for resilient supply chain functions and improved bottom- and top-line results. Thus, the internal maintenance logistics functions or sub-contract external partners are a crucial strategic consideration for companies that are seeking to steer a way through organizational competitiveness. That's where the new 4PL logistics providers with their integrated approach offer optimal resource utilization, infrastructure management, and harness technological innovation for supply chain forecasting.

Sectors such as food & beverages, healthcare, retail, automotive, and manufacturing face complexities in the supply chain of materials and goods due to a lack of appropriate operational management. Furthermore, inflation, changing consumer expectations, port congestion, unpredictable consumer demand, rising freight prices, and restructuring are some other factors creating supply chain challenges in 2025. For instance, according to a report published by the White House, there is a correlation between supply chains and inflation, and as per the Global Supply Chain Pressure Index, produced by the Federal Reserve Bank of New York, which tracks both headline and core goods inflation in the U.S. and the Euro Area, the index surpassed over the first year of the pandemic in April 2020 and since then the index is witnessing the downfall and accounted 1.74 standard deviations in 2023.

To overcome such challenges, businesses need to adopt advanced transport and logistic solutions. Every business differs in size, domain, and structure, thus one-fit-for-all approaches don’t work for effective supply chain planning, which further boosts the demand for customized and innovative operational models. Thus, most companies are investing in 4PL logistics for effective and personalized supply chain optimization, transportation, inventory, warehouse management, order fulfillment, and freight forwarding.

Key Fourth-Party Logistics (4PL) Market Insights Summary:

Regional Highlights:

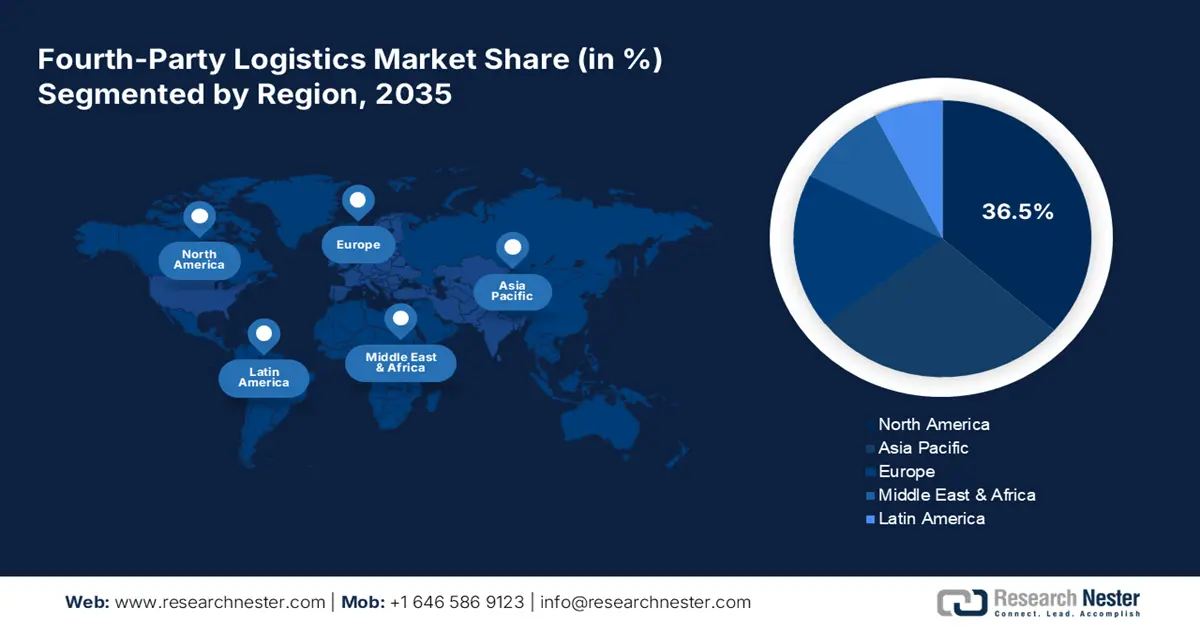

- North America holds a 36.5% share of the Fourth-Party Logistics Market, fueled by booming e-commerce, port trade, and demand for reliable logistics, positioning it as a logistics hub through 2026–2035.

Segment Insights:

- The Supply Chain Optimization segment is forecasted to achieve a 24.2% share by 2035, fueled by demand for transparency and visibility in supply chains across multiple regions and sectors.

- The Food & Beverages segment is expected to achieve 22.2% market share by 2035, driven by increasing demand for online food products and adoption of 4PL logistics to manage seasonality and consumer demand.

Key Growth Trends:

- Integration of digital technologies

- E-commerce growth fueling 4PL demand

Major Challenges:

- High implementation and operational costs

- Resistance to change

- Key Players: Federal Express Corporation, CEVA Logistics, DB Schenker, and DHL Supply Chain.

Global Fourth-Party Logistics (4PL) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 74.92 billion

- 2026 Market Size: USD 79.57 billion

- Projected Market Size: USD 146.01 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, China, Germany, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Fourth-Party Logistics Market Growth Drivers and Challenges:

Growth Drivers

- Integration of digital technologies: The fourth-party logistic (4PL) solution producers are integrating digital technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), blockchain, and big data analytics to enhance the features and capabilities of their services. Advanced technologies integrated 4PL solutions transform supply chain management leading to more efficient and smooth deliveries. AI and ML algorithms help in effective decision-making related to inventory and freight management, which further aids businesses in tackling and responding to 4PL logistics market changes.

Furthermore, IoT-enabled sensors and GPS are superior in warehouse optimization and fleet management. Thus, digital technologies advance 4PL providers with the tools to offer flexible, scalable, and data-driven logistics solutions that can meet evolving requirements of end use organizations, contributing to the overall 4PL logistics market growth. For instance, in August 2024, the Federal Express Corporation introduced the Surround monitoring and intervention solution to enhance global supply chain visibility. This solution uses AI technology to boost logistics and supply chain management. Thus, this highlights that digital technologies integrated f4PL logistics solutions offer flexibility & control, high operational value, and proactive monitoring. - E-commerce growth fueling 4PL demand: The swiftly expanding e-commerce activities are fueling the need for advanced supply chain management solutions in both B2B and B2C segments. According to the International Trade Administration, the global B2B e-commerce 4PL logistics market is expected to expand at a CAGR of 14.5% and reach USD 36 trillion by 2036. The advanced energy, manufacturing, healthcare, and professional business services are majorly augmenting this B2B sales value.

Furthermore, many companies are relying on 4PL logistics as they can aid in handling large volumes of orders efficiently and meet deliveries more quickly and transparently owing to their advanced tools that aid in real-time tracking, enhancing inventory management, and last-time delivery optimization. Another factor that makes 4PL a critical partner of businesses in the evolving e-commerce landscape is its ability to scale operations and offer flexible solutions during peak demand periods.

Challenges

- High implementation and operational costs: For setting up the 4PL logistics, businesses need significant capital investments as the technologies offered by 4PL are highly advanced and require advanced infrastructure and a skilled workforce to handle them. Many small-scale businesses often hesitate to invest in these advanced 4PL technologies due to their high costs. This impact is always observed in the price-sensitive 4PL logistics market with limited profit margins.

- Resistance to change: The implementation of the 4PL model within an organization may face cultural and organizational barriers. Resistance to change and concerns about data security, loss of control, and dependency on others may limit the 4PL logistics market growth to some extent. The lack of awareness and advanced infrastructure are some of the other factors contributing to these barriers.

Fourth-Party Logistics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 74.92 billion |

|

Forecast Year Market Size (2035) |

USD 146.01 billion |

|

Regional Scope |

|

Fourth-Party Logistics Market Segmentation:

Solution (Supply Chain Optimization, Transportation Management, Inventory Management, Warehouse Management, Order Fulfillment, Freight Forwarding, Distribution Management)

Supply chain optimization segment is anticipated to dominate around 24.2% 4PL logistics market share by the end of 2035. The rise in the demand for transparency and visibility in the supply chain is augmenting segmental growth. The businesses are operating across several regions and sectors across the world, this increases the complexity of multi-tiered supply chains. To overcome this challenge, companies are adopting advanced supply chain optimization solutions that offer real-time visibility, predictive analysis, and decision-making tools.

Furthermore, the increasing consumer demand for fast and reliable deliveries is pushing businesses to optimize logistics, boosting the adoption of modern supply chain optimization solutions. For instance, in October 2023, Unisys LLC announced the launch of a next-gen Unisys Logistics Optimization solution. Integrated with AI, quantum computing and advanced analytics help effectively in supply chain optimization and real-time decision-making. Thus, the introduction of advanced technologies is also expected to boost the sales of innovative supply chain optimization solutions in the coming years.

Application (Food & Beverages, Healthcare, Retail, Automotive, Manufacturing, Others)

By 2035, food and beverages segment is projected to dominate over 22.2% 4PL logistics market share. The increasing demand for online food products and dishes is pushing F&B organizations to adopt 4PL logistics. The food and beverage demand can vary depending on seasonality, weather conditions, and shifting consumer demand. To manage supply chains effectively during peak demand periods the adoption of advanced logistics solutions is vital. To overcome such challenges, food and beverage companies or service providers are employing advanced, reliable, and effective 4PL logistics due to their innovative and modern tools that aid in supply chain management and last-minute deliveries, effectively.

Our in-depth analysis of the global fourth-party logistics (4PL) market includes the following segments:

|

Solution |

|

|

Operational Model |

|

|

Mode |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Fourth-Party Logistics Market Regional Analysis:

North America Market Forecast

North America industry is expected to hold largest revenue share of 36.5% by 2035. The presence of industry giants, growth in the port trade, and a boom in the e-commerce sector are fuelling the need for advanced 4PL logistics in the region. The rise in port trade activities is increasing the demand for 4PL logistics that offer reliable and effective transportation and storage facilities. with effective outsourcing of transportation, warehousing, and distribution.

The U.S. 4PL logistics market is expected to increase at a healthy CAGR during the projected period. The digital shift in several organizations is driving the adoption of logistic solutions with advanced technologies. As advanced logistics mitigates errors and optimizes the supply chain, many organizations are employing these technologies, leading to 4PL logistics market growth.

In Canada, international trade is gaining a boom particularly due to agreements such as the United States-Canada- Mexico Agreement (USMCA). This economic relationship is boosting cross-border trade and simultaneously necessitating the demand for advanced and reliable 4PL logistic solutions. The 4PL logistics market players are finding lucrative opportunities as local companies are turning to 4PL logistics to aid in managing complex supply chains across multiple borders, ensuring compliance and optimized transportation.

Asia Pacific Market Statistics

Asia Pacific is one of the rapidly expanding 4PL logistics market owing to the rapid urbanization, increasing industrial activities, and digitalization trend. Many individuals in the region are migrating towards urban areas in search of job opportunities, trade, education, and more. This urban shift directly influences several sectors such as healthcare, food and beverages, and manufacturing, which subsequently fuels the demand for advanced 4PL in these industries for seamless supply chain and deliveries.

India is the burgeoning consumer market and continuous advancements in this sector are majorly driving the need for advanced logistics solutions. The swift digitalization among topmost businesses in India is creating a reliable and efficient supply chain environment in the country. India’s ambition to participate in the global value chain is to increase its participation from 40% to 50% and for that digital technologies are playing a vital role. Considering this trend, many logistic solution producers are entering the 4PL logistics market to earn high profits and strengthen the country’s supply chain through digital technologies.

China is well known for its robust e-commerce sector and the increasing demand from cross-borders is necessitating companies to adopt innovative and reliable logistic services. According to the International Trade Administration (IEA) report, China generates around 50% of global e-commerce transactions. This underscores that high e-commerce sales require advanced and reliable logistics services such as 4PL logistics for effective supply chain management and deliveries.

Key Fourth-Party Logistics Market Players:

- Federal Express Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CEVA Logistics

- DB Schenker

- DHL Supply Chain

- DSV Panalpina

- Geodis

- Kuehne+Nagel

- Maersk (A.P. Moller - Maersk)

- H. Robinson Worldwide, Inc.

- UPS Supply Chain Solutions

- XPO Logistics

- SF Express Co., Ltd.

- Deloitte Touche Tohmatsu LLC

- Logistics Plus Inc.

- FourKites

- Alibaba Group Holding Limited

Key players in the 4PL logistics market are employing strategies such as innovations, new product launches, collaborations, mergers, and regional expansions to earn more. 4PL solution producers are integrating advanced technologies such as AI, ML, and IoT to enhance their product offerings and attract a wider consumer base. They are also offering customized 4PL logistics solutions as per the requirements of the end users. Furthermore, industry giants are collaborating with other players to introduce advanced solutions and increase their market reach. Also, by adopting regional expansion strategies 4PL logistics market players are tapping into high-potential markets to earn high revenue shares.

Some of the key players include:

Recent Developments

- In September 2023, UPS Supply Chain Solutions announced that it acquired MNX Global Logistics a time-critical logistics provider. This acquisition is set to offer more precision and capabilities to UPS customers in the healthcare and related sectors who rely upon time-sensitive, often life-impacting logistics solutions.

- In September 2023, FourKites announced the launch of a Generative AI solution ‘FinAI’. This solution is helping companies to make proactive decisions and achieve an automated supply chain.

- Report ID: 6702

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Fourth-Party Logistics (4PL) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.